Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Markets continued to slide in September, finishing the month at the lows of the year. The S&P 500 generated a total return of -9.2%, completely giving back the 17.4% bear market rally that took place during the summer. Canadian markets fared better this month with the TSX Composite declining just 4.3%. As of the end of Q3, the TSX has generated a total return of -11.1% which compares to the S&P 500 return of -23.9% and the MSCI World Index return of -25.1%.

Last month, we discussed the relative resiliency of the North American economy relative to the rest of the world. In September, this gap widened as conditions worsened across multiple regions. Tensions between Russia and Ukraine escalated after a series of unfortunate developments, including Putin’s declaration of a partial mobilization, phony referendums and speculated sabotage of the Nord Stream pipelines. In the UK, the Bank of England was forced to support prices of UK government bonds after its newly formed government, led by Liz Truss, announced controversial tax cuts. In China, debt problems are surfacing, evidenced by a wave of debt restructurings that are taking place both domestically in its real estate sector and abroad from countries that China lent to as part of its Belt and Road policy.

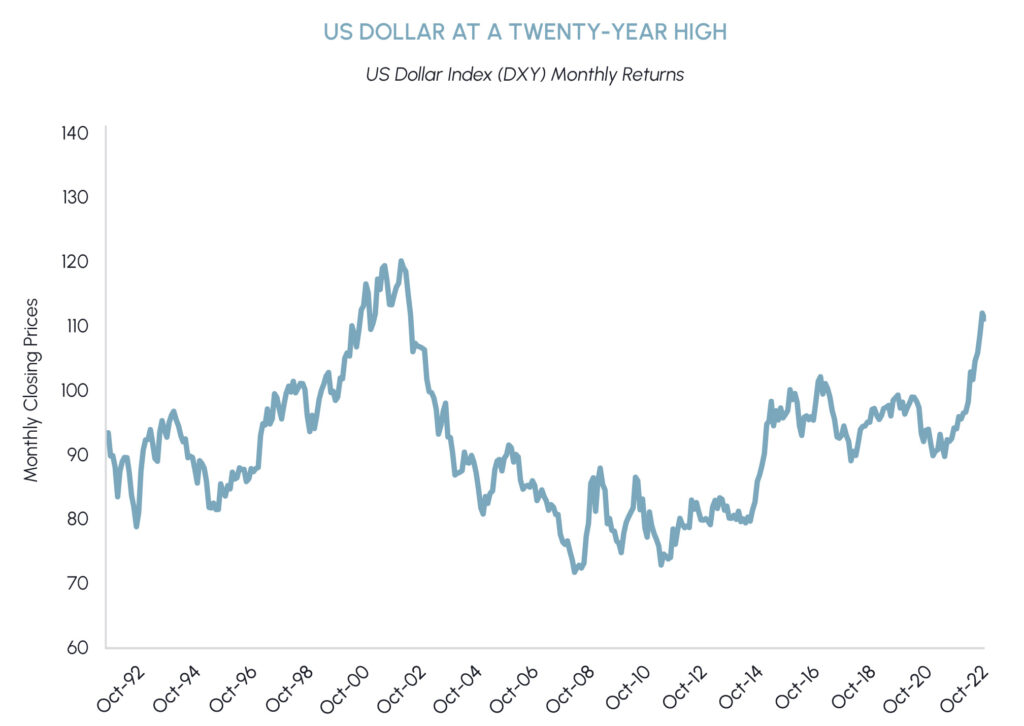

We believe several interrelated conditions need to be met before markets can form a bottom. First, we need to see a retracement in the surging US dollar. The US Dollar Index, which measures the currency against a basket of six peers, reached a twenty-year high in September. US companies with international operations are experiencing significant foreign exchange headwinds which may cause investors to reset margin expectations during Q3 earnings season. The dollar’s strength is also stoking inflation in other countries as it makes importing essential items such as food and fuel more expensive since they’re priced in US dollars.

|

|

The second area we are watching closely is the labour market. Wages currently represent the stickiest component of inflation and have been grinding higher for months. Wages in the US increased 8.6% in August 2022 compared to the same month in the previous year. The US unemployment rate registered at 3.5% in July, matching its lowest level in the last 50 years, before rising to 3.7% in August. Continued tightness in the labour market has been supporting the Federal Reserve’s aggressive rate hiking path this year. Thankfully, we are starting to see signs that these conditions are changing. Job openings in the US dropped 10% in August while the labour force participation rate rose by 0.3% to 62.4%, its highest level of the year.

Third, we are looking for signs that 2-year Treasury yields (2Y) are peaking. The run in 2Ys this year has been remarkable, having surged from 0.73% at the start of the year to 4.22% at the end of Q3. 2Y yields offer valuable insights into monetary policy and where the market expects short-term borrowing rates will be over the medium term. A sustained decline in 2Ys would improve sentiment and be supportive of equity valuations.

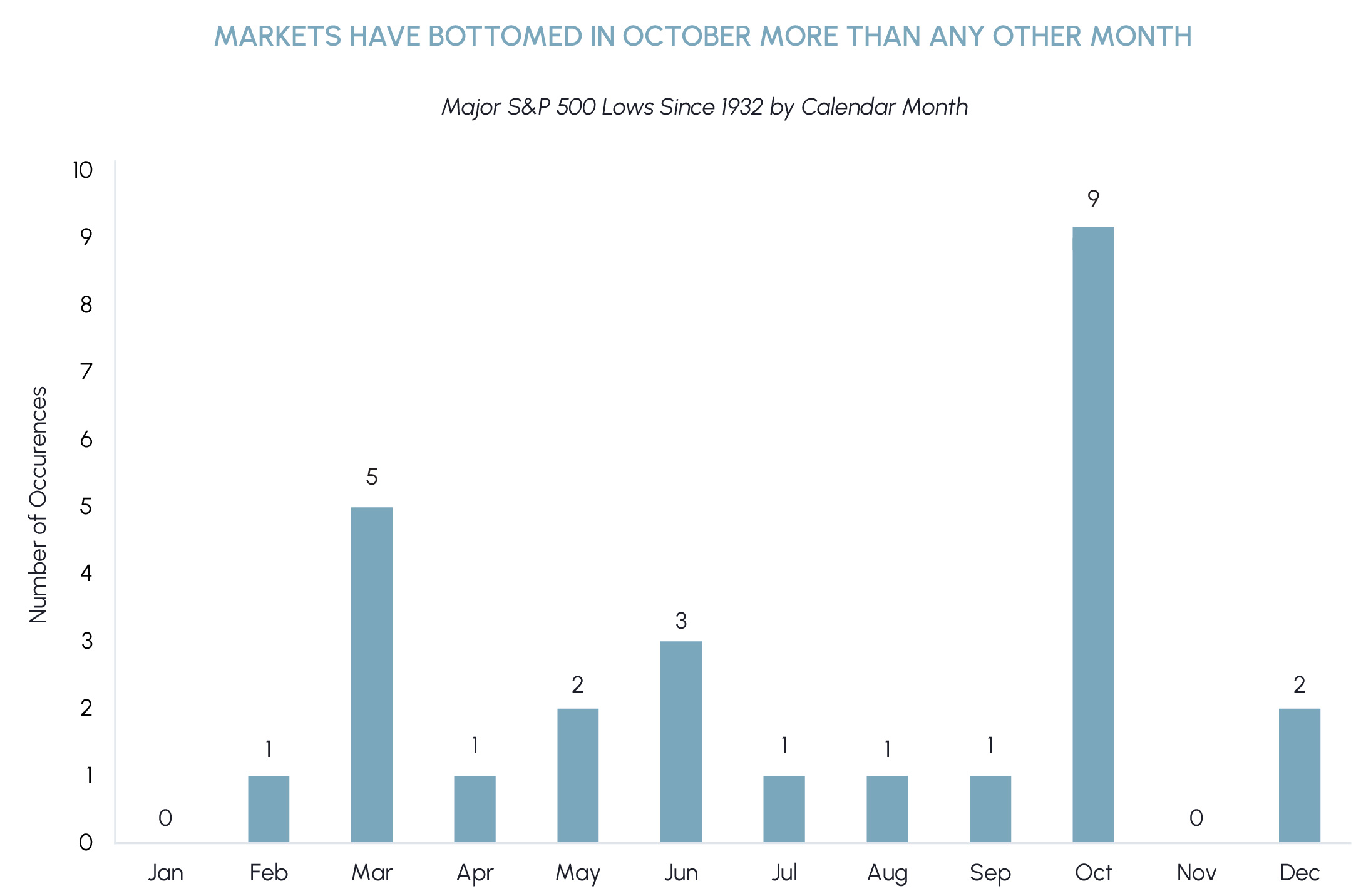

Finally, we are watching for analysts to incorporate a more realistic outlook into their earnings and margin projections, a development that could occur during the Q3 earnings season. While September is historically the worst month of the year for equities, October has been the best for markets finding a bottom. Major market bottoms have occurred in October more than any other month since 1932, and by a significant margin. We will be watching currency, labour tightness, treasury markets and earnings estimates closely this month in hopes that these conditions are being met.

|

|

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

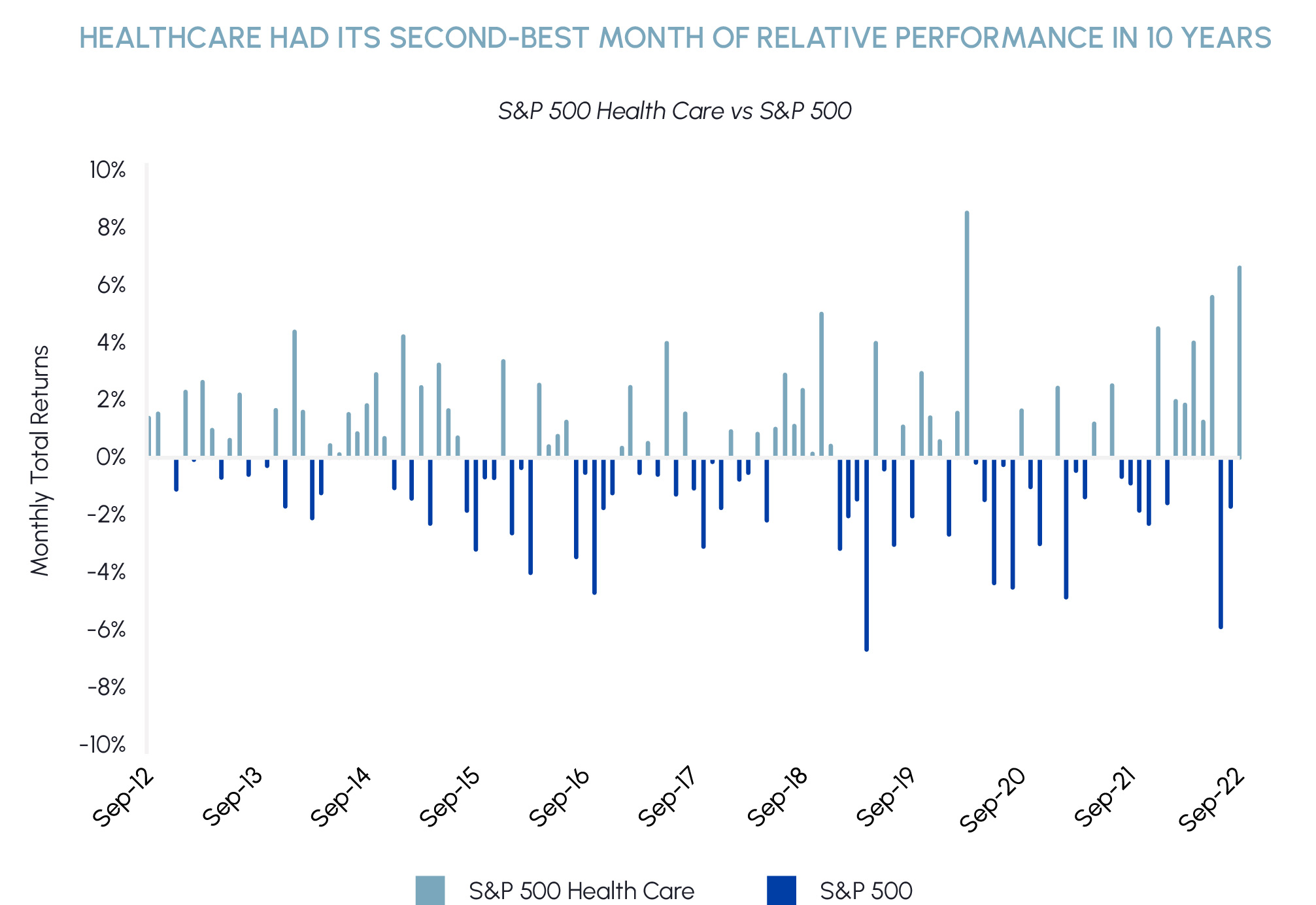

Healthcare was by far the best performing sector in the S&P 500 this month, down only -2.6%. It outperformed the next best sector by over 5%, including traditionally defensive sectors such as staples and utilities. The magnitude of outperformance relative to the broader market was the widest since March 2020 in the early days of the pandemic and the second widest over the last decade.

While the defensive sub-industries of healthcare have been driving the sector’s performance recently, we are becoming more constructive on the industries that have lagged due to macro factors. Supply chain disruptions and labour costs have been particularly problematic for medical equipment (medtech) companies and have caused a slowdown in procedure volumes. We are starting to see signs that these headwinds are stabilizing and expect revenue and cost trends to improve into year-end. Demand for travel nurses (nurses who take temporary nursing positions in high-need areas) has fallen 35% since the start of the year and hospital operators have noted significant declines in hourly rates. Management teams of medtech companies have also adopted a more upbeat tone with regards to these headwinds at recent investor conferences we have attended.

As of September 30th, the S&P 500 health care equipment sub-industry had returned -29.2% this year, trailing the healthcare sector by more than 15%. We believe this performance gap will eventually narrow and have slowly started to increase our exposure to the group in high-quality, dividend paying names. In September, we initiated a position in Baxter International, a globally diversified medtech company that sells a host of products including sterile IV solutions, infusion devices and dialysis therapies. Baxter is positioned to benefit from improving hospital admission rates and recovering surgery volumes. It also has a shareholder-friendly capital allocation strategy which has resulted in a 16% annualized growth rate in its dividend over the past 5 years.

|

|

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Canadian REITs returned -8.5% in September, underperforming the TSX by 4.2%. It was the sector’s second worst monthly performance in the last two years and is reflective of current investor sentiment and current positioning. While REIT fundamentals have not changed significantly, investor sentiment is negative due to rising rates and concerns surrounding an economic slowdown. Notwithstanding, we believe market sentiment is overly negative, thereby making current trading levels a very attractive entry point into one of Canada’s most resilient sectors.

Middlefield hosted a roundtable event on September 27th featuring Kevan Gorrie, CEO of Granite REIT, and Mark Kenny, CEO of Canadian Apartment Properties (CAPREIT). The discussion reinforced our conviction in both companies and the underlying demand trends in their respective sectors. For industrial REITs, the growth in E-Commerce is being supported by demand stemming from the ongoing shift from “just-in-time” to “just-in-case” inventory management among tenants. Reshoring is another emerging demand driver due to mounting geopolitical tensions and political initiatives such as Biden’s infrastructure bill. For Canadian multi-family REITs, immigration tailwinds have never been stronger. Canada’s population increased by 285,000 during the second quarter, a 0.7% increase relative to the previous quarter and the largest since the baby boom of the 1950s. International migration accounted for 95% of this growth, propelled by the arrival of approximately 45,000 Ukrainian refugees. Supply of apartments is not expected to keep pace with demand which should continue to support strong market rent growth.

First Capital REIT (FCR), a core holding, announced a new capital allocation strategy in September. The goal of the new program is to grow funds from operations per unit by 4% per annum through 2024 and to reduce its leverage ratio to less than 10x EBITDA. Its goals will be facilitated by a planned $1 billion asset disposition program, 15% of which has already been announced. Earlier in the month, FCR also hiked its dividend from $0.43/unit to $0.86/unit, reversing a dividend cut the company had prudently announced in 2020. With a dividend yield now above 5% and capital appreciation potential supported by the company’s growth and de-leveraging strategy, we see excellent value in FCR’s shares which currently trade at more than a 20% discount to net asset value.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

This month, the Biden administration unlocked approximately $1.5 billion of the $5 billion total that is earmarked for funding EV charging infrastructure under the Bipartisan Infrastructure Law (BIL). The planned investment is substantial, spanning all 50 states across 75,000 miles of highways. We believe it will significantly drive EV adoption, a positive readthrough for Tesla, our preferred exposure to the industry.

Another noteworthy announcement in the clean energy space was made by the Department of Energy (DoE). It released a draft of its national hydrogen strategy which provides a blueprint for how $9.5 billion of hydrogen grants will be distributed over the next four years. The plan aims to meet 100% of the United States’ projected jet fuel demand with sustainable aviation fuel (SAF) by 2050. We have a positive outlook on hydrogen demand as its applications expand, reaffirmed by strong order volumes received by Plug Power, a leader in North America. The DoE also released a report called Industrial Decarbonization Roadmap this month which identifies four key pathways to reduce industrial emissions. Supportive government policies backed by sizable funding initiatives and the urgency to decarbonize industries is making investing in North American renewables even more attractive. Middlefield’s sustainable funds provide exposure to these technologies by investing in clean energy leaders such as Plug Power (PLUG), Sunrun (RUN), Enphase (ENPH) and key enablers such as Prysmian (PRY), Eaton (ETN) and Vulcan Materials (VMC).

Severe weather remains a tail risk as the world continues to struggle with grid fragility. Hurricane Ian, which has left many homes in the dark, highlights the importance of incorporating storage with the power grid. Historically, destructive natural disasters have led to a rise in demand for Generac’s storage solutions, one of the holdings in our Clean Power Fund (CLP.UN). We remain bullish on storage solution providers and believe that storage will play an instrumental role in the overall energy security landscape.

Enbridge made a series of important announcements in September. Late in the month, it announced that twenty-three First Nation & Métis communities will collectively acquire an 11.6% non-operating interest in seven Enbridge-operated liquids pipelines in the Athabasca region of northern Alberta for $1.12 billion. The newly created entity represents the largest energy-related Indigenous economic partnership transaction in North America. Subsequent to this transaction, Enbridge announced the acquisition of Tri Global, the third largest onshore wind developer in the US, for US$270 million to complement low carbon growth initiatives. While the deal is small relative to Enbridge’s size, it offers significant growth potential as the recent Inflation Reduction Act incentivizes rapid adoption of renewables. While Enbridge has long had an onshore renewables presence in North America, its focus in recent years has been offshore wind development in France/Germany. This deal represents a shift back to onshore development, which is partly driven by Enbridge’s self-powering initiatives to reduce net carbon intensity across its systems by integrating renewables as a power source.

Enbridge also announced Al Monaco’s retirement as President and CEO and from its Board of Directors with the current Chairman Greg Ebel succeeding him effective January 1, 2023. Mr. Monaco successfully navigated the company through a critical period of its history marked by the transformative $37 billion Spectra acquisition in early 2017, effectively balancing the business between natural gas and oil and geographically between the U.S. and Canada. Mr. Ebel has been the Chairman of Enbridge since 2017 where he worked closely with Al Monaco on the strategic direction of the company. We do not expect a material change in the company’s direction. Mr. Ebel was the Chairman, President and CEO of Spectra Energy from 2009 until it was acquired by Enbridge. That said, based on Mr. Ebel’s executive experience in the gas infrastructure business, we would not be surprised to see Enbridge accelerate its shift towards natural gas/LNG infrastructure assets relative to liquids, which would likely be welcomed by energy transition focused investors.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

The Nasdaq bear market continued in September, falling -10.4% and making a new low for 2022. While that marked an end to a difficult month and quarter, we remain optimistic about the long-term growth potential of leading technology companies, as we highlighted in our Innovation Primer.

In terms of positioning, we are largely avoiding industries that “over-earned” during the pandemic. For example, we only have select (and mostly indirect) exposure to the PC market and have been reducing our allocations to gaming. Overall, we remain underweight IT hardware in general and have a significant preference for software.

Two industries that continue to impress are cloud computing and cybersecurity, both of which remain at the top of priority lists for IT spending budgets. We believe that leading players in these areas will demonstrate durable growth for the next 5+ years, regardless of broader macro trends. Our top picks in cloud and cyber remain Amazon (AMZN) and Palo Alto Networks (PANW). The former is expected to show a significant step up in free cash flow generation as Amazon Web Services and advertising become larger parts of the business and retail shows CapEx moderation after doubling the size of its fulfillment network during the pandemic. The latter is well positioned to grow margins and free cash flow, with a broad portfolio of solutions that should allow it to take share from legacy companies while protecting it from potential vendor consolidation.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

At the OPEC+ meeting on October 5th, the group agreed to a 2 million barrel per day production cut in November. The move signals a willingness to resume active market management to support prices well above the recent low of US$80/barrel and avert a major sell-off due to recession concerns or expectations of policy driven supply increases. It is likely that OPEC+ has already been producing well below its quota, meaning a cut wouldn’t translate into 2 million barrels per day coming off the market. Further, there are suggestions the US could use further Strategic Petroleum Reserve sales to try and offset the impacts. Nevertheless, the reaction of OPEC+ to the current market environment is a positive for oil prices.

We are witnessing a shift in both policy and public opinion towards nuclear energy. The world has realized the importance of energy security and energy independence, and how essential it is to have access to abundant 24/7 energy that is independent of geopolitical pressures, the weather, or the season. The recently passed Inflation Reduction Act includes some highly impactful appropriation for existing nuclear power plants including $30 billion in credits for current operations and credits which will directly benefit the development of next generation reactors.

After two years of virtual participation, the Denver Gold Forum returned in early September with in-person participation. Overall, company plans are largely unchanged despite lower gold prices. Most senior producers continue to generate positive free cash flow, pay out consistent dividends, and maintain strong balance sheets. Growth in gold production continues to be downplayed among the seniors who are largely looking to sustain gold production levels via lower capital-intensity and brownfield expansion projects versus looking to grow output.

The Russia-Ukraine war has magnified the fundamental instability across the global food system. At the macro level, global food CPI and agricultural commodity prices have declined from near historic levels but will remain structurally high. There is a risk that elevated food and fuel prices will persist and spark broad social and political unrest, particularly in Central Asia and North Africa. Climate change, finite arable land and population growth will drive opportunities from new technologies to support reinventing the Agri-food industry to provide sufficient, low-carbon, healthy and sustainable food.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

A word that one often hears in the world of ESG, but that many people do not understand, is “taxonomy.” This commentary will explain what the term taxonomy means and why it is important in the ESG field. In the ESG world, a taxonomy is a classification system for sustainable investments or, more broadly, sustainable activities. In the ESG field, a major aim of a taxonomy is to incentivize the channeling of private investments into activities classified as sustainable by enhancing investor confidence and awareness of the environmental impact of financial products and by trying to prevent greenwashing.

There are over 20 different existing or proposed taxonomies around the world, all classifying what activities are deemed to be sustainable for a particular country or group of countries. The European Union (EU), for example, produced a taxonomy that applies to all countries in the EU. According to the EU, its taxonomy “is a green classification system that translates the EU’s climate and environmental objectives into criteria for specific economic activities for investment purposes”. Furthermore, the EU taxonomy “recognises as green, or ‘environmentally sustainable’, economic activities that make a substantial contribution to at least one of the EU’s climate and environmental objectives, while at the same time not significantly harming any of these objectives and meeting minimum social safeguards.”

The economic activities that are characterized as sustainable by any given taxonomy are not set in stone, so there can be controversies about what activities should or should not be characterized as sustainable. For example, in September various environmental groups filed legal challenges with the EU to try to reverse the decision made by the European Parliament earlier this year which included natural gas and nuclear power on the EU taxonomy’s list of sustainable investments.

In Canada, the final report of the Expert Panel on Sustainable Finance published in 2019 recommended that Canada adopt what we call a “made in Canada but internationally aligned” taxonomy, stating as follows: “Ideally, Canada would adopt a single internationally-aligned taxonomy encompassing not just green definitions, but a broader mapping of transition and resiliency-linked economic activities and asset classes. Because such a taxonomy is unlikely to come forward in the near-term, Canada should begin by adopting an international green taxonomy that aligns with its global investment and trade priorities. It should then work either independently, or with other countries with similar resource endowments, to develop supplemental coverage for industry transition activities that are essential to Canada but not captured under current criteria.”

After the publication of the aforementioned Expert Panel report, a committee was formed to create a taxonomy for Canada. However, it was reported that fundamental differences of opinion existed among committee members working on the framework for the taxonomy, which resulted in a pause in its creation. We understand that work on a Canadian taxonomy restarted, however, and that a roadmap to create a Canadian taxonomy is expected to be published this year.

There have been many articles in the press about attempts in the last few years to create sustainability disclosure standards that are globally compatible in terms of concepts, terminologies and metrics. Compatibility in financial reporting standards, however, is only part of the equation. With over 20 existing or proposed taxonomies in the world, another part of the equation is consistency as to whether an economic activity is sustainable and thus should be included in a taxonomy. Unless and until there is such consistency, there will be confusion about greenwashing when some economic activities are taxonomy-aligned in certain countries but not in others.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |