Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

The year 2024 proved to be an impressive one for equity investors, marked by substantial gains that have laid a strong foundation for continued growth in 2025. The S&P 500 and TSX Composite delivered total returns of 25% and 22%, respectively, showcasing the strength and resilience of the North American markets. This superb performance was broad-based, with 10 out of 11 S&P 500 sectors posting positive returns. Building upon similar performance in 2023, the US market has now returned over 50%, marking the best two-year gain since the notable period in 1997/1998.

Equity markets were resilient in January amidst a slew of headlines coming out of the Trump Administration and the AI industry. The S&P 500, TSX Composite and MSCI World Index returned 2.8%, 3.5% and 3.6%, respectively.

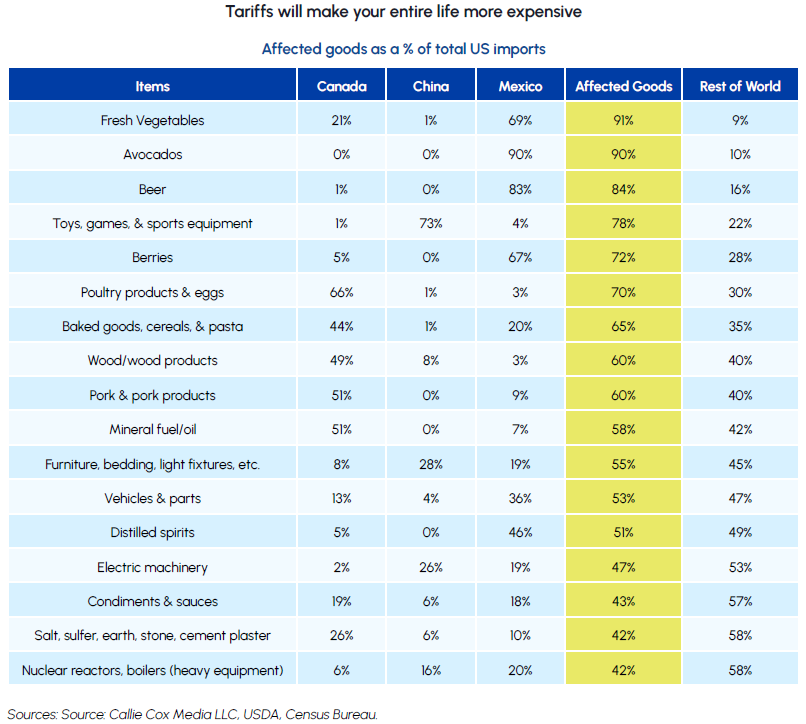

President Trump announced 25% tariffs on imports from Canada and Mexico on January 30th, only to delay them four days later by 30 days. As we have previously stated, tariffs on goods from the United States’ top two trading partners would have detrimental impacts on U.S. consumers and are primarily being used as a negotiating tactic. That said, tariff risks are likely to persist over the coming months and are to be monitored closely. Despite the uncertainty, Trump’s objectives have become clearer in recent days which creates a path to resolution. Canada’s $1.3 billion border plan, which involves 10,000 border personnel, investments in drones and helicopters, and the appointment of a Fentanyl Czar, appear to have placated Trump’s concerns over the border for now.

Unlike the border issue, which can be addressed quickly and relatively inexpensively, USCMA renegotiations represent a much larger and more complex issue to resolve. The official deadline for the trade pact to be joint reviewed is July 1st 2026, but it has become apparent that President Trump wishes to accelerate that timeline. Having an elected Prime Minister represents a necessary condition for substantive negotiations to take place between Canada and its North American trading partners and could act as a catalyst for tariff issues to be resolved. Based on public statements from the leaders of various political parties in Canada, we believe there is a high likelihood that a Federal election will be called in Q2 of this year.

The U.S.-Canada tariff dispute has prompted Canadian businesses to expand relationships beyond North America to reduce their reliance on the United States. These efforts are moving quickly, giving us optimism for the long-term trade prospects for the Canadian economy. For example, Canada announced a new free trade agreement with Ecuador, marking Canada’s 16th such deal under its eight-year diversification strategy. Canada is also negotiating with ASEAN’s 10-member bloc while leveraging existing agreements like CETA and the trans-Pacific trade pact. There is also a growing consensus for Canada to streamline regulations and reduce interprovincial trade barriers domestically. We expect this trend to continue and are focusing on companies and industries best positioned to benefit from these initiatives.

While we do not expect headline noise to subside any time soon, we are encouraged by the fundamental backdrop underpinning the stock market. The U.S. economy has shifted from a rapid post-pandemic rebound to a more sustainable growth phase, with key indicators such as employment, business investment, and consumer spending stabilizing at healthy levels. Corporate cost restructuring and AI-driven efficiency gains are also propelling earnings growth despite a moderating labour market. While geopolitical tensions and policy risks persist, the fundamental backdrop remains supportive of equities.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

The Canadian real estate sector generated a total return of 0.4% in January. Notwithstanding the positive return, REITs lagged the TSX by 3% and remain at historically low valuations. Macro events (i.e., tariffs) have overshadowed positive fundamentals in the sector, highlighted by 5-6% AFFO/share growth over each of the next two years. Canadian REITs offer an attractive mix of earnings growth and multiple expansion potential and are positioned to outperform as macro risks subside.

U.S. REITs fared much better this month, generating a total return of 4.1% and outperforming the S&P 500 return of 2.8%. The world’s largest REIT, Prologis, was a big contributor to this performance with a return of 12.9% in January. On its earnings call, management provided a bullish outlook on the U.S. industrial real estate market which helped boost sentiment in the sector. The company estimates net absorption will increase 20% in 2025 and for new supply deliveries to fall by 35%. Prologis signed more than 60 million square feet of leases during the quarter, setting a company record, and reported a 17% increase in its leasing pipeline compared to last year. Prologis represents a core position in our real estate funds and we believe the stock has further upside as operating conditions improve.

The ability to high-grade portfolios during market downturns is a huge advantage in real estate. Primaris and Chartwell, both long time core holdings, were active on this front in January, opportunistically acquiring newer properties and disposing of older assets. Primaris announced a series of transactions which represent the company’s most impactful acquisitions to date. These include the acquisition of a 50% interest in Southgate Centre in Edmonton and a 100% interest in Oshawa Centre for $585 million and the disposition of non-core assets in Guelph and Sherwood Park for proceeds of $139 million. Primaris has increased its exposure to malls generating over $100 million in sales from 40% two years ago to more than 60% today. Chartwell announced the acquisition of Les Quartiers in Montreal for $136 million – a recently built asset offering a continuum of care for its tenants. The fully-occupied property has significant mark-to-market rent potential in addition to margin expansion opportunities. We view both transactions favourably as they reflect cost-of-capital advantages and a willingness to invest in long-term growth opportunities.

We also believe the current disconnect between REIT fundamentals and trading prices are extremely pronounced. The negative implications of lower Canadian immigration and prospective tariffs are more than priced into Canadian REIT prices. As a result, the sector is currently trading at an average +/-25% discount to NAV and any potential M&A activity, further reduction in longer-dated government bond yields or positive news on tariffs would be catalysts for a significant re-rating. Moreover, any pick-up in foreign investor buying activity, which some market participants claim has already begun, will be sure to support REIT prices higher.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

Healthcare hit the ground running in 2025 with the S&P 500 healthcare sector generating a total return of 6.8% in January. Following two consecutive years of underperformance, healthcare is trading near a historically wide valuation discount relative to the broader market despite offering market-leading EPS growth. We believe there is great potential for continued multiple expansion across the sector and see an abundance of opportunities for additional upside.

In 2025, mergers and acquisitions are poised to be a significant catalyst in healthcare, following a year of subdued activity in which no deals exceeded the $5 billion mark. The resurgence of M&A activity in the early part of 2025 has already set an encouraging tone for the year. Noteworthy transactions include Johnson & Johnson’s purchase of Intra-Cellular for $14.6 billion, Stryker’s acquisition of Inari for $4.9 billion, Eli Lilly’s acquisition of Scorpion Therapeutics for up to $2.5 billion, and GSK’s acquisition of IDRx Inc. for up to $1.15 billion. A substantial focus has been placed on the oncology space, reflecting the sector’s strategic priorities. This renewed M&A momentum is expected to reinvigorate investor interest, potentially driving higher valuations as companies are acquired at premiums to their trading prices. With exposure to diverse biopharma and MedTech firms, we are well-positioned to capitalize on this trend, as several of our holdings may emerge as acquirers of innovative pipeline assets or attractive M&A targets.

The Life Sciences industry stands to be a major beneficiary of advancements in artificial intelligence. The joint venture Stargate is set to invest up to $500 billion over the next four years in new data centers, providing critical infrastructure for AI-driven innovations. During the Stargate announcement, Larry Ellison and Sam Altman emphasized AI’s transformative role in healthcare with the potential to revolutionize cancer detection and treatment, precision vaccine development and the development of therapeutics at an unprecedented rate. AI is already demonstrating its value in radiology and diagnostics, with further opportunities emerging in drug discovery, where it can enhance efficiency and targeting capabilities. As AI continues to evolve, the Life Sciences sector is well-positioned to capitalize on its profound impact.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

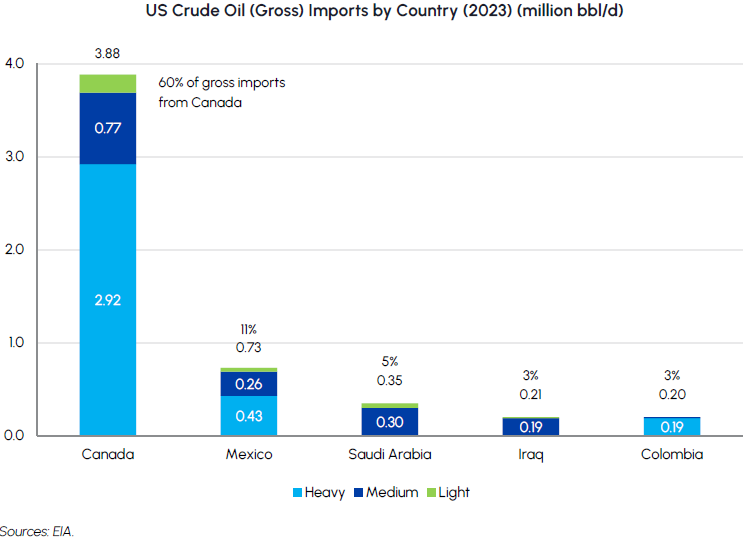

Canadian pipeline companies such as Enbridge (ENB), TC Energy (TRP), and Pembina (PPL) are insulated from potential tariffs on oil and gas exports due to their long-term, take-or-pay contracts that minimize direct commodity price exposure. These contracts ensure pipeline operators receive stable revenues resulting in predictable cash flows regardless of fluctuations in oil and gas prices, even if energy producers experience reduced margins from the potential 10% U.S. tariff.

Beyond their robust business models, ENB and TRP boast strong fundamentals and continue to focus on enhancing shareholder returns, strengthening balance sheets, and executing disciplined capital allocation strategies. Both companies have been reducing debt, optimizing assets, and expanding their infrastructure footprint across North America. Their vast pipeline networks, spanning both Canada and the U.S., serve as critical infrastructure for North American energy security. Meanwhile, U.S. refiners remain highly dependent on Canadian heavy crude, which has limited substitutes in the U.S. market. Cutting off or taxing this supply would raise costs for U.S. refiners and disrupt the stable flow of energy inputs that underpin domestic fuel production.

While the U.S. remains Canada’s largest energy export market, new export channels are opening to further diversify Canada’s customer base. The TMX Pipeline provides direct access to global markets, particularly Asia, reducing reliance on U.S. buyers. Similarly, LNG Canada will enable Canadian natural gas producers to export to Asia and Europe, tapping into high-demand regions that need secure, long-term energy supply.

Recent tariff threats serve as a wake-up call for Canada to reduce its reliance on the U.S. and develop a more self-sufficient energy sector. Inter-provincial trade barriers and regulatory challenges have hindered domestic energy trade for decades, forcing Canadian producers to rely heavily on U.S. markets. We envision the growing consensus that Canada must reduce trade barriers between provinces, expand infrastructure, and streamline regulations will be a major campaign issue in the upcoming Federal election. We are already seeing tangible signs of progress on this front with the B.C. government expediting approvals for 18 natural resource projects worth $20 billion in early February. We are optimistic that such developments signal the start of a shift toward a more investment-friendly approach to Canadian energy and infrastructure projects at home.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

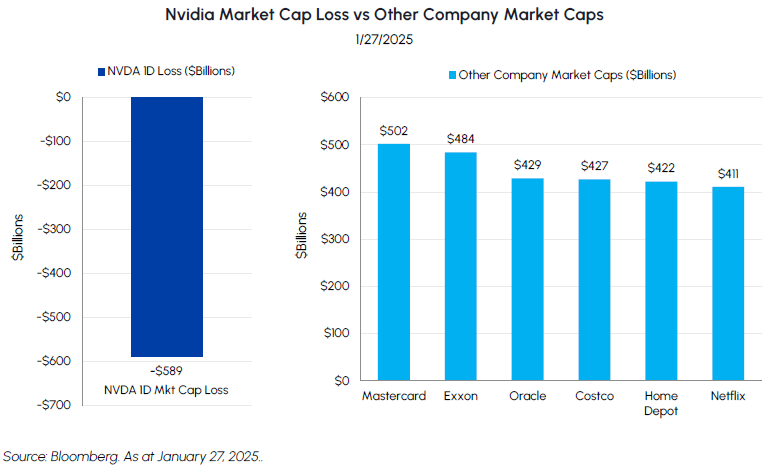

AI infrastructure stocks were whipsawed this month following a series of headlines that highlight how quickly the AI industry is evolving. The $500 billion Stargate Project, led by OpenAI, SoftBank and Oracle, aims to build the world’s largest AI infrastructure, reinforcing U.S. leadership in AI while massively increasing power demand. AI infrastructure stocks rallied on the announcement of the project, only to be pulled back down by DeepSeek’s R1 launch just days later. DeepSeek’s R1 release, which demonstrated innovative techniques to optimize AI efficiency, stoked fears that lower AI model costs could hurt demand for semiconductor chips. NVIDIA lost $600 billion in market cap in one day – the largest single-day market capitalization loss in history.

We view the recent downturn in AI stocks as a massive overreaction, a sentiment reinforced by the recent earnings reports from Microsoft (MSFT), Meta (META), and Alphabet (GOOGL). These tech giants have not only highlighted the relentless AI arms race but have also signaled their unwavering commitment through massive upgrades to their Capital Expenditure estimates for 2025. This surge in investment underscores the accelerating demand and long-term potential of AI, solidifying our confidence in our AI stock holdings across the semiconductor, software and hardware industries.

While DeepSeek’s recent advancements showcase clever optimizations in AI efficiency, framing them as fundamentally disruptive is premature. These techniques, while innovative in their approach to efficiency, are not entirely novel and will undoubtedly be rapidly absorbed and refined by mega-cap technology companies with their vast resources and engineering prowess. As AI delivery becomes increasingly cost-effective, the companies with established, expansive distribution channels – think cloud platforms like Azure, AWS, and GCP, ubiquitous app stores, and dominant operating systems like Windows and Android – are unequivocally poised to capture the lion’s share of the burgeoning AI market.

Building upon the undeniable advantage of these dominant distribution networks, the benefits of cheaper AI extend far beyond the mega-cap sphere to encompass the broader consumer and business landscapes. For example, small to medium-sized businesses, previously hesitant to fully embrace AI due to perceived high costs and complexity, will find it increasingly compelling, even strategically imperative, to explore its transformative potential given the now irresistible deflationary backdrop. However, our bullish outlook extends beyond just AI-centric investments. We are also growing increasingly bullish in non-AI areas such as gaming, a sector brimming with multiple catalysts on the horizon, including next-generation consoles and “once in a decade” game releases.

The relentless race for ever-larger and more sophisticated models, spearheaded by players like OpenAI, xAI, and the mega-caps, will continue unabated, further driving demand for compute power. Furthermore, the evolution from simple text-based prompts to richer modalities like text-to-video, coupled with the anticipated rise of always-on, proactive AI agents that will navigate the internet and digital world on our behalf, promises an exponential surge in inference demand. We anticipate these agentic software systems, due to their continuous and proactive nature, may consume 100x more compute than current AI applications, thereby providing sustained and robust support for key AI semiconductor companies. Finally, we continue to assert that cybersecurity stocks are a “must own” in this evolving landscape. The rise of agentic software, designed to autonomously operate across the internet, will inevitably introduce novel and complex security concerns, further emphasizing the critical and growing importance of robust cybersecurity solutions to protect individuals and organizations in this increasingly AI-driven world.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

The price of gold closed the month above the important US$2,800/oz level for the first time ever. The threat of tariffs and ongoing policy uncertainty should continue to support gold demand as a hedge against inflation and uncertain economic growth. Further demand may also come from China given the Republic’s persistent goal of diversifying its foreign exchange reserves. Since the April 2011 peak for gold equities, gold has risen more than 80% while the GDX gold miner’s ETF is down 44% and the GDXJ junior gold miner’s index is down 73%. These conditions have created rare circumstances where gold producers such as Barrick and Newmont trade at P/E discounts to the S&P 500 and have double the dividend yield backed by strong free cash flow. We maintain a positive view on precious metals producers and expect margin expansion to drive valuations toward historic multiples. This expected outperformance of gold equities was evident in January as the S&P/TSX gold index returned 16% while the price of gold was up 6.8%.

The looming threat of tariffs is likely to be a near-term headwind for the Canadian energy sector. That said, the overall revenue impact on Canadian producers will likely be muted given a weaker Canadian dollar and the prospect of higher WTI crude prices if tariffs go into effect. Trump’s plea for producers to accelerate drilling activity is likely to face challenges as U.S. oil and gas production is principally determined by well economics, not policy. Meanwhile, China’s bold stimulus measures are expected to filter their way into the global economy and support oil demand. The Trans Mountain Expansion Project has also transformed Canada’s oil egress situation and provides Canadian producers with global market optionality beyond the United States.

The outlook for natural gas is increasingly positive with new LNG exports driving a structural improvement in demand this year. We expect gas prices will rebound in 2025 after a nearly two-year bear market. European gas prices have reached their highest levels in over a year driven by cold weather, concerns around LNG supply instability and capacity restrictions being extended in Norway. Given the international demand backdrop for LNG and the deregulatory tone from the Trump Administration, we maintain a positive view on natural gas producers and have exposure across several of our diversified equity income strategies.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.