ROB LAUZON, managing director and chief investment officer at Middlefield, can afford a smile of satisfaction when he contemplates the Middlefield Income Plus Class fund’s stellar performance over the past 12 months.

It is the asset management company’s flagship fund, which seeks to provide stable income by investing in a diversified portfolio of equity and fixed-income securities, all while emphasizing capital preservation. The actively managed strategy recently won Fundata’s prestigious award for top global equity balanced fund of 2022. While its competitors’ performance dived by up to 10 percent, the Income Plus Fund maintained a steady course through the turbulence that amounted to a stunning outperformance.

This has earned it a prized Fundata FundGrade A+® rating, which is given to funds that have consistently demonstrated the best risk-adjusted returns throughout an entire calendar year.

INCOME PLUSBest ideas in equity & debt across our key focus areas |

|||||

|---|---|---|---|---|---|

|

|

|

|

|

|

| Real Estate | Healthcare | Energy | Innovation | Global Dividends | Infrastructure |

Ideal “rainy day fund”

Still, the last year has been, as Lauzon candidly admits, a confusing time, with slowing economic growth and rising interest rates causing all sorts of dislocations in sectors and stocks. The fund could be said to be designed for that kind of environment, and Lauzon describes it as a “rainy day fund.”

That makes it sound like the safe, steady kind of vehicle for wiser, older people, and Lauzon agrees that it is best suited to income clients, to whom it pays out monthly dividends. It’s ideal for clients who want to pay off something like property tax, he says.

“You put $100,000 into it, we’re going to earn you $5,000 to $6,000 a year,” he says, adding, “Say I have to create a stream that just pays my property tax every year, or, if I don’t need any income, I could put it on DRIP” – a dividend reinvestment plan that allows investors to reinvest their cash dividends in additional shares or fractional shares of the underlying – “and I’m compounding that every year.”

With income at its core, the fund needs a good spread of dividend-bearing holdings, and ideally, Lauzon likes every one of them to pay a dividend – but at the very least he tries to achieve 90 percent-plus in that camp as fund holdings.

Lauzon’s aim is to keep the fund producing high single-digit returns in the long run. To that end he keeps a minimum of 10 percent in fixed income. Meanwhile, its biggest sector allocation currently is focused on the global energy transition, while Lauzon “loves REITs this year” and is bullish on financials and healthcare.

But although he owns Apple and Microsoft, he is not overweight on technology stocks because he says it is hard to find good-quality dividends with technology companies. The sceptical theme continues when it comes to consumer stocks, in which he also takes an underweight position.

He doesn’t own staples, as he thinks their run is over, and he believes the sector is calling out for a market correction. It is an area he will avoid for another quarter or two, he says.

As befits an income fund, Lauzon is careful to shield it from any risks to its assets from squalling market clouds on the horizon. He says, “Protecting capital is important. This fund is designed to do that with low costs and diversified investments. So, it can be an all-weather fund. If someone just has one fund only with their money, this could be it because of its revenue diversification. I am giving you income and you can take it in cash, or you can DRIP it and compound it. I am giving you a low fee, and I am giving you active management, which checks a lot of boxes.”

Extensive due dilligence

Its low fee is another of its attractive features for investors, especially during inflationary times, making it very competitive with ETFs. “We should probably raise the fee on the fund because it’s probably too cheap! But we are not going to do that,” Lauzon laughs.

All this strong performance while protecting capital takes a lot of careful work to achieve, and Lauzon takes the fund’s due diligence seriously. Company results are interrogated with prosecutorial zeal before any investment is made. Lauzon is alert to the fact that some businesses may try to embellish their results to make them look better to potential investors. He says, “There’s a point where a company is just pulling the wool over your eyes by saying, ‘I’m giving you a six-percent yield.’ But if you look at the numbers, they’re only earning three. So you’ve got to look at the balance sheet, especially in a rising rate environment.”

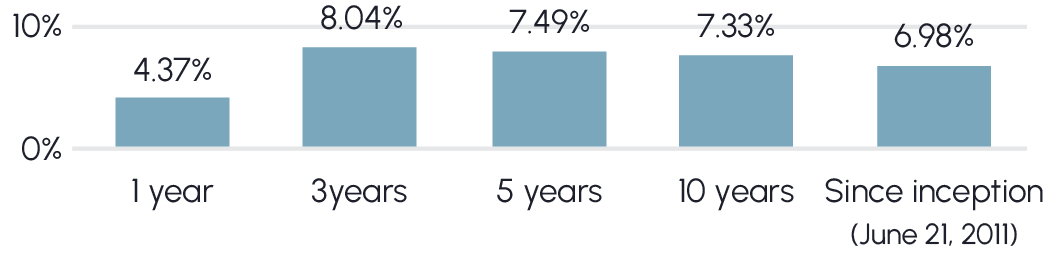

Fund Perfomance(Series F) as of January 31, 2023 |

|---|

|

Any signs of insider trading are also carefully scrutinized by Lauzon and his team. They are decidedly keen on management owning a lot of stock in the company that they are pitching for investment and want alignment of interests between management and shareholders. Although the Income Plus fund is not an ESG vehicle, Lauzon still uses the insights he has gleaned from it to tailor his stock-picking. In particular, he applies the lessons of good governance to ensure that management compensation is appropriate to a company’s growth trajectory.

The economic outlook for the next year currently hovers between a drizzle of rain and prolonged torrential downpour, depending on the forecaster. It’s weather for which the fund has been built. Lauzon takes a relatively upbeat view, describing himself as being in the soft-landing camp, and thinks that a mild recession could be on the cards.

“It’s a really good time to talk to your clients about getting value,” he observes.

And that’s at the heart of the fund’s philosophy – that and getting a good performance for a passively managed price.

Disclaimer

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.