Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

March was a turbulent month for equity markets, particularly in the financial sector. Regional banks experienced significant deposit outflows, three U.S. banks closed their doors and UBS acquired Credit Suisse in a forced sale. While the financial sector returned -9.6% in the US and -5.9% in Canada, the broader market proved to be extremely resilient against this backdrop. The S&P 500 generated a total return of 3.7% in March and 7.5% in Q1. The Canadian market, which has a higher weighting in Financials, declined just 0.2% and finished Q1 with a total return of 4.6%.

A notable reversal in market leadership took place during the first quarter. Aside from real estate, all sectors that lagged the S&P 500 in 2022 outperformed in Q1 2023. Information Technology, Communication Services and Consumer Discretionary returned 21.8%, 20.5% and 16.1%, respectively. Given tech’s substantial weighting, it accounted for 5.6% of the index’s 7.5% total return. Meanwhile, sectors that led in 2022 have underperformed thus far in 2023. Notable laggards include defensive sectors such as Consumer Staples, Healthcare and Utilities in addition to Energy, which was the top performing sector in both 2021 and 2022.

|

|

There are several explanations as to why growth has outperformed value but falling interest rates are likely the biggest contributor. Beginning with the collapse of SVB on March 10th, interest rates have fallen precipitously. US 2-year treasury yields experienced the biggest three-day decline since 1987, falling by over one percent. Further down the yield curve, US 10-year treasury yields declined by 45 basis points in March, finishing at 3.45%. While the Federal Reserve may hike short-term borrowing rates again at its next meeting in May, it is becoming apparent that the end of the current tightening cycle is near. The lower interest rate outlook has contributed to multiple expansion, particularly in more expensive sectors. The forward price to earnings multiple on the S&P 500 expanded by 8% in Q1 to 18x.

Despite a more benign interest rate environment, the risk of tightening credit conditions has not gone away. While we do not expect a credit crunch like the Great Financial Crisis, it is expected that lending standards at banks have become more stringent in recent weeks. One issue that is getting a lot of attention is the amount of Commercial Real Estate (CRE) debt outstanding. According to the Mortgage Bankers Association, total CRE mortgage debt outstanding is $4.4 trillion, of which $450 billion is set to mature in 2023. U.S. commercial banks also held $455 billion of construction and land development loans as of early March. With muted transaction volumes and office vacancies near all-time highs, fears of asset write-downs are elevated. Historically, a cooling in bank lending trickles through the economy, making a recession more likely.

Notwithstanding the growing risk of a recession, there are several earnings tailwinds that will help protect corporate margins if the economy softens. The U.S. Dollar Index fell by 2.7% in March and is down more than 10% from its highs last year – a meaningful tailwind for US companies with multinational operations. Supply chains and inventories are normalizing, resulting in a much more predictable global trading environment. Cost-cutting announcements and layoffs show that management teams are taking profitability seriously. Layoffs first started in tech but have spread to other large companies including Disney, McKinsey, Goldman Sachs and McDonald’s. Q1 earnings season kicks off in mid-April and will be closely watched by investors. It’s also important to remember that markets are forward-looking with the ability to look past near-term headwinds and price in next years’ earnings. We are focused on companies that can protect margins in the short-term while preserving their ability to invest and grow once economic conditions improve.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 325 / SIH.UN

by Robert Moffat, Portfolio Manager

It has been a tough start to the year for healthcare investors. In fact, Q1 was the worst first quarter for healthcare relative to the S&P 500 over the last 30 years. Despite the slow start, we encourage investors to stay invested in the sector due to its relative stability and predictability – attractive characteristics against an uncertain economic backdrop.

One of the benefits of investing in healthcare is that it is an inherently diversified sector. While defensive industries such as pharmaceuticals and managed care operators have lagged this year, more growth-oriented sub-industries such as medical equipment and life sciences tools & services have performed well. Boston Scientific (BSX) is a MedTech stock we have been adding to recently that has performed well. BSX has a strong presence in the structural heart and medical surgery fields. The company continues to benefit from market share gains for its left atrial appendage closure device, Watchman, which surpassed $1 billion in sales in 2022. The company also has an exciting new product launch on the horizon in electrophysiology to treat atrial fibrillation, a vertical in which it is looking to solidify its already strong presence.

Even within industries that have lagged, such as pharmaceuticals, there are growth opportunities to be found. Diabetes and obesity are among the most exciting and fastest growing verticals in all of healthcare, underpinned by ground-breaking new treatments entering the market. GLP-1 agonists, such as Ozempic, represent a new class of drugs that were initially developed to treat Type 2 diabetes but were found to have the added benefit of significant weight loss. Eli Lilly is our preferred name in the diabetes and obesity space due to the impressive clinical data for its drug, Mounjaro. It was approved to treat Type 2 diabetes last spring and has already become one of the most successful drug launches in history. The company expects to receive FDA approval for obesity later this year, expanding its total addressable market by hundreds of millions of patients. We also have a favourable view on its main competitor Novo Nordisk, the maker of Ozempic, but are more likely to add to this name on a pullback considering the incredible run the stock has been on recently.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RA.UN / MSRE.UN

by Dean Orrico, President & CEO

After a strong start to the year, March was a challenging month for the real estate sector. Canadian REITs returned -4.7% while US REITs returned -1.4%. Volatility was primarily driven by emerging credit concerns, particularly within the office asset class.

Exposure to Commercial Real Estate (CRE) loans has become topical since the collapse of Silicon Valley Bank. Regional banks in the US have outsized exposure to CRE. According to Fitch, CRE loans comprise approximately 33% of the total assets held on the balance sheets of banks with assets between $1 billion to $10 billion. Further, it is estimated that office represents 39% of U.S. bank CRE portfolios. Considering the significant exposure that banks have to office loans, combined with the elevated scrutiny banks are receiving with regards to the fair value of their assets, it is no surprise that investors are concerned. Moreover, unlike other CRE sectors, operating fundamentals for the office sector are weak. The vacancy rate rose to a record high in Manhattan during the first quarter and is near the highs reached during the Global Financial Crisis. In Canada, the national office vacancy rate stands at 17.7%, with downtown Class B space reaching 22.7%. In 2022, it became obvious that the desire to work from home was going to persist for some time and our real estate funds have, accordingly, maintained a very low weighting in office at approximately 1%. Moreover, we have no plans to step back into the sector even though office REITs are trading at steep valuation discounts.

Notwithstanding the challenges facing office, operating fundamentals across other property types in Canada remain extremely solid. Specifically, industrial, multi-family and grocery-anchored retail are very stable and we expect continued growth in net operating income in 2023. CBRE recently reported that the average market rent growth for Canadian industrial space in Q1 increased 28% compared to last year, with “every market in Canada” posting positive numbers. Demand for multi-family residential is set to surge amid rising immigration and the emerging housing affordability crisis facing Canadians. Retail landlords will also play a key role in providing lower cost housing options for new Canadians through their robust mixed-use development pipelines. These three sub-industries comprise the core weights in our real estate funds as we believe they offer the most attractive risk/reward dynamic and currently trade at attractive discounts to underlying value. They are complemented by select international exposures we cannot access in Canada, including cell towers, data centres, single-family housing, life science labs and manufactured housing.

Following the recent sell-off, Canadian REITs are now trading at more than 20% discounts to their net asset values on average. Valuations are approaching 2020 trough levels; a period when the whole country was locked down and REITs were having to provide rent relief to struggling tenants. High-quality REITs with rock solid fundamentals and conservative balance sheets are currently being painted with the same brush as companies with uncertain outlooks (such as office), providing an excellent opportunity for public REIT investors.

Our investment strategy hasn’t changed but we have made a few minor changes to the portfolio. We are prioritizing balance sheet strength in the near-term given the heightened scrutiny banks are getting around their commercial real estate loan books right now. With the financing environment becoming more challenging for REITs over the past several weeks, especially in the US, we have further reduced our exposure to companies with floating rate debt or near-term maturities.

Sustainable Infrastructure

Middlefield Fund Tickers & Codes: MINF / CLP.UN / MID 265 / MID 510 / ENS / ENS.PR.A

by Robert Lauzon, Managing Director & CIO

The S&P Global Clean Energy index returned 2.7% in March, slightly underperforming MSCI World at +3.2%. We remain very optimistic on the clean energy space due to our view on rates as well as the favourable regulatory backdrop.

The global energy storage industry has reached new heights, with total deployments climbing to 16 GW in 2022, a remarkable 68% year-over-year increase as reported by Bloomberg New Energy Finance. This impressive growth was reflected in the strong results posted by SolarEdge and Enphase, partly driven by a higher number of residential installations across European markets. These companies, along with Tesla, also have a major presence in the US residential storage market. According to EnergySage, the operator of an online marketplace for comparing options on solar inverters, 80% of all quotes in 2022 were for those three brands alone.

Canada demonstrated its commitment to sustainability by including a 15% tax credit for non-emitting electricity generation, abated natural gas, storage, and transmission in its 2023 budget. This is meant to improve the relative attractiveness of investing in clean energy projects here in Canada. The budget also outlines tax credits for hydrogen projects, ranging from 15% to 40% based on their carbon intensity. We believe that we will also see more public-private partnerships in the space as Canada aims to double the capacity of its grid by 2050. These developments are positive and have reinforced our confidence in key holdings such as TransAlta, Brookfield Renewable Partners, Boralex, and Capital Power. That being said, we believe the budget lacked additional incentives and clear policy specific to Canadian carbon capture projects resulting in a significantly less attractive investing environment for this emission reduction process versus other jurisdictions.

Enbridge signed a letter of intent to be a 50/50 partner with Yara Clean Ammonia to construct a low-carbon blue ammonia production facility near Enbridge’s Corpus Christi, Texas export facility. The announcement comes as a vote of confidence in transforming Corpus Christi into an export hub for both traditional hydrocarbon and future low carbon products (i.e., Ammonia & hydrogen with CCUS). The cost of the 1.2-1.4MTPA project is expected to be US$2.6-$2.9 billion. Yara operates the largest global ammonia network with 15 ships and access to 18 ammonia terminals and consumption/production sites. Enbridge noted at its recent Analyst Day that it is looking to sanction the facility in 2024 and that it will be an attractive long term take or pay type agreement. The announcement continues to highlight that the company is on the leading edge of energy transition opportunities leveraged by its low carbon export hub at Corpus Christi.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925

by Shane Obata, Portfolio Manager

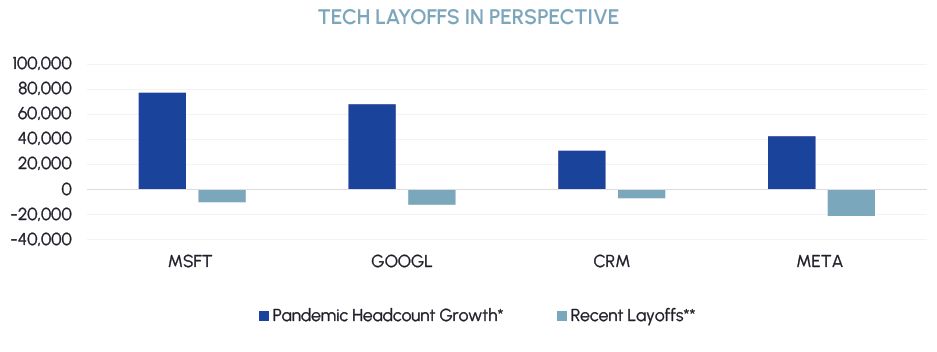

Tech stocks outperformed in March with the Nasdaq Composite rising 6.8%. The year-to-date rally can be explained by several factors. The first is that the end of the Fed hiking cycle is in sight. We are not so sure about imminent cuts but we do think that the vast majority of tightening is behind us. This is important for technology stocks, which are often considered as “long duration” assets, given that a lot of their value comes from future value creation (which has not happened yet) versus steady state value (which is based on current earnings power). The second key contributor is margin protection. Large tech companies that added hundreds of thousands of workers to support COVID-induced growth are now retrenching by laying off excess staff and cutting costs elsewhere. We would argue that even after recent layoffs, tech companies remain bloated. This is significant because it shows that big tech companies have ample room to protect margins.

|

|

The third key driver has been excitement around generative AI. While we are highly optimistic about its potential, we acknowledge there is significant hype around the theme and would caution investors that not every company with “AI” in its description will benefit from it. Even so, the rate of adoption for ChatGPT and the rapid number of new releases and applications is amazing to watch. The overarching theme here is actually productivity. These new tools will allow workers to increase their output and reduce the amount of “busy work” they need to do. All of this should lead to better profitability for not only the companies selling the enabling technologies but also those embracing it in their day-to-day operations.

Overall, we believe that sentiment around tech will continue to improve over the course of 2023, especially given the interest rate / macro backdrop, which bodes well for growth-oriented businesses. Even so, we remain selective in terms of stock selection as we expect the cost of capital to remain much higher than it was only a couple of years ago. In this environment, we continue to focus on profitable companies with demonstrated technological leadership in their respective industries. In terms of themes, we continue to have high conviction in cybersecurity and data center networking, both of which should prove resilient this year.

Resources

Middlefield Fund Tickers & Codes: MID 161 / ENS / ENS.PR.A / MID 265

by Dennis da Silva, Senior Portfolio Manager

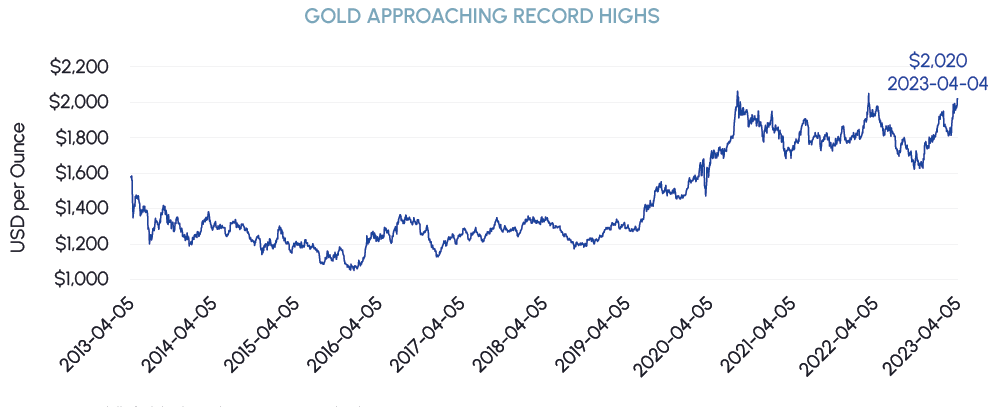

The price of gold rallied in March, driven by regional bank concerns and expectations for less hawkish monetary policy from the Fed and other key central banks. With elevated recession risks, gold’s risk/reward is skewed to the upside given its “safe haven” attributes. If uncertainty persists, gold prices could set new milestones above the US$2,000/oz mark. The S&P/TSX Global Gold Index was up 16% in March, materially outperforming the price of gold, which was up 8%.

|

|

The battle for critical minerals is intensifying. Expectations for the near-term release of the European Critical Raw Materials Act while the European Union holds discussions with the U.S. on future strategy will keep new policy in the headlines. The initial focus has been for the developed world to alleviate its dependence on China for refined products. To put that in perspective, China produces almost 60% of global steel and aluminum, approximately 50% of all other base metals, and 70% of battery raw materials. There is little doubt that China will maintain its position as the leading producer of these metals for years to come, but it is the level of dominance that the Inflation Reduction Act and the EU Critical Raw Materials Act are seeking to diminish. Reshoring and developing robust end markets for domestically produced materials are key tenets of these nascent strategies.

Oil was caught in a macro maelstrom this month. Themes driving oil price volatility included recession concerns, unpredictability from OPEC+, the re-opening of China, and an eventual SPR replenishment. It is noteworthy that in January, the godfather of shale oil, Pioneer Natural Resources CEO Scott Sheffield, stated that OPEC would likely take steps to boost oil prices, which started the year in free-fall. In early April, OPEC+ announced an additional 1.16 MMBbl/d supply cut starting in May. Despite the cut announcement, U.S. crude production will likely flatline due to investors’ demands for capital discipline. U.S. producers have made it clear that the world will need to turn to OPEC to satisfy demand growth. Further influencing U.S. supply concern is that the inventory of drilling locations has become an increasing concern, where in the words of ConocoPhillips boss Ryan Lance: “The Permian has been a great gift to the world over the last 15 years, and it’s going to keep giving for a long period of time. But it is starting to recede — and the plateau is on the horizon.”

Fertilizer markets remain relatively muted heading into spring in the Northern Hemisphere. Gradually emerging demand in the U.S. has supported volumes and kept prices steady in North America, but fertilizer markets in other regions continue to see moderate declines and slower demand. While affordability indicators are very favourable with strong relative crop prices relative to fertilizer prices, it appears distributors are struggling to clear higher-priced inventories, which has resulted in slow market activity. The highly anticipated U.S. Prospective Plantings report could prove positive for near-term fertilizer demand, with projected corn and soybean planted acres set to be the fourth largest on record.

ESG: Environmental, Social and Governance

Middlefield Fund Tickers & Codes: MDIV / MINF / CLP.UN / SIH.UN / MSRE.UN

by Stephen Erlichman, Chair, ESG (Environmental, Social and Governance)

Considering ESG factors is an important aspect of Middlefield’s decision-making process when determining (1) what companies should be added to or removed from the portfolios of the various investment funds we manage and (2) how shares of those companies should be voted at shareholder meetings. Their importance derives from the fact that they can constitute potential risks and opportunities for companies which, in turn, can affect their stock price.

What ESG factors are most material to companies will vary from company to company. The high profile E factor which one hears about in the media on a regular basis, however, is climate change. For example, in March at the opening of the new session of the Intergovernmental Panel on Climate Change (IPCC), the United Nations Secretary General Antonio Guterres issued the following statement about climate change: “Our world is at a crossroads, and our planet is in the crosshairs. We are nearing the point of no return.” Whether or not one believes the foregoing warning, investment managers do consider how the risks and potential opportunities afforded by ESG factors, including existing and possible future climate issues, can affect the valuation and of portfolio companies. The IPCC’s report published in March set out various warnings about the possible effects of climate change, including the statement that “[d]elayed mitigation and adaptation action would lock-in high-emissions infrastructure, raise risks of stranded assets and cost-escalation, reduce feasibility, and increase losses and damages”, many of which effects can be relevant to the valuation of portfolio companies.

In response to the IPCC’s report, in March the International Corporate Governance Network (ICGN) also re-published its November 2022 Statement of Shared Climate Change Responsibilities. The ICGN stated that “boards, management, investors, the auditing profession, standard setters, and others have unique responsibilities to clearly identify challenges, determine solutions, and implement assertive action”. In regard to corporate boards and management, the ICGN’s recommendations included having “robust governance procedures and board competence in overseeing how management identifies, monitors, measures and manages climate change risks and opportunities aligned with company purpose and long-term strategy.” In regard to investors, the ICGN’s recommendations included the recommendation to “integrate financial, natural, and human capital considerations into company monitoring across asset classes, investment decisions, and stewardship activities.” In regard to auditors, the ICGN’s recommendations included the recommendation to “[e]nsure the application of guidance related to climate change risks in planning and performing audits on financial statements as provided by standards-setters… This includes, where financially material, linking climate risks and transition planning to company financial statements.”

In Canada, CEOs of companies large and small make public statements about ESG, including how to build value at companies in the context of climate change. For example, at the beginning of this month Dave McKay, the CEO of Royal Bank of Canada, wrote in an opinion piece in The Globe and Mail: “The question of how to revive growth is at the top of the list for government and business leaders everywhere. Even more important is how to combat climate change while doing so.”

At Middlefield we continue to consider ESG risks and potential opportunities, including climate change, in our investment and voting analysis when we believe ESG factors are material to the value of companies in the various portfolios that we manage.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Real Estate Dividend Fund | MSRE.UN | Sustainable Real Estate |

| International Clean Power Dividend Fund | CLP.UN | Sustainable Power |

| Middlefield Global Real Asset | RA.UN | Real Assets |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |