Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Equity markets continued to recover in November with the S&P 500 and TSX Composite returning 5.6% and 5.5%, respectively. Since bottoming on October 12th, the two indices have rallied 14% and 12.7%. We have entered a historically strong period for stocks and, despite known macro risks, we see potential for the current Santa Claus rally to continue into year end.

There are several tailwinds that have supported markets recently, including split results of the US

election, a less stringent approach to COVID from the Chinese government and a weaker US dollar. While these developments are positive, we believe that signs of peaking inflation have been the biggest driver of recent performance. US CPI increased 7.7% in October, below expectations of 7.9% and the smallest year-over-year increase since January. Many items that experienced the biggest price spikes earlier this year, including used cars, shipping rates and poultry, are now plunging. The Dallas Fed manufacturing report showed the raw materials prices index moved down nine points to 22.6, falling below its series average of 28.1 for the first time in more than two years.

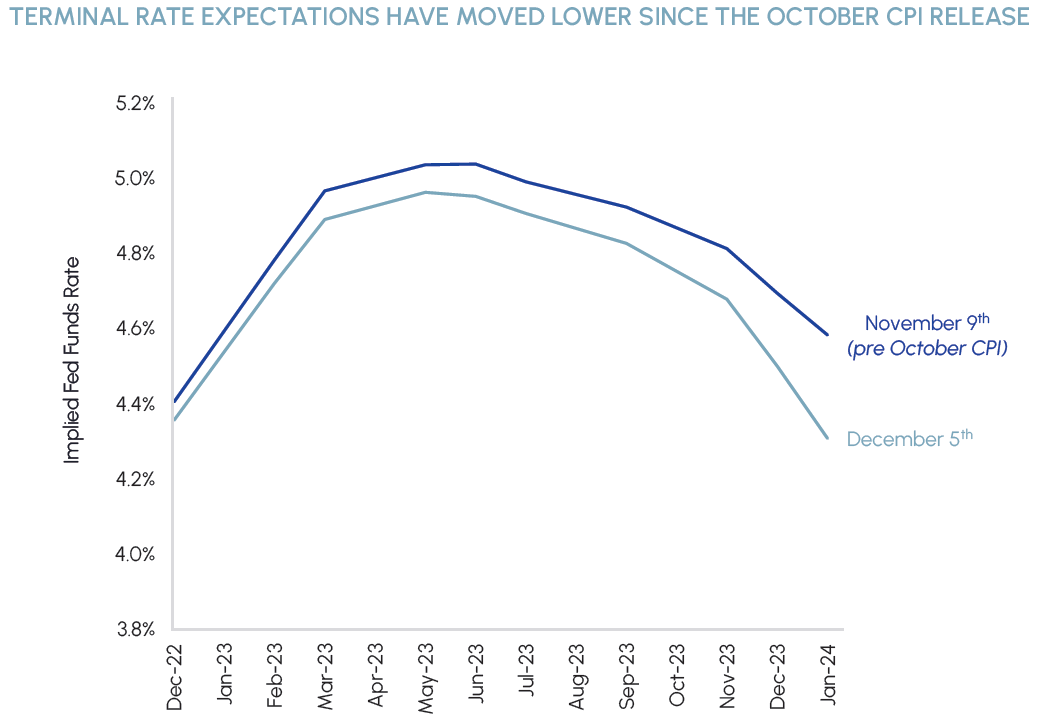

The weaker-than-expected inflation print on November 10th has led to a swift decline in interest rates. Year-end terminal rate expectations moved lower by 22 basis points just 10 minutes after the print, sparking the biggest one-day rally since 2020. This sentiment was reinforced by Fed Chair Jerome Powell at his November 30th press conference during which he hinted at a 50 basis point hike at the upcoming December FOMC meeting. US 10-year Treasury yields declined 44 basis points in November to 3.6% while Canadian 10-year bond yields finished the month below 3%.

We are encouraged by the recent trends in inflation and interest rates; however, we believe investor focus is quickly shifting away from these areas and towards future growth expectations. Rising interest rates have lagged effects, most of which have not yet been felt throughout the economy. For example, US nonfarm payrolls increased 263,000 in November, above the 200,000 estimate.

Consumer spending also remains strong. Adobe Analytics reported that consumers spent a record $11.3 billion on Cyber Monday, a 5.3% jump from last year; these numbers bode well for Q4 2022 earnings but may be difficult to replicate next year once higher rates have had time to diffuse through the economy. Companies will start providing full year 2023 guidance during Q1 of next year and we believe there is a high likelihood that earnings estimates will be revised lower across most sectors. As a result, the market may soon transition from an environment where softening economic data is perceived as good news due to its effect on interest rates, to an environment where soft data is treated as bad news because of its negative growth implications.

Market strategists are starting to lower their 2023 EPS targets and are projecting the biggest earnings revisions in economically sensitive sectors such as consumer discretionary and industrials. Considering our view that earnings estimates may be revised lower, we prefer companies and sectors that are less vulnerable to EPS declines and are positioning portfolios defensively heading into the new year. In recent weeks, we have been adding to our exposures in healthcare, utilities, and multi-family real estate due to their defensive characteristics and reasonable valuations. We are emphasizing companies that consistently grow their dividends over time reflecting steady earnings growth and sustainable profitability.

|

|

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

We continue to recommend exposure to the defensive healthcare sector. During the past three recessions, the average peak-to-trough earnings decline for the S&P 500 was -23%. Over the same periods, the healthcare sector increased earnings per share by 3% on average, ranking above all other sectors. Healthcare demand is inelastic, underpinned by the needs-based nature of its products and services. Another important factor is that patients are largely reimbursed by governments or insurance companies when they consume healthcare products. As a result, healthcare spending does not factor into household budgeting decisions the same way discretionary purchases do.

After a near total disappearance during the pandemic, Respiratory Syncytial Virus (RSV) is experiencing an alarming and unseasonably early resurgence in Canada, the US and other countries. Despite being a relatively harmless virus that is most frequently detected in children and older adults, the recent surge is raising concerns of overwhelming health centers as flu cases climb and COVID-19 continues to circulate.

Unfortunately, there are currently no approved RSV vaccines in North America but the race to gain approval has escalated in recent months. GlaxoSmithKline (GSK) appears to have a lead in the adult population after announcing that the FDA has granted Priority Review to its vaccine. Its Phase III pivotal trial showed an impressive 94% efficacy rate against severe disease and overall efficacy of 83%. FDA approval for adults could come as early as Q1 2023.

Pfizer has the leading RSV vaccine candidate in the maternal population. The company announced in early November that its Phase III trial hit one of its primary endpoints required for regulatory filing. Interim data shows an efficacy rate of 82% for infants in their first 90 days of life as well as a high safety profile for mothers and newborns. Pfizer is expected to file for approval in both adult and maternal populations before year-end. We have been increasing our positions in Pfizer recently based on its attractive valuation and its catalyst-rich pipeline. Pfizer is expected to have 4-5 major pipeline readouts next year in areas that include gene therapy, oncology and vaccines. The stock trades at just 9.5x forward earnings and has lagged its pharma peers by more than 20% this year.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

Due to rising interest rates and concerns of an impending recession, REITs have returned -19.4% in Canada and -22.5% in the US year-to-date. However, Real Estate performed well in November, generating a total return of 6.9% in both Canada and the US. Given continued solid fundamentals in the publicly listed REIT sector generally, several REITs are trading at attractive valuations.

Last month, we discussed how Canadian industrial REITs were trading at attractive valuations relative to their intrinsic values. On November 7th, our convictions were validated when Summit Industrial Income REIT announced an agreement to be acquired for $5.9 billion by a group of investors led by GIC, a sovereign wealth fund in Singapore. The all-cash transaction represents a 31% premium to Summit’s previous closing price and was a significant contributor to our funds’ performance. Prior to the announcement, Summit represented a top 10 holding across all our real estate funds in addition to being a core position in several of Middlefield’s diversified equity income mandates. The transaction also provided a boost to our other core industrial names, including Granite REIT and Dream Industrial REIT, which returned 14.8% and 10.9% in November, respectively.

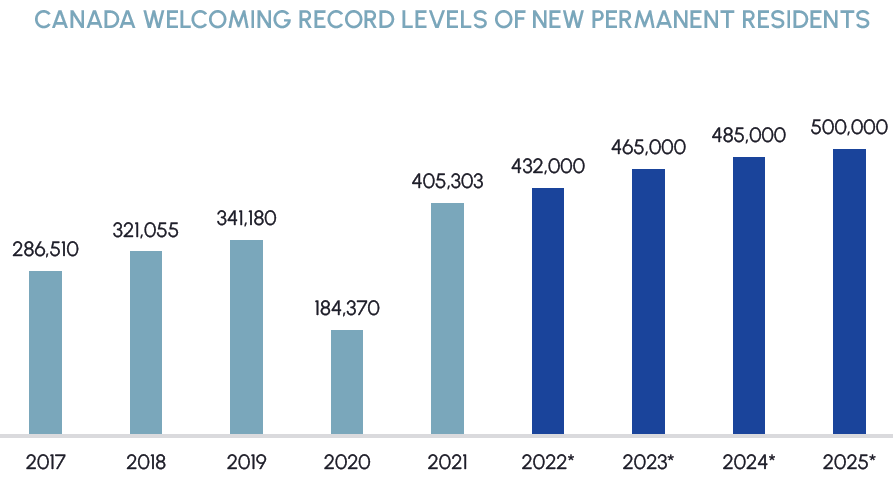

The rental market continues to surge across Canada. According to Rentals.ca, average rent prices increased 2.2% in October from the previous month and are up 11.8% compared to a year ago. Demand for rentals is being fueled by higher mortgage rates and record population growth. Despite average house prices in Canada decreasing by 20% since the peak in February, they remain well above pre-pandemic levels. With five-year fixed mortgage rates close to 6%, many would-be homebuyers can no longer afford or qualify for mortgage financing, forcing them to rent. While we expect borrowing costs to normalize soon, we are not expecting population growth to moderate. On November 1st, The Government of Canada updated its long-term immigration targets and now aims to welcome 465,00 permanent residents in 2023, 485,000 in 2024 and 500,000 in 2025. These new figures represent 3.8% population growth over the next 3 years and will require a substantial increase in many forms of housing supply. As a result, we believe rents will continue to climb for the foreseeable future in Canada. Our preferred names within this asset class include Canadian Apartment Properties, Killam Apartment REIT and Boardwalk REIT.

|

|

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

In early November, Enbridge reported third quarter financial results ahead of the street consensus. During the conference call, management reiterated its bullish view that North America will play an important role in providing stable and secure sources of natural gas, with Enbridge well positioned given it currently moves 20% of U.S. LNG through its infrastructure and that could grow to 30%. At month-end the company released its 2023 outlook and announced a 3.2% dividend increase, which appears conservative, but they also intend to file for a $1.5 billion NCIB that will provide it with another avenue to supplement returns to shareholders. The only blemish was that Mainline negotiations will likely continue into the new year as opposed to filing in Q4 which was previously communicated. We came away with a positive outlook given the implied 6% EBITDA growth and dividend increase as investors turn their attention to the early March investor day for updates on potential new projects and a Mainline resolution. The update reflects the strength of Enbridge’s business and financial model, underscored by an improving growth outlook, a self-funded strategy, a deleveraging balance sheet, and steady dividend increases.

The Global Clean Energy Index returned 10.9% in November, significantly outperforming the S&P 500. During the month, Bloomberg New Energy Finance (BNEF) released its annual Energy Outlook report which paints an optimistic picture of a net zero scenario consistent with the Paris Agreement objective of keeping global warming below 2 degrees Celsius. The global energy crisis and recent record commodity prices have resulted in improved economics for renewables compared to traditional energy sources, accelerating their implementation. Meanwhile, countries across the globe agreed to devise additional policies to accelerate renewable power adoption when they recently met at COP 27. In the US, solar stocks rebounded strongly on the release of a more favorable than expected Net Energy Metering (NEM) 3.0 proposal by the California Public Utility Commission. This iteration of the NEM proposal will allow customers to share excess electricity produced through their rooftop solar power systems with the grid at more advantageous terms than were outlined in the previous motion, thereby incentivizing greater adoption of such systems. Solar names in our International Clean Power Fund (CLP.un) including Sunrun and SolarEdge returned an impressive 44.7% and 29.9%, respectively in November.

Additionally, both companies reported strong Q3 earnings, underscored by solid demand despite the turbulent macroeconomic backdrop. Elevated demand aided by favorable government policies help reinforce our positive view on clean energy equities.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

The Nasdaq gained 4.5% in November but trailed the broader markets. We remain confident regarding technology’s long-term prospects; however, we have become more defensive in the short-term following the exceptional Q4 rally.

We think that leading software companies across verticals (e.g. Adobe in design) will continue to gain market share over time. Even so, we are cautiously optimistic on the industry as we are seeing a broader trend of greater expense scrutiny leading to sales-cycle elongation, which is especially concerning for companies with rich valuations that are highly dependent on top-line growth. In semiconductors, our top picks have largely stayed the same throughout the year (e.g. AMD in CPU). Even so, we have reduced our allocations due to heightened risk for an inventory cycle that may persist into 2023.

The aforementioned risks have had multiple implications for our asset allocation. In response, we have increased our exposure to communications equipment, which we think will continue to benefit from the 5G upgrade cycle. In addition, we remain focused on companies that operate within attractive market structures (e.g. duopolies or oligopolies) as they should retain much better pricing power than their competitors in the current above-trend inflationary environment. We have also been increasing our exposure to defensive areas such as Telecom, which we expect will perform much better going forward due to less upside pressure on interest rates.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

Gold had a good month, gaining 8% from almost 2-year lows, as both the U.S. dollar and 10-year treasuries retreated. As we have previously discussed, rising rate expectations and U.S. dollar strength have proven material headwinds this year for gold, despite multi-decade high inflation. As we approach the terminal rate and U.S. dollar weakening, we see these headwinds abating.

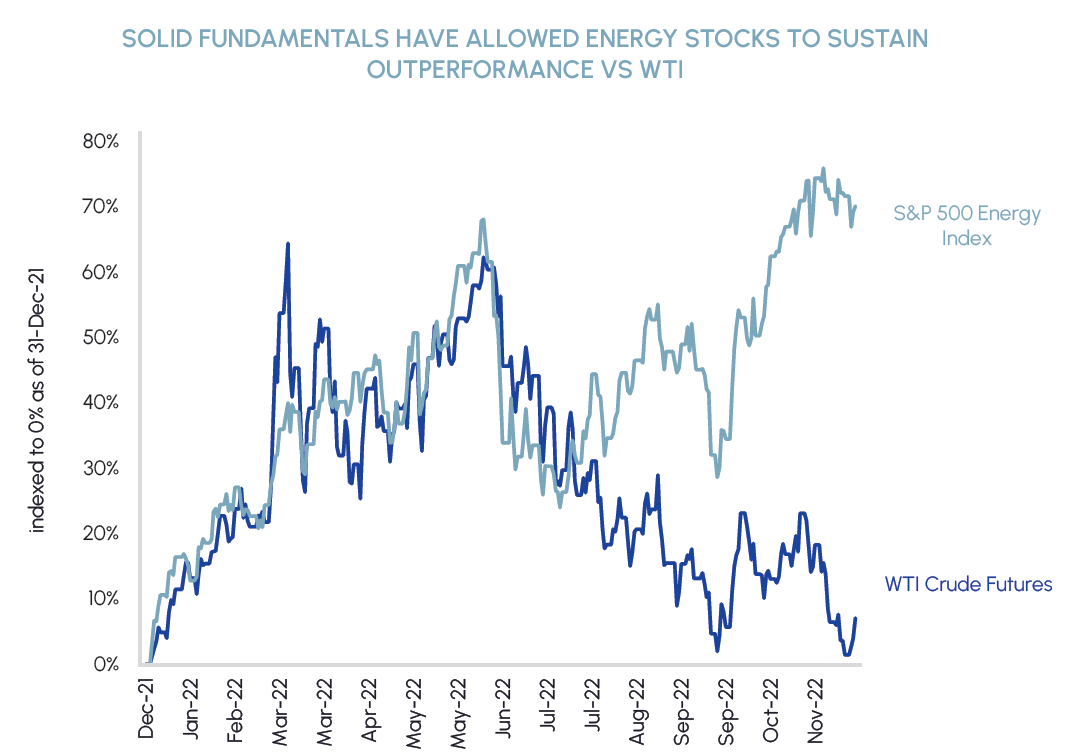

The oil industry has been undercapitalized for years and faces an average annual decline rate of roughly 4-5 million barrels per day. According to the International Energy Agency, the world’s oil producers need to spend nearly 50% more annually (compared to 2021) from 2022 to 2030 to meet the world’s oil needs. In the last month, oil prices have fallen 10% on recession fears, while energy equities have been resilient, suggesting a moderate re-rating is occurring. Investors seeking income can still find attractive returns within the energy sector through regular and special dividends. We see Tourmaline Oil and ARC Resources as standouts, positioned to deliver low single-digit levels of production growth in tandem with some of the highest levels of return of capital to shareholders.

Fertilizer equities had a rough start in November as bellwether stocks Nutrien and CF Industries reported 3rd quarter results that highlighted soft near-term demand, although Nutrien performed relatively worse as the company highlighted weaker volumes, margins and an annual guidance cut. While Nutrien shares may see limited traction in the near-term until potash markets stabilize, we still see a strong long-term opportunity based on industry fundamentals. The quarter seems to indicate fertilizer prices will stabilize in early 2023, setting the stage for improved demand. Companies in less cyclical parts of the agriculture input market (such as Corteva) performed very well in the quarter. Global grain stock-to-use is the lowest in over 25 years, following six consecutive years of declines. Spot prices of corn, soybeans and wheat are up meaningfully versus long-term averages, which should provide an incentive for farmers to boost production in 2023 and maximize crop yields.

|

|

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

Around the world institutional investors (i.e., assets owners, such as pension funds, and asset managers, such as Middlefield) often retain a proxy advisory firm to assist them in analyzing proxy voting matters. In Canada the two major proxy advisors are Glass Lewis (“GL”) and Institutional Shareholder Services (“ISS”). GL and ISS have a series of benchmark proxy voting guidelines for Canada and various other countries around the world, and at the end of each year they publish the changes to their existing policies which will take place in the following year.

For the 2023 proxy season, GL has announced six changes to its proxy voting guidelines for Canada which deal with ESG issues, while ISS has proposed two changes applicable to Canada which it will finalize shortly. This month’s ESG Commentary highlights the GL changes and ISS proposed changes for Canada for the 2023 proxy season.

GL’s Changes for Canada for the 2023 Proxy Season

The following are six changes that GL is making to their 2023 voting guidelines for Canada.

- Board Gender Diversity: GL is transitioning from a fixed numerical approach to gender diversity on the board of directors to a percentage-based approach. GL generally will recommend voting against the nominating committee chair of any board of a TSX-listed company that is not at least 30 percent gender diverse, and also will recommend voting against all members of the nominating committee of a board with no gender diverse directors.

- Environmental and Social Risk Oversight: GL generally will recommend voting against the governance committee chair of any company in the S&P/TSX Composite Index that fails to provide explicit disclosure about the board’s role in overseeing E&S issues. GL believes that companies should determine the best structure for this oversight, which could be conducted by specific directors, the entire board, a separate committee, or combined with the responsibilities of a key committee.

- Cyber Risk Oversight: GL states that cyber risk is material for all companies and that a company’s stakeholders would benefit from clear disclosure regarding the role of the board in overseeing issues related to cybersecurity. GL states it may recommend against “appropriate directors” where cyber-attacks have caused significant harm to shareholders if GL finds the company’s disclosure of oversight to be insufficient.

- Director Accountability for Climate-related Issues: GL states that climate risk is a material risk for all companies and that companies should provide clear and comprehensive disclosure of their risks, including how they are being mitigated and overseen. GL may recommend voting against a “responsible member of the board or other relevant agenda item(s)” if companies with increased climate risk exposure have not provided thorough climate-related disclosure aligned with the framework of the Task Force on Climate-related Financial Disclosures (TCFD) or have

not explicitly and clearly defined board oversight for climate-related issues. - Director Commitments: For TSX companies, GL will consider a director to potentially have excessive board commitments (i.e., being “over boarded”) if the director serves as an executive officer of a public company and also serves on more than one additional external public company board.

- Long-Term Incentive Awards: GL will raise concerns in their analysis of executive pay programs which have less than 50 percent (an increase from 33 percent in GL’s guidelines last year) of an executive’s long-term incentive awards subject to performance-based vesting conditions.

ISS’s Proposed Changes for Canada for the 2023 Proxy Season

The following are two proposed changes to ISS’s 2023 benchmark voting policy for Canada, which ISS expects to finalize in December after completing its consultation process.

- Climate Board Accountability: ISS states that it is updating its policy for the universe of high emitting companies, which ISS proposes as those companies listed in the Climate Action 100+ Focus Group (and thus includes a handful of Canadian companies). In cases where a company is not considered to be adequately disclosing climate risk disclosure information, such as according to the TCFD framework, and does not have either medium-term GHG

emission reduction targets or net zero by 2050 GHG reduction targets for at least a company’s operations (Scope 1) and electricity use (Scope 2), ISS generally will recommend voting against “appropriate directors and/or other voting items available”. - Board Diversity: ISS states that in 2024, after a one-year grace period in 2023, companies in the S&P/TSX Composite Index will be expected to have at least one racially/ethnically diverse director.

Companies don’t like to learn that proxy advisory firms are making negative voting recommendations

about their ESG practices, so it will be interesting to see what actions Canadian companies will take as a result of the above changes from GL and proposed changes from ISS to their Canadian benchmark proxy voting guidelines.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |