Index

Infrastructure is comprised of a broad set of investment opportunities, each with unique characteristics. It falls under the category of real assets – physical assets that have that have intrinsic value due to their substance and properties. Specifically, infrastructure represents the physical structures and facilities needed for the operation of an enterprise or society. Although infrastructure assets vary in purpose, they are intended to last decades or even centuries and share certain characteristics that make them coveted by investors. Cash flows are typically underpinned by long-term contracts, giving them a high degree of visibility and consistency. The counterparties to these contracts are often governments or large private entities with large pools of capital.

Due to a confluence of factors, the concept of sustainable investing has become a top priority for infrastructure investors. Support from governments, corporations and consumers has culminated in a sustainability movement that continues to gain momentum. Energy transition, carbon neutrality and the circular economy aim to reduce the environmental and social impacts of today’s actions and form the foundation of this movement. Nations accounting for almost 90% of global GDP have announced net zero goals. This has resulted in billions of dollars being channeled towards infrastructure projects that aim to achieve decarbonization targets. These investments are improving existing technologies and forging new industries, creating a dynamic new category within the infrastructure sector.

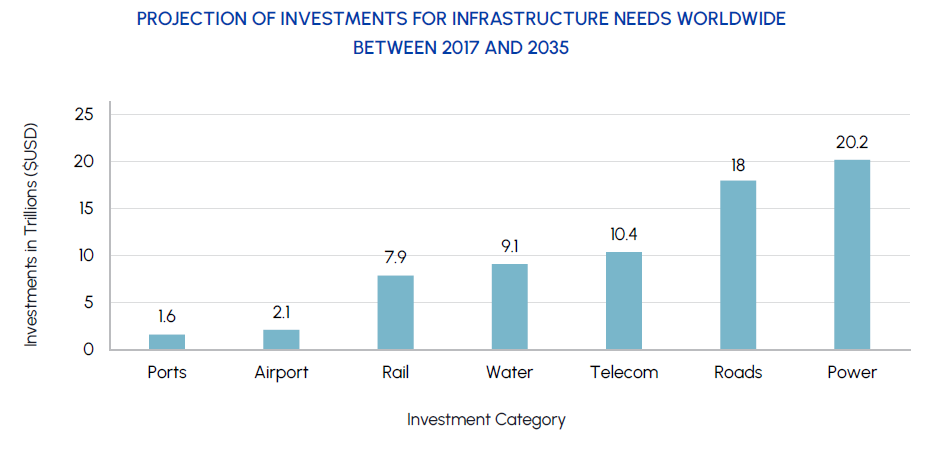

Institutional investors have been investing in infrastructure for decades. While direct ownership of infrastructure assets remains concentrated in the hands of large, sophisticated investors, individuals can access sustainable infrastructure by investing in publicly-traded companies that own, operate, or supply the physical assets that power modern society. It is estimated that $3.6 trillion dollars needs to be spent on global infrastructure annually, with over $2 trillion to come from power, water and data infrastructure. These massive investments will unlock a wealth of opportunities for public market investors over the coming years.

|

|

Sustainable Infrastructure Sub-Sectors

Core Infrastructure

Regulated Utilities

- What is it? Companies that provide essential services such as electricity, heat and water

- What drives demand: Urbanization trends and a growing middle class

- Outlook: Steady and consistent earnings growth underpinned by regulated rate bases and grid modernization investments

Energy Infrastructure

- What is it? The physical systems and facilities necessary for the production, processing, and distribution of energy

- What impacts demand: Energy security and growing demand for LNG

- Outlook: Robust capital spending environment to produce and deliver energy in a more sustainable and efficient manner

Renewable Power Producers

- What is it? Companies that generate electricity from renewable energy sources such as solar, wind and hydro

- What impacts demand? Power prices and decarbonization initiatives

- Outlook: Continued innovation and investment will solidify renewables’ position as cheap and reliable sources of electricity

Water

- What is it? Companies that deliver safe and reliable water supplies

- What impacts demand: Population growth, agriculture, industrialization and electricity demand

- Outlook: Innovation being driven by smart water companies that promote efficiency and sustainable water management

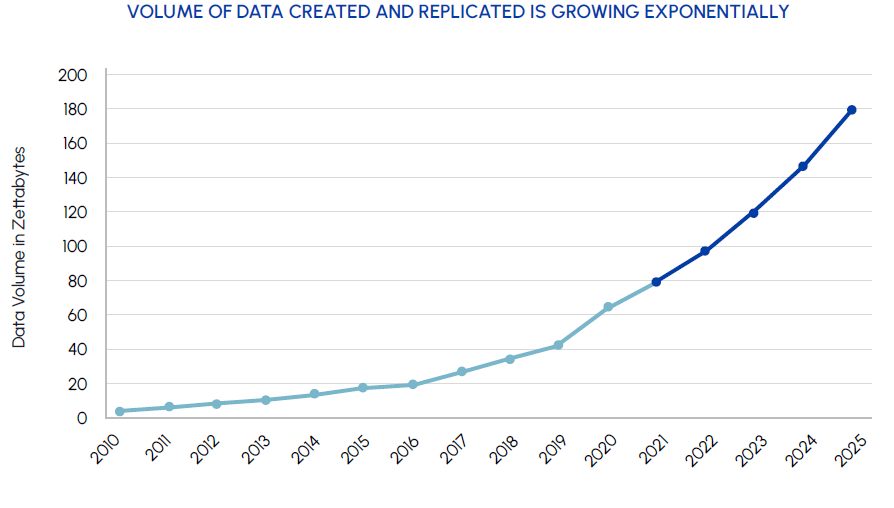

Data Infrastructure

- What is it? Communications towers that host mobile network equipment and data centers that process and manage data

- What impacts demand: Increased reliance on digital technologies

- Outlook: Secular growth tailwinds as larger data sets are created and the adoption of A.I. accelerates

Emerging Technologies & Industries

Batteries / Storage

- What is it? Systems designed to store and release large amounts of electricity to the grid when needed

- What impacts demand: Technology advancements driving scalability

- Outlook: More investments in critical technologies that help address one of the biggest challenges facing renewable energy – intermittency

Hydrogen

- What is it? The world’s most abundant component that can be used to replace fossil fuels in a variety of applications

- What impacts demand: Technology advancements + falling costs of electricity generated from renewables

- Outlook: Hydrogen is increasingly being recognized as a key element of the energy transition

Carbon Capture & Storage

- What is it? Technologies and processes that sequester CO2 emissions

- What impacts demand: Ambitious decarbonization targets from emission-intensive sectors such as utilities, transportation and manufacturing

- Outlook: Significant potential for reducing greenhouse gas emissions from existing energy production and industrial processes

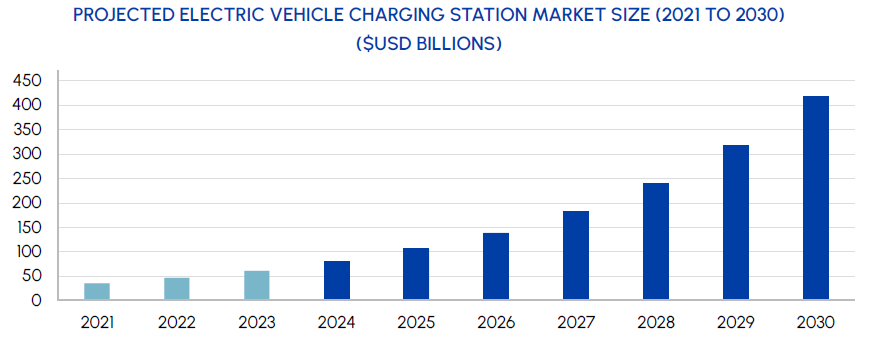

Electric Vehicles & Charging

- What is it? Vehicles that are powered by electricity rather than gasoline or diesel

- What impacts demand: Advancements in battery technology together with social awareness of climate change and government subsidies

- Outlook: Widespread adoption of EVs requires significant investments in charging infrastructure to support their long-term feasibility

Grid Modernization

- What is it? Processes and technologies that make the electric grid more efficient, reliable, secure and resilient

- What impacts demand: Necessary investments in upgrading existing infrastructure and integrating new technologies

- Outlook: Essential for ensuring that the electric grid can meet the changing needs of consumers in a rapidly evolving energy landscape

Decarbonization

Trends Impacting Sustainable Infrastructure

- The world is rapidly increasing its use of electricity as a primary energy source which requires modernization of the electric grid

- Electricity demand is projected to triple by 2050

- The IEA projects EV sales will account for 60% of new car sales by 2030 to meet net zero targets

- EVs have already achieved more than 50% market share in new car sales in certain countries such as Norway and Iceland

- Natural gas and nuclear energy have become widely accepted as important bridge fuels in the energy transition, particular as a replacement for coal

- Global LNG demand is projected to grow by 76% by 2040 and nuclear capacity is expected to grow by 43% by 2050

|

|

Regulation & Policy

- Balancing the amount of greenhouse gases emitted with the amount removed from the atmosphere is essential for mitigating climate change

- The world’s biggest polluters, including China, the United States and the European Union, have set net zero targets

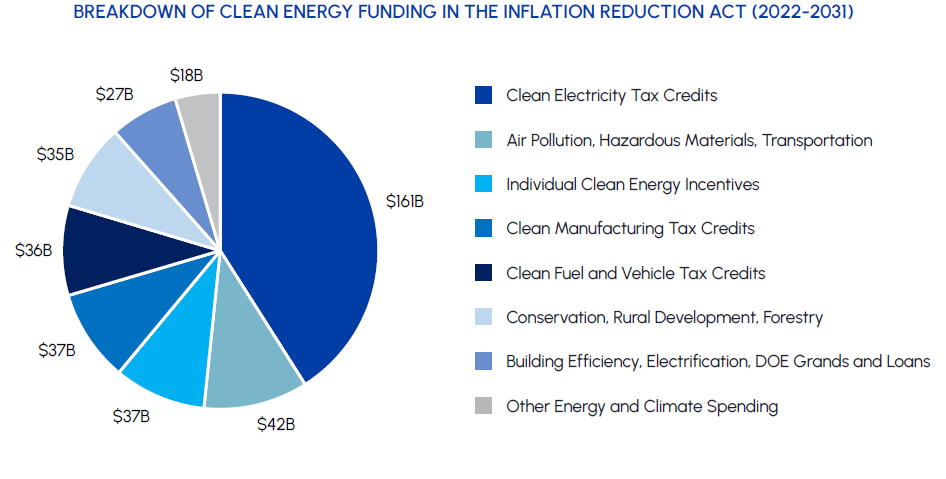

- The largest climate action investment in U.S. history – $370 billion of green infrastructure investments by 2032

- Includes 20 new or modified tax incentives and tens of billions of dollars in grant / loan programs for new clean energy technologies

- Enshrines into law a 55% reduction of greenhouse gas emissions by 2030 and making Europe climate-neutral by 2050

- Multiple funding mechanisms in place totaling over €1 trillion

|

|

Demographics

- Millennials are big consumers of digital technologies and have surpassed baby boomers to become the largest generation in the U.S.

- Data being generated, processed and stored is growing exponentially

- Cities must design and grow their infrastructure in a sustainable way

- It is expected that more than two thirds, or close to 7 billion people, will live in urban areas by 2050

- Household incomes and energy consumption are strongly correlated

- By 2030, another 700 million people are expected to join the global middle class, making it more than half of the world’s total population

|

|

Sustainable Infrastructure: Advantages

Contracted Income

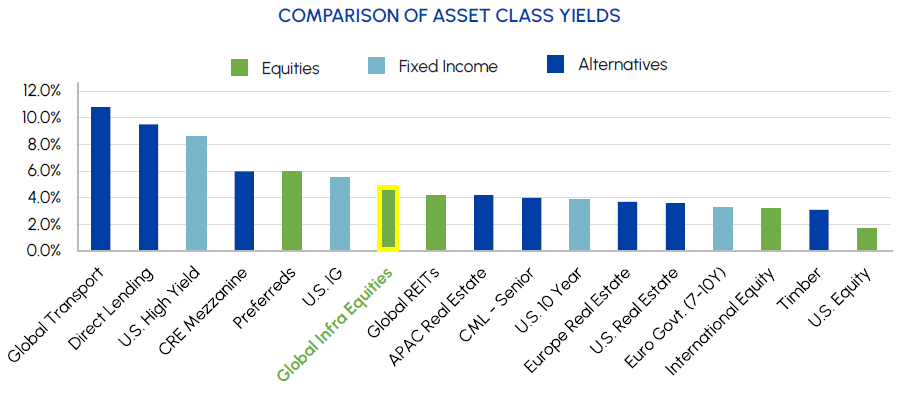

Sustainable infrastructure assets have long operational lives. Their revenues are typically guaranteed by long-term contracts that provide high cash flow visibility, even under challenging economic conditions. For example, Power Purchase Agreements (PPAs) are commonly used to underwrite renewable power projects. Under a PPA, the power producer agrees to sell electricity to the power purchaser at an agreed-upon price for a specified period, often spanning 10 to 20 years. PPAs provide certainty for both parties over the life of a project which can also help secure financing for the project. Take-or-pay contracts are another commonly used structure for energy infrastructure assets which require one party to either accept delivery of a specified quantity of goods or services or to pay a pre-specified amount of money if they do not take delivery. Contracts de-risk future cash flow streams for investors and support attractive dividend yields for sustainable infrastructure companies. Dividend income generated from infrastructure companies tends to be higher than the dividends received from other equities as a result.

|

|

Inflation Hedge

Investing in sustainable infrastructure can serve as a useful hedge against inflation. PPAs are often structured to include inflation-linked provisions to reduce the impacts of higher prices. Moreover, continued technological advancement and improved economies of scale are leading to lower costs of electricity. For example, solar technologies have yielded 85% price declines over the past decade while the cost of both onshore and offshore wind have fallen by more than 45%. The swift drop in the cost of utility-scale solar and wind power products have made them the cheapest sources of power in two-thirds of the world. Lower input costs, together with contracted revenues, reduce the impacts of inflation and protect the profitability of these assets.

|

ESG Credentials

Sustainable infrastructure and emerging clean technologies are inherently ESG friendly as they minimize negative environmental impacts, promote social welfare and adhere to high standards of governance. The common goals that renewable power and/or grid hardening projects aim to achieve are to reduce emissions, conserve natural resources and promote efficiency. From a social lens, infrastructure that improves access to clean water, sanitation, public transportation and access to the internet are also proven to have meaningful impacts on social welfare. Modern day infrastructure projects are also held to high ethical and regulatory standards, with unprecedented levels of transparency, accountability and public disclosure.

For further information about how Middlefield reflects ESG in its investment selection and strategies, please visit ESG Policy | Middlefield Group or review the respective fund’s regulatory documents at: Fund Documents | Middlefield Group.

Access to a High-Barrier Asset Class

Direct ownership of sustainable infrastructure is expensive and complicated. Large-scale projects can cost hundreds of millions of dollars and require specialized capabilities to navigate engineering, approvals, procurement, maintenance, etc. As a result, these assets are often concentrated in the hands of large, institutional investors with technical expertise. Luckily, investors can still gain exposure to the asset class by investing in publicly-listed companies that either own and operate a portfolio of sustainable infrastructure assets or those that are involved in the supply chain. These opportunities can be found across multiple sectors with most coming from Utilities, Industrials, Energy and Real Estate.

Diversification

Infrastructure has a low correlation with other traditional asset classes, making it a valuable source of portfolio diversification. Unlike traditional equities, which are more directly impacted by short-term market fluctuations, its cash flows are often regulated or contracted. This means that megatrends, including decarbonization, urbanization and electrification, are the key drivers of value for infrastructure investments.

Middlefield’s Sustainable Infrastructure Solutions

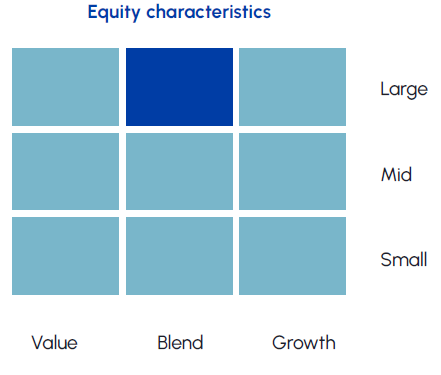

Middlefield’s sustainable infrastructure strategies are designed for investors seeking income and growth from a portfolio of large-cap companies diversified across the global real estate sector. Middlefield’s history of investing in infrastructure dates back to the 1990’s and we have been managing dedicated infrastructure strategies for 10 years. Our solutions provide Canadian investors with global exposure to an asset class that has attractive defensive and inflation-protection attributes.

| Strategy | Fund Structure | Ticker/Fund Code | Investment Focus | Risk Rating |

|---|---|---|---|---|

| Middlefield Sustainable Infrastructure Dividend ETF | ETF | MINF | Global Sustainable Infrastructure | Medium |

| Middlefield International Clean Power Dividend Fund | Closed-end Fund | Renewables & Clean Technologies | N/A | |

| Middlefield Global Infrastructure Fund* | Mutual Fund | Diversified Global Infrastructure |

Medium | |

| * Please note that the Middlefield Global Infrastructure Fund is not classified as a sustainable fund. | ||||

Distributions

All Middlefield sustainable infrastructure funds provide investors with attractive levels of monthly distributions.

Holdings

Middlefield’s sustainable infrastructure strategies are actively managed portfolios holding approximately 30 to 45 names. We prefer long-life, in-demand infrastructure assets that sustainably provide essential services to society.

Disclaimer

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and ETF investments. Please read the prospectus and publicly filed documents before investing. Mutual funds and ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell shares of an investment fund on the Toronto Stock Exchange or alternative Canadian trading platform (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedar.com. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements in this document may be viewed as forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, intentions, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “plans”, “estimates” or “intends” (or negative or grammatical variations thereof), or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements including as a result of changes in the general economic and political environment, changes in applicable legislation, and the performance of each fund. There are no assurances the funds can fulfill such forward-looking statements and the funds do not undertake any obligation to update such statements. Such forward-looking statements are only predictions; actual events or results may differ materially as a result of risks facing one or more of the funds, many of which are beyond the control of the funds.