Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Markets extended their winning streak in July with major indices reaching fresh highs. Tech stocks led to the upside once again with the NASDAQ returning 3.7%. The S&P 500 returned 2.2%, slightly outperforming the TSX Composite return of 1.7% and the MSCI World Index return of 1.3%.

U.S. trade policy has been unpredictable in recent months with various Trump-imposed deadlines expiring, being extended or removed altogether. This has created a challenging environment to navigate and caused heightened uncertainty. Nevertheless, the market has continued to climb, driven by strong corporate earnings that consistently exceed expectations. Of the 435 S&P 500 companies that have reported earnings thus far, 81% have surpassed expectations with an average beat of 8.5%. On a year-over-year basis, Q2 earnings have grown by 11.7%. As we noted at the start of the year, valuations leave limited room for multiple expansion, making returns dependent on earnings growth. Midway through the year, that thesis appears to be holding true, with solid earnings performance largely unaffected by tariffs and trade uncertainty. Forward-looking earnings expectations remain constructive, and we believe the current cycle of margin expansion and top-line stability can extend further — particularly among high-quality businesses with pricing power and disciplined capital allocation.

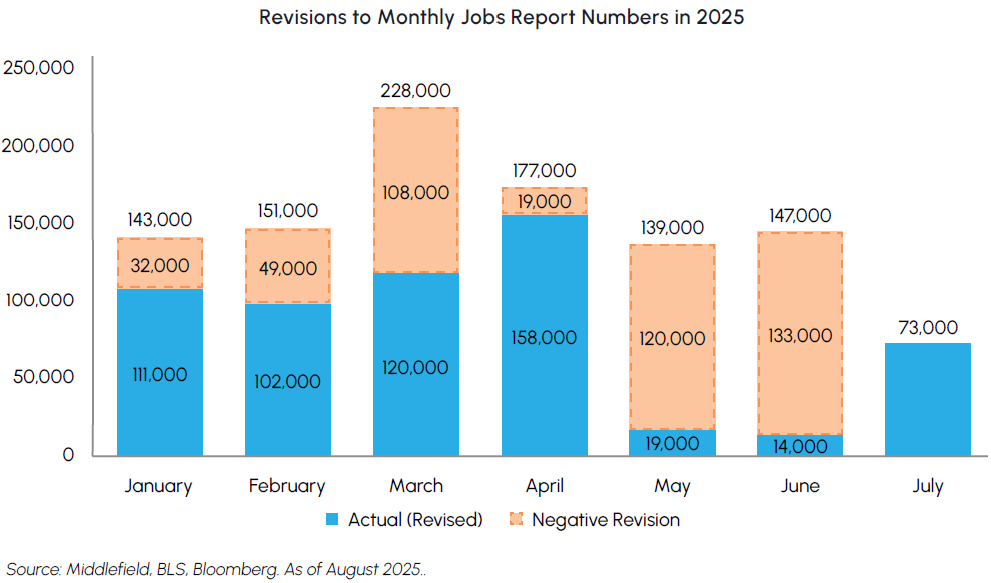

While debate around future monetary policy is always prevalent, the past several months have placed this dynamic under an intense spotlight. President Trump’s ongoing criticism of Fed Chair Jerome Powell — including public threats to fire him — has added a layer of uncertainty around the direction of Fed policy. At his most recent press conference, Powell defended the decision to hold rates steady, citing a strong labour market and the ongoing risk of tariff-driven inflation. Just days later, however, the Bureau of Labour Statistics released non-farm payroll data that came in well below expectations. More importantly, jobs numbers for May and June were slashed by 258,000, resulting in the largest downward revisions to job numbers since 1979 outside of COVID. While we agree with Powell’s pragmatic approach to inflation, the revised employment figures confirm the labour market is softening. As a result, we expect the Federal Reserve to lower short-term rates by at least 25 basis points at its next meeting in late September, with a 50 bps cut possible if inflation data softens or labour market weakness deepens.

Despite recent softness in the labour market, the U.S. consumer remains resilient. June retail sales rose 0.6%, rebounding sharply from May’s decline and exceeding expectations. Core retail metrics were also strong, with sales excluding autos and the GDP-related control group each increasing 0.5%, both above consensus forecasts. The broad-based strength in spending helps alleviate concerns about a pullback in consumption and suggests underlying momentum in the U.S. economy remains intact. Consumer spending remains the most important driver of company earnings, supporting our bullish outlook on continued EPS growth over the next several quarters.

The current market environment is highly supportive of Middlefield’s core strategies. Dividend-paying stocks are well-positioned to benefit from declining interest rates, as yields on fixed income alternatives become increasingly unattractive. We believe this will prompt income-oriented investors to shift capital away from short-term vehicles like GICs and back into dividend-paying equities. These companies typically have established competitive advantages that facilitate consistent growth in free cash flow. In recent weeks, we’ve seen a resurgence of the “meme stock” phenomenon that first gained traction in late 2021 — driven largely by retail enthusiasm for low-quality businesses with limited earnings power. While chasing these moves can be tempting at times, we remain firmly committed to investing in quality, established companies with strong fundamentals and a consistent record of paying and growing their dividends. While macro uncertainty persists, the combination of a resilient consumer, strong earnings outlook, and supportive capital flows reinforces our constructive view on Middlefield’s equity-income offerings.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

REITs performed well this month, generating a total return of 4.7% in Canada. We remain constructive on the sector heading into the back half of 2025. A combination of attractive valuations, persistent supply-demand imbalances, and a pickup in M&A activity has renewed investor interest in Canadian REITs. Institutional capital — including sovereign wealth funds and private equity — continues to target high-quality Canadian real estate. Despite strong performance recently, REITs are still trading at an estimated 15% discount to NAV, offering further upside as transaction volumes accelerate.

Multi-family apartment REITs have been among the strongest performers in Canada in 2025. We recently hosted investor events with the CEOs of Canadian Apartment Properties and Killam Apartment REIT, both of whom provided compelling insights that reaffirm our positive view on the sector. They highlighted strong population growth — driven by continued immigration and urbanization — as a key tailwind for rental demand, particularly in major cities where housing affordability is pushing more households toward long-term renting. On the supply side, elevated construction costs, restrictive zoning policies, and prolonged approval timelines are curbing new rental development, exacerbating the housing shortage and forcing prospective renters to double or triple-up in single units until affordability is restored. This persistent imbalance is expected to support a resurgence in rent growth and high occupancy levels for years to come. Given the sector’s defensive characteristics, resilient fundamentals, and inflation-protected cash flows, multi-family remains a core overweight within our real estate funds.

The U.S. industrial market is gaining momentum as well. Prologis reported stronger-than-expected Q2 operating results and raised its 2025 outlook, citing a growing leasing pipeline and increased tenant confidence despite ongoing macroeconomic uncertainties. The company also boosted its guidance for development starts by $750 million to a range of $2.25–$2.75 billion and signaled plans for more acquisitions than initially anticipated earlier this year. Similarly, Granite REIT, which has half its portfolio concentrated in the U.S., appears to be turning a corner after a challenging period marked by elevated vacancy rates. The company recently announced a 631,000 square foot lease signing in Shepherdsville, Kentucky and is rumoured to be nearing completion on several other U.S. property lease transactions. These catalysts, together with renewed interest from generalist investors, have supported Granite’s recent share price appreciation following a prolonged period of trading below intrinsic value.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

Healthcare experienced another challenging month in July, finishing last among the eleven S&P 500 sectors with a return of -3.3%. The recent stretch of underperformance has resulted in healthcare trading at its widest P/E multiple discount relative to the broader market in 30 years.

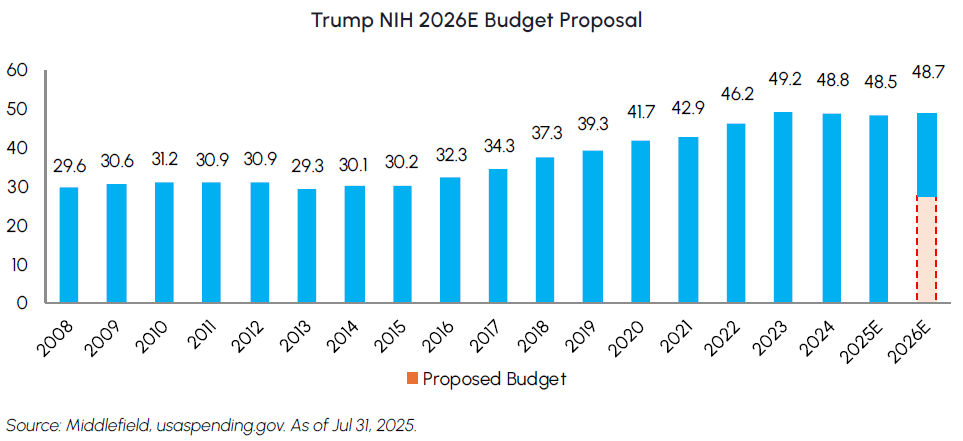

Healthcare’s recent underperformance can be attributed to two main factors: a risk-on market tone that has favoured cyclical sectors like tech and consumer discretionary over defensives, and ongoing policy uncertainty specific to healthcare. While concerns around pharma tariffs, Most-Favoured Nation (MFN) pricing, and budget cuts have weighed on sentiment, we believe the sector’s current valuation discount is not justified. Policy changes in healthcare have historically had more bark than bite, as demonstrated by the recent NIH funding outcome. After months of speculation regarding the 2026 NIH budget, the Senate Appropriations Committee overwhelmingly approved a 1% increase ($400 million), bringing total funding to $46.4 billion. This stands in sharp contrast to the Trump Administration’s earlier proposal for a 40% cut and reinforces the broad bipartisan support for scientific research and academic funding. That clarity, combined with constructive commentary from management teams at Thermo Fisher and Danaher, helped drive a 6.2% gain in Life Science Tools & Services in July.

We believe a similar setup is unfolding in pharma. President Trump recently sent letters to 17 drugmakers, demanding they extend MFN pricing to Medicaid customers within 60 days. Notably, this suggests a narrower range of outcomes when compared to the more sweeping executive order that was issued by the administration this past May demanding drug companies cut prices across the board. Medicaid is already the lowest-priced payor and accounts for a relatively small portion of industry sales — making this ask far less disruptive than it may appear. While it may take more time for this policy to settle, we believe that once clarity emerges, the sector is poised for a rapid re-rating.

We have been adding to our biopharma exposure recently by topping up existing positions as well as initiating in new names. Two companies we have initiated positions in recently are Pfizer and Alnylam Pharmaceuticals. We added Pfizer in anticipation of its Q2 results, which exceeded earnings expectations on the back of continued execution of cost management initiatives. The stock trades at a compelling valuation of less than 8x EPS, offering attractive upside as fundamentals stabilize. Our thesis for Alnylam is predicated on a new product launch for a recently approved drug, Amvuttra, which is an RNAi therapeutic that treats a rare hereditary heart condition by silencing the TTR protein responsible for disease progression. Amvuttra delivered $492M in sales, well ahead of expectations, and management raised guidance for the franchise by $563M at the midpoint — a 34% increase — reinforcing confidence in the launch trajectory and long-term opportunity.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

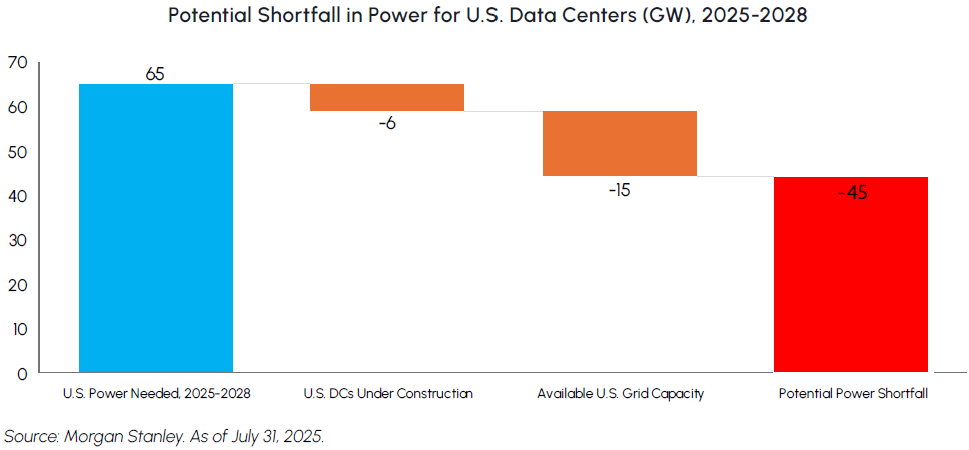

The inaugural Pennsylvania Energy and Innovation Summit showcased the growing leadership of Canadian companies in North America’s energy transition. With over $90B in major infrastructure projects announced, including from Enbridge, Brookfield, Capital Power, and TC Energy, these commitments underscore the vast resources and capabilities that Canadian firms bring to the table. Enbridge’s $1B pipeline expansion, Brookfield’s 20-year clean energy partnership with Google, and Capital Power’s $3B investment into U.S. gas infrastructure all demonstrate that Canadian companies are critical to building a more resilient North American energy grid and addressing the massive shortfall in power. These projects are expected to generate thousands of jobs and secure long-term energy supply while sending a clear message – Canadian companies have the scale, expertise, and capital strength to drive the next era of energy transformation alongside global partners.

Canadian energy infrastructure companies delivered strong Q2 results, exceeding investor expectations and reinforcing the sector’s positive momentum. Topaz Energy (TPZ) is a Canadian royalty and energy infrastructure company that provides exposure to natural gas and oil production through fee-based and royalty interests. TPZ benefits from a strategic partnership with Tourmaline Oil, one of North America’s largest and lowest-cost natural gas producers. Tourmaline’s newly announced five-year growth plan to increase production from 650 mboe/d to 850 mboe/d by the early 2030s directly supports TPZ’s long-term royalty revenue growth. With over 90% of cash flows either contracted or tied to royalty volumes, TPZ provides reduced exposure to commodity price and strong earnings visibility, which in turn supports its attractive ~5% dividend yield, and remains a core holding in our Infrastructure funds.

Enbridge also reported Q2 results ahead of expectations, driven by notable strength in its Gas Transmission segment, benefiting from surging data-center power needs and industrial onshoring. These trends are driving higher utilization across key assets, underpinning the company’s confidence in achieving the upper end of its 2025 adjusted EBITDA guidance. Complementing its core infrastructure growth, Enbridge recently sanctioned the 600MW Clear Fork solar project in Texas, supported by a long-term offtake agreement with Meta. The $900M project is expected to generate revenue in 2027 and is accretive to both cash flow and EPS, highlighting ENB’s expanding role in stable, contracted renewables with long-term growth potential.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

The investment backdrop for technology remains robust, underpinned by an unwavering, multi-year commitment to Artificial Intelligence from the industry’s largest players. The AI arms race is running full steam ahead, with hyperscalers like Microsoft and Google, alongside key players like OpenAI, Meta, and Tesla, continuing to announce massive, multi-billion-dollar capital expenditure plans to build out the necessary data center capacity. This durable spending cycle is not just a forecast; it is a present-day reality driving the entire ecosystem. Crucially, leaders of some of the world’s largest enterprises, including Apple and Amazon, continue to emphasize that we are still in the very early stages of the AI adoption cycle, particularly for enterprise and consumer integration. This sentiment reinforces our view that the buildout is a marathon, not a sprint, with a long runway for sustained growth ahead.

This powerful secular trend is translating directly into superior financial performance, and we expect above-market earnings growth to continue propelling tech outperformance. For calendar year 2025, consensus estimates project the Information Technology sector will deliver earnings growth of approximately 18%, significantly outpacing the ~8% growth expected for the broader S&P 500. However, the spoils of the AI revolution are not being distributed evenly. We maintain our view that the profits are primarily accruing to the foundational layers of the AI stack. The leading semiconductor and hardware companies that design and manufacture the specialized chips for AI are capturing the lion’s share of value, as evidenced by their explosive earnings and margin expansion. To a lesser but growing extent, infrastructure players that provide the platforms (e.g. Cloud) are also benefiting. It appears too early for most pure-play software companies to benefit greatly, and we have noted that investors seem to be pricing in a degree of disintermediation risk, a view we believe is justified as AI agents threaten to disrupt established software workflows.

One of our top picks, Sony, exemplifies a company executing a clear strategy to enhance profitability across its world-class franchises. The company reported solid June quarter results, with operating profit soundly beating expectations, driven by strength in its core Gaming and Semiconductor segments. In Gaming & Network Services (G&NS), operating profit margins surged to an impressive 15.8%, an 8.3 percentage point year-over-year increase, rivaling levels seen during the pandemic. The Imaging & Sensing Solutions (I&SS) division was also strong, with sales up 15% year-over-year and wafer utilization hitting a remarkable 98%. Looking ahead, Sony raised its full-year operating profit guidance, signaling confidence. We believe there is still room for upside in G&NS and see further catalysts in 2026, including increasing momentum within the Pictures division. Even after the recent positive stock move, we still see a total return potential of approximately 20% through the end of calendar year 2026.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

The long-term outlook for gold remains attractive, underpinned by ongoing central bank purchases, persistent geopolitical tensions, and renewed concerns over U.S. fiscal stability and dollar weakness. Gold’s appeal stands out despite elevated bond yields, reinforcing demand versus traditional hedges like U.S. Treasuries. The recent consolidation in gold is viewed as a healthy pause, helping to unwind overbought conditions and potentially setting the stage for a renewed rally. We maintain our view of gold as a core risk mitigator, offering diversification and a hedge in the current macro environment. Gold equities outperformed bullion in July, with the S&P/TSX Gold Index rising 2.1% compared to a 0.4% decline in gold itself.

A series of policy shifts caused heightened volatility in energy markets this month. President Trump issued a September 2nd ultimatum to Moscow to reach a ceasefire in Ukraine or face sweeping 100% secondary tariffs on Russian energy and related exports including penalties for countries continuing to buy Russian oil, gas, or uranium. The President made good on this threat shortly thereafter by doubling India’s tariff rate from 25% to 50% due to its continued purchases of Russian oil. The increased pressure on Russia and its energy partners was counter-productive to Trump’s goal of lowering oil prices, with WTI crude rising 6.4% during the month.

A new U.S.-EU trade agreement includes a pledge from the European Union to purchase US$750 billion in U.S. energy exports over the next three years — a significant increase from the EU’s total energy import bill of US$433 billion in 2024 (Eurostat). The EU remains committed to phasing out all remaining Russian LNG and pipeline gas by 2028, opening the door for U.S. producers to fill the gap. With added pressure on key buyers like India and China, geopolitics is playing an increasingly dominant role in global energy prices.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.