Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

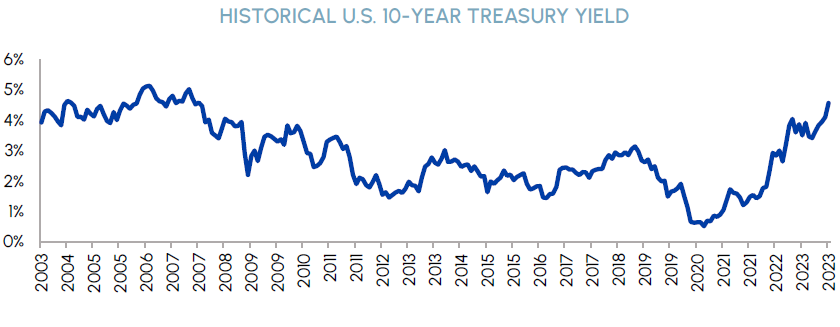

Equity markets continued to slide in September with the TSX Composite, MSCI World and S&P 500 Indices generating total returns of -3.3%, -4.3% and -4.8%, respectively. A sharp increase in bond yields drove stock markets, with U.S. 10-year treasury yields increasing nearly 50 basis points in September.

Although 10-year yields have risen to sixteen-year highs, they are still in-line with the 40-year average of 5%. Markets are adjusting to a more typical rate structure as we exit the extremely low interest rate environment of the past decade. We are not overly concerned by the current level of yields, as equity markets have historically produced good returns in similar rate environments. What is striking is the velocity at which rates have moved higher over the past two years, and the speed at which markets have had to recalibrate their cost of capital assumptions.

|

|

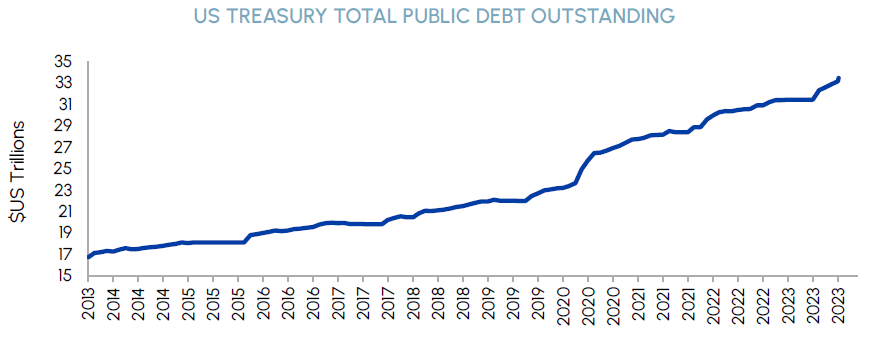

Much debate is taking place as to why bond yields have moved higher in recent weeks. Normally, moves in yields are tied to monetary policy and market expectations concerning central bank rate-setting moves. Instead, the narrative has shifted towards fiscal policy and the supply/demand mismatch for sovereign debt. The concern is that escalating federal budget deficits will require more government borrowing thereby creating a supply of bonds exceeding demand. As a result, higher yields are required for investors to absorb the increased supply of bonds.

While concerns about government deficits have been raised for years, it appears that “Bond Vigilantes”, a term coined by Ed Yardeni in the 1980s, are sending a signal to the market that the situation is becoming untenable. The amount of total public debt outstanding in the U.S. has doubled to $33.4 trillion over the past ten years and, as of August 2023, it costs over $800 billion per year to service that debt.

|

|

While Bond Vigilantes may have driven the Treasury market in recent weeks, and fiscal spending concerns are warranted, we maintain the view that monetary policy will ultimately determine the path forward for rates and equity markets. We are optimistic that inflation will continue trending lower in the US, especially with shelter costs decelerating. Economic indicators tied to the health of the consumer have started to deteriorate as credit card delinquencies rise while intentions to travel have decreased as indicated by the recent sales on Disney Park vacations. While we acknowledge that the economy is starting to show signs of slowing, these developments match our base case of a soft landing in the US. This, in turn, should allow the Federal Reserve to soften its hawkish stance. Indeed, we believe the Fed may be done with rate hikes altogether supported by the fact that the bond market is pricing in only a 30% chance of a hike (as of October 6th) at the upcoming November 1st meeting.

Much of the interest rate risk in the market has been priced in, and we see an attractive entry point for multiple sectors. Rate-sensitive businesses, such as real estate and utilities, are currently screening as deeply oversold and are positioned for a near-term rally. The S&P 500 has declined 8% since its July 31st high leaving it right around its 200-day moving average. Over the same period, its forward price-to-earnings multiple has declined from 20x to 18x, which is below its 5-year average of 19x. We view the recent pullback as a healthy correction within a broader bull market and are optimistic for a strong finish to 2023. Considering the growing body of evidence that suggests the economy is beginning to slow, we favour companies that possess defensive growth attributes – high free cash flow, low capital expenditures and strong balance sheets.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

REITs sold-off in September as interest-sensitive sectors were impacted by rising interest rates. The publicly listed real estate sector is becoming increasingly attractive based upon historic valuation metrics. Aside from the embattled office sector, operating fundamentals have arguably never been stronger, yet they continue to trade at discounts to NAV which are greater than those seen during the pandemic or global financial crisis. In the last few weeks, we’ve met with virtually all the management teams of our REIT portfolio companies. They’ve described how their balance sheets and liquidity ratios have remained healthy during this unprecedented rise in interest rates while still benefiting from the growing demand and constrained supply for their properties.

CBRE released its quarterly Canada Industrial Figures report which showed the pace of rental rate growth slowed in Q3 but remains positive, rising a healthy 11.8% year-over-year. Even though completion of new industrial properties (ie. deliveries) reached an all-time high in Q3, the national availability rate for industrial space rose a mere 40 basis points to 2.5% during the quarter. Overall, Canada’s vacancy rate remains well-below its 15-year average of 4.7% and is among the lowest globally. In addition, in-place rents on existing leases remain well-below market asking rents which should provide several years of embedded rent growth as expiring leases are marked-to-market. We view the recent moderation in market rent growth and occupancy uptick as healthy normalizations from levels that were abnormally high over the past three years. Granite REIT and Dream Industrial REIT are trading at 20% and 25% discounts to net asset value, respectively, and remain high conviction long-term holdings.

CBRE also released its quarterly Canada Office Figures report which showed office market vacancy increased just 0.1% to 18.2%, moderating from the +0.4%/0.6%/0.7% increases we saw over the prior three quarters. Vacancy rates for quality downtown Class A office space decreased 0.2% to 16.3%, reflecting an ongoing flight to quality from tenants. While these signs of stabilization in the office market are encouraging, we remain cautious on the outlook given elongated leasing cycles, continued tenant downsizing and additional supply expectations in Q4. Office REITs have been the worst performers year-to-date and are now trading at implied cap rates of 9% which we believe accurately reflects the challenges facing the asset class in the years ahead.

Since early 2022, the multi-family REIT sector has been actively working with the federal government to help them better understand the supply challenges in the Canadian housing market. While Canada has among the world’s highest levels of immigration, it also suffers from the lowest level of housing per capita among G7 countries. Recent announcements from the Trudeau government indicate they better appreciate the need for more housing supply and solutions based upon better cooperation between government and industry. More specifically, they announced the elimination of the GST on the construction of purpose-built rentals and the provincial governments are following suit by waiving the provincial portion of the HST. In addition, CMHC has also recently announced an additional $20 billion in low-cost financing will be made available to developers to spur the construction of much-needed rental apartments. These specific measures should benefit apartment REITs as well as many of our grocery-anchored retail REITs with active multi-family development projects in the pipeline.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

The S&P 500 Healthcare sector declined 3% in September, outperforming the S&P 500 by 1.8%. Healthcare’s attractive defensive growth attributes, which are underpinned by inelastic demand for needs-based products, should continue to attract investors against an uncertain economic backdrop.

Since Novo Nordisk released topline data from its SELECT trial on August 8th, which showed that taking obesity drugs reduces the risk of adverse cardiac events, the perceived winners and losers from a lower prevalence of obesity have moved sharply in opposite directions. Eli Lilly, Novo Nordisk, and other companies that will assist in supplying and distributing GLP-1 drugs have significantly outperformed the past two months. We maintain our bullish stance on these companies as we expect weight loss drugs to be prescribed and consumed on a massive scale, and to ultimately emerge as the top selling drugs of all time.

On the other hand, the perceived “losers” from weight-loss drugs, particularly in MedTech, have been sold with abandon. The concern is the negative effect on future demand for a range of MedTech products associated with obesity if a large percentage of the population takes GLP-1 drugs and loses weight. We believe certain companies are more exposed to this risk than others. For example, sleep apnea represents an area that we expect to be directly impacted by GLP-1 drugs and we are therefore avoiding it within MedTech sector.

On the other hand, many high-quality, relatively insulated businesses are extremely oversold. For example, diabetes and orthopedic surgery stocks are being sold indiscriminately despite the limited impact GLP-1 drugs will likely have on their businesses. We expect Dexcom and Abbott, which sell continuous glucose monitoring (CGM) devices to patients with diabetes, to continue growing revenues through increased market penetration and expansion outside the US for many years. In fact, Abbott’s recent analysis of US pharmacy data has shown that people on GLP-1 drugs wear CGM sensors more, and that they could be a modest accelerator for the company.

Similarly, Stryker’s management recently noted that obesity acts as a gating factor for receiving surgery and many orthopedic surgeons turn away patients whose body mass index is too high. If these patients can reduce their BMI through weight loss drugs, it could increase the pool of eligible patients for large joint reconstruction surgery. We think recent pressure on these names is unwarranted, presenting a rare opportunity to accumulate positions in the highest-quality names in MedTech.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

In early September, Enbridge announced the US$14 billion acquisition of three US-based natural gas utilities. While we have seen some pressure on the stock from an associated $4 billion equity issue and the rapid rise in interest rates, we highlight that the gas utility assets are being purchased at a material discount to historically comparable transactions. The deal doubles the size of its existing utility business and is accretive in its first full year of ownership. The acquisition creates North America’s largest natural gas utility platform and diversifies Enbridge’s earnings mix to a fifty-fifty split between gas/renewables and liquids. We like the transaction as the assets provide above-average rate base growth, which enhances the visibility of Enbridge’s overall growth profile.

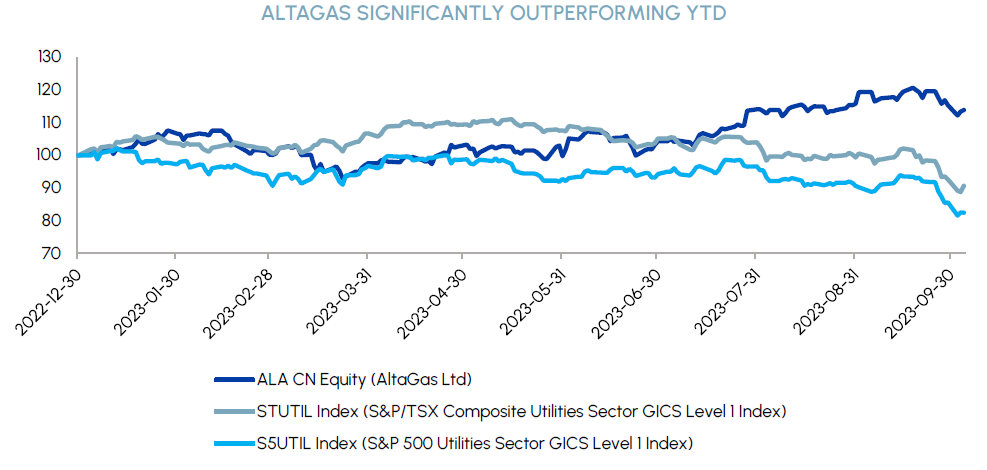

At the sector level, Utilities have gone from oversold to extremely oversold, which we do not think is warranted given the inherent stability of many businesses within the sector. As a result, we are finding attractive opportunities, especially in regulated businesses with exposure to grid investments. For example, one of our favourite holdings, AltaGas (ALA), has significantly outperformed the overall sector.

|

|

ALA has many of the attributes that we look for in a sustainable infrastructure name, including its: 1) growth opportunities in both the utility and midstream divisions; 2) focus on debt reduction; 3) attractive valuation; 4) emission reduction strategies; and 5) strong management. We were pleased when ALA announced Vern Yu as the new CEO earlier this year. We are confident in Vern’s ability to articulate and execute a clear long-term strategy and deliver industry-leading dividend growth through stable and increasing cash flows. Under Vern, deleveraging could be accelerated by asset sales. A prime candidate is their stake in the Mountain Valley Pipeline, the construction of which should be completed by early 2024. Another reason for our bullish stance is M&A opportunities such as ALA’s recent accretive acquisition of Alberta Montney infrastructure assets from Tidewater.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

The Nasdaq 100 has held in much better than the S&P 500 recently. We believe this is attributable to solid growth prospects and attractive valuations for mega-cap tech specifically. According to Goldman Sachs, the largest tech stocks are expected to demonstrate 12% per annum sales growth from 2023 to 2025 versus the S&P 500 at just 3%. Furthermore, following recent multiple compression and improving earnings estimates, mega-cap tech now trades at a significant discount to the S&P 500 on a forward PEG basis. The relative PEG ratio currently sits at 0.7x versus the long-term median of 0.84x. If estimates hold, then mega-cap tech stocks could appreciate by 20% simply by returning to the long-term median. This would have significant positive impacts on the Technology sector and the market as a whole.

As we enter Q4, investors are focused on key turning points that should support higher-than-market earnings growth for technology in 2024. During COVID, we witnessed outsized demand for consumer electronics such as smartphones and PCs. There was a long digestion period thereafter, with companies such as Apple and Dell showing multiple consecutive quarters of negative revenue growth. We believe we are moving past the worst and that each sub-industry should recover through year-end 2024. This has massive implications for not only the aforementioned pure plays, but also the companies in their supply chains. With additional earnings potential from AI, we have a great recipe for tech outperformance.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

In September, Gold reached a seven-month low, dropping below the critical US$1,900/oz mark due to Fed policymakers signaling a prolonged period of tight monetary policy. This narrative, combined with a 16-year high in treasury yields and a strong US dollar, led to seven consecutive days of losses for the metal, causing gold equities to significantly retract.

In contrast, oil prices surged as WTI reached $90 per barrel, a level not seen in eleven months. This marked the most substantial third-quarter gain in nearly two decades, driven by extended OPEC+ production cuts, a cessation of Russian diesel exports, and five-year lows in crude stockpiles at Cushing, Oklahoma. The Joint Organizations Data Initiative (JODI) data confirms that global crude oil inventories are at their lowest in five years. Prudent spending practices have limited capital investments, foreshadowing a decline in supply growth in 2024, especially in the U.S., where the oil rig count reverted lower to early 2022 levels. Expectations of sustained high oil prices above $80 underpin our optimism for the sector driven by enhanced shareholder returns, accelerated deleveraging, and attractive valuations relative to historical norms.

Saudi Aramco, the world’s largest oil producer, made a strategic pivot by investing in MidOcean Energy, entering the burgeoning liquefied natural gas (LNG) market. Wood Mackenzie forecasts a 70% growth in LNG demand through 2050. MidOcean is actively pursuing interests in four Australian LNG projects and participating in a consortium to acquire Sydney-based Origin Energy Ltd. Aramco’s plans include a $110 billion investment to develop the Jafurah gas field, doubling output by 2030 and transforming the kingdom into a gas exporter. While the S&P/TSX Capped Energy Index rose 2.8% in September for a fourth consecutive monthly increase, it pales in comparison to oil’s 8.6% surge.

ESG: Environmental, Social & Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN / MID 265

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

On September 11, a revised version of the G20/OECD Principles of Corporate Governance (the “Principles”) were endorsed at the G20 Leader’s Summit that took place in New Delhi, India. The Principles state that they are the leading international standard for corporate governance.

The Principles underwent a comprehensive review in 2021-2023 to update them in light of recent evolutions in corporate governance and capital markets. The review had two major objectives: 1) to support national efforts to improve the conditions for companies’ access to finance from capital markets; and 2) to promote corporate governance policies that support the sustainability and resilience of corporations which, in turn, may contribute to the sustainability and resilience of the broader economy.

The Principles state that they provide shareholders, directors, management, the workforce, relevant stakeholders, financial intermediaries and service providers with information and incentives to perform their roles and help ensure accountability within a framework of checks and balances.

The OECD’s announcement of the release of the revised Principles noted that in order to promote sound governance and well-functioning capital markets, key changes in the revised Principles include the following:

- promoting disclosure of sustainability-related information, clarifying the responsibilities of boards on sustainability matters, and recommending dialogue between companies and their shareholders and stakeholders on sustainability matters;

- addressing the complex range of issues that boards are now expected to manage, including diversity, risk management and the interests of non-shareholder stakeholders;

- encouraging the use of digital technologies in corporate governance practices and supervision and highlighting boards’ management of digital risks;

- considering the rise in the role of institutional investors through recommendations on stewardship codes and ESG rating and index providers as well as proxy advisors.

Although the Principles focus on publicly traded companies, the OECD noted that the Principles also may be a useful tool to improve corporate governance of private companies.

The Canadian Coalition for Good Governance (CCGG) had made various recommendations in a submission on the OECD’s public consultation in 2022 on the draft revisions to the then existing version of the Principles. When the revised Principles were published, CCGG noted that they “would have liked to see a greater inclusion of investor protections in the revised final version based on our specific recommendations”.

It will be interesting to see whether the non-binding revised Principles will in fact result in governments, regulators, stock exchanges and market participants (such as issuers, institutional investors, ESG rating agencies, index providers and proxy advisors) in Canada and in other countries around the world developing their own frameworks for corporate governance that follow upon the recommendations in the revised Principles or whether the revised Principles will be largely ignored.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |