Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

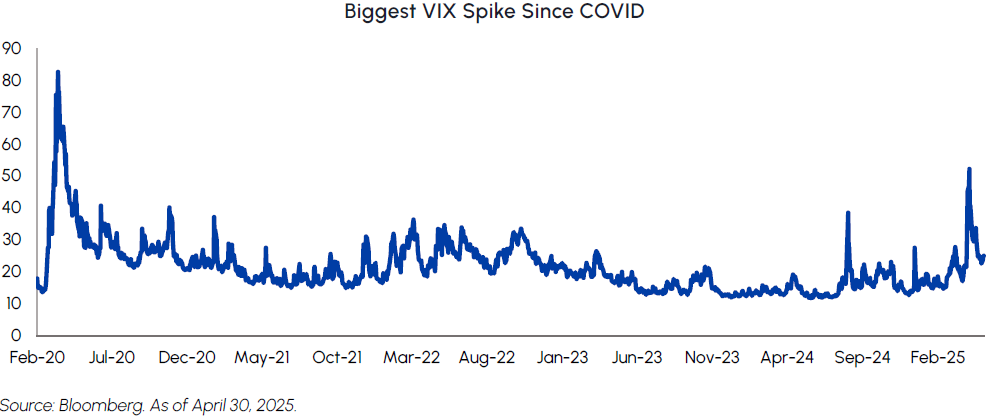

If one only checked the monthly returns of the market, April 2025 may have seemed like a relatively boring month. The S&P 500 returned -0.7%, the TSX was flat and 10-year bond yields ended the month just four basis points lower than where they started. In reality, April proved to be a historic month in many ways. The S&P 500 experienced its worst two-day loss in history on April 3 and 4, had its largest one-day gain since 2008 on April 9, and went on its longest daily winning streak in over 20 years beginning April 21. Meanwhile, the VIX Index reached its highest level since March 2020 while the U.S. dollar depreciated by more than 4%.

The tone of the market is much more sanguine than it was a month ago. The White House has sent a clear signal that it has a pain threshold when it comes to market volatility, effectively creating a Trump Put. In recent weeks, the White House has backtracked on several aggressive policy fronts by announcing a 90-day pause on reciprocal tariffs (except China), carving out exemptions for electronics and auto parts, and dialing back threats to remove Fed Chair Jerome Powell. Meanwhile, early signs of a diplomatic off-ramp with China are emerging, with Treasury Secretary Scott Bessent and U.S. trade representative Jamieson Greer scheduled to meet with their Chinese counterparts in Switzerland to de-escalate trade frictions. These moves suggest that the tariff escalation on April 2 may mark the peak of trade-related policy risk. Looking ahead, we expect the administration to continue managing sentiment by announcing preliminary trade agreements or memoranda of understanding with countries such as the U.K., India, Japan, and South Korea. While these agreements may be largely symbolic, they should nevertheless help stabilize markets and reinforce the view that the worst of the policy shock may be behind us.

Despite the headline noise, Q1 earnings have been much better than expected. Year-over-year EPS growth for Q1 of 12% is tracking well-above initial growth expectations at the start of the year. 77% of S&P 500 companies have reported positive earnings surprises, primarily driven by improved margins. Importantly, 45% of companies have provided full-year guidance, keeping in-line with the historical percentage. Of the companies that have provided guidance, an above-average share of companies have maintained their previous full-year guidance range. Although management teams are expressing uncertainty around the final impact from tariffs, most have highlighted mitigation strategies to offset costs through either higher prices or supply chain actions.

Mark Carney’s Liberal Party formed a minority government in a remarkable comeback from early polling deficits. We are optimistic that Carney can reinvigorate the Canadian economy and navigate a challenging diplomatic environment with the United States. His distinguished background as the former Governor of both the Bank of Canada and the Bank of England, in addition to leadership roles with Brookfield Asset Management and Bloomberg L.P., brings deep business acumen to the role. Carney campaigned on various pro-growth initiatives including incentives for critical mineral sectors, expedited approvals for major infrastructure projects and various tax cuts. Moreover, Carney proved his ability to be firm yet diplomatic in his first meeting with President Trump which may reflect early signs of tensions thawing between Washington and Ottawa. Overall, we expect the change in leadership to act as a catalyst for higher investment in Canadian companies from both domestic and foreign investors.

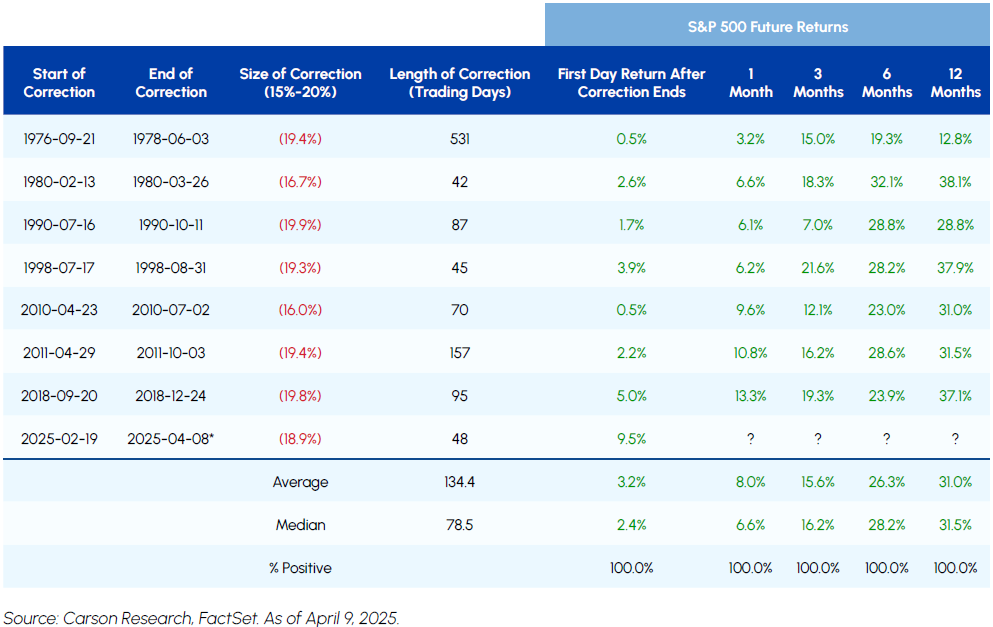

Market technicals and historical analysis paint a bullish picture for the market going forward. The recent peak-to-trough correction in the S&P 500 was -18.9% — just below bear market territory. During the other 7 instances of 15-20% corrections in the past, the Index has gone on to generate exceptional returns over the following 3, 6 and 12 months. Moreover, the recent occurrence of a Zweig Breadth Thrust, which occurs when the percentage of advancing stocks surges from below 40% to above 61.5% over a 10-day period, signals that the recent momentum is likely sustainable. Notwithstanding the elevated uncertainty stemming from the White House, we are encouraged by these technical factors that should support equities over the coming months.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

Middlefield’s REIT strategies continue to perform well in 2025, with a total return of 1.2% as of April 30, 2025, versus -0.1% for the S&P/TSX and -4.9% for the S&P 500. This reflects the contractual nature of its revenue streams and the continued imbalance between demand and supply for most commercial real estate sectors.

Retail REITs were the top-performing sub-industry in Canada this month. Choice Properties kicked off the Q1 earnings season with results that exceeded expectations. With Loblaw representing 57% of Choice’s gross rental revenue, Choice is one of the most defensive names in the Canadian REIT sector. Loblaw leases, which are long-term with annual rent escalators, are supported by leases with other high-quality necessity-based retailers and more than 20 million square feet of new and modern industrial properties. Choice reported strong leasing spreads of 10.3% within its retail portfolio and 16.6% within its industrial portfolio this quarter. We value the stability and consistency that Choice offers in our REIT strategies and expect funds to continue flowing into the name as investors seek defensive businesses offering income and growth potential.

Industrial REITs, on the other hand, underperformed in April despite confirmation of healthy fundamentals from CBRE’s quarterly Industrial Figures Q1 2025 Report. Four million square feet of industrial space was absorbed during Q1, slightly below the 5.4 million square feet absorbed in Q4’24 which was the strongest level since 2022. On the supply side, sublet space declined for a third consecutive quarter while new construction starts continued to fall from their peak. Average asking rents held steady and are still nearly double 2019 levels, solidifying the attractive mark-to-market opportunity for landlords with upcoming lease expiries. We anticipate these dynamics will support above-average earnings growth in 2025 – the second highest growth rate in the REIT sector behind seniors housing. Even so, industrial REITs trade at a 25% discount to NAV and have underperformed the REIT sector this year. We believe tariff concerns are overshadowing the solid fundamentals in the industrial REIT space and have created an attractive opportunity to buy companies with high growth visibility at a steep discount.

A sector which continues to drive superior earnings and overall returns is the senior living REITs. Our exposure to leading retirement and long-term care players in both Canada and the U.S. has been additive to performance and is supported by ongoing increases in occupancy, revenues and operating income. Due to demographics (aging population) and the inability of supply to keep up with demand, we continue to maintain a significant exposure to this part of the real estate sector.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

After significantly outperforming the broader market in Q1, healthcare lagged in April with a total return of -3.7%. As of April 30, the sector is still up 2.6%, highlighting the sector’s defensive qualities amidst market volatility.

Much of the sector’s underperformance in April stems from looming tariffs on pharmaceuticals that have been signaled by the Trump Administration. We expect an announcement to be made in the coming weeks and for pharmaceutical products to be subject to tariffs under Section 232. Importantly, we believe companies are well-positioned to manage this risk given their high gross margins (typically 70-85%) and the flexibility that is already built into their supply chains. Additionally, exemptions may be granted to companies that commit to expanding their U.S. manufacturing capacity. In recent weeks, Eli Lilly, Johnson & Johnson, Novartis, Roche, Amgen, Regeneron and Merck have collectively announced over $160 billion of investments in the United States across manufacturing and R&D while being praised for their commitments by the President.

Notwithstanding the tariff overhang, healthcare continues to serve as a defensive sector that can help mitigate portfolio volatility while still participating in market upside. Our primary focus remains on earnings visibility, which is increasingly important in an environment where certain areas of the market are vulnerable to negative earnings revisions. As we have seen throughout Q1 earnings season, companies that can meet expectations and maintain forward-looking guidance are poised to outperform. Most of our portfolio companies have reported solid quarterly results and, importantly, reaffirmed their full-year guidance after incorporating the expected impact of existing tariffs. Given the needs-based characteristics of healthcare products and services, we expect healthcare company earnings to be resilient over the next several quarters regardless of macroeconomic conditions.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

Energy infrastructure companies such as Enbridge, TC Energy, and Gibson Energy continue to demonstrate resilience amid global trade uncertainty and broader market volatility. Their business models are underpinned by long-term structural tailwinds, including rising North American energy demand, the need for reliable grid infrastructure, and global energy security priorities. With minimal exposure to commodity prices and revenues that are underpinned by long-term, take-or-pay contracts, these businesses offer stable and predictable cash flows. A Carney-led federal government could further support the sector by streamlining permitting processes, reducing regulatory friction, and accelerating infrastructure approvals—key enablers of capital investment and long-term earnings growth.

Capital Power (CPX) reported strong Q1 earnings, reflecting solid operational execution and early contributions from its recent acquisition of two U.S. natural gas-fired utilities in the PJM region. The transaction strategically diversifies CPX’s earnings mix, with pro-forma EBITDA now 50% from the U.S., 40% from Alberta, and 10% from Ontario—reducing concentration risk and enhancing exposure to more stable regulatory environments. Management maintained its full-year guidance, underscoring confidence in the earnings trajectory and integration of the acquired assets. Looking ahead, key catalysts include the potential re-contracting of U.S. gas assets, growing interest from data center operators in Alberta as demand for reliable power surges, and additional M&A opportunities that align with CPX’s disciplined capital allocation strategy. Together, these factors support a clear path to long-term growth in earnings and cash flows, while maintaining balance sheet strength and an attractive 5% dividend yield.

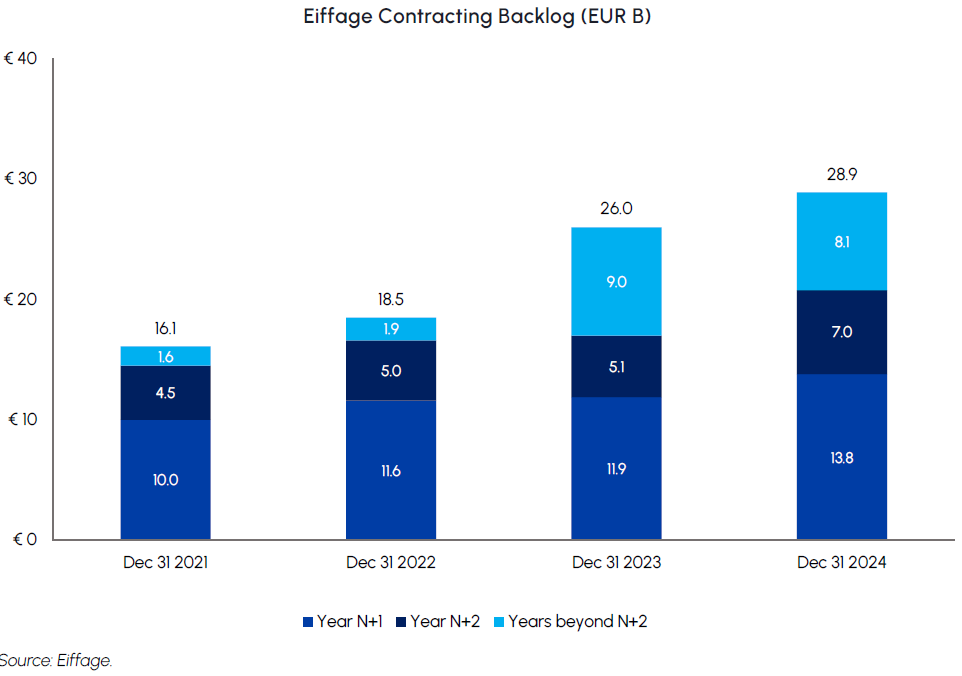

European holdings such as Eiffage continue to outperform, driven by structural tailwinds in construction, infrastructure renewal, and energy transition projects. Fiscal stimulus program targeting infrastructure modernization, renewable energy expansion, and defense capabilities are translating into strong project pipelines and improving visibility across the sector. Eiffage, with its well-diversified portfolio spanning transportation infrastructure, energy networks, and concession-based assets, is well-positioned to capitalize on this supportive environment. Its strong fundamentals, consistent execution, and exposure to multi-decade investment trends make it a leading name in the European infrastructure landscape.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

The technology sector has performed extremely well throughout the Q1 earnings season. Based on reports from 41 of the 69 companies in S&P 500 Tech Index, the sector achieved impressive sales growth of 8.4%, more than double the 3.7% seen for the S&P 500. This strong top-line performance translated into even more substantial bottom-line gains, with earnings growth hitting 13%, ahead of the S&P 500’s 11.7%, underscoring the sector’s continued earnings power.

Microsoft and major cloud providers have reinforced confidence in the AI investment landscape with strong results and compelling commentary. Microsoft showcased robust Azure expansion, largely fueled by escalating demand for its AI services, and reiterated its commitment to aggressive AI-related capital expenditures. Similarly, Amazon’s AWS highlighted sustained, strong uptake of its compute resources for AI model training and inference, alongside new AI service rollouts. Google pointed to Google Cloud’s growth propelled by AI workloads and enterprise adoption of its Gemini models, while Meta’s earnings call emphasized its unwavering, substantial investments in AI infrastructure to power its family of apps and future ambitions. These re-affirmed massive spending plans and strong demand signals from key players have helped to dispel concerns regarding any near-term slowdown in the AI build-out.

On a company-specific note, we identified a compelling entry point for Take-Two Interactive following the revised timeline for Grand Theft Auto VI. While the shift to a May 26, 2026 release (from the initial window of Fall 2025) initially caused some market disappointment, we interpret the company’s commitment to a specific release date as a positive development that firms up expectations and likely reduces the probability of further significant delays. More critically, we believe current street estimates for both the game’s average selling price and initial launch-window unit sales are extremely conservative. As anticipation builds and marketing intensifies as we move toward the release date, we anticipate upward revisions to these forecasts, which should serve as a significant positive catalyst for the stock.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

The Liberal platform presents a mixed outlook for Canada’s resource sector. On the positive side, the proposed “Major Federal Project Office” aims to streamline environmental assessments by reducing duplication across federal and provincial levels, which should accelerate mining approvals. The government also plans to support critical mineral development through infrastructure investments such as the First and Last Mile Fund to better integrate these projects into supply chains. That said, the oil and gas industry still encounters regulatory headwinds given the Liberals plan to maintain environmental commitments for fossil fuels, including preserving the industrial carbon tax, enforcing emissions caps, and continuing to restrict pipeline development in certain regions. On balance, the election outcome should yield a more positive environment than the previous government but does not deliver some incentives that were being offered by the Conservatives.

Gold markets were unusually volatile in April, trading in a wide US$525/oz range despite hitting multiple all-time highs. This volatility, the highest since 2020, coincided with broader equity market swings driven by tariff uncertainty and political instability in the U.S. Ultimately, gold prices rose 5.3% in April and investors have taken notice. According to CIBC, mining has accounted for approximately 40% of Canadian new issuances year-to-date. Strong performance from the precious metals sector comprising ~11% of the TSX Composite has resulted in underweight generalist investors adding exposure.

Oil prices declined sharply in April on growing concerns for weakening demand and increasing supply. Global supply is expected to rise by ~700,00 b/d by year-end due to OPEC+ accelerating its tapering schedule. Some interpret this policy shift as a short-term deal with the U.S. to dampen inflation, while others have concluded it was a strategic move designed to punish non-compliant members. Regardless of what is motivating the Saudi’s, producers will likely have to contend with weaker oil prices over the medium-term.

Natural gas sentiment also weakened in April due to lower weather-driven demand during the shoulder season. Despite the near-term disruption, our long-term view on natural gas pricing remains constructive. Supply growth remains constrained, with less associated gas delivered from the Permian amid lower oil volume growth in the region. On the demand side, hyper-scalers have confirmed plans to maintain elevated spending on A.I. capex while a major step-change in LNG demand looms in the near term. If production doesn’t increase meaningfully, prices will need to rise to balance the market. We believe this sets the stage for a constructive natural gas price recovery later in the year.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.