Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Markets continued their ascent in August and have faced very little resistance since early April. The S&P 500 has completed its best five-month run since the post-pandemic rebound and is enjoying its longest stretch without a 3% pullback in nearly two years. At the same time, valuations have broadened beyond the Mag7, with small and mid-cap companies starting to participate more meaningfully in the rally. Historically, surges of this magnitude have often marked the beginning of durable bull markets.

Deal activity has accelerated against this backdrop, underscoring renewed corporate confidence. Since June, $1.1 trillion in M&A has been announced in the U.S., including nearly $300 billion in August alone – the busiest summer since 2021. In Canada, we have seen several high-profile transactions involving our portfolio companies, including Guardian Capital, MEG Energy and Dream Residential REIT. These deals highlight the return of strategic buyers in Canada and are expected to assist in driving performance in our funds going forward. This surge in M&A not only validates undervalued assets but also serves as a healthy catalyst for capital recycling and future market performance.

Since the weak jobs report in early August, investors have been betting that the Federal Reserve will cut short-term rates at its upcoming September 17 meeting. Fed Chair Jerome Powell reinforced this assertion by striking a more dovish tone at the Jackson Hole Symposium by noting “the balance of risks could warrant an adjustment in the Fed’s stance.” Markets rallied strongly on the prospect of a Fed Put, though Powell has been clear that upcoming inflation and labor market data will guide policy decisions. Opposing forces between the Fed’s dual mandates suggest policy uncertainty may not abate any time soon. Payroll growth has slowed sharply, averaging just 35,000 per month over the past three months compared with 168,000 per month in 2024. Meanwhile, core PCE inflation is still running close to 3% with services inflation proving sticky.

Tariff uncertainty is not making matters easier for the Fed or investors. A recent ruling from the U.S. Court of Appeals upheld a previous decision from the Court of International Trade (CIT) invalidating Trump’s IEEPA tariffs. For now, there is no immediate impact, as the tariffs remain in place under a temporary stay until October 14, setting up a Supreme Court showdown. If SCOTUS ultimately upholds the ruling and eliminates the IEEPA tariffs, it will deal a significant blow to the Trump administration’s tariff agenda given the majority were issued under IEEPA. That said, the White House is unlikely to abandon its aggressive trade agenda, and efforts are already underway to shift tariff authority toward national security statutes including Section 232 of the Trade Expansion Act. While eliminating tariffs would be positive for margins, earnings and inflation, the more likely outcome is a period of renewed trade uncertainty as companies contend with shifting tariff structures and the prospect of prolonged Section 232 reviews. On the revenue side, White House officials have suggested tariffs could generate several hundred billion dollars annually, with some estimates exceeding $500 billion. Bond vigilantes immediately reacted to the news, selling Treasuries on the prospect of reduced tariff revenues and the weaker fiscal backdrop it implies. However higher yields were quickly reversed as August job numbers suggested the employment landscape is rapidly inflecting in a negative direction resulting in a continued shift in dovish Fed expectations.

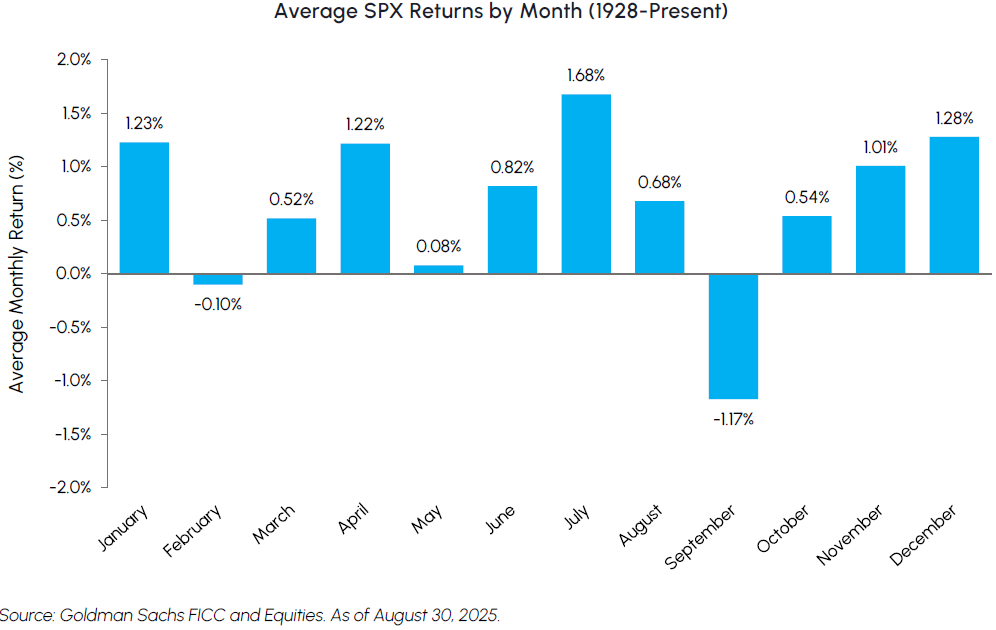

Seasonality poses another challenge for investors to contend with in the near term. September has historically been the weakest month of the year for equities, with the S&P 500 posting an average decline of -1.17% since 1928. This vulnerability is compounded by stretched valuations and unusually high market concentration. As a result, we would not be surprised if the recent market rally takes a breather into Autumn. If a pullback does materialize, we think it will be short-lived and present a buying opportunity given past bouts of September weakness have often set the stage for year-end recoveries. With monetary policy expected to turn more supportive, earnings momentum broadening, and corporate deal-making picking up, markets may be well positioned to weather seasonal headwinds and push higher into year-end.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

REITs delivered another strong month of performance, generating total returns of 3.8% in Canada and 2.2% in the U.S. Results from the Q2 earnings season were broadly solid, with 90% of Canadian REITs reporting results that were in-line or above expectations. This strength has started to attract more investor attention, with our real estate funds now up more than 10% year-to-date. Even so, we continue to see significant runway for further outperformance as fundamentals remain supportive and valuations compelling.

The recent wave of consolidation in the Canadian REIT sector continued this month with another multi-family trust being acquired. Dream Residential REIT (“DRR”) announced that it will be purchased by Morgan Properties, one of the largest private multi-family real estate owners in the United States, at a price of $10.80 per unit. The transaction values DRR nearly 20% above the previous day’s closing price and 60% higher than where it traded in February, before takeover speculation emerged. According to public filings, Middlefield is the third-largest owner of DRR, holding the position across our core real estate funds as well as in Income Plus. Over the past year, we have consistently encouraged DRR’s management team and other stakeholders to evaluate strategic alternatives, including a potential sale. It is gratifying to see this outcome come to fruition, as it validates the constructive feedback we provided and ultimately unlocks significant value for unitholders. Beyond the direct impact to DRR investors, this development is a broader positive for Canadian REITs. M&A activity not only establishes higher valuation benchmarks, it also facilitates the recycling of capital into other listed REITs, providing healthy support for unit prices across the sector.

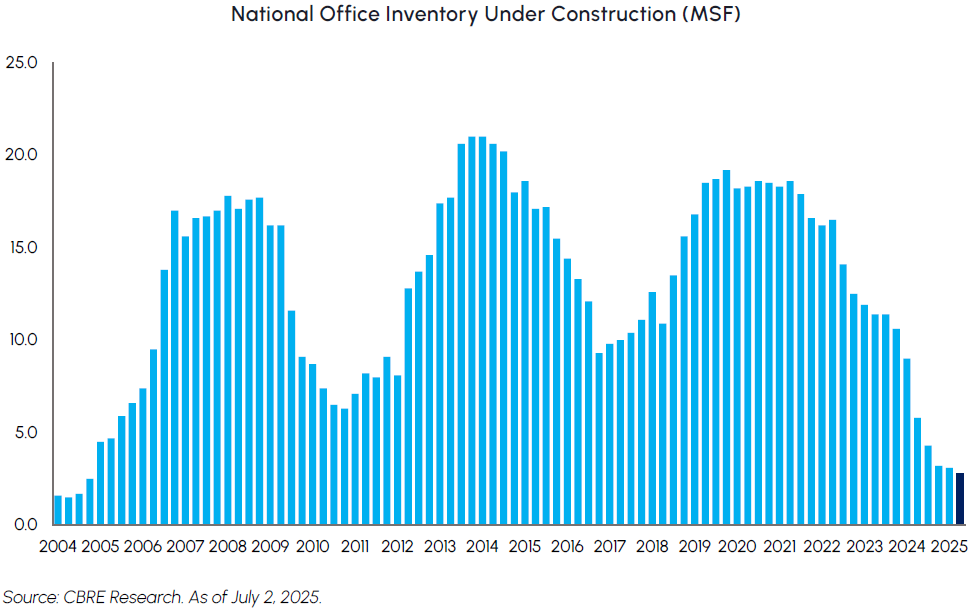

After remaining cautious on the sector for an extended period, we have recently begun to selectively add exposure to office REITs. While we acknowledge that risks remain, we believe office vacancy rates have likely bottomed and are positioned to gradually improve, creating a constructive backdrop for the sector. This shift comes at a time when many companies and governments are mandating employees return to the office, a trend that should support demand for office space. Moreover, construction of new office buildings has reached twenty-year lows with no new office projects commencing in over a year. At current valuations, we are finally seeing a compelling risk/reward setup for this asset class.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

Healthcare stocks staged a strong rebound in August, returning 5.4%. After a difficult stretch earlier this year (April–July), investors are re-visiting the sector which remains deeply undervalued, trading at its widest discount to the S&P 500 in 30 years. While most other sectors brace for seasonality headwinds, healthcare is entering a period of relative strength. Since 1990, healthcare has been the top-performing S&P 500 sector from September through November, outperforming the market by an average of 1.4%. We see ample room for further outperformance in the months ahead.

It was reported on August 14 that Warren Buffett’s Berkshire Hathaway had purchased a stake of five million shares in UNH last quarter, valued at $1.6 billion. Berkshire joins a list of notable hedge fund managers, including Michael Burry and David Tepper, that have been adding to positions in the name. Meanwhile, Eli Lilly has seen sizeable insider buying from its CEO, CSO and multiple Board members recently, signaling confidence in the company’s long-term prospects. These investments have helped draw attention to both industry-leaders where we hold positions and maintain our long-term conviction.

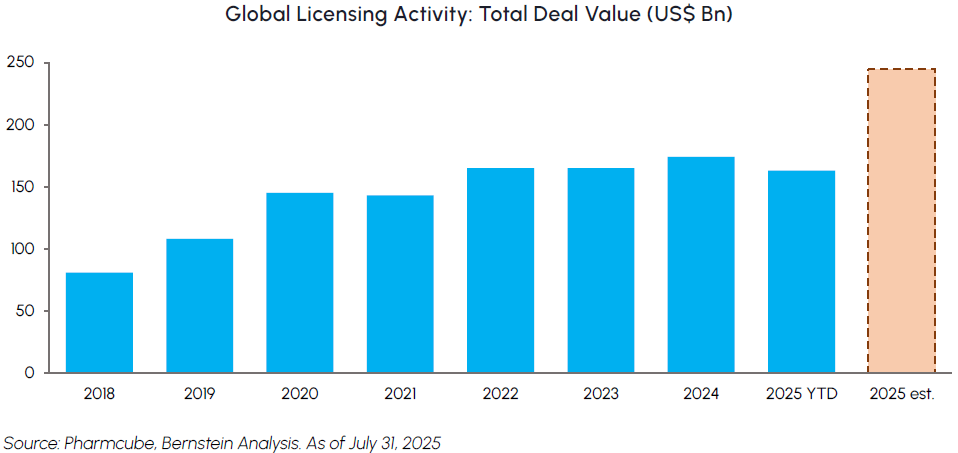

We have been adding to our biotechnology exposure recently where we see compelling opportunities. Large pharma companies are approaching the steepest patent cliff in history, with hundreds of billions of dollars in revenues losing exclusivity by the end of the decade. While strong R&D pipelines will help offset some of this pressure, they will not be sufficient on their own. As a result, business development and M&A will play a critical role in filling the gap. We have already seen a surge in deal activity this year, particularly through licensing agreements and partnerships, which allow acquirers to pay less up-front and more later if drugs succeed in the clinic. We expect this M&A theme to remain a dominant driver of the biopharma space for years to come, and view SMID-cap biotech companies as well-positioned beneficiaries as large-cap acquirers increasingly turn to them for innovation. Our healthcare funds have initiated new positions in several biotech companies recently and are overweight the industry relative to the benchmark.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

Canada’s role as a leading global energy supplier gained renewed momentum this month when Prime Minister Carney and the Natural Resources Minister traveled to Europe to advance LNG export discussions. Meetings in Germany highlighted European buyers’ eagerness to secure long-term partnerships, with Canadian LNG offering clear advantages — a low-cost production base, shorter shipping routes to both Europe and Asia, and one of the cleanest carbon profiles in the world. German officials emphasized that natural gas demand will remain materially higher for longer than previously anticipated, driven by energy security concerns and surging electricity requirements tied to industrialization and AI adoption. Against this backdrop, Canada is positioning itself as a global supplier of choice for nations seeking reliable, low-carbon fuels while broadening its trade channels beyond the U.S.

Domestically, momentum is ramping up to ensure this opportunity translates into accelerated infrastructure development. Canada’s newly established Major Projects Office in Calgary will act as a central hub to streamline approvals, coordinate stakeholders, and fast-track nation-building initiatives. Alberta’s Premier has endorsed the move as Canada prepares for several major projects through 2030 and beyond, including LNG terminals, pipelines, power generation assets, and critical minerals infrastructure. Tens of billions of dollars will be invested over the next five years across Canadian utilities and pipeline companies. Enbridge (ENB) has a $32 billion secured capital backlog, targeting 5% annual growth in EBITDA, EPS, and its dividend through 2030. The alignment of global demand, supportive domestic policy, and major investment signals a multi-year runway for growth, cash flow generation, and re-rating potential across Canadian energy and infrastructure assets.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

Nvidia remains the undisputed winner of the AI build-out, a fact reinforced by its latest quarterly results. Data Center revenue surged to $41 billion (56% year-over-year increase) driven by insatiable demand for its Blackwell platform. The company affirmed this powerful growth trajectory while forecasting minimal sales contribution from China for the second half of the year, underscoring the immense strength of demand from the U.S. and other global regions. While Nvidia’s own valuation remains reasonable given its growth, pockets of the AI semiconductor and hardware ecosystem have become expensive. As a result, we are taking a contrarian stance by selectively increasing our software exposure. Here, we favor infrastructure players but are also adding to innovative companies that can benefit from AI-accelerated new product development. We also continue to like cybersecurity, which we view as a defensive necessity, as the proliferation of AI tools also creates more sophisticated and widespread security threats.

While our broad enthusiasm for Technology is unchanged, its fundamental strength is clear, with the sector forecast to deliver the highest year-over-year earnings growth in the S&P 500 for Q3’25 at an estimated +20%; more than double the +7.5% expected for the broader index. Beyond pure-play tech, we are finding attractive, tech-adjacent opportunities in other sectors. We are looking at global leaders in Communications and Consumer Discretionary that are directly exposed to durable themes like digital entertainment (videogames and music), cloud computing, and e-commerce. This allows us to diversify our sources of growth while maintaining exposure to powerful, long-term secular trends that transcend traditional sector definitions.

One company we believe is turning the corner is Chinese e-commerce giant Alibaba. The company recently reported solid results, with its Cloud Intelligence Group being a key highlight, with revenue growing 26% to exceed ¥33 billion. As geopolitical lines are drawn in technology, it has become a strategic imperative for China to cultivate a domestic cloud champion, and we believe Alibaba is the clear leader positioned to capture this massive opportunity. That said, the company is investing heavily to compete in its core e-commerce business and to fund the growth of its cloud and AI ambitions. While these necessary investments may weigh on profitability in the near term, they are crucial for securing its long-term competitive position.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

Gold surged to a record $3,448/oz heading into the Labour Day weekend, its first new high since June. The metal has more than doubled over the past three years, rising 35% in 2025 alone — its best performance since 1979. The S&P/TSX Gold Index has soared 85% this year, its strongest since 1993, as miners finally caught up to bullion’s move with record margins and cash flow. For perspective, gold is up 2.2x since September 2022, compared with a 2.7x rally from 2008–2011 and nearly 4x from 2001–2008. The latest leg higher followed the Jackson Hole Symposium, where expectations for U.S. rate cuts and concerns over Fed independence boosted demand for precious metals. Central banks now hold more gold than U.S. Treasuries for the first time in almost 30 years, reflecting sanctions risk, debt concerns, and a drive for diversification.

Gold has also reshaped Canada’s currency dynamics. Once tied closely to oil, the loonie is increasingly driven by gold exports, which generated a record $44 billion trade surplus in the past year. National Bank economists argue this helped the Canadian dollar absorb recent economic shocks. In August, gold equities outperformed sharply — the S&P/TSX Gold Index gained 20.7% versus a 4.8% rise in bullion and broad market declines.

On energy, the Trump–Putin Anchorage meeting delivered little substance, though Trump imposed a new 25% tariff on Indian imports in response to continued purchases of Russian crude. India, which sources roughly one-third of its oil from Russia, has shown no signs of scaling back. With OPEC’s production ramp slower than expected and global demand resilient, crude has held up better than typical seasonal patterns.

Natural gas has struggled, with NYMEX prices down ~35% this summer on cooler weather and export outages. Still, production discipline and stable rig counts support the longer-term outlook, with LNG and power demand expected to drive growth. North American markets could turn undersupplied in 2026 as LNG export capacity nearly doubles through the decade. While near-term headwinds persist, structural demand growth underpins a constructive medium-term view. In August, the S&P/TSX Capped Energy Index gained 1.9% despite oil and gas prices falling 7.6% and 3.5%, respectively.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.