Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Volatility returned to equity markets in August after an impressive two-month summer rally. The S&P 500 appreciated 17.4% between June 16th and August 16th before falling more than 8% during the final two weeks of the month. We think markets could remain choppy in September, historically the most volatile month of the year for stocks.

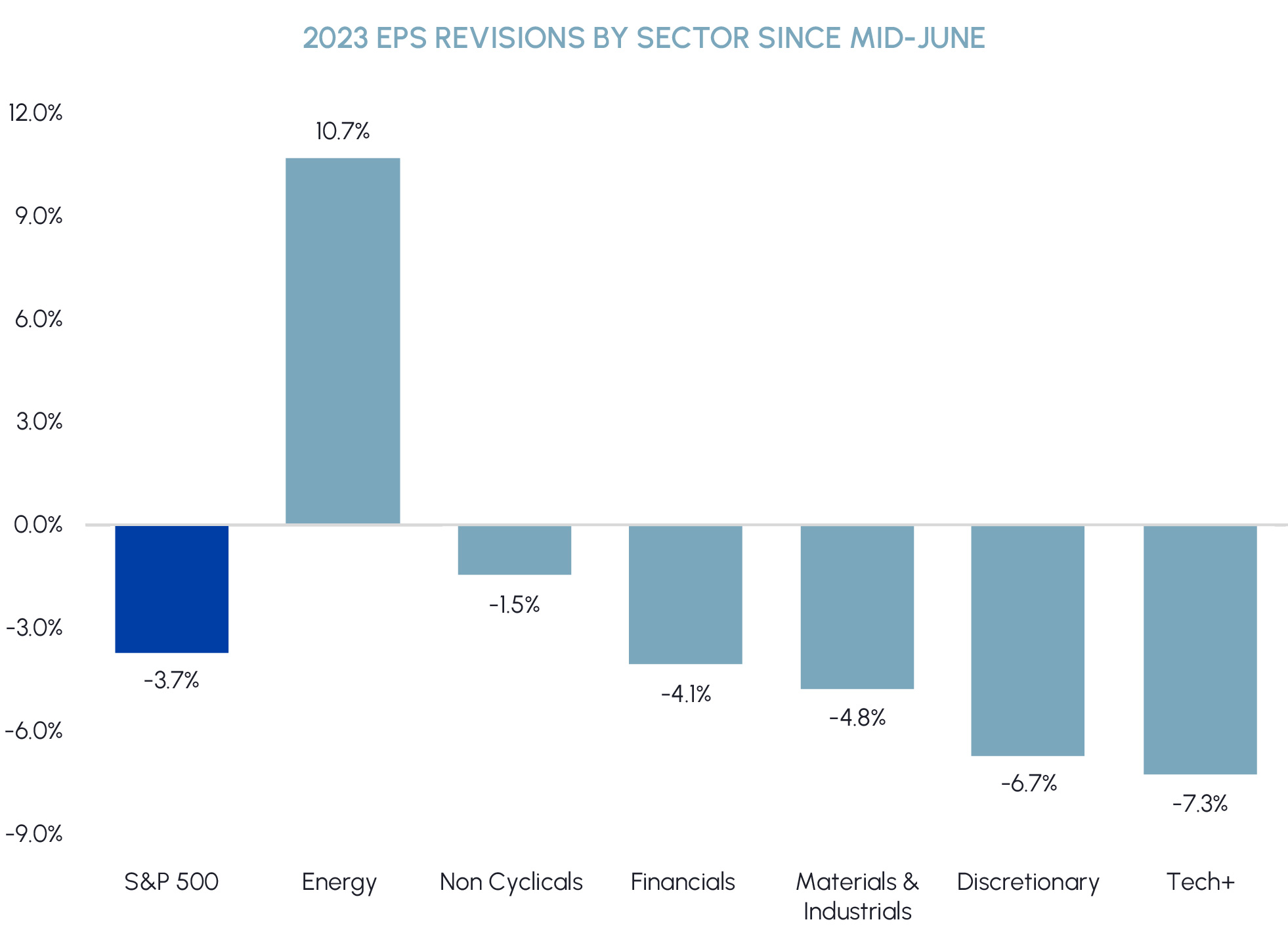

The general view from economists is that there is a six-to-twelve-month lag between rate hikes and impacts on earnings. As the effects of higher interest rates permeate the economy, different sectors may

experience downturns at different times, resulting in a rolling recession. Q3 and 2023 earnings estimates for North American companies have started to come down since peaking in mid-June with the exception of energy. Overall, we do not anticipate a widespread and deep recession in North America and believe that North American companies are well positioned relative to global alternatives.

The recent escalation in tensions between the Eurozone and Russia are expected to weigh on global growth. Barring a significant easing of tensions in the region, we are now expecting a European recession in the near-term. On September 5th, Russia’s state-owned Gazprom shut down the Nord Stream Pipeline which, until recently, was the main transit route for Russian natural gas into Europe. The cutoff, which the Kremlin has blamed on Western sanctions, is expected to last indefinitely. European power prices have already been soaring through the summer and are likely to remain elevated for the foreseeable future. The situation is expected to result in demand destruction and a curtailment in economic output from the Eurozone this winter, especially if weather conditions are colder than normal. With energy rationing becoming increasingly likely this winter, consumer confidence as measured by the Eurozone’s economic sentiment indicator registered -27.0 in July, the lowest reading since the start of the data series in January 1985.

Unlike Europe, signs that inflation has peaked in North America have emerged. Many costs that were increasing the fastest are now showing signs of moderation, including used cars, appliances, airfares, clothing, furniture, and lodging. U.S. wholesale gasoline prices finished August at $2.70/gallon after peaking above $4.25/gallon in early June. Core CPI increased by 0.31% month-overmonth in July, below expectations and the slowest monthly pace since September. In Canada, CPI also improved in July, rising 7.6% year-over-year compared to 8.1% in June.

|

|

In his most recent speech at Jackson Hole, Fed Chair Jerome Powell reinforced his message to investors that the FOMC is committed to tackling inflation with further rate hikes. On September 7th, the Bank of Canada hiked its overnight policy rate 2022 by 75 basis points to a fourteen-year high of 3.25% and left the door open to more tightening. Given the positive trends we are seeing with inflation statistics, together with the magnitude of the hikes we have already witnessed this year, we believe both the Fed and Bank of Canada are approaching the end of the current rate hiking cycle. That said, we do not anticipate either central bank to be cutting interest rates in 2023 as markets had been pricing in earlier this summer. Rents and wages represent two key components of inflation that will be more challenging to address and may cause inflation to stay above the 2% target over the medium-term.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

The S&P 500 healthcare sector returned -5.8% in August, trailing the Index return of -4.2%. Pharmaceuticals, the sector’s largest industry, returned -8.2% and gave back some of its yearto- date outperformance. Conversely, SMID-cap biotechnology stocks performed well with the S&P Biotechnology Select Index returning 3.2%.

The Inflation Reduction Act (IRA) was signed into law on August 16th and represents the first substantive healthcare reform since the Affordable Care Act in 2010. The cornerstone of the bill, as it relates to healthcare, will allow the U.S. government to directly negotiate the prices of a small subset of prescription drugs on behalf of Medicare beneficiaries. Negotiations will start with 10 drugs in 2026 and grow to as many as 60 by 2029. One silver lining of the bill for pharma companies is that it also puts a ceiling on out-of-pocket drug costs for those enrolled in Medicare, which should improve patient adherence. Overall, we view the bill as a manageable risk for the pharma sector with a marginal impact on future earnings. The IRA was the likely cause for pharma’s underperformance this month but we think it should be viewed as a clearing event for the group as it removes an overhang of regulatory uncertainty and political risk.

A rise in M&A has been the main driver of recent strong performance in biotech. Several large deals were announced in August including Pfizer’s $5.4 billion acquisition of Global Blood Therapeutics, Amgen’s $3.7 billion bid for ChemoCentryx and Gilead’s purchase of MiroBio for $405 million. Deals like these are crucial to the industry’s long-term growth and have historically been supportive of stock prices for both acquirers and targets. Large pharma companies have the capital and resources to take innovative pipeline assets from a clinical to commercial stage and benefit from adding new products to their shelf, while smaller companies focused on R&D receive financing for further drug development. We have seen an uptick in M&A from other areas of healthcare as well, specifically in the healthcare services industry. Amazon announced the acquisition of primary care provider One Medical for $3.9 billion in July which was followed by CVS announcing it will buy home health and technology services company Signify Health for $8 billion. We have exposure to all the aforementioned acquirers in our healthcare funds and view the deal announcements positively as they improve each company’s long-term growth prospects.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Canadian REITs wrapped up a solid Q2 earnings season in August. Operating fundamentals remain solid, highlighted by 4% year-over-year growth in adjusted funds from operations across the group. That said, rising interest rates have impacted REIT valuations with many sell-side analysts raising their capitalization rate estimates to account for higher debt costs and economic uncertainty. Despite this, REITs remain attractively valued as they still trade at steep discounts to recently downward revised net asset value estimates.

In terms of cap rate expansion (i.e., property values coming down), necessity-based retail has been the best performing asset class in the sector. According to CBRE, the national average cap rate for these properties increased between 7 and 11 basis points in Q2, well below other property types which increased as much as 30 basis points. Grocery anchored retail properties generate steady, low-risk cash flow streams that are highly coveted by large private investors. Against the backdrop of a decelerating economy and discounted valuations, necessity-based retail is very attractive to many investors. SmartCentres REIT, Crombie REIT and CT REIT are three REITs we hold in our real estate funds whose properties are anchored by long-term leases with core needs-based tenants. These defensive attributes support dividend yields for each of these companies that exceed 5%.

RioCan REIT and First Capital REIT, two other retail REITs we hold, do not have a major anchor tenant throughout their portfolio like the previously mentioned companies. Most of their income still comes from necessity-based tenants but, given their focus on urban neighbourhoods, they also have exposure to non-essential services such as restaurants and gyms. As a result of the pandemic, only the strongest tenants have survived and the enhanced quality of their tenant portfolios has nowbecome a tailwind. Specifically, both companiesreported lower bad debt expenses and highervariable revenue from parking services in Q2. In addition, RioCan renewed 1.2 million square feet of leases at a spread of +11.2% and completed 390,000 square feet of new leases at a spread of +6.8%. First Capital delivered growth in same property net operating income of 5.6% and renewal releasing spreads of 11%. Due to their healthy organic growth potential, we have a constructive view on both companies going forward.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

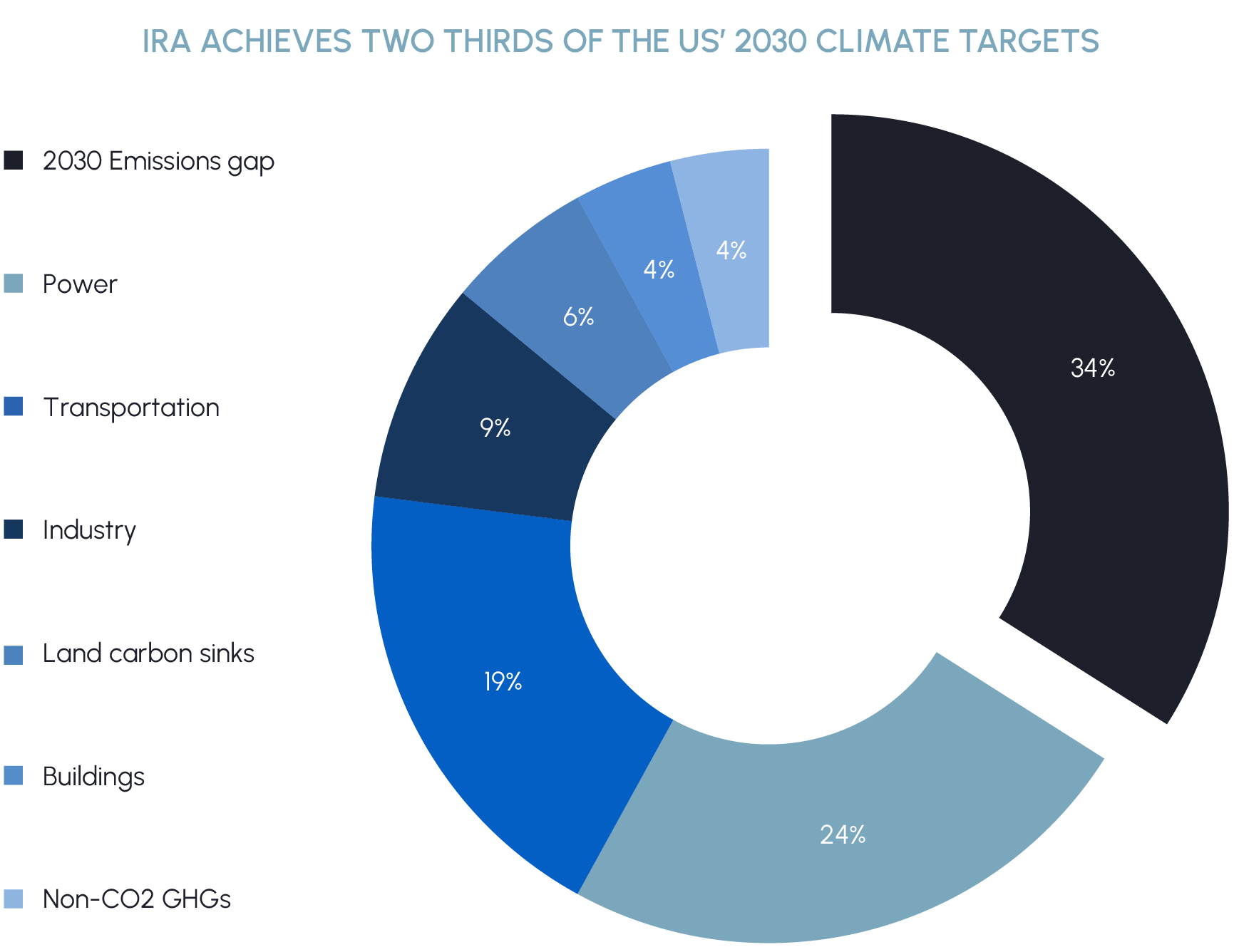

The S&P Global Clean Energy index was flat in August and has now outperformed the S&P 500 for four consecutive months. Momentum in clean energy stocks was largely driven by the signing of the IRA. The $750 billion package includes major investments for combating climate change, including the single largest investment in climate action in U.S history worth $437 billion. Funds will be allocated across clean energy generation, electrification, green technology retrofits, and wider adoption of electric vehicles, among other purposes. These investments will flow into a multitude of end-markets to which companies in our funds have exposure. Key beneficiaries in the clean energy space include Plug Power, Sunrun, Enphase, NextEra, and many others that are positioned to benefit from extension of Production Tax Credits (PTC) and Investment Tax Credits (ITC). These credits have the potential to reshape the energy security landscape in the U.S. as they improve the affordability of renewable energy production which we expect will boost demand. This, coupled with consistent improvement in green energy technologies, will further accelerate adoption as the scale of production increases.

|

|

The IRA also earmarks investments in low-emission building retrofits which directly benefits heat pump manufacturers Daikin and Johnson Controls. It promotes the use of sustainable building, construction and renovation materials which bodes well for companies including Vulcan Materials, CRH and Saint Gobain. About $6 billion is allocated across federal agencies for the procurement of low-carbon materials for transportation and other projects, to reduce emissions from the industrial sector which is currently responsible for about a third of the country’s emissions. A study fromPrinceton University projects that the IRA will cut annual GHG emissions in 2030 by an additional ~1 billion metric tons. This will close approximately two thirds of the emissions gap between current policy and the nation’s 2030 climate target.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

The NASDAQ declined 5.1% in August, slightly underperforming the S&P 500. As we enter the seasonally weak month of September, macro risks remain top of mind for tech investors. Even so, we

are seeing plenty of attractive opportunities in the tech space.

Given the potential for sustained market volatility, we have been adding to names that provide not only growth characteristics but also defensive attributes. One name that meets both criteria is Motorola Solutions (MSI). MSI is one of our favorite companies within the tech hardware industry. The company is largely driven by its legacy LMR division, which consists of radio communication technologies that keep people safe, connected and effective across various end markets in public safety (e.g. police, fire & emergency medical) and enterprise security (e.g. utilities & mining, oil & gas). We view this segment of the business as highly defensive and believe it could surprise to the upside, supported by a robust backlog and easing supply chain constraints. MSI also provides access to the highly attractive Video Security and Access Control market, which stands to benefit from an increase in government support for public safety initiatives. As the company continues to transition its business mix from hardware to software, we expect that recurring revenues will become an even greater part of the business mix, leading to structurally higher margins and multiple expansion in the years to come.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

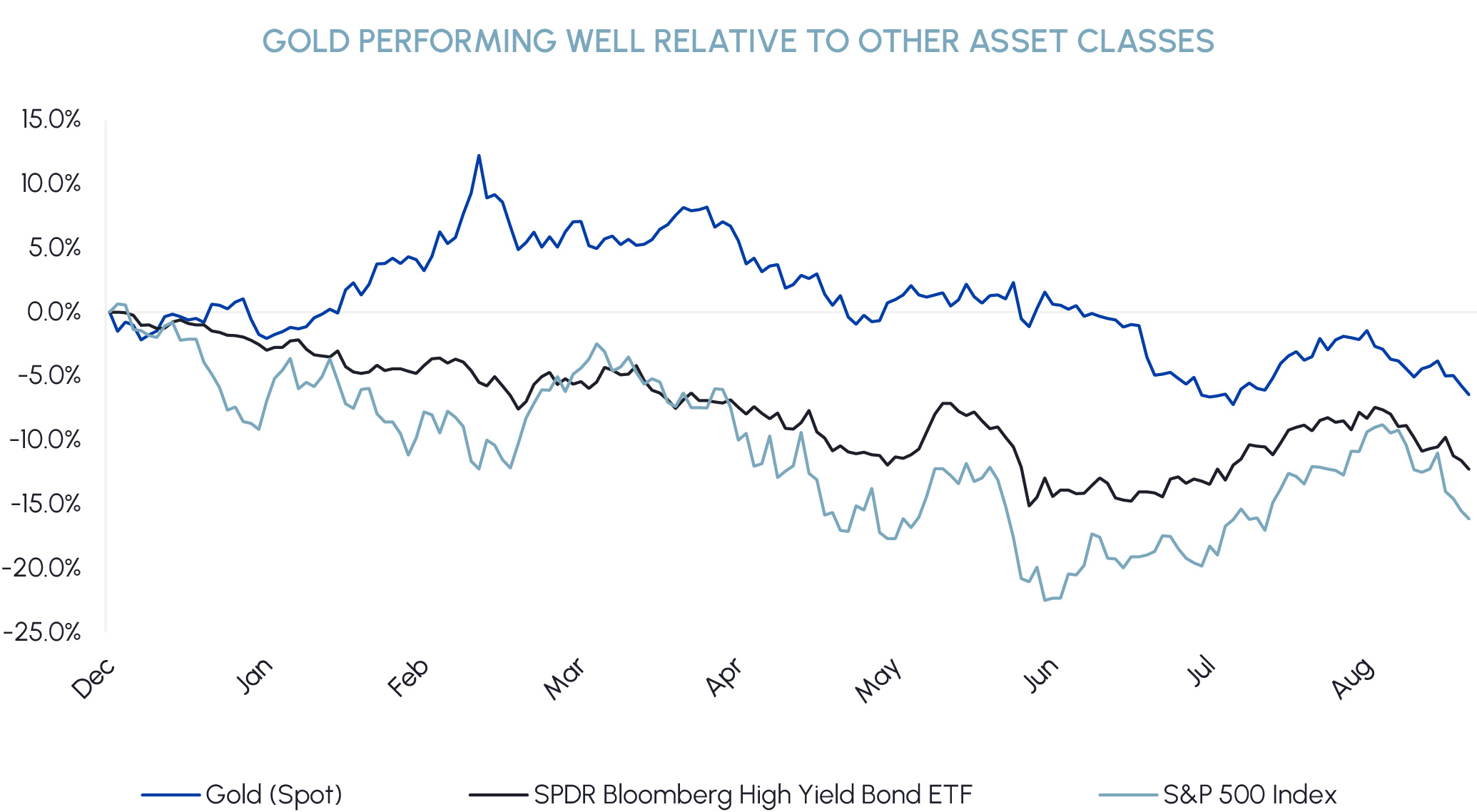

Much more aggressive Fed rate hike expectations during 2022 compared to other global central banks was a significant cause of rising real yields and the U.S. dollar hitting a 20-year high. These factors adversely affect gold which still managed to hold a key support level of $1,700/oz. At first glance, gold’s year-to-date performance may seem dull, but gold has nonetheless been one of the best performing assets so far and with below average volatility.

As we approach year-end, the setup for gold is attractive. Inflation is elevated and economic growth is slowing, two factors that have propelled gold in the past. In years when inflation was higher than 3%, gold’s price increased 14% on average, and in periods where US CPI averaged over 5%, gold has averaged nearly 25%. In the last 13 recessions dating back to 1929, the average S&P 500 correction has been over 36%. Meanwhile, gold has outperformed in 12 of those periods and was positive in 9 recessions delivering average upside of over 10% and relative outperformance of almost 47%. We think the prospects for Canadian gold companies remain attractive as valuations are low compared to their fundamentals.

|

|

With the world moving towards net-zero carbon energy, we believe that nuclear power will be part of the solution as a stable baseload source. Our view has been reinforced by the ongoing energy crisis unfolding in Europe and Asia. In July, the European Commission cleared the way for the addition of nuclear power as a sustainable energy source, effectively opening the door for environmentally focused investors to invest in nuclear energy when it takes effect January 1, 2023. More recently, Japan announced plans to restart four more nuclear reactors in time to avert any power crunch over the winter, marking a return to nuclear power as a stable source of energy for resource-poor Japan. Nuclear accounts for ~10% of total electricity globally and is the second largest source of carbon free power, making it an important piece of the energy transition story.

The global agriculture complex continues to tighten – a positive for crop prices and the need for crop inputs. As a result, farmers are in excellent economic condition. According to the U.S. Department of Agriculture’s September 1 forecast, net farm income in 2022 is forecast to be higher by 5%, 56% and 42% compared to 2021, 2020 and the 20-year average, respectively. The report also shows the average U.S. farmer’s balance sheet is in solid shape with farm sector equity the difference between farm sector total assets and total debt forecast to increase by 10.4% relative to 2021. These conditions are ideal for John Deere’s Production & Precision Ag and its Small Ag and Turf segments. Deere represents a core holding in our agriculture funds.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

This year has seen a vociferous backlash against ESG matters, often taking place in the politically charged US but also seen in the EU and other jurisdictions. This pushback against ESG comes in various forms, examples of which we explain below.

- There has been a large amount of criticism of ESG rating agencies. The criticisms deal with various issues, often arising from the fact that ESG ratings of a particular company by various raters can be very different, with one rating agency giving a high ESG rating to a company while another rating agency giving that company a low ESG rating. The criticisms relate to issues such as the lack of transparency on how ESG ratings are made by the various raters, conflicts of interest at the various raters, a company not having the opportunity to rebut the conclusions of the rater, or how a ESG rating is made if a company does well in one ESG category such as E but does not do well in another ESG category such as S (for example, Tesla). As a result, there has been a call, particularly in the EU and the US, for ESG rating agencies to be regulated.

- Both issuers and investment managers have been criticized for “greenwashing” ESG. On the issuer side, issuers have been criticized and been the subject of legal proceedings for saying they are taking various positive steps in relation to ESG when they allegedly were not doing so (which could possibly be considered legal misrepresentations), while on the investment manager side, investment managers have been criticized and also been the subject of legal proceedings in regard to how those managers are following the ESG investing process that they have set out in their prospectuses or on their websites. For example, in May of this year BNY Mellon Investment Advisor agreed to pay a US$1.5 million penalty to the SEC for misstatements and omissions concerning ESG considerations in BNY’s investment process.

- Officials in various US states and in US federal government branches have criticized the “woke” ESG agenda of various investment managers. Some US states have even passed what have colloquially been called anti-ESG laws which require state entities to divest from or refuse to contract with companies that engage in ESG investing. For example, in June of this year the state government of Texas passed a law prohibiting its state financial institutions from investing in companies that boycott fossil fuels. In August, the Texas Comptroller announced an initial list of 10 financial companies (a financial company being defined as a publicly traded financial services, banking or investment company) that are boycotting energy companies and thus subject to divestment under the Texas law. The list includes such well known names as Blackrock, BNP Paribas, Credit Suisse, Schroders and UBS. In announcing this list, the Texas Comptroller stated: “The environmental, social and corporate governance (ESG) movement has produced an opaque and perverse system in which some financial companies no longer make decisions in the best interest of their shareholders or their clients, but instead use their financial clout to push a social and political agenda shrouded in secrecy”.

At Middlefield, we believe that there are some valid criticisms of what some have called “woke capitalism” or “reducing ESG to one simple measure”, including criticisms about ESG ratings and ESG greenwashing. We also believe, however, that ESG factors are important considerations that Middlefield should use in analyzing risks and opportunities at companies, because ESG factors can affect a company’s financial performance or reputation which in turn can affect a company’s stock price. This concept was enunciated well in August of this year by Fiona Reynolds, who was the long-time CEO of the PRI (the United Nation’s Principles for Responsible Investment), as follows: “ESG at its core has always been a simple concept. Investors who are investing over a long-time horizon need to consider the material risks that environmental, social and governance issues may have on their investments, and they need to understand how externalities will impact those investments, as investors don’t operate in a vacuum. …But investors do have a role, in ensuring the sustainability of their investments and considering externalities particularly negative ones in managing those investments.”

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |