Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Volatility returned to equity markets in February with the S&P 500 experiencing a 5% drawdown in the last 10 days of the month. Given the strength of the rally early in the year, a period of consolidation was expected at some point. “In like a Lion” is certainly an accurate way to describe the first week of trading in March with the S&P 500 now in negative territory YTD, currently trading below its 200-day moving average. The extreme chaos with which the tariff announcements are being made are almost as bad as the tariffs themselves. Its creating a lot of anxiety and uncertainty resulting in the unwinding of the Trump trade. The pain threshold of the Trump administration should soon express itself given the recent underperformance of the U.S. markets versus the rest of the world.

In Canada, a 25% tariff on all imported goods took effect on March 4, while a reduced 10% tariff was applied to Canadian energy, critical minerals, and potash. Days later, a month-long reprieve was granted for imports to the U.S that are compliant with the United States-Mexico-Canada Agreement (USMCA). Trump has also threatened to impose “reciprocal” tariffs globally on April 2. It’s possible the April reciprocal tariff announcement could be an enormous purgative event, providing the transparency investors crave and allowing sentiment to settle. Regardless of timing, it is clear Canada will face a different trade playbook than previous years while Trump rolls out his plan to pull forward a renegotiation of the USMCA while dealing with a different Canadian Prime Minister. The silver lining resulting from the risk to Canada’s economic prosects are pushing our Governments and businesses to pursue substitutions to U.S supply chains, such as with Asia Pacific and European regions, along with boosting domestic trade and infrastructure investment among the provinces and territories.

While trade tensions remain elevated, we believe the current dynamic may represent the peak in tariff-related headwinds, Recently, it does seem the White House is responding to a certain extent to pressure from the economy and financial markets with Treasury Secretary Scott Bessent signalling the potential for relief in the near-term. There’s also reports that lawsuits may be filed against Trump’s tariff actions, some of which could be in violation of the law. This gives us encouragement that the trade plan could be curbed further over the coming weeks. In addition to push back from the economy and markets, Republicans in Congress are being more vocal in expressing their displeasure with tariffs. Nonetheless, a prolonged trade war could erode consumer sentiment and present a political challenge for Trump’s pro-growth agenda.

Tariffs represent a unique economic threat for the Federal Reserve to address given its dual mandate is to keep inflation low and stable while maintaining a healthy labor market. Tariffs are expected to both raise inflation, which calls for higher interest rates, and reduce employment, which calls for lower rates. The Fed will likely have to choose which threat to emphasize at its upcoming meetings. Futures are now pricing more than three total cuts from the Fed in 2025, up from just one cut in January. While much is to be determined over the coming months, the prospect of a “Fed Put” re-entering the market is an emerging narrative that would put a floor on equity prices.

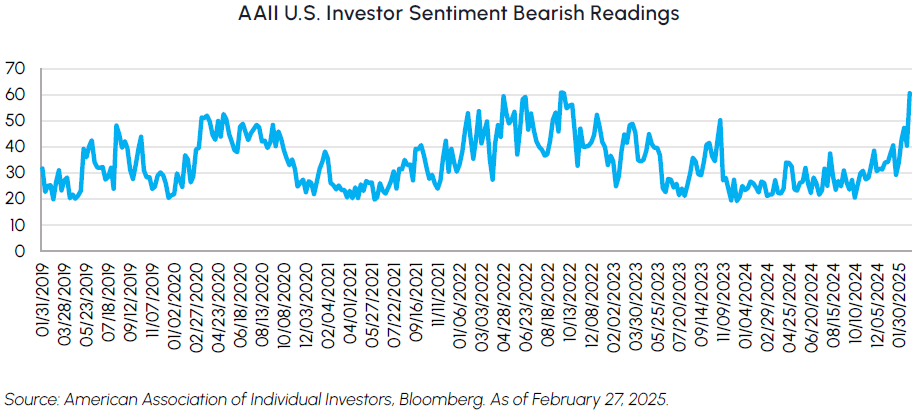

While macroeconomic uncertainties are likely to persist, extreme bearish sentiment suggests the market may be poised for a near-term rebound. Investor emotion has reached deeply pessimistic levels and short-term momentum oscillators are signalling extremely oversold conditions. The AAII U.S. Investor Sentiment Index measures the direction that investors think the stock market is heading over the next 6 months and is a historically reliable contrarian signal. In late February, it registered its highest bearish reading since October 2022, coinciding with the S&P 500’s last major bottom, which was followed by a 70% rally. Overly negative positioning has preceded strong equity performance in the past and should lead to more buying in the weeks ahead.

Volatility is likely to persist as the Trump 2.0 administration implements its new mandate. We expect economic data will continue signaling a growth slowdown; however, we do not expect a recession this year. Our focus remains on high-quality companies with strong balance sheets, sustainable cash flow generation and strong competitive moats. In an environment where headlines are driving short-term moves, maintaining a longer-term perspective remains critical.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

REITs outperformed the TSX in February, with the TSX Capped REIT Index returning 2.2%. In conjunction with their Q4 2024 earnings reports, most Canadian REITs have provided their 2025 outlooks, reinforcing the sector’s resilience. Despite broader macroeconomic uncertainty, fundamentals across various real estate segments remain solid, supported by steady demand, constraints on supply and prudent capital allocation.

A major transaction was announced in the Canadian seniors housing sector, underscoring the long-term attractiveness of the asset class. Welltower, a core holding in our REIT funds, announced the acquisition of Amica from the Ontario Teachers’ Pension Plan for $4.6 billion. This deal provides Welltower with a scaled platform of 4,700 luxury retirement suites in Canada at below replacement cost and highlights the REIT’s low cost-of-capital. The transaction also has positive implications for other Canadian seniors housing operators, including Chartwell and Sienna. The estimated transaction value of $680,000 per suite is more than double Chartwell’s implied valuation of $334,000 per suite. We remain bullish on the seniors housing sector, with Chartwell expected to grow earnings in the mid-teens for at least the next two years.

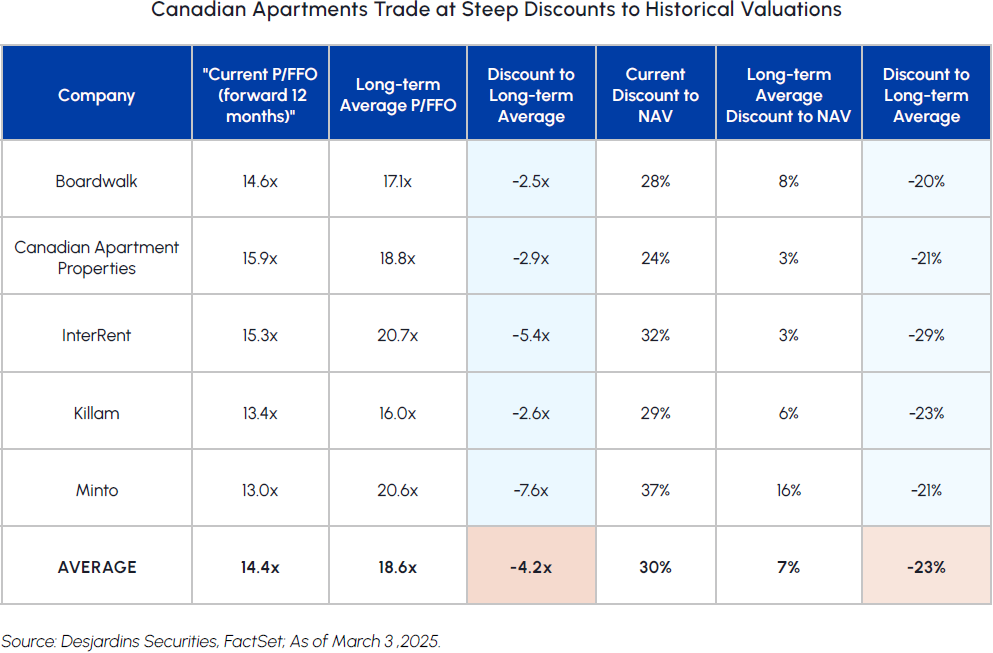

Multi-family apartment REITs have started to inflect higher recently. Canadian apartment REITs provided organic growth guidance in the mid-to-high single digits for 2025, driven by solid demand and expense controls. Despite these solid fundamentals, the group is currently trading at trough valuations, in line with levels last seen during the COVID-19 downturn when macro uncertainty was significantly higher. Apartment REITs are trading at a 4.2x discount to their long-term price-to-FFO multiples and at a 30% discount to NAV on average. Moreover, the sector has historically demonstrated resilience during periods of macro uncertainty, outperforming the broader market by an average of 5% during the Global Financial Crisis, oil price declines, and the COVID-19 pandemic. Given these factors, we see an attractive opportunity in this segment of the real estate sector.

Our preferred real estate sectors, including multi-family and seniors housing as well as grocery-anchored retail and industrial, are all positioned to re-rate higher as we get more clarity on the trade front and federal government leadership in Q2 2025. We believe these developments will become key catalysts for foreign investors looking for attractive sectors offering both high income and significant capital appreciation potential.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

Healthcare continues to recover after two consecutive years of underperforming the broad market. The sector returned 1.5% in February and is the top performing S&P 500 sector year-to-date with a total return of 8.4%. Despite its impressive start to the year, healthcare continues to trade at a 3x forward P/E multiple discount to the S&P 500, leaving plenty of runway for the re-rating to continue.

We remain very bullish on the outlook for the GLP-1 market, which is expected to reach $140 billion in annual sales by 2030. While the market is gradually maturing, ongoing accrual of health outcomes data should broaden access and sustain momentum, as payers become increasingly comfortable covering these treatments for expanded indications beyond diabetes and obesity. Both primary care physicians and specialists continue to demonstrate strong enthusiasm for the class, underscoring the durability of demand.

Competition in the GLP-1 space is intensifying, with over 80 companies pursuing more than 160 drug candidates. We continue to believe that Eli Lilly (our top holding) is still best positioned to dominate the market. After a choppy December, prescription trends for Zepbound and Mounjaro have strengthened in early 2025, a trend we expect to persist as the company ramps up promotional efforts following an expansion in manufacturing capacity. Beyond the near term, we view Lilly’s pipeline as a significant competitive advantage, with key catalysts on the horizon. Most notable is Phase 3 data for oral GLP-1 orfoglipron, expected in Q2. Lilly recently signaled an accelerated regulatory timeline for the product, with a mid-2026 launch now expected – 6 to 9 months ahead of prior estimates. Orfoglipron could play a key role in the GLP-1 market, serving as a maintenance option for patients who have already lost significant weight, an alternative for those with needle aversion, and a practical solution for markets with logistical barriers to injectable therapies. Additionally, Lilly’s ongoing commitment to capacity expansion should solidify its long-term leadership. In late February, the company announced plans to more than double its U.S. manufacturing investment since 2020, with $27 billion of incremental capital spending plans within the U.S. This proactive move will create 13,000 jobs for highly skilled workers and aligns with broader economic and policy objectives, a factor that could play favorably under the Trump administration.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

We attended Enbridge’s Investor Day and left with greater confidence in the company’s long-term growth outlook. Management outlined an extensive $50 billion pipeline of projects under evaluation through the end of the decade, including $10 billion for liquids pipelines, $23 billion for gas transmission, $9 billion for gas distribution and storage, and $7 billion for renewables. In addition to investments in growth expenditures, management also reiterated its commitment to returning $40-45 billion in capital to shareholders over the next 5 years through steady dividend growth. With a disciplined capital allocation strategy, a strong balance sheet, and a clear path to mid-single-digit annual EBITDA and distributable cash flow growth, Enbridge remains well-positioned to capitalize on North America’s evolving energy landscape. The company’s ability to secure long-term contracts with high quality counterparties further reinforces its low-risk, stable cash flow profile. Given the scale and predictability of Enbridge’s cash flows, we continue to view it as a best-in-class energy infrastructure operator with strong long-term fundamentals.

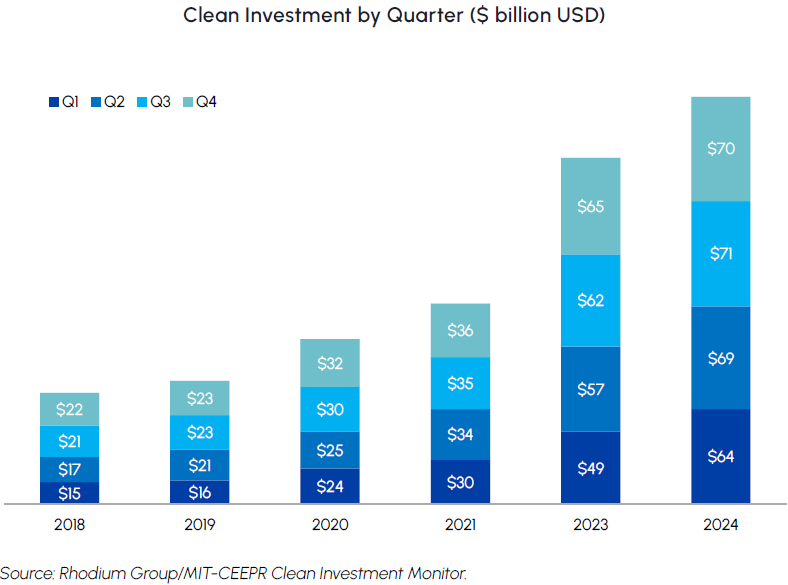

Investor sentiment toward publicly traded Canadian renewables has strengthened in recent weeks, driven by easing monetary policy, attractive valuations, and heightened M&A activity. The recent acquisition of Innergex Renewable by CDPQ at a 58% premium to its closing price reinforces the significant value embedded in renewable energy assets and signals growing institutional interest in the sector. As rate cuts continue and financing conditions improve, we expect further consolidation and capital deployment into high-quality renewable portfolios, as the industry continues to grow as depicted in the graph below.

Northland Power remains committed to expanding its global renewable energy footprint. The company is advancing its offshore wind projects in Europe and Asia, while also scaling its battery storage and solar initiatives in North America. Management has reiterated its focus on disciplined capital allocation, securing long-term contracts, and optimizing operational efficiencies to drive stable cash flows and long-term growth. Brookfield Renewables, one of the largest renewable energy operators globally, is also well-positioned to benefit from improving sentiment and increasing capital flows into clean energy. With a diversified portfolio of hydro, wind, solar, and storage assets, Brookfield remains a key consolidator in the sector and continues to deploy capital into high-return projects, as evidenced by its recent acquisition of National Grid’s U.S. onshore renewables business.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

The technology sector, particularly the burgeoning field of Artificial Intelligence (AI), has experienced heightened volatility in 2025. Given our bullish long-term outlook on AI and its future applications, we interpret these market fluctuations as strategic buying opportunities rather than a cause for concern. Historically, tech sell-offs have provided a chance to buy high-growth companies at more attractive valuations. Given the above-market earnings growth potential inherent in the Tech sector, we believe the current climate is particularly opportune.

The anticipated acceleration in AI adoption is well underway. OpenAI’s weekly active users surged past 400 million in February, and its paying business users also crossed two million. Similarly, Google’s Gemini (formerly Bard and Duet AI) is being integrated across its Workspace suite (Gmail, Docs, Sheets, etc.), streamlining workflows and boosting productivity for businesses. Anthropic’s Claude is also finding significant traction, particularly in areas like software development and technical writing, demonstrating AI’s capacity to augment, rather than replace, human capabilities. Enterprise adoption is a key trend, with companies embedding these AI tools into their operations.

We maintain that the entire AI supply chain presents a multi-year investment opportunity, and its key players are currently oversold. Monumental infrastructure projects are just getting started, including OpenAI’s $500 billion Stargate project and Meta’s planned $200 billion data center initiative. While much attention has been paid to the immediate beneficiaries (e.g., semiconductor companies), the true potential spans a much broader ecosystem including power producers, networking equipment, electrical components, rare earth mining and construction. We are in the early stages of a secular growth cycle that will have a profound impact on society and lead to a wide spectrum of opportunities. The combination of attractive valuations, expanding adoption by major players, and massive infrastructure development creates a powerful investment thesis.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

The price of gold continued to climb through February to a record high of US$2,956/oz amidst ongoing trade tensions, sticky inflation and economic growth concerns. We expect central banks to remain the driving force for gold demand in 2025, with gold ETF investors joining the fray. Gold-backed ETFs experienced their largest weekly inflow in three years and are now back to early 2024 levels in tonnage terms. In equities, Canadian gold producer Agnico-Eagle overtook Newmont to become the largest gold company by market capitalization. Agnico has a lower risk profile than Newmont with 90% of its production coming from Canada and Australia, in addition to a largely de-risked pipeline of brownfield development opportunities. TSX gold stocks were up 4.5% in February, outperforming the 2.1% gain in the price of gold and the TSX return of -0.4%.

Despite the risks posed by tariffs, Canada’s energy sector may ultimately benefit from rising trade tensions with the U.S. over the long-term. Decades of policy missteps, burdensome regulations and interprovincial trade barriers have left Canada over-reliant on a single trading partner. Shifting sentiment toward large-scale infrastructure could drive a new wave of project development geared towards international exports. With regulatory and political challenges still to navigate, the near-term focus will be on resurrecting stalled projects and securing alternative markets.

Supply/demand dynamics for natural gas remain attractive, supported by a cold snap that has driven significant storage withdrawals. U.S. inventories sit more than 20% below year-ago levels, while European inventories have fallen sharply to 40% of capacity, compared to 64% last year. Capital discipline among producers and growing LNG demand should continue to support prices. U.S. LNG exports have set new record highs, with additional supply from Plaquemines and LNG Canada coming online in the months ahead. Shell’s latest outlook projects a 60% increase in global LNG demand by 2040, with Asia leading growth and Europe requiring long-term imports as domestic production declines. Conversely, oil prices declined 3% in February and are testing key support levels as OPEC+ is set to proceed as planned with the increase of 140 kb/d of supply to the market beginning in April while global growth worries emerge. We expect the price of oil to find support at current levels and continue to closely watch geopolitical risks, specifically Iran, that could initiate material upside in the commodity.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.