Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

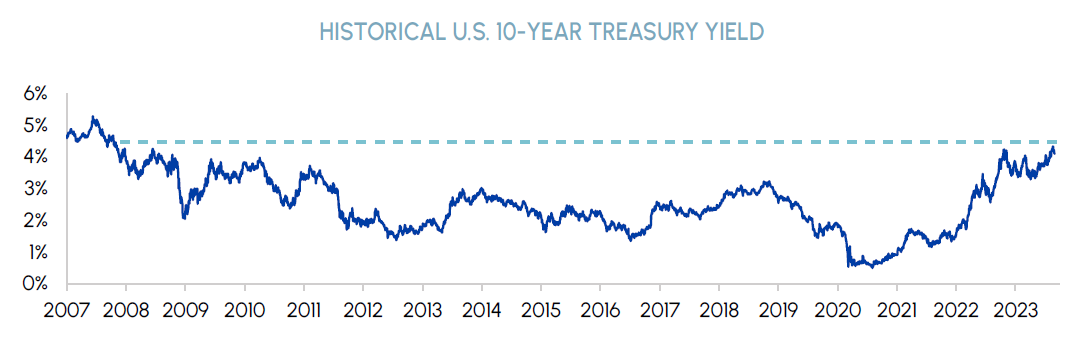

Equity markets took a breather in August following an impressive streak of positive monthly returns. The S&P 500 returned -1.6%, one of only two negative months so far in 2023. The sell-off was a function of multiple contraction driven by an increase in Treasury yields and higher volatility. US 10-Year yields climbed to as high as 4.34% on August 21 – the highest level since 2007.

|

|

Bond yields have reached multi-year highs on concerns that central banks may keep short-term borrowing rates higher for longer. At his recent speech in Jackson Hole, Fed Chair Jerome Powell listed several key factors the Fed is watching that would cause it to abandon its hawkish stance, including Core PCE inflation dropping closer to 2%, demand for labour matching supply, and a cooling of consumer spending. In Canada, it has become increasingly likely that the Bank of Canada has concluded its rate hiking campaign following the recent release of quarterly GDP data that showed the Canadian economy contracted at an annualized rate of 0.2% during the second quarter.

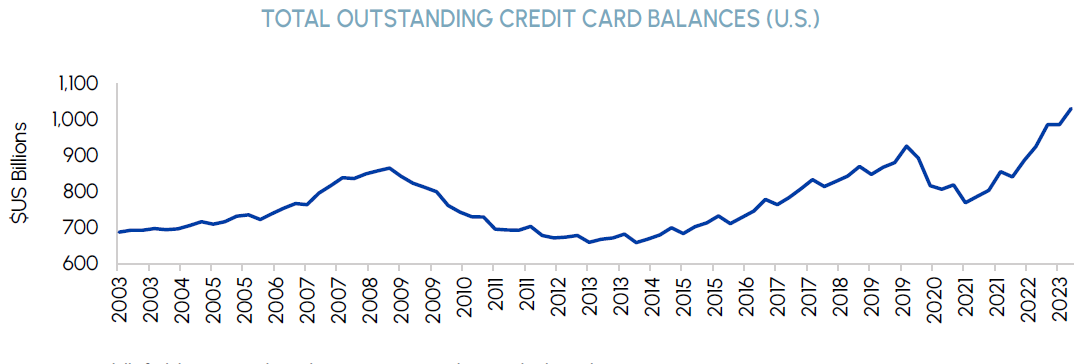

Forecasters who called for an economic hard-landing this year have consistently been proven wrong by the American consumer. US consumer spending increased by 0.8% in July, the most in six months. While these ongoing trends are encouraging, we expect to see signs of the slowdown that many have been predicting to emerge soon. The main reasons for this view are the lagged effects from higher borrowing costs and the depletion of household savings amassed during the pandemic. The savings rate in the US fell to 3.5% in July, the lowest level since November 2022. Meanwhile, total credit card balances reached a record high of $1.03 trillion according to the Federal Reserve Bank of New York. Unlike the past three years, governments are effectively tapped out in their capacity for providing additional fiscal stimulus, with the annual cost of servicing US government debt jumping to more than $650 billion in July. Meanwhile, student loan payments will restart in October after a three-year pause. Student debt payments may have a material impact on consumer spending as nearly 44 million Americans held student loans valued at over $1.6 trillion at the end of March 2023.

|

|

The labour market, which has been another key pillar of economic strength since early 2021, is finally showing signs of softening. Total job openings in the US fell to 8.8 million in July, down from 11.2 million at the start of the year and a high of 12.0 in March 2022. The unemployment rate jumped from 3.5% to 3.8% in August as the number of people seeking a job increased more than payrolls. While trends of a softening labour market are traditionally viewed negatively, we view them as positive developments in the context of the current landscape. Job openings are still 25% higher than they were in February 2020 and the unemployment rate still sits nearly 2% below its long-term average of 5.7%. The Fed will be watching for further normalization in the labour market to justify a pause in rate hikes.

We maintain a cautiously optimistic outlook on the market for the remainder of the year. We expect the pace of economic growth to slow in Q4 and early 2024 as student debt repayments restart and the lagged effects of higher interest rates take hold. Our optimism stems from the fact that a cooling economy should come with lower interest rate expectations. We believe higher interest rates represent the biggest risk to stocks right now and note that consumer spending, the labour market and inflation have room to slow without tipping the economy into a recession.

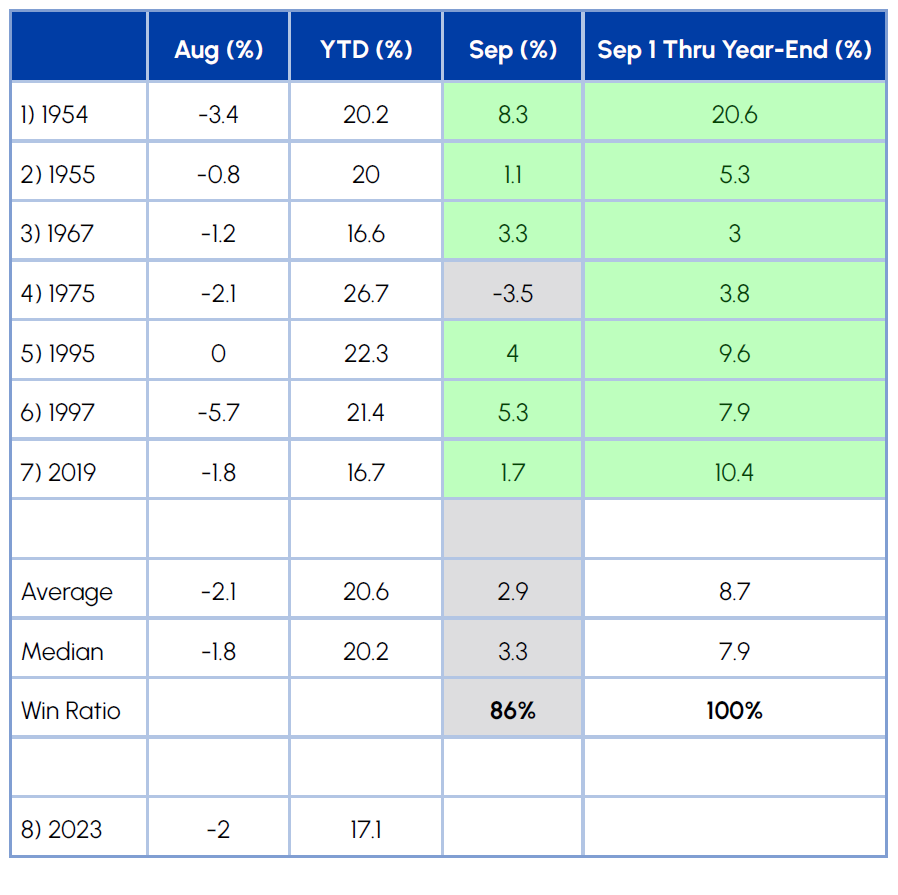

September is widely known to be a volatile month, but returns are significantly better when the market is down in August but still up more than 15% year-to-date. According to Fundstrat, there have been 7 other instances of this happening since 1950. 86% of the time the market rallied in September and 100% of the time it rallied through the year-end.

|

|

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Canadian REITs returned -1.0% in August, outperforming the TSX return of -1.4%. In the US, real estate returned -3.0%, trailing the S&P 500 return of -1.6%. We currently favour Canadian over US REITs within the sector’s major sub-industries (i.e., industrial, multi-family and retail) but continue to invest in select US asset classes that are not easily accessible in Canada such as data centers, single family rentals and manufactured housing communities.

The Federal government’s immigration policies over the past several years, together with an aggressive monetary tightening cycle from the Bank of Canada, has created a record imbalance between housing demand and supply. The ratio of housing starts to the working-age population fell to a record low of 0.26 in Q2, less than half its historical average of 0.61. As homebuilders fail to keep pace with the influx of people, home ownership and affordability are significant challenges. The long-term solution will require a multi-faceted approach to constructing new supply, involving collaboration between the private sector and all three levels of government. Many industry insiders believe the government is seriously considering various policy measures, including tax incentives, to stimulate more housing supply in the coming years. In the meantime, leasing rates will continue to edge higher with rents already up by an average of 22% since April 2021.

Boardwalk REIT and Killam Apartment REIT, both core holdings have stood out among their multi-family peer group this year. Boardwalk reported same-property net operating income (SPNOI) growth of 12.5% in Q2 and raised its full-year SPNOI growth guidance to a range of 11.5% to 14%. Similarly, Killam raised its full year SPNOI growth guidance to 6% (originally 3% to 5%) and sees a longer-term rent mark-to-market opportunity between 25% and 30%. Boardwalk and Killam’s key advantages relative to peers are the concentration of their assets in markets with outsized population growth (Alberta) and less restrictive rent control (Alberta and the Maritimes). Alberta currently does not have any rent control in place and the cap on rent increases for existing tenants in Nova Scotia will move from 2% to 5% in 2024, positioning both to continue delivering attractive topline growth.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

It was a busy month in the healthcare sector, with two major announcements making headlines. First was the release of topline data from Novo Nordisk’s (NOVO) SELECT study, which showed that taking obesity drugs reduces the risk of Major Adverse Cardiovascular Events (MACE). The second was the Centers for Medicare & Medicaid Services (CMS) publishing its initial list of ten drugs that will be eligible for price negotiation in 2026 under the Inflation Reduction Act (IRA).

The headline results from NOVO’s SELECT trial demonstrated that taking its obesity drug, Wegovy, resulted in a 20% reduction in MACEs such as heart attacks, strokes, and arrhythmias. The study started in 2018 and includes nearly 18,000 patients across 41 countries. The data has important implications for future reimbursement of obesity drugs as payors/employers are more likely to opt-in to obesity drug coverage given the preventive benefits they provide.

The obesity opportunity is growing, and the uptake of these medications is expanding rapidly. Morgan Stanley recently projected the total obesity market to reach $77 billion by 2030. Approximately 750 million people are living with obesity worldwide which is estimated to climb to 1 billion by 2030. Importantly, people living with obesity have an increased risk of cardiovascular disease, and it is estimated that obesity is associated with >200 health conditions and responsible for 5% of all deaths. Eli Lilly (LLY), our healthcare funds’ top holding, was up 15% the day of the announcement as its leading diabetes/obesity drug, Mounjaro, indirectly benefits from NOVO’s trial results.

On August 29, CMS announced the first 10 drugs covered under Medicare Part D selected for drug price negotiation. The highly anticipated announcement was relatively in-line with expectations, with no major surprises in terms of drugs that were included or excluded from the list. Negotiations between selected companies and CMS will occur in 2023 and early 2024, with negotiated prices being announced in September 2024 and becoming effective in 2026. Going forward, CMS will determine a list of drugs every year that it intends to negotiate, with price cuts taking effect approximately 2 years later. Overall, we expect a low to mid-single-digit earnings per share impact on biopharma companies by the end of the decade from the Inflation Reduction Act.

Individual company exposure will vary over time, with initial negotiations having the largest impact on medications that are at or near the end of their patent lives. The impact from price negotiations will be partially offset by improved reimbursement and lower out-of-pocket costs for patients, which should lead to higher prescription volumes. While the earnings impact will be manageable, we anticipate the headline risk from future negotiations could be an overhang on sentiment within the sector. In our view, the best way to reduce this risk is to focus on companies with strong drug pipelines that carry blockbuster potential and avoid companies with maturing, lower-growth assets. Eli Lilly, Merck and AstraZeneca fall into the former category and remain top holdings in our healthcare funds.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

After a relatively quiet summer following the announcement of a Mainline Toll settlement in May, Enbridge kicked off the post Labour Day week with a $19 billion acquisition of three US-based natural gas utilities. The large size of the package and the multi-state jurisdiction of the assets limited the potential bidding field, allowing Enbridge to buy them at a material discount to historical parameters. According to Enbridge, the deal diversifies and doubles the size of its existing utility business and should be accretive in its first full year of ownership. The acquisition creates North America’s largest natural gas utility platform. Enbridge’s 5% medium-term growth outlook is de-risked with the transaction as the deal adds approximately $5 billion (25% increase) of secured growth backlog, which supports Enbridge’s long term dividend growth profile of 3-5%.

Utilities and other rate-sensitive sectors have lagged the broad market significantly in 2023. While this is not entirely surprising given the upside pressure in interest rates, the dispersion has become too extreme in our view. For example, the US utilities sector is down 9.3% year-to-date versus a total return of 18.7% for the S&P 500. As a result, US utilities are trading at a forward P/E of 15.5x, nearly two turns below the 10Y average of 17.4x.

We believe this is an attractive entry point for utilities, specifically those exposed to renewable energy. While companies such as Orsted – which recently warned of a US$2.3 billion impairment – have raised concerns about the overall transition to renewables, we think the severity of the concerns is overblown. Most of the issues we are seeing are from “legacy” offshore wind projects that were awarded before 2021 and were impacted by extreme increases in equipment and funding costs. In contrast, companies such as RWE, which have future-dated projects, have reported no major concerns with their US assets. In addition, we are seeing continued progress in onshore wind and solar. Companies operating within these industries have been able to lock in costs after being awarded contracts that protect project returns. Overall, we believe the sector is extremely oversold and should outperform as we move past the peak in interest rates. The government-driven push for clean power is underway and we expect key players to benefit as the power mix gradually evolves towards more renewables.

The automotive industry has passed a crucial inflection point in its transition to electric vehicles. According to analysis from Bloomberg Green, 23 countries have reached the threshold of 5% of new car sales from fully electric vehicles. This is an important signal because it indicates the beginning of mass adoption, as it did in previous technological adoption curves for televisions, mobile phones and LED light bulbs. Increasing competition has resulted in lower prices. Moreover, more efficient batteries have allowed for longer ranges. These improvements, combined with continued investments from legacy automakers and attractive subsidies for consumers, are likely to continue driving adoption in the years ahead. Using history as a guide, the EV adoption rate could surge from 5% to 25% over the next four years in these countries.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

With positive market momentum, supportive macro (i.e., falling inflation and strong consumer spending) and improving fundamentals, we are expecting further gains for the tech sector through year-end.

AI spending remains robust and the PC market appears to be bottoming, as indicated by strong results from Nvidia and Dell. While the smartphone market remains weak, as indicated by Apple’s third consecutive quarter of negative revenue growth, we expect the outlook to improve following the launch of the iPhone 15. The return of topline growth at Apple should help the entire sector, not only because of its weight in the major indexes but also due to positive flow-through effects at companies such as Broadcom and TSM, both of which noted weakness in their wireless segments.

In terms of fundamental drivers, we expect that “margin protection” will remain a critical theme in technology. Meta led the way in its “year of efficiency”, but we are also seeing significant progress elsewhere. Salesforce, for example, achieved its 30% operating margin target 3 quarters ahead of schedule and increased its FY24 target to 30% from 28%. We believe the Salesforce example is representative of the bloating that occurred more broadly in tech companies when rates were near-zero and there was less emphasis on profitability. Thus, there is still a lot of fat to trim, which should support earnings growth as cost cutting continues.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

In August, gold traded in a narrow range and within striking distance of the key US$2,000/oz level. Lingering uncertainty surrounding global growth, inflation and geopolitical risks should underpin gold’s value as a haven asset over the medium-term. Also supporting prices near-term are recent news reports that BRICS members might be stockpiling gold to support a new currency. The S&P/TSX Global Gold Index was down 1.3% in August, in-line with gold and broad equity indexes.

Saudi Arabia is once again seeking to put market skeptics on notice by announcing it will extend its 1 million boe/d production cut through the remainder of the year alongside OPEC’s 2 million boe/d collective cut. The “longer, deeper” narrative will not sit well with a Biden Administration that has no legitimate options at its disposal to tame crude prices following the depletion of the strategic petroleum reserve.

While Chinese macro data have underwhelmed over recent weeks, product inventories are tight and gasoline stocks have fallen for 13 consecutive weeks. European natural gas prices were volatile amid strike risks at Australian LNG facilities, which represent 10% of global LNG exports. The potential outage once again highlighted the fragility of European energy markets, reminding us of both the long-term importance and potential of North American LNG exports. From the end of Q1 to date, natural gas prices have been steadily improving, which we expect to continue as supply has been constrained due to moderated drilling activity.

Valuations for North American oil and gas equities are near multi-decade lows as investors remain skeptical about the future of the fossil fuel industry. According to BMO Capital Markets, based on current consensus estimates, the Canadian oil and gas group is trading at a 2024 EV/EBITDA multiple of 3.8x versus a five-year average of 4.4x and 10-year average of 5.8x. Perhaps the relative value is starting to get noticed as the S&P/TSX Capped Energy Index was up 6.7% in August.

ESG: Environmental, Social & Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN / MID 265

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

In our June ESG Commentary we discussed the growth of “greenwashing”, which is the practice of misrepresenting sustainability-related information, practices or features. We explained that greenwashing allegations against various market participants, including public companies, are taking place around the world and that greenwashing has become a focus of regulators (such as securities regulators and competition regulators) as well as private plaintiffs.

The International Auditing and Assurance Standards Board (IAASB) recently published a proposal that, if enacted, will be useful to assist in combatting greenwashing. In August, IAASB issued its proposed “International Standard on Sustainability Assurance (ISSA) 5000, General Requirements for Sustainability Assurance Engagements”. ISSA 5000 should help in assuring that public companies’ sustainability-related information (whether contained in sustainability reports or other published documents) that is considered by investors in making investment and voting decisions, is reliable and credible and not just greenwashing.

According to the Chair of IIASB, “Our proposed ISSA 5000 is a crucial step in enhancing confidence and trust in sustainability reporting. … Corporate reporting, whether financial or sustainability focused, is more trusted when it receives external and independent assurance based upon globally accepted standards independently developed in the public interest.”

Proposed ISSA 5000 covers both “reasonable” and “limited” assurance engagements on sustainability information reported by public companies. A reasonable assurance engagement for sustainability information is equivalent to an audit of financial statements, whereas a limited assurance engagement for sustainability information is similar to a review of interim financial statements and thus provides less confidence that the reporting is correct.

ISSA 5000 is a principles-based standard that will apply to sustainability reporting under multiple frameworks (including the EU’s Corporate Sustainability Reporting Directive (CSRD), the International Sustainability Standards Board’s IFRS S1 and S2 disclosure standards, the Global Reporting Initiative (GRI)) as well as required climate-related reporting that is expected to be announced in due course in the U.S. by the Securities and Exchange Commission and in Canada by the Canadian Securities Administrators. The IASSB states that ISSA 5000 is “profession agnostic” and thus can be used by both professional accountants as well as non-accountant assurance practitioners when performing sustainability assurance engagements.

Proposed ISSA 5000 is open for comments until December 1, 2023. The IAASB is holding a series of roundtables on the proposals starting in September and invites stakeholders to attend the roundtables and to provide comments on the proposals. ISSA 5000 is expected to be finalized by the end of 2024. Various public companies already have been voluntarily obtaining some type of external assurance on their publicly disclosed sustainability-related information. As assurance becomes a legal requirement, first in Europe and perhaps later in North America and other parts of the world, the establishment of a standard for assurance engagements in ISSA 5000 should be a development that is well-received by anyone investing in securities of public companies.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |