Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

The market rally continued in May following a de-escalation of tariffs between the U.S. and China. The S&P 500 generated a total return of 6.3%, its best monthly return since November 2023 and the best month of May since 1997. The TSX Composite Index was close behind with a total return of 5.6% which resulted in the Index reaching new all-time highs.

Investors were not the only ones feeling better in May. U.S. consumer confidence registered its largest monthly gain in four years, fueled by easing trade tensions. The Conference Board’s index jumped 12.3 points to 98, with widespread increases spanning age, income, and political groups. Consumers expressed greater confidence in future business conditions, job prospects, and income expectations, leading to more plans to purchase cars, homes, and take vacations. The resilience of the U.S. consumer has been a key driver of corporate earnings since the pandemic, making this month’s reversal of a recent downtrend a very encouraging signal.

The trade narrative has improved significantly since April, validating our previous views that Liberation Day marked peak tariff concerns. The 90-day détente between the U.S. and China and the Court of International Trade’s (CIT) ruling on IEEPA tariffs represented pivotal catalysts for investors to turn more bullish. That said, tariff drama is far from over and is likely to persist over the coming months. The White House has already appealed the CIT’s ruling (an appeals court temporarily reinstated the tariffs while it considers the case) and Trump could also ramp utilization of Section 232 sector tariffs. In addition, the initial suspension of widespread reciprocal tariffs only has another month before it expires and no official trade deals have been signed to date. Overall, we have become more comfortable with tariff risks but are also expecting incremental tariff headlines over the coming weeks.

Treasury yields are back in the spotlight as bond vigilantes reflect ongoing concerns with the fiscal position of the United States. U.S. 10-year yields briefly exceeded 4.6% in May before settling back at 4.4% to close the month. The CBO expects Trump’s Big Beautiful Bill (BBB), which passed in the House by just one vote, to add $2.4 trillion to the deficit over the next decade. The Bill is now being reviewed in the Senate where significant amendments are likely. The Senate must strike a balance between demonstrating fiscal responsibility—by reducing deficits and controlling spending—and preserving essential social programs that millions of Americans rely on. We are monitoring the situation closely as we feel a spike in Treasury yields likely represents the biggest risk to the market at this juncture.

Despite tariffs on steel, aluminum and autos, Canadian equities have outperformed the U.S. in 2025. The TSX Composite has returned over 7% year-to-date, beating the S&P 500 return of 1.1% by a significant margin. The Canadian dollar has also appreciated 4.5% relative to the greenback despite recent weakness in oil prices. Markets appear to be reflecting a more sanguine outlook for the Canadian economy, which is also showing up in hard data. GDP growth in Q1 was better-than-expected at 2.2% while the early read on April data exceeded expectations. In addition, investors were frontrunning the upcoming catalyst for economic reform in Canada which was recently announced through legislation to remove federal barriers to internal trade, define and fast-track certain “nation-building” projects, and relax rules on where skilled workers can operate. The goal is to pass the ‘One Canadian Economy Act’ through the House of Commons and Senate before the summer break.

A deal may also be coming between Canada and the U.S. on steel and aluminum tariffs, which were recently increased from 25% to 50%. Rather than announcing countermeasures, Prime Minister Carney said his government would take some time to respond because they “are in intensive discussions right now with the Americans on the trading relationship.” We are optimistic a deal could be struck before the upcoming G7 meeting which would provide a further boost to sentiment for Canadian equities.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

The real estate sector delivered strong performance this month with a total return of 4.4%. Year-to-date, our REIT funds have returned approximately 7%, tracking closely with the sector benchmark and are currently rated 5 stars by Morningstar across every time frame since inception. Despite this recent strength, we continue to see compelling value in the space. Real estate remains steeply discounted relative to historical valuations, even as sector fundamentals—particularly occupancy, rent growth, and balance sheet health—remain sound.

Residential REITs were the top-performing sub-industry this month, posting a total return of 9.5%. The key catalyst was the announcement that InterRent REIT will be acquired by CLV Group and GIC at a proposed price of $13.55 per unit, implying a $2 billion equity value. The offer represents a 35% premium to InterRent’s share price before take-out rumours surfaced in March and a 29% premium to its 90-day VWAP. The agreement includes a 40-day go-shop period, and there remains a possibility of a competing bid or a sweetened offer from CLV/GIC. Regardless of the outcome, the transaction underscores the embedded value in the sector, especially since the buyer is a joint venture between InterRent’s Executive Chairman/Founder who has intimate knowledge of the company’s operations and GIC, a sovereign wealth fund from Singapore who is one of the world’s leading private real estate investors. As such, this announcement validates our view that publicly-listed apartments are trading significantly below their true intrinsic values and M&A activity will help support a re-rating in the apartment sector specifically and in Canadian REITs generally.

Senior housing was another area of strength, advancing 8.4% in May. We recently met with management teams of Chartwell and Extendicare, and both confirmed that industry fundamentals are as strong as we’ve ever seen. A long-term shortage of seniors housing supply—across both public and private channels—continues to drive high occupancy and consistent rental rate growth. We believe this supply-demand imbalance will support robust earnings and asset values in the years ahead.

After 355 years in operation, Hudson’s Bay (HBC) officially closed its doors on June 1. While this will result in vacant space in the near term, it also presents a significant long-term opportunity for landlords. Much of the space had been underutilized for years, contributing limited rent growth and foot traffic. Re-leasing and re-merchandising these locations provides an opportunity to enhance the overall tenant mix, improve the customer experience, and drive incremental value for both the landlords and adjacent retailers. In addition, retail fundamentals are stronger today than they have been in years, offering a supportive backdrop for this transition. RioCan has the most exposure to HBC properties and has lagged its retail peers by approximately 10% since the HBC’s bankruptcy filing. Given the quality and diversity of RioCan’s remaining portfolio and the long-term opportunity presented by the HBC transition, we think the stock offers excellent value at its current 17% discount to NAV.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

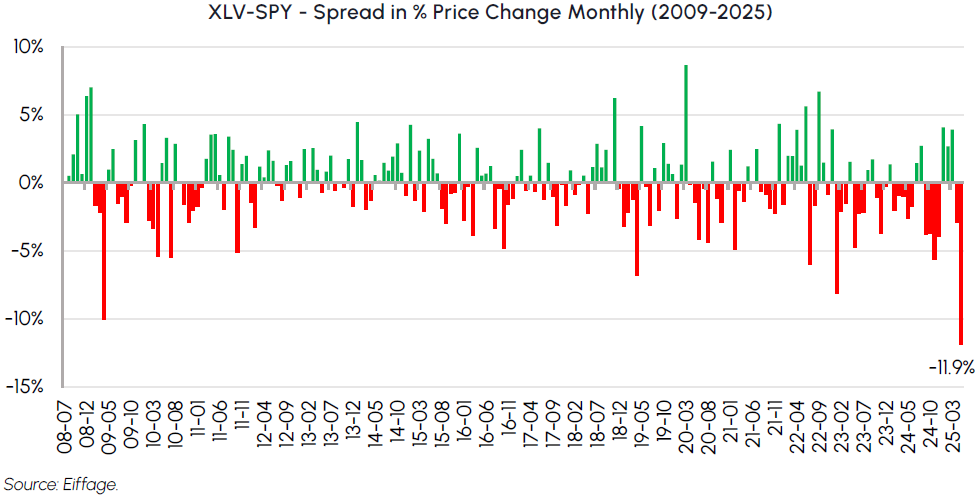

It was a difficult month for healthcare investors. Policy uncertainty and idiosyncratic setbacks within the sector (e.g. UnitedHealth) led to the widest monthly underperformance since 2009. While some investors have moved to the sidelines, we see a rare opportunity to buy quality healthcare stocks at a significant valuation discount. As of May 30, the healthcare sector was trading at a 5.5x P/E discount to the S&P 500 compared to its historical premium multiple.

UnitedHealthcare (UNH) has lost ~$300 billion in market capitalization and was a major contributor to the magnitude of the sector’s underperformance in May. In a surprise announcement on May 13, the company suspended its 2025 guidance and replaced its CEO, Andrew Witty, with the company’s Chair and former CEO, Steve Hemsley. Steve was instrumental in building UNH into an industry-leader during his previous tenure as CEO between 2006 to 2017 and has intimate knowledge of the company’s operations. We view the management shake-up positively, but do not anticipate a quick fix to UNH’s issues. The company is seeing higher reimbursement costs across multiple business lines in what appears to be an uncharacteristic mispricing of risk. Further, the company continues to deal with public criticism since its claims denials and coding practices have been in greater focus since the assassination of Brian Thompson. The company is expected to reinstate guidance at the end of July, which provides an opportunity to reset expectations and lay out a recovery plan. Despite facing myriads of headwinds, UNH continues to benefit from significant competitive advantages stemming from its scale and vertically integrated model, which includes the largest Medicare Advantage membership base, the third-largest pharmacy benefit manager, the largest physician network, and the leading externally monetized payer-focused data analytics platform. Additionally, the stock is trading at 12x forward EPS (on revised consensus estimates), well below its 10-year average of approximately 17x.

Pharma stocks were another source of weakness this month with the S&P 500 pharma industry falling 9%. Looming pharma tariffs and an executive order for companies to adopt most-favoured nation (MFN) pricing have impacted sentiment. Despite the constant flow of headlines, we believe both proposals are either 1) unlikely to come to fruition or 2) will have a minimal impact on earnings and fundamentals. The MFN executive order lacks a clear legal pathway to implementation and would require action from Congress to cause substantial changes. Trump’s first attempt at price indexing during his first term failed for similar reasons, making the recent announcement appear more symbolic in nature. Meanwhile, pharma tariffs have taken a backseat to MFN but are still a lingering topic we expect an update on soon. While it is difficult to assess impacts without more information, we note that pharma companies have very high gross margins (70-85% on average) and could offset higher costs via streamlining R&D or SG&A. Moreover, pharma companies have significant flexibility built-in to their supply chains already and could reconfigure existing footprints to mitigate tariffs.

Our actively managed healthcare funds have mitigated volatility this year by underweighting the most politically sensitive sectors, including biopharma and health insurers. We are becoming more constructive on these segments and think they are pricing in worst-case outcomes. Valuation discounts to the broader market are consistent with past periods of policy uncertainty which have consistently proven to be excellent buying opportunities. The fundamentals in the healthcare sector remain attractive, underpinned by long-term trends such as innovation, aging demographics and inelastic demand.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

Prime Minister Mark Carney and Canada’s provincial premiers recently announced plans to fast-track “nation-building” infrastructure projects by introducing legislation that would cap approval timelines to two years. Projects under consideration include new oil pipelines and transmission corridors—including a possible Western and Arctic energy corridor—which Carney emphasized would need to demonstrate clear national interest and the potential for Indigenous partnerships. This signals renewed momentum for large-scale infrastructure investment that aims to boost national resilience, diversify Canada’s market access, and unify the country through economic development.

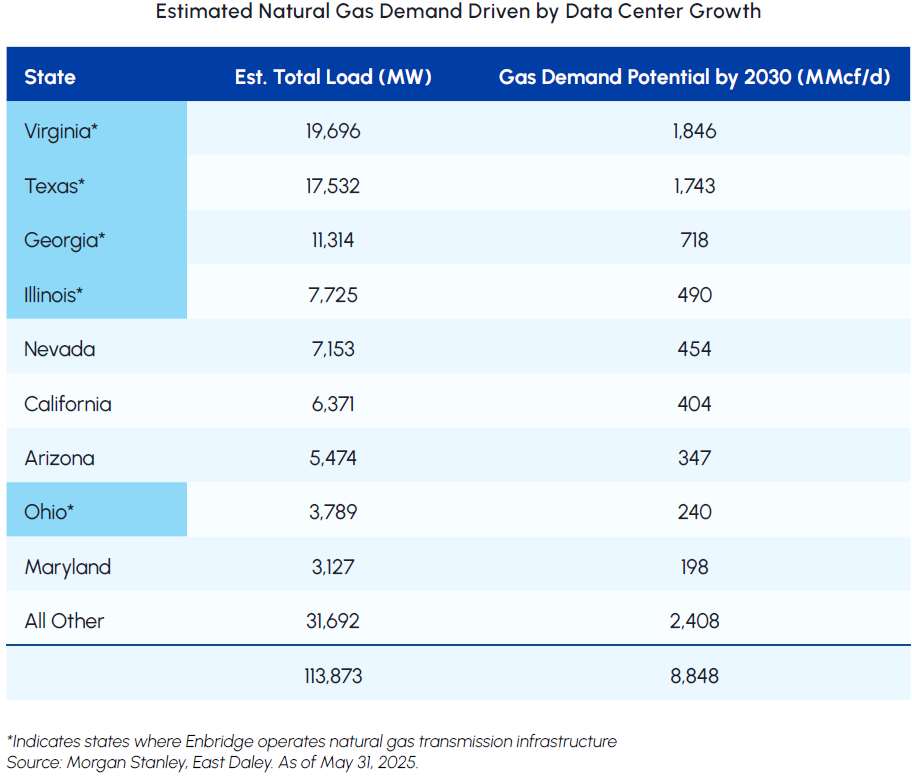

As North America’s largest energy infrastructure company, Enbridge (ENB) is well-positioned to benefit from this trend. Its vast pipeline network spans both Canada and the U.S., with significant exposure to natural gas transmission in key U.S. states. ENB stands to be a clear beneficiary of the growing bipartisan movement toward deregulation and expedited permitting for critical infrastructure projects on both sides of the border. Enbridge’s Line 5 pipeline, which has faced political hurdles from Michigan regulators over environmental concerns, received a boost after a favorable assessment by the U.S. Army Corps of Engineers. This review supports the advancement of the Line 5 tunnel project, reducing regulatory uncertainty and setting the stage for new infrastructure builds. Beyond regulatory tailwinds, Enbridge is strategically aligned with a major structural demand shift—surging natural gas needs from hyperscale data centers. These facilities require reliable, continuous energy and are being concentrated in several U.S. states where Enbridge already operates. This growing demand vertical reinforces Enbridge’s strong long-term fundamentals. The table below highlights U.S. states with the largest potential electricity load growth driven by data centers and indicates where Enbridge has existing natural gas transmission infrastructure, further supporting the company’s opportunity-rich outlook.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

The long-term durability of the Artificial Intelligence investment theme continues to strengthen, now extending significantly beyond initial cloud-led adoption. A pivotal new multi-year demand driver is the emergence of “Sovereign AI,” with nations, particularly in the Middle East, making substantial commitments to develop their own AI infrastructure using US technology. This global strategic race for AI leadership ensures sustained demand for specialized silicon and data center capacity, reinforcing the longevity of this transformative cycle.

Concurrently, AI’s mainstream proliferation is accelerating dramatically. The user base for generative AI tools, such as OpenAI, has surged into the hundreds of millions, fueled by rapid advancements beyond text-to-text capabilities to sophisticated text-to-image and now text-to-video models. This expansion into richer media generation is creating an exponential surge in demand for AI inference—the computational power to run these models at scale—which will define the next phase of AI infrastructure build-out.

Beyond the pure AI narrative, we identify a compelling investment opportunity in Sony (SONY). This entertainment behemoth has successfully transitioned from consumer electronics to focus on the highly attractive video game and music industries. PlayStation 5 leads the current console generation, with robust growth in online services, while Sony Music is a global top-three record company. Sony’s Gaming & Network Services division, its crown jewel, now sees two-thirds of its revenue from higher-margin software and services and is set to benefit from major releases like GTA VI through its 30% digital sales rake. The Music business promises durable high-single-digit growth, capturing value as streaming prices rise. Furthermore, Sony’s world-leading image sensor business has upside from AI-enhanced smartphones and automotive applications. Continued business simplification, such as the planned Financial Services spin-off, will further highlight these premier assets, likely unlocking a higher valuation multiple. We project Sony can achieve ~225 JPY in FY’27 EPS; a 21x multiple suggests a price target of 4,725 JPY, representing roughly 25% upside.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

The price of gold exhibited material price swings this month. Sentiment from a U.S.-China trade truce dampened demand for haven assets, offset by Moody’s downgrade of the U.S. credit rating. April data showed China imported the highest amount of gold in nearly a year despite record prices, representing a 73% jump from March. We feel continued central bank buying resulting from diversification away from dollar-denominated assets will remain supportive of prices.

A Trump executive order directing renewed nuclear energy development has revitalized the uranium market. Uranium spot prices have rebounded 11% from their lows in March while uranium producers were up significantly the past month. Nuclear expansions remain robust, led by China, while AI led demand remains a structural tailwind. Utilities have also re-engaged this year, purchasing more than 75% of what they procured during all of 2024.

Strathcona Resources had a busy month. After selling its’ Montney liquids-rich gas assets for $2.8 billion across three deals, they subsequently launched a rare $5.9 billion hostile offer for heavy oil producer MEG Energy. We view the offer of just over $23 per share (under a 10% premium) as opportunistic and too low as we view MEG’s assets to be superior to Strathcona’s. In addition, the $3.7 billion in tax pools are more valuable to acquirers with less tax pools than Strathcona. It is possible that additional offers may surface, including potential white knights: Cenovus, CNQ, Suncor and Imperial Oil.

Since the federal election, the spotlight has re-emerged on the current & proposed LNG projects off Canada’s west coast. Over the next 5 years these projects would represent over 6 Bcf/d of export capacity if all were to go ahead – material relative to Canada’s production of approximately 19 Bcf/d today. While AECO natural gas price is currently experiencing softness, there is an expectation that further egress out of the basin (LNG Canada) will drive a significant price improvement. As such, approximately 10% of current Canadian production is expected to shift west once LNG Canada is at full capacity. We maintain our high conviction on the medium to long-term outlook for Canadian gas companies.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.