Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Markets continued to rally in April with the S&P 500, TSX Composite and MSCI World Index returning 1.6%, 2.9% and 1.8%, respectively. For all the volatility-driven excitement over the past twelve months, the S&P 500 finished April at the same level it was at one year ago.

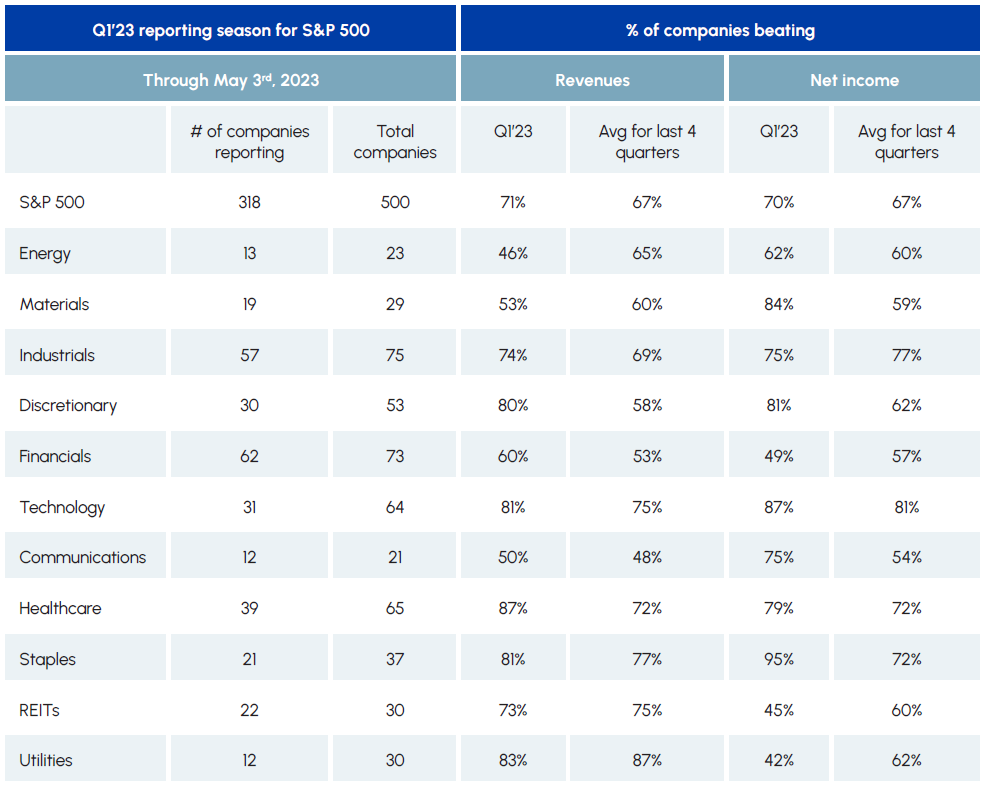

Recent data has been mixed, creating an uncertain investment backdrop. On the positive side, there have been three notable themes providing support for stocks. First, Q1 earnings have come in better than expected with over 70% of companies beating revenue and EPS estimates thus far. Tech companies, which represent the biggest weight in the S&P 500, have been noticeably strong with an earnings beat rate of 87%. Second, inflation data continues to trend in the right direction which has given central banks some breathing room. Although the Federal Reserve announced a 25 basis point rate hike on May 3rd, we believe the Fed, as well as other major central banks, are in the final stages of the current tightening cycle. Finally, the consumer has been remarkably resilient, supported by historically low unemployment. This has resulted in strong retail sales, especially in service-oriented industries.

|

|

While the aforementioned factors have supported markets this year, a growing body of data is signaling that an economic slowdown may be on the horizon. The Conference Board Leading Economic Index (LEI) for the US fell by 1.2% in March to its lowest level since November 2020. Negative contributions have been widespread, with 8 of the Index’s 10 components in decline over the previous six months. The Leading Credit Index is one measure we are paying particularly close attention to given recent events in the US regional banking system. On May 1st, First Republic Bank became the third regional bank in the US to fail this year while the depressed share prices of several of its peers continue to reflect the risk of a similar fate. We believe the recent struggles could lead to slower loan growth over the near-term and policy reforms over the longer-term. The Federal Reserve recently released a report on its supervision of Silicon Valley Bank in which the Fed acknowledges its failures to identify the bank’s vulnerabilities as well as the speed with which the Fed responded. The report lays the groundwork for regulatory reforms down the road; however, it was made clear that changes would not be effective for several years as they are expected to go through a standard notice and comment rulemaking process.

In addition to the economic data we are monitoring, an emerging risk is forming in the political sphere – the debt ceiling. We expect negotiations between Republicans and Democrats to be intense over the next several weeks, which could create headline risk and market volatility. If the US government were to default on its debt, the ramifications would be enormous. Ultimately, we expect a 11th hour deal to be reached as neither Republicans nor Democrats want to be held accountable for causing a debt default. This issue is probably more noise than substance and we view any market weakness related to this topic as a buying opportunity.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

After posting its worst first quarter in over 30 years, the Healthcare sector rebounded in April with a total return of 3.1%. Given heightened concerns about an economic slowdown, Healthcare’s defensive qualities and stable earnings profile position the sector to build on recent momentum.

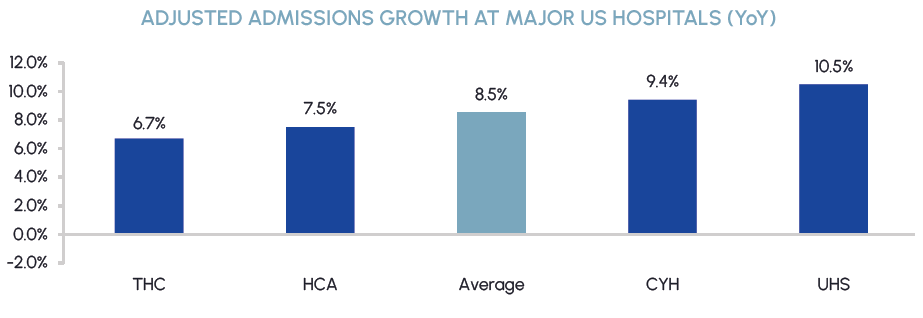

The majority of Healthcare companies reported Q1 earnings in late April and results have exceeded expectations thus far. 79% of companies have beat earnings estimates while 87% of companies have beat on revenues. Large-cap biopharma and managed care organizations have reported solid results, but the biggest story has been the MedTech industry. We have written about how we expect last year’s macro headwinds to become tailwinds this year, and Q1 results further solidified this view. Improving supply chains and labour issues have allowed elective procedure volumes to rebound sharply in the hospital setting. Q1 results from our core holdings, which include Intuitive Surgical, Abbott, Boston Scientific, Stryker and Edwards LifeSciences, all demonstrated that volumes are recovering as year’s challenges fade. This trend is evident in year-over-year hospital admissions, which are up 8.5% on average. Our healthcare funds are overweight MedTech names relative to the benchmark which has been a positive contributor to performance this year.

|

|

Another reason we like MedTech in the current environment is that it’s relatively insulated from political headwinds. Federal and state governments have spent trillions of dollars over the past several years, which has contributed to record budget deficits and an emerging debt ceiling crisis. There is much debate over how to address these issues, and cuts to government spending are starting to gain a much louder voice. Healthcare spending represents nearly 20% of U.S. GDP and is an area where potential savings could be found. In particular, Pharmacy Benefit Managers have received more attention recently from multiple layers of government, including the FTC, the House and the Senate. While we do not expect any sweeping legislation that will significantly alter the earnings power of these companies, it is possible that sentiment could be impacted by political rhetoric as we head into an election year. We have limited exposure to this group currently and prefer companies that are less sensitive to political headlines.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

REITs had a much better month in April, returning approximately 1% in both Canada and the US. We continue to believe the Real Estate sector is well positioned and attractively valued based on significant discounts to NAVs and the relatively limited near-term impacts we expect from risks relating to debt/liquidity and reduced development activities.

We are particularly bullish on the Canadian REITs in the current environment. Unlike US REITs, where fears of credit loss and loan defaults are elevated, debt and liquidity levels remain very healthy in Canada. Commercial real estate (CRE) lending is dominated by well capitalized large banks, life insurance companies and pension funds which compares to the US where loans from regional banks and commercial mortgage-backed securities are more common. After a muted 2022, debt issuance accelerated in Canada during the first quarter with unsecured debentures issued totalling $1.4 billion.

Development activity has ground to a halt due to higher costs of borrowing, construction and land. Fortunately, Canadian REITs are primarily focused on acquiring, owning and operating properties; not building. The expected contribution to their net operating income from development is not material with most new projects already de-risked through pre-leasing. In fact, the current slowdown in development activity is likely to benefit Canadian REITs over the medium-term as it will limit the amount of new supply being added to the market, thus increasing the value of their existing assets.

We believe the main concerns with CRE relate to the office market. In Canada, office properties are highly concentrated in large, well capitalized pension funds, life insurance companies and global private equity firms. These owners are very disciplined in their leasing discussions since they have long term investment horizons. As a result, Canada is not likely to experience the same level of distress in office that we’re now seeing in the US. Other property types, including our core exposures to industrial, multi family and grocery anchored retail, continue to be on solid footing.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

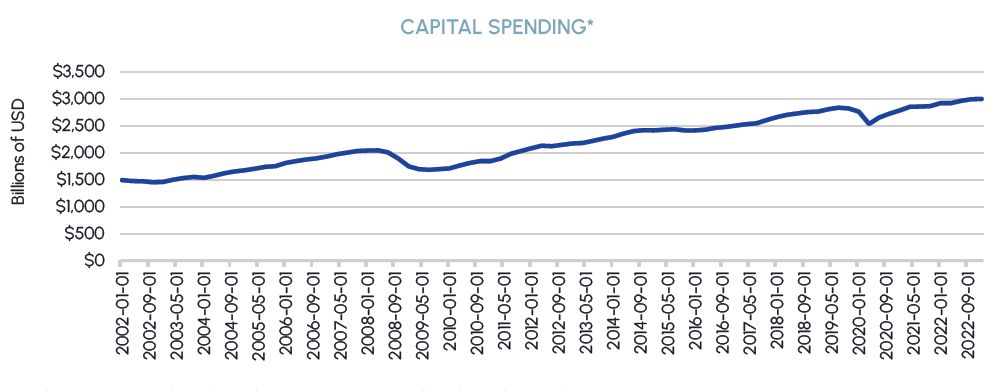

The backdrop for infrastructure remains positive, as indicated by US capital spending, which rose to a record high during the first quarter of 2023. This helped our holdings in Industrials and Infrastructure companies to deliver strong earnings on the back of robust end-market demand.

|

|

We favor sustainable infrastructure names that are exposed to secular themes such as electrification, onshoring, grid hardening and the proliferation of data. Many of these trends are further supported by policy tailwinds including the CHIPS and Science Act, Inflation Reduction Act (IRA) and EU’s policy response. Companies with exposure to these trends are already starting to benefit from higher capital spending. For example, citing robust demand, both electric components manufacturer Eaton and cable manufacturer Prysmian saw growth in their already outsized backlogs this quarter. As we gain more clarity on tax credits and grants under the IRA throughout the year, we believe our preferred names have meaningful upside that is not fully reflected in street estimates.

In terms of positioning, we currently have a tactical bias towards European utilities which remain undervalued in our opinion. Enel recently reported record high EBITDA of €5.5b, a 20% increase compared to last year. Enel’s turnaround story is unfolding as management continues to streamline its business through asset disposals and expansion of its renewable assets. The company is strategically growing its footprint in the US by building its first plant for solar cells outside of Italy to benefit from the IRA. Our other significant European utility holdings, Iberdrola and EDP, also reported strong earnings, benefiting from elevated hydro generation output in Iberia.

After nearly two years of negotiations, Enbridge announced in early May that it reached a negotiated settlement with shippers covering both the Canadian and US portions of the Mainline liquids system. Enbridge’s Mainline is the largest liquids pipeline system in Canada, moving over 3 million barrels of crude oil and liquids from Western Canada per day. The terms of the agreement extend through 2028, covering 70% of Mainline volumes. Enbridge expects to finalize the settlement with industry participants while submitting an application with the Canada Energy Regulator in the third quarter, with the expectation that the new tolling settlement could be approved and implemented by the end of the year.

We see several positive takeaways to the Enbridge news. While neutral to 2023 earnings guidance, the successful conclusion of the negotiation process has removed the perceived risk of a draconian outcome. In addition, it provides a financial performance collar through operational incentives but also downside protection to ensure the Mainline will earn attractive 11% – 14.5% returns (similar to the average returns experienced during the previous tolling agreement). The agreement also incorporates inflation and foreign exchange protection as well as toll adjustments for major pipeline expenditures such as expansions. Furthermore, we view the settlement’s toll certainty and incentive-based framework as a positive for Enbridge’s growth profile as it looks at potential expansions along the Mainline.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

Tech stocks have outperformed significantly year to date, led by the FANG+ index, but have recently been under pressure as we move through earnings season. We are viewing this as a healthy digestion period and, while Q2’23 could prove challenging, we remain optimistic for H2’23. Overall, Q1’23 results have been positive, with Technology stocks reporting 81% and 87% beat rates for revenue and net income respectively, according to JPM’s estimates.

The mega cap names were largely better than feared, with META being the most positive standout and Amazon being the most negative. Overall, the cloud computing industry is showing resilience – aside from AMZN’s reported deceleration in April – and might begin to reaccelerate, partially because of the meteoric rise of generative AI. While many companies will benefit from utilizing AI in their business models, the most clear winners are likely to be the cloud service providers. They control the infrastructure and thus have the best tools to continue improving their own AI capabilities.

AI is also likely to help other areas such as software (e.g. Microsoft 365 Copilot) and semiconductors, with NVDA being the most obvious winner. Even so, we expect that other players such as AMD will also gain though this may take time to manifest. We also think that networking companies will benefit but this may not happen until 2024.

As we approach peak interest rates for this cycle, the backdrop for technology is likely to improve. 2023 numbers will hinge on a strong second half (e.g. A rebound in personal computers); however, the passage of time should reward patient investors who are already looking out to 2024 and beyond. We continue to focus our innovation mandates on secular themes such as cloud computing, cybersecurity and electric vehicles, all of which are providing ample opportunities for investors seeking out growth at a reasonable price.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

Fueled by a mix of economic data, global tensions, a weakening dollar, and wariness of the banking system, gold has regained its place as a haven portfolio allocation. For the near-term, we believe these ongoing factors as well as accelerated purchases by central banks will support prices above the psychological watermark of US$2,000/oz. The S&P/TSX Global Gold Index was up 3.7% in April, outperforming the gold price which was up 1.1%.

After an initial surge due to the OPEC+ production cut announcement, oil lost steam through the second half of April, falling from its highs of US$83/bbl to settle around US$77/bbl. Despite lower oil prices, global energy supermajors continued to print money after a record breaking 2022. Chevron, ExxonMobil, and Shell have led the charge, reporting first-quarter profits that were up from the previous year and beating market expectations. We maintain our view that oil prices could move higher throughout the year as China’s economy continues to recover and supply responses remain muted.

There are signs we are seeing a rebound in fertilizer prices this spring, with potash and phosphate prices up over 10% and nitrogen up an impressive 40% in April. Over the past year, wholesale fertilizer prices have dropped by more than half, and this marks the first monthly increase for US fertilizer prices since August 2022. As a result of lower input costs, operating profits for U.S. farmers are still elevated, after setting a 49-year record in 2022. We expect a strong demand response to lower input costs during the upcoming planting season.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

Each year the Ontario Securities Commission (OSC) publishes its Statement of Priorities (SOP) for the upcoming fiscal year. In November 2022, the OSC published for comment a draft SOP for fiscal 2023/24, then after considering the comments it received on the draft the OSC published its final SOP on April 18, 2023 as part of the OSC’s new business plan. The SOP sets out four strategic goals the OSC intends to focus on this fiscal year (beyond its core regulatory operations), one of which deals with various ESG matters. The OSC’s strategic Goal #1 is to “promote trust and fairness in Ontario’s capital markets among market participants and investors”. The OSC sets out seven key priorities to achieve this goal, several of which key priorities relate to ESG matters.

The OSC’s first ESG-related priority is entitled “Advance Work on Environmental, Social, and Governance Disclosures for Reporting Issuers”. The OSC states that their actions in 2023/24 under this priority will include to:

- lead the consideration of international developments and how they may impact or further inform the proposed Canadian rules on disclosure of climate-related matters by reporting issuers

- develop a better understanding of the needs of, and the regulatory impacts on, Indigenous Peoples

- continue their leadership role on the International Organization of Securities Commissions’ Sustainable Finance Taskforce’s steering group, including co-leading the workstream on promoting good practices in the asset management industry and for ESG ratings and data providers

- complete a focused review of ESG disclosures by investment funds and publish a summary of findings and any guidance updates by December 2023.

The OSC states that their planned outcomes from their actions under the foregoing ESG-related priority are twofold, namely 1) investors to have access to the ESG information needed to inform their investment and voting decisions, and 2) reporting issuers to have clarity on their ESG disclosure requirements.

The OSC’s second ESG-related priority is entitled “Consider Broader Diversity on Boards and in Executive Roles at Reporting Issuers”. The OSC states that their actions in 2023/24 under this priority will include to:

- publish for comment proposed changes to the disclosure requirements on diversity, board renewal and the director nomination process and related corporate governance guidelines [We note that these proposed changes were published for comment by the Canadian Securities Administrators on April 13, 2023]

- develop a better understanding of the needs of, and the regulatory impacts on, Indigenous Peoples through further engagement with Indigenous organizations.

The OSC states that their planned outcome for their actions under the foregoing ESG-related priority is for investors to have access to the diversity and board renewal information needed to inform their investment and voting decisions. One takeaway from the OSC’s 2023/24 SOP is that ESG considerations, as they relate to both issuers and investors, remain an important focus for the OSC in this fiscal year.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |