Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Global equity markets rebounded sharply in October after their September meltdown. The S&P 500 generated a total return of 8.1% on hopes of dovish rate hikes from the Fed, while the Dow Jones posted its best month since 1976 with a 14.1% total return. Canadian markets also fared well in October with a 5.6% total return fueled by 13.8% from energy equities. European equities strengthened as inflation eased somewhat on the back of lower natural gas and electricity prices, propelling a 9.4% total return on the German DAX index during October. Reflecting these moves in major indices, the MSCI World Index generated a 7.2% total return in October.

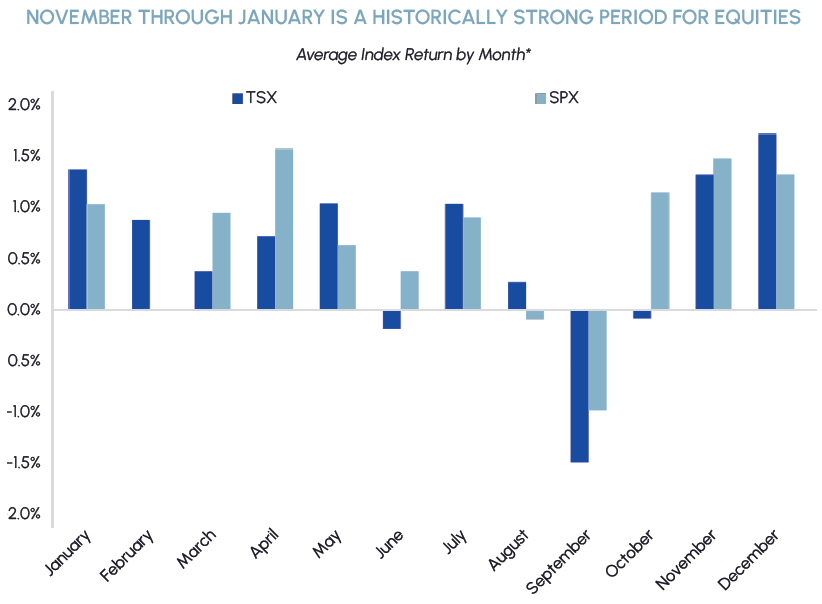

We are entering a seasonally strong period for stocks in both the TSX and S&P 500 indices. As per the chart below, November to January is historically one of the strongest consecutive three month periods of the year for returns. Potential tailwinds supporting seasonal strength this year include (1) the upcoming midterm elections in the United States; (2) acknowledgement by global central banks that the rapid rate hikes to date have started to produce slowdowns in certain sectors of the economy suggesting that the federal funds rate incorporated into the current dot plot will be sufficiently restrictive; and (3) a rebound in economic sentiment toward China assuming the authorities begin to dial back stringent virus controls by the spring of 2023.

Last month we discussed conditions that needed to be met before markets could form a bottom. A few, but not all, have started to move in the right direction. A pullback in the U.S. Dollar Index and benchmark 2 & 10 Year yields were key factors behind the strength in equities during October. However, we are still looking for evidence of a softer labour market and a comfortable bottom in forward earnings estimates, the latter based on anticipated lower profit margins going into 2023. For the current rally to be sustainable, we need to see a clear change in interest rate and U.S. dollar trends as well as valuations based upon more realistic earnings expectations. While encouraged by improvements in the various momentum indicators and market breadth, we continue to view the current gains as a relief rally.

Positive sentiment toward the loonie has been correlated with “risk-on” days for equity markets. Therefore, a continued rally in stocks and/or a more dovish Fed could bolster the Canadian dollar. However, a higher rate path in the U.S. should act as a drag and cap the upside in the Canadian dollar into the end of the year.

Our view is the “old normal” equities will show leadership over the coming decade. This conclusion reflects various trends including onshoring, increased labour costs, energy security concerns, and higher interest rates levels than prevailed during the recent ‘helicopter money” period. “Blue Chip” and value stocks have been making a comeback of late evidenced by the outperformance of “old economy” Dow stocks such as J.P. Morgan Chase, Chevron, and Merck. More broadly, value has outperformed growth this year with the Russell 1000 Value index down 9.3% versus the Russell 1000 Growth index down 26.6%.

The “Old Normal” playbook bodes well for investments in Canadian equities. Our economy and equity indices are driven by resource rich, high cash flow, dividend paying companies whose valuations currently offer an attractive entry point given the changing macroeconomic environment. We believe we are in the initial stages of international funds flows favouring Canadian Energy and Infrastructure, REITs, Materials and Financials.

|

|

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

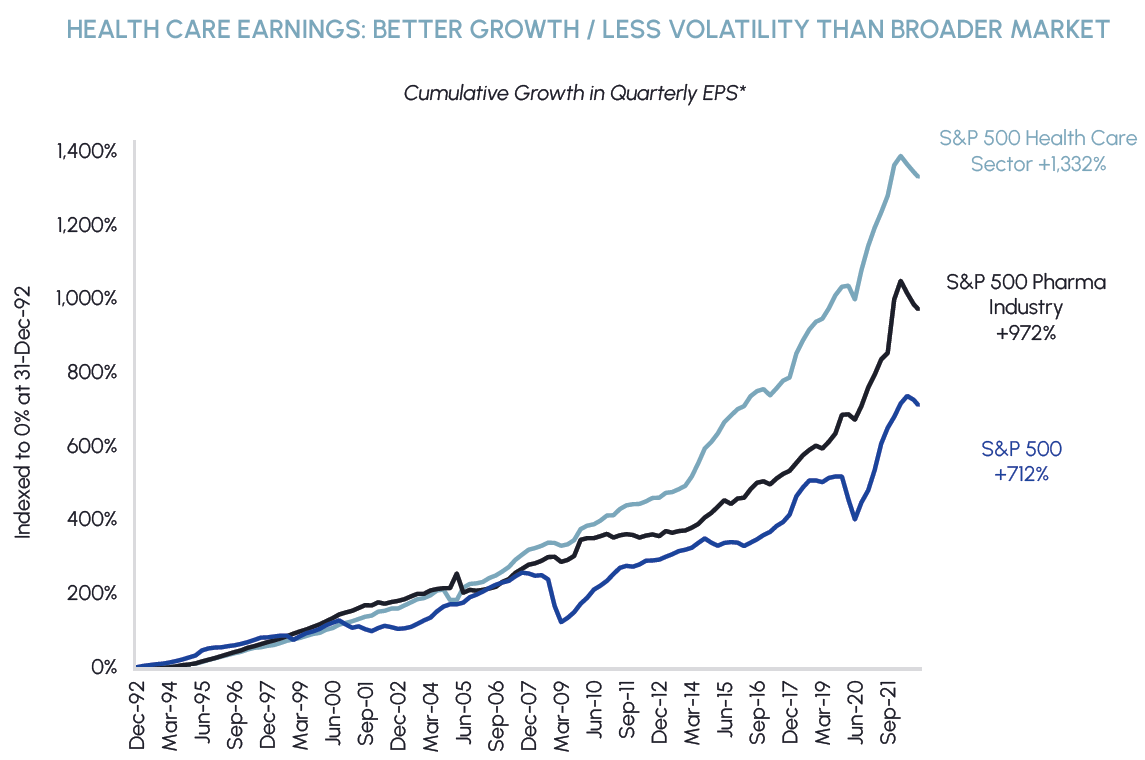

Healthcare continued its impressive year-to-date relative performance this month, generating a total return of +9.7%. The recent period of outperformance is consistent with past periods of slowing economic growth. Historically, healthcare earnings have exhibited far less variability than the broader market. This earnings attribute should continue to dampen the impacts of volatility in market sentiment as reflected in fluctuating earnings multiples.

Healthcare’s earnings stability is underpinned by inelastic demand for needs-based products. Prescription medications, physician consultations and critical procedures are among the least likely spending items to be cut by consumers during a recession. Moreover, most of these products and services are reimbursed by insurance companies or governments which further insulates them from potential drops in discretionary consumer spending. During the past two major economic recessions of 2001 and 2008, sales growth of pharmaceuticals declined just 1-3% and remained positive during both periods. Healthcare companies have reported promising Q3 earnings thus far, reaffirming our view that they will not experience the same downward revisions to earnings as other sectors.

Merck, a top three holding across our healthcare funds, reported another solid beat this quarter. We were encouraged to see the strong results being driven by its core products where the underlying momentum is expected to carry into 2023. Keytruda, its blockbuster immunotherapy drug used to treat a wide array of cancers, beat Q3 revenue expectations by 5%. Keytruda is projected to generate nearly $25 billion in revenue next year and become the world’s top-selling drug. Merck’s Gardasil vaccine, which protects against cancers caused by the human papillomavirus, also performed well, beating revenue expectations by approximately 15%. The strength in the company’s core franchises was complemented by better-than-expected sales of Molnupiravir, its COVID-19 oral antiviral. Although we expect sales of COVID therapies to decline across the sector, the short-term influx of cash positions Merck to pursue accretive business development opportunities, increase its dividend or buy back shares. Merck’s stock price reached an all-time high following the release of its Q3 results.

|

|

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Canadian REITs caught a bid in September, generating a total return of +2.9%. The Bank of Canada’s surprise decision to increase the overnight policy rate by only 50 basis points instead of 75 served as a positive catalyst for the sector, which has been adversely affected this year by expanding capitalization rates on the back of rapidly rising bond yields. Notwithstanding the expectation of further rate increases from the Bank of Canada, we believe the end of the current rate hiking cycle is approaching, which should help improve sentiment in the sector. We continue to believe REITs are significantly oversold based on significant discounts to their NAVs and thus represent an attractive opportunity for patient investors.

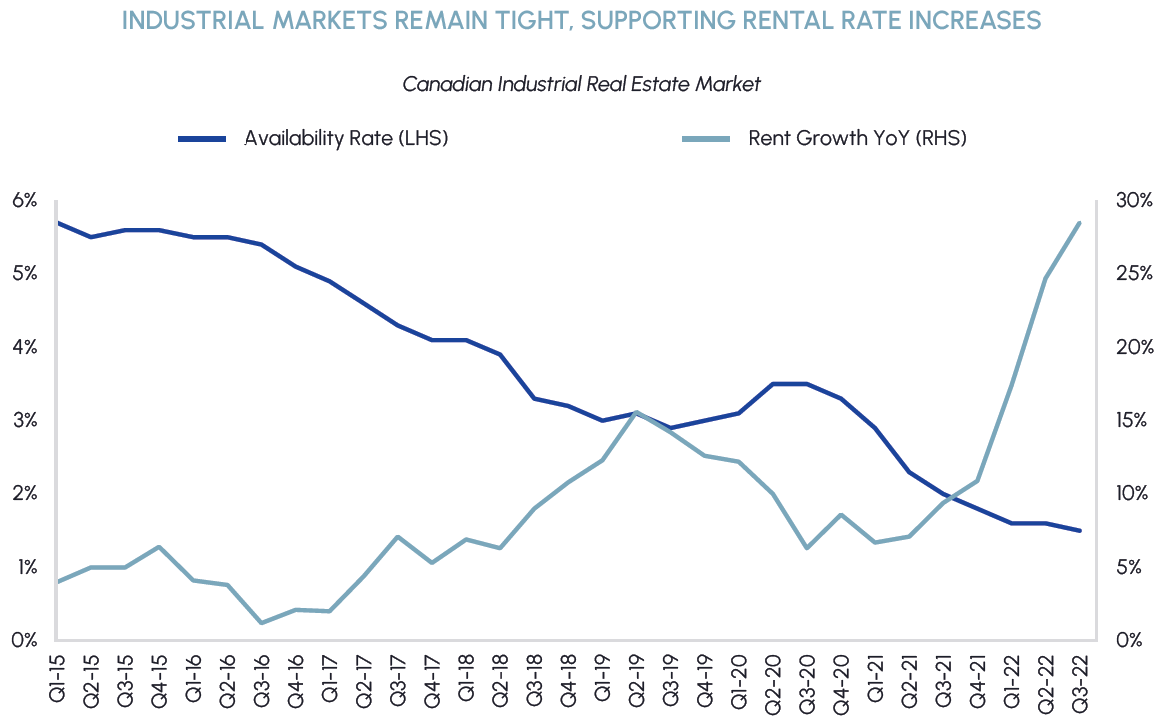

CBRE released its Q3 industrial market statistics in October which showed trends continue to strengthen in Canada. The national availability rate decreased further to 1.5% and is very tight across all markets. Growing demand and a finite amount of available space has led to exceptional growth in market rents. Canadian market rent growth accelerated to a record 29% year-over-year in Q3 from the comparable Q2 statistic of 25%.

Despite these attractive market fundamentals, Canadian industrial REITs continue to trade at steep discounts to their net asset values. They are also trading at a discount to competing asset classes such as retail and diversified REITs, a dramatic shift from previous years where industrial REITs commanded a significant valuation premium. We believe industrial REITs offer attractive value at current levels considering their rent growth potential from expiring leases.

|

|

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

The S&P Global Clean Energy Index fell -1.7% in October. We believe the current pullback is largely attributable to negative macro trends and funds flows following the announcement of the Inflation Reduction Act (IRA). With the industry once again trading at an attractive growth-adjusted valuation, we are finding multiple buying opportunities. One of the top picks in our International Clean Power Fund (CLP) is Enphase (ENPH). ENPH released another strong earnings report driven by solid demand for solar technologies and easing supply chain issues. We expect that the renewables industry will continue to grow rapidly in the US. Bloomberg New Energy Finance recently said that the Inflation Reduction Act is projected to boost the development of solar, wind and big batteries by more than 20% through 2023 versus pre-IRA expectations.

With energy security still top of mind, investors are revisiting the case for nuclear power. This was evidenced by the recent deal by Cameco and Brookfield Renewable Partners for Westinghouse Electric Co., which makes technology used in approximately half of the world’s 440 reactors. The deal is expected to spur growth across the nuclear industry, which is “becoming increasingly important in a world that prioritizes electrification, decarbonization and energy security,” according to Tim Gitzel, chief executive of Cameco.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / WORK.UN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

The Nasdaq rebounded by 3.9% in October but failed to keep pace with the broader market. Even so, tech stocks showed remarkable resilience despite disappointing results and / or guidance from all the FAAMG stocks except Apple. While acknowledging Tech is cyclical, we continue to believe that macro risks have had an outsized impact on the sector. This situation has created an attractive setup with significant long- term capital appreciation potential for leading players addressing technology-driven secular growth trends.

Cloud growth remains impressive, especially considering the size of the big three players. Still, the recent deceleration shows that nothing is immune from a broader economic slowdown. While we may see slower growth in the quarters ahead, we would classify this as a cyclical slowdown within a structural uptrend. For example, Amazon Web Services (AWS) reported that its backlog grew 57% year-over-year to more than $100 billion. We believe this supports the long- term potential of cloud computing in general and AWS in particular.

In terms of portfolio construction, we remain focused on capital preservation and thus have been increasing our exposure to defensive areas of the market while largely avoiding unprofitable companies. Recently, we have added to Deutsche Telekom (DT), which is the majority shareholder in T-Mobile (TMUS). DT is an inexpensive way to access TMUS, which we believe is best positioned for the continued 5G rollout in the US, while getting paid a healthy dividend. We would also note that, at current prices, the valuation of the ex-US segment (i.e. non-TMUS related) is at a record low.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

The price of gold continues to move in a neutral pattern as the market tries to anticipate a Fed pivot. A pause is likely to signal a peak for the US dollar which has historically led to strong gold performance. Despite a relatively flat gold price, senior gold companies as represented by the VanEck Gold Miners (GDX) ETF are up 10.7% since hitting a 31-month low in late September. We recently added royalty and streaming company Franco-Nevada Corporation as a lower risk way to participate in the potential rebound of gold. Franco Nevada is a unique vehicle that provides yield and growth from the gradual development of assets in its diversified portfolio while limiting exposure to cost inflation and other operating risks.

Earnings reports including several super majors and refiners kicked off in late October and the phrase “The old economy is back” certainly resonates. ExxonMobil and Chevron delivered material beats and reported combined 3rd quarter earnings of US$30.5 billion. With oil prices well off their Q2 highs, Exxon generated its highest quarterly profit ever while Chevron and Shell had to settle for second best after setting their own records the previous quarter. Overall, in the S&P 500, 89% of reporting energy companies beat consensus earnings compared to 70% for the broad market and the average beat was 4.8% versus 3.6% for the broad index. Oil was the clear outperformer relative to natural gas. However, momentum shifted toward the end of the month as a more constructive weather forecast and increased visibility around the end of U.S. LNG facility maintenance helped lift natural gas prices over 10%.

We believe Secure Energy Services will be a major beneficiary of solid industry fundamentals including strong energy prices, producer balance sheets, and cash flows. Secure is a leading North American energy infrastructure and environmental business that is pivoting its focus in 2023 towards significant shareholder returns in the form of recently announced higher dividends while continuing to pay down debt.

In mid-October a seemingly conciliatory tone from Putin spooked investors into thinking that, if the war cools down, we could see improvements in grain and fertilizer shipments more than offset by price declines, wiping out up to 10% of fertilizer companies’ market caps. The correction seemed at the time overdone, especially considering these equities were already trading at discounts to mid- cycle valuations.

A strong Q3 beat by Yara International helped support our current bias towards nitrogen within the traditional fertilizer space. The company beat the street’s expectations thanks to strong pricing and despite lower deliveries and higher input costs (natural gas). Yara sees nitrogen markets remaining tight as fertilizer inventories remain at historic lows in Europe and there is risk of nitrogen shortages and price spikes during the winter. Yara is a nitrogen producer/distributor that has been impacted by natural gas prices in Europe, where it has a significant footprint. By comparison, we have favoured names such as CF Industries and OCI N.V. for their lower cost gas sources.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

A paper in the field of behavioural economics that likely will be of interest to investment managers and advisors was published in October by three professors at Boston University and Tel Aviv University entitled “How Much Do Investors Care about Social Responsibility?”

The paper’s authors conducted an experiment that involved real monetary gains for participants, on 279 Americans with investing experience. The authors tried to find answers to several questions: Do investors wish to maximize returns or are they willing to forgo returns for social purposes? Do market participants, such as investors and consumers, differ from donors in the way in which they prioritize monetary gains and the promotion of social goals?

The experiment looked at the tradeoffs that individuals make between their own financial interests and four different social interests: gender diversity; income equality; environmental protection; and faith-based values. Participants were randomly assigned scenarios where they were asked to make investment decisions, consumption decisions and donation decisions. The authors’ empirical analysis provided the following results.

- When making investment decisions, most individuals are willing to forgo some returns in order to promote social interests. The average sacrifice in the experiment varied depending on the particular cause, corresponding to forgoing returns of between 1.76% and 2.53% out of a potential total return of 10%.

- Even though most investors are willing to forgo some returns in order to promote social interests, a significant percentage of investors (32%) are unwilling to forgo even very small amounts (i.e., not even a 0.1% return out of the 10% potential return) to advance any of the four social goals presented to them through their investment decisions.

- The amount of money that individuals are willing to forgo in order to promote social interests depends on the channels through which they make their decisions. In particular, individuals are willing to forgo greater amounts when making consumption decisions and donation decisions than when they are making investment decisions.

- There is significant heterogeneity in individuals’ willingness to forgo in each of the three channels (investment, consumption and donation) which is related to their political affiliation, gender and income. The experiment finds that individuals identifying as Democrats and women, as well as those with higher income, are more willing to forgo (and to forgo greater amounts) to promote social causes compared to those identifying as Republicans or independents and men or those with lower incomes.

The authors state that the experiment’s results raise challenging questions for investment managers: How should investment managers attempt to influence corporate leaders with respect to their social responsibility decisions? How much of their investors’ returns should investment managers be willing to sacrifice to improve the extent to which corporations favour social interests?

The authors do not provide answers to these questions but note that investment managers cannot continue to avoid them.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |