Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

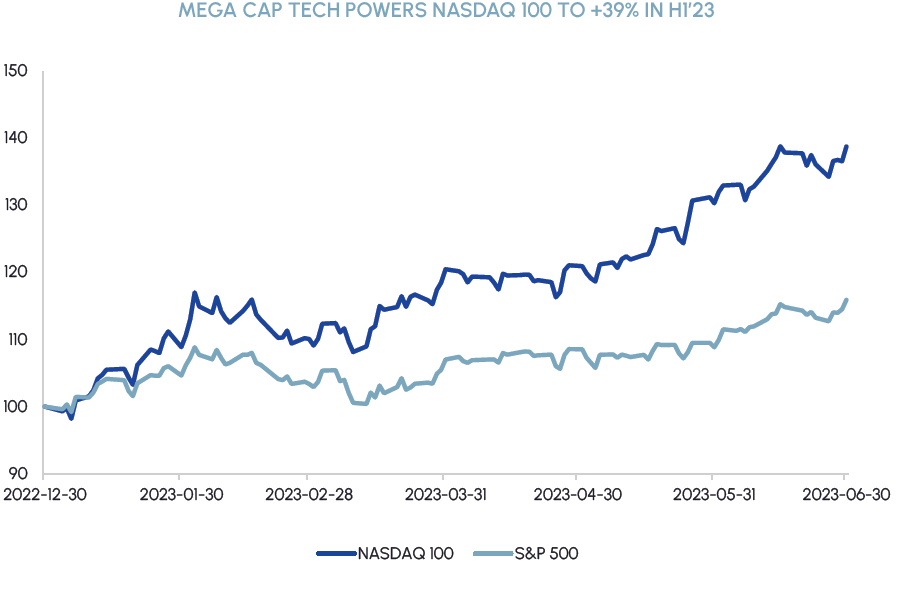

North American equity markets finished the first half of 2023 on a positive note. The S&P 500 returned 6.6% in June, bringing its year-to-date total return to 16.9%. The TSX Composite, which has more exposure to cyclicals and has lagged the U.S., started to perform better with a total return of 3.4% in June. European markets have also performed well recently with the Euro Stoxx 50 Index returning 4.4% in June and 19.2% in H1.

The sharp recovery in tech stocks has been the biggest story of the year. The Nasdaq 100 rose 39% for its best start to a year in history (with data going back to 1985). The “magnificent seven” – Apple, Microsoft, Google, Amazon, Meta, Tesla and Nvidia – did most of the heavy lifting, returning ~58% year-to-date. While market leadership has been narrow, we believe it is well deserved by some of the best companies in the world that will benefit from the artificial intelligence cycle. Seasonality bodes well for sustained momentum in the short-term as the Nasdaq has traded higher in each of the last 15 years during the month of July. In addition, the market tends to continue moving higher both when the 1st half of the year returns exceed 10% and following a negative year prior (i.e., 2022).

|

|

Regarding inflation, a significant drop in CPI is taking place. Year-over-year inflation in the U.S. decreased to 4.2% in May and is projected to decrease to 3.2% in June (July 12 release). The University of Michigan’s June reading also shows that short-term inflation expectations have fallen to a two-year low. While these data points are encouraging, it is important to note that the anticipated drop in inflation is primarily due to base effects. Although the Federal Reserve left interest rates unchanged at its most recent meeting, Chair Powell indicated that the decision to hold rates was to slow down the pace of hikes, not to stop them. Meanwhile, a majority of FOMC participants foresee at least two more rate hikes this year, signaling a continuation of the tightening process. We anticipate there will be a 25 basis point hike from the Fed at the upcoming July meeting.

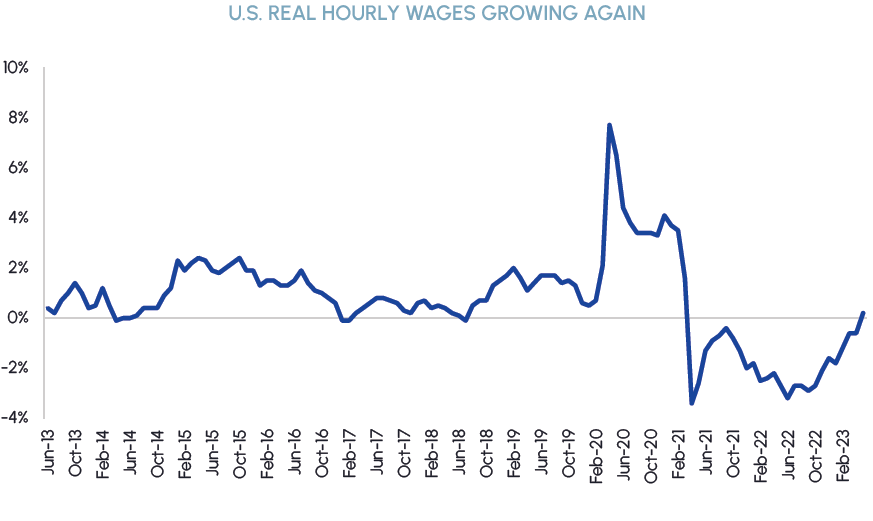

Falling inflation is causing real wages to rise. Real hourly earnings increased by 0.2% recently, ending a two-year period of negative readings. Real weekly earnings have also been steadily improving and are expected to turn positive in the upcoming months. These developments, together with a robust labor market, should continue to support healthy consumer demand. U.S. retail sales unexpectedly rose in May as consumers sped up purchases of motor vehicles and building materials. Although most economists have been forecasting a recession since late 2022, the broad strength of the consumer and the tightness of the labour market may be enough to support a soft landing – an outcome that we believe is becoming increasingly likely.

|

|

Our market outlook is relatively sanguine as we enter the second half of 2023. Recession risks are receding and investor sentiment has started to improve. A huge amount of capital that made its way into money market funds during Q4’22/Q1’23 is now starting to flow back into equities. We have noted a growing list of individual stocks that are starting to break out of recent trends which supports our view that market breadth is poised to improve. Tech stocks have led the market so far this year but valuations are beginning to look stretched, requiring a more selective approach to security selection going forward. We believe a rotation out of expensive growth stocks into more reasonably priced value names is likely over the coming months, which bodes well for many of our attractively priced dividend-paying core holdings. In sectoral terms, we are bullish on REITs, Financials, Energy and select areas of Healthcare.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Canadian REITs were down as much as 5% in June but rallied during the final week of the month to finish with a positive return. As we wrote about last month, REITs have historically outperformed the TSX twelve to twenty-four months after the first Bank of Canada rate hike. We are optimistic that sentiment is starting to bottom, and the sector is positioned for a catch-up trade during the second half of the year. REITs continue to act as an effective hedge against inflation. Companies have been able to raise rents on expiring leases, particularly in undersupplied asset classes such as industrial, multi-family and retail. At a 27% discount to net asset value (NAV) on average, we do not believe valuations accurately reflect healthy fundamentals across most of the sector.

We continue to have a very favourable view of the industrial real estate sector. Vacancy remains very low in key markets including Toronto, Vancouver, Montreal and major U.S. cities. Although Industrial REITs have been under pressure recently, the US$3.1 billion acquisition of industrial assets by Prologis from Blackstone announced in late June validates the fundamental value underlying the Industrial REIT sector. Two of our largest holdings, Granite REIT and Dream Industrial REIT, are trading at very attractive valuations with implied cap rates of 5.8% and 5.6%, respectively, compared to the 4% cash cap rate paid by Prologis.

Allied Properties made headlines in June when it announced the sale of its urban data centre portfolio. The $1.35 billion transaction represents a premium to the portfolio’s IFRS NAV of $1.2 billion and will meaningfully improve the company’s balance sheet. We recognize the challenges facing office landlords today but are becoming more comfortable with valuations for companies that own high-quality assets. Allied’s amenity-rich, brick & beam properties are in premium locations across the best markets in Canada. Analysts have already lowered their NAV estimates for Allied significantly, but the stock is still trading at a 40% discount to updated numbers. Even if NAV estimates are lowered further, there is still a very large buffer between its trading price and intrinsic value, representing an attractive risk/reward proposition for patient investors.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

Despite generating a total return of 4.4% in June, Healthcare trailed the S&P 500 by more than 2% this month. Defensive sectors have lagged the broader market throughout the year but certain areas of healthcare, such as MedTech, have performed well on a relative basis.

Commentary from various management teams at the Goldman Sachs healthcare conference supported MedTech stocks in June. Comments from UnitedHealth Group (UNH), the world’s largest health insurance company, received the most attention when it surprised investors by guiding Q2 and 2023 cost trends to come in above consensus estimates. Specifically, the company stated that senior citizens are replacing their hips and knees at an unprecedented rate due to accelerated elective surgery demand that they don’t expect to abate in the near term. Elevated hospital utilization carries positive readthroughs for MedTech companies. Several of our core MedTech names, including Stryker, Medtronic and Edwards LifeSciences traded up significantly on the UNH news. The UNH update validates our view that MedTech companies are recovering from last year’s challenging macro environment and that they are positioned to beat + raise earnings this year. The UNH announcement also supports our active management strategy. The ability to tactically overweight / underweight specific industries within the healthcare sector is at the core of our value proposition. Our healthcare funds are overweight MedTech stocks by approximately 10% relative to the benchmark which has led to strong performance.

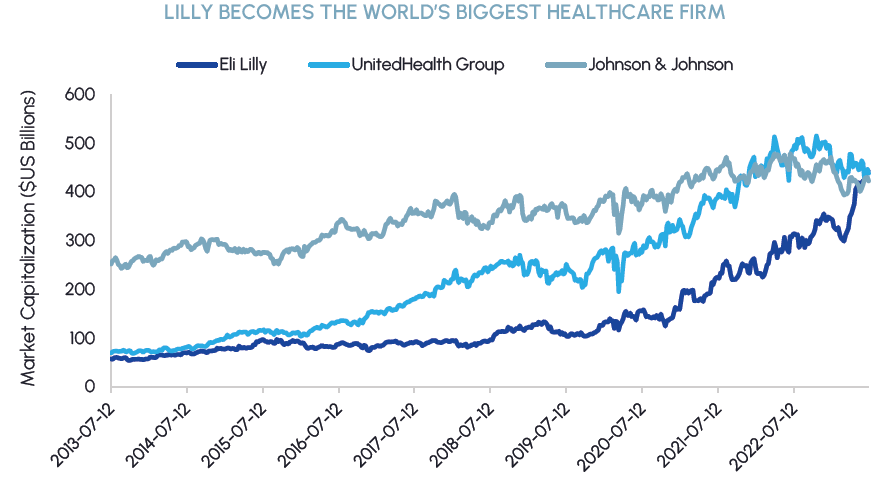

Eli Lilly (LLY) presented a series of updates at the 83rd American Diabetes Association Scientific Sessions in late June which strengthened the moat around the company’s diabetes and obesity franchise. Presentations related to its flagship GLP-1 agonist, Mounjaro, included detailed updates in obesity, type 2 diabetes risk reduction, and analysis of metabolic outcomes. In addition, the company presented Phase 2 trial data from its next-generation obesity drug, retatrutide, which demonstrated 22-24% weight loss in obese patients after 48 weeks of treatment. LLY’s emerging leadership in the fast-growing field of diabetes and obesity has driven the stock to all-time highs. LLY recently surpassed Johnson & Johnson and UnitedHealth Group in terms of market capitalization to become the largest healthcare company in the world.

|

|

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

We share the market’s optimism around the future of AI and plan to capitalize on the expected market growth through investments across multiple sectors. The unique infrastructure needs of generative AI, specifically the reliance on high-performance Graphics Processing Unit (GPUs), are expected to drive an increase in power consumption. Further, it will require the use of large uninterruptible power systems (UPSs) and power distribution units (PDUs). Eaton, a key player in the UPS industry, is very well-positioned to benefit from this trend through its Data Centers & Distributed IT business segment, which accounts for 14% of current sales. In addition to providing essential components for data center infrastructure such as transformers, power panels, switchgear, and racks, Eaton has also added inorganic growth to its portfolio through strategic acquisitions in the space. We continue to own Eaton in our sustainability-focused funds due to its exposure to a multitude of secular themes including electrification, decarbonization, and more recently, AI.

Another industry experiencing rapid development is the battery industry, where Engie and RWE, two of our prominent holdings, are spearheading noteworthy advancements. Engie’s Hazelwood Battery Energy Storage System (HBESS) in Australia, featuring 342 Fluence battery modules, has emerged as the world’s largest utility-scale battery project. Engie’s decision to repurpose the Hazelwood coal power plant for this project validates our investment thesis, which involves the company shifting away from coal power and towards renewable energy sources. Similarly, RWE has made significant strides by successfully connecting its first utility-scale battery storage project to the California grid, incorporating a solar PV facility to store excess capacity.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

AI remains top of mind in the tech sector, particularly within the semiconductor space. We expect Nvidia to remain an industry-leader but also expect Broadcom (NASDAQ: AVGO) to benefit early. Broadcom possesses GARP characteristics within the high-beta semiconductor industry in addition to an attractive dividend yield.

Broadcom is mostly exposed to semiconductors (~78% of sales in FY 2022) but also provides stable growth and recurring revenue through its infrastructure software segment (~22% of sales). Within the former segment, Broadcom is diversified across end markets and functions. While the company’s chips are used for many purposes – such as providing wireless capabilities for Apple’s iPhones – we are most excited about its data center networking and custom chip solutions. To meet the needs of generative AI, data centers are expected to become more complex. This requires not only better computing but also more advanced networking. Broadcom’s networking infrastructure solutions allow for higher bandwidth, faster speeds, and improved energy efficiency. These characteristics were key drivers for the division’s 20% year-over-year growth in the most recent quarter, with approximately half of this number coming from AI applications.

Broadcom also has a highly attractive custom chips business in partnership with companies such as Google and Meta to build custom AI processors. Taken together, we expect that Broadcom’s AI-related revenues could amount to at least $7.5 billion in 2024, which would position the company as the 2nd largest AI compute/ networking semiconductor business behind Nvidia. With expectations for high-single-digit revenue growth, over 10% EPS growth and expanding operating and net income margins, we do not believe Broadcom is expensive at a forward P/E of less than 20x. As a result, we expect to continue holding the name as a core tech position for years to come. Our thesis is predicated on the notion that the AI cycle has just begun which, If true, would support growth in dividends and free cash flow generation, the latter having grown at a CAGR of 38% since fiscal year 2016.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

Gold prices reached a 3-month low of just under $1,900/oz in June, due to funds rotating into broad equites and hawkish central bank positioning. Inflation levels have decreased in developed economies, dampening investor sentiment for gold. Despite this inflation trend, gold is approaching a key support level of $1,900/oz after two consecutive months of declines which could attract bargain hunters.

Oil markets have appeared tight on paper for months, but physical markets have been inconsistent. Support for the commodity will likely emerge in July with Saudi/OPEC+ cuts, 2 million bbls/d of refining capacity returning and an expected uptick in Chinese crude imports. The recent dislocation between paper balances and physical prices is noteworthy and we will soon find out if OPEC+ is over tightening or if the market is closer to equilibrium than what’s forecasted.

Canadian natural gas storage is at a five-year low with wildfires impacting production. US power consumption is higher than normal amid a heat wave in Texas and hot weather in the forecast. After a stagnant winter, where natural gas prices hovered between US$2.00-$2.50/mcf, prices are starting to gain momentum and have risen to $2.80/mcf. Historical data indicates positive natural gas price momentum from July to November, with average increases of 18% over the past decade while gas-weighted equities have delivered an average return of 11% from June to November, outperforming energy indices.

After a challenging Q1, fertilizer stocks re-rated higher in May, reaching oversold levels. June started on a negative note following the Canpotex/China potash contract that fell below consensus. Market sentiment improved once investors started to interpret the contract as the start of a bottoming process in the potash market which sets the stage for a recovery when demand returns. Fertilizer stocks performed well, and agriculture stocks are showing signs of growth. We acknowledge the recovery process will likely take several months to play out but have added to positions in agriculture stocks such as Nutrien and CF Industries. Positive indicators such as crop profitability, fertilizer affordability and tight supply suggest that the worst is behind us.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN / MID 265

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

On June 26, the International Sustainability Standards Board (ISSB) published two voluntary International Financial Reporting Standards (IFRS) which aim to improve the transparency, consistency and comparability of ESG information disclosed by public companies around the world. According to the ISSB’s press release, the two new standards will usher in “a new era of sustainability-related disclosures in capital markets worldwide” and “will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions”.

The two ISSB standards are designed to have companies provide sustainability-related information alongside financial statements, in the same reporting package. Consistent, comparable and clear sustainability information, alongside financial information, should allow investors and other stakeholders to gain a more comprehensive understanding of a company’s performance and its commitment to creating sustainability value.

The two voluntary disclosure standards are called “IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information” and “IFRS S2 Climate-related Disclosures”. The standards integrate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and incorporate industry-based disclosure requirements derived from the Sustainability Accounting Standards Board (SASB) Standards.

The objective of IFRS S1 is to require a company to disclose information about its sustainability-related risks and opportunities that is useful to users of general purpose financial reports in making decisions relating to providing resources to the company. The objective of IFRS S2 is to require a company to disclose information about its climate-related risks and opportunities that is useful to users of general purpose financial reports in making decisions relating to providing resources to the company.

Pursuant to IFRS S1, a company would disclose material information about the sustainability-related risks and opportunities to which it is exposed, including information about the company’s governance, strategy, risk management, and metrics and targets. IFRS S2, which is designed to be used with IFRS S1, is a topic specific standard pursuant to which a company would disclose certain information about its governance, strategy, risk management, and metrics and targets in respect of climate-related risks (both physical and transition) and opportunities.

The ISSB noted that IFRS S1 and S2 were developed to be used in conjunction with any accounting requirements and thus are suitable for application around the world, thereby creating a global baseline for sustainability and climate-related disclosures. IFRS S1 and S2 are to be effective for annual reporting periods beginning on or after January 1, 2024. Because the two ISSB standards are voluntary, however, a key question is whether governments or securities regulators around the world — or possibly stock exchanges — will require their companies to adopt the standards and, if yes, when. Another question is whether governments, securities regulators or stock exchanges will require companies to provide sustainability disclosures beyond just the IFRS S1 and S2 global baseline disclosures.

In Canada, the newly formed Canadian Sustainability Standards Board (CSSB) will work with the ISSB by supporting the uptake of ISSB standards here and highlighting key issues for the Canadian context. On June 26 the CSSB stated that “[w]hile the ISSB has set an effective date for annual reporting periods beginning on or after January 1, 2024 for IFRS S1 and S2, decisions about adoption — including how effective dates are determined in Canada — will be part of the CSSB’s initial discussions” taking place this summer.

The ISSB noted that it plans to work with jurisdictions and companies to support the adoption of its standards. The ISSB also stated that IFRS S1 and S2 are its “inaugural standards” and the publication of these standards “is just the starting point as we consult on our future priorities, beyond climate”. Accordingly, we should not be surprised to see additional voluntary disclosure standards published by the ISSB in the future in other ESG areas, which could possibly include biodiversity, human capital and human rights.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |