Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Markets extended their rally throughout September and early October, showing little sign of fatigue as investors continued to embrace the ongoing bull market. During September, the MSCI World Index advanced 3.3% while the S&P 500 returned 3.6% and the TSX Composite surged 5.4%, driven by strength in materials and energy. Through the first three quarters of 2025, these three indices have generated total returns of 17.9%, 14.8%, and 24.0%, respectively. Participation in the rally has remained broad, supported by firming earnings expectations, dovish policy signals, and improving risk appetite globally. The result has been one of the most durable and synchronized advances across global equities in recent years.

Earnings momentum in the U.S. has strengthened meaningfully in recent months, providing a solid foundation for equity markets heading into year-end. Analyst revisions to both revenue and profit forecasts have turned sharply higher since May, with September marking the strongest pace of upward estimate activity in nearly four years. The share of upgrades across the S&P 500 has climbed to levels that rank among the top 15% of monthly readings since the mid-1980s, underscoring how broad and powerful this rebound has been. Encouragingly, the improvement has extended well beyond technology, with Financials, Communication Services, Industrials, and Healthcare all posting multi-year highs in revisions activity. In total, seven of the S&P 500’s eleven sectors now have more analysts raising estimates than lowering them — up from just one sector in the spring. Historically, swings of this magnitude in earnings revisions have tended to precede sustained market gains, as rising expectations help validate and extend rallies. The breadth and persistence of this recovery suggest that corporate fundamentals are improving across the economy, marking a clear turn toward a more expansionary earnings cycle.

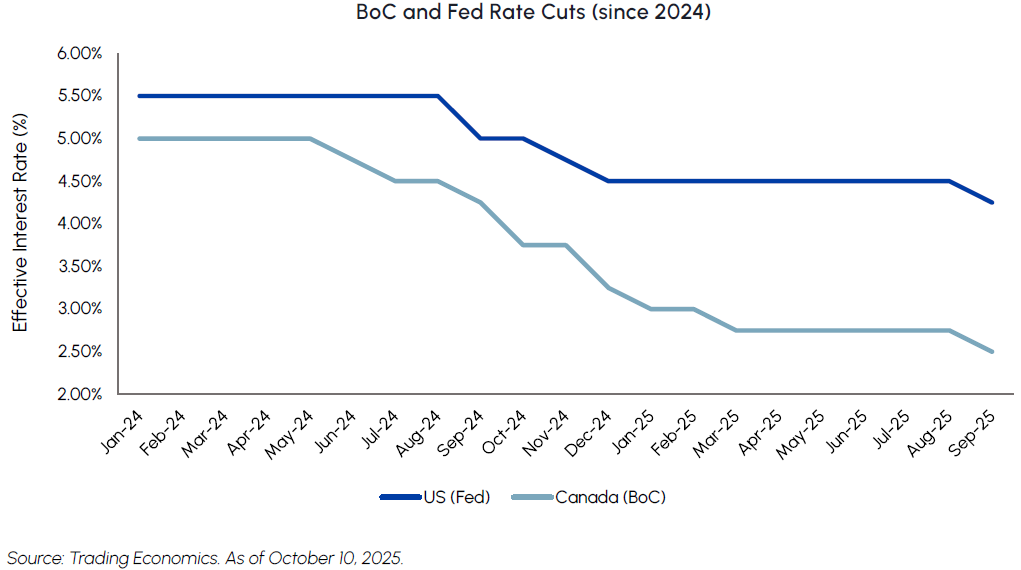

As expected, monetary policy turned more accommodative in September as both the Federal Reserve and the Bank of Canada cut short-term borrowing rates. The Fed lowered its target rate by 25 basis points to 4.25%, marking its first reduction in nine months. On the same day, the Bank of Canada also trimmed its Policy Rate by 25 basis points to 2.5%, ending a six-month pause as inflation and employment indicators continued to moderate. Policymakers in both countries signaled that additional easing is likely in the coming months, reinforcing expectations for a gradual shift toward more accommodative financial conditions. Historically, rate-cutting cycles that don’t coincide with a recession have been a powerful tailwind for equities, as lower borrowing costs support valuations and stimulate demand. Specifically, dividend-paying stocks may stand to benefit as investors rotate back toward income-oriented equities in a lower-yield environment. As the old market adage goes, investors may once again be reminded not to fight the Fed.

Prime Minister Carney’s recent visit to the White House helped ease tensions with President Trump, marking a noticeable improvement in tone from his first trip earlier this year. The meetings were described as constructive, with both sides signaling a willingness to cooperate on trade and defense issues ahead of a pivotal phase in North American economic negotiations. Against this backdrop, the United States formally kicked off the mandatory six-year review of the USMCA on September 16, several weeks ahead of schedule, setting the stage for a comprehensive re-examination of regional trade relations. The review is expected to proceed on two parallel tracks — bilateral negotiations aimed at addressing tariff and defense-related concerns, and a longer-term multilateral effort to strengthen regional integration. Other contentious issues, including auto and computer components, transshipment from China, labor enforcement, and dairy market access, are also expected to feature prominently in negotiations. Greater clarity on trade policy in the months ahead would be a constructive development for North American markets, particularly if progress toward tariff normalization bolsters business confidence and cross-border investment.

We believe elevated valuations are justified given the strength of earnings momentum and the improving macro backdrop. With monetary policy turning more accommodative, stocks should continue to find support through the coming quarters. Any short-term pullbacks due to tariff noise and the U.S. government shutdown are likely to be temporary and, in our view, represent attractive opportunities to add to quality positions.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

REITs were relatively unchanged in September, consolidating after an impressive ~20% rally since April. We met with the CEOs of our portfolio companies during recent industry conferences which reaffirmed our view that valuations remain well supported by a very active private market and renewed foreign capital flows into Canada. This marks a sharp reversal from the outflows experienced in 2024 and represents a constructive shift in sentiment. Several management teams also noted growing interest from U.S. investors who have been on the sidelines for the better part of the past 12 months. We believe an increase in foreign capital flows will be a meaningful catalyst for further strength in Canadian REITs.

We maintain a constructive outlook on our core exposures in Canada, including retail, industrial, multi-family, and seniors housing. Valuations in retail are strengthening amid strong demand for grocery-anchored shopping centres, driving notable rental rate growth—benefitting holdings such as Choice, First Capital, and RioCan. In the industrial sector, rents have stabilized in the GTA, and despite headline uncertainty from tariffs, leasing activity remains healthy with no discernible impact on landlords. Apartment rental rates have softened over the past six months but appear to be bottoming, while recent takeovers of Dream Residential and InterRent supporting the sector’s underlying value. Meanwhile, fundamentals in seniors housing remain exceptionally strong across both retirement and long-term care, underpinned by powerful demographic tailwinds and limited new supply.

While we continue to prefer the fundamental and valuation backdrop in Canada, we also look to the U.S. for selective opportunities not available domestically. Recently, we added to two U.S. homebuilders—Pulte Group and Toll Brothers—which are well positioned to benefit from the persistent housing shortage that continues to constrain supply across the U.S. Both companies delivered solid earnings beats last quarter and stand to gain further from an eventual easing in interest rates. These positions have already been positive contributors to our real estate fund performance.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

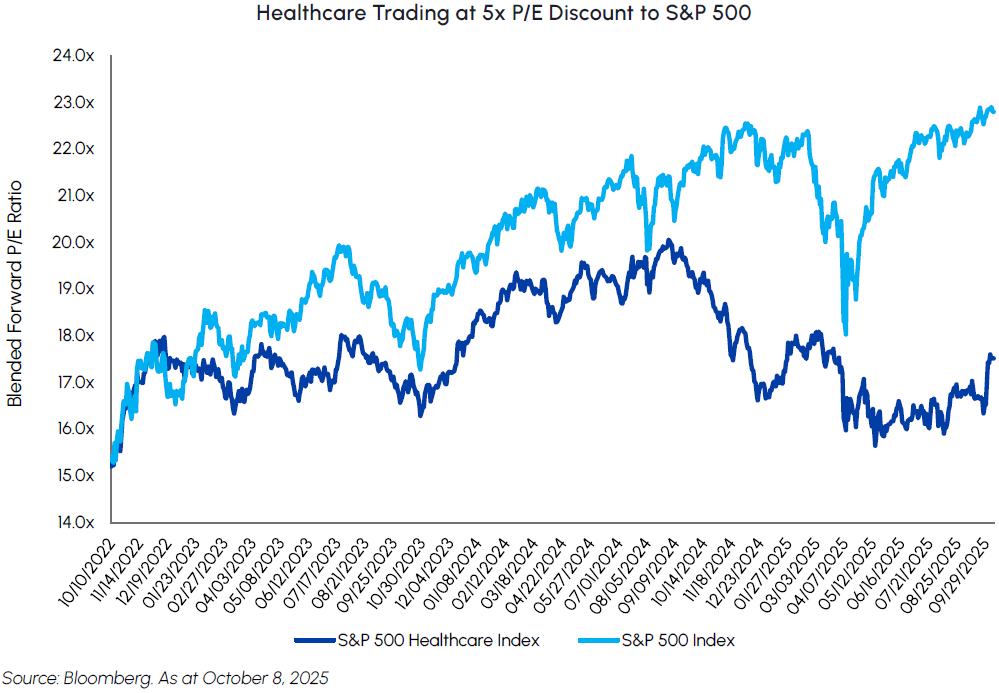

Healthcare stocks saw relief from policy headwinds in late September, causing the sector to rally 7% in a week. Despite the rebound, the sector remains deeply undervalued, still trading at a 5x forward P/E discount to the S&P 500, which sits in the 5th percentile of relative valuations over the past 30 years.

This month, investors gained incremental clarity on two major overhangs from the Trump Administration: tariffs and MFN drug pricing. On tariffs, the Administration announced a 100% levy on imported branded drugs unless the manufacturer is investing in the U.S.—a crucial caveat that effectively provides an exemption for companies with domestic operations. Large-cap biopharma firms have collectively announced over $300 billion in U.S. capital investment across manufacturing and R&D facilities recently, suggesting most will be exempt from the tariffs. Investors also received greater visibility on MFN drug pricing following Pfizer’s agreement with the White House, which narrows the range of outcomes and establishes a blueprint for future industry deals. The updated policy limits MFN to Medicaid—where only 5–15% of sales are derived, and pricing is already deeply discounted to promote access for lower-income populations. In addition, Pfizer announced plans to sell certain drugs directly to consumers via the new “Trump Rx” website, a move that aligns with policymakers’ broader efforts to reduce the role of intermediaries in the pharmaceutical supply chain. Large-cap biopharma stocks rallied more than 10% following these announcements—their strongest move in 25 years.

We continue to see meaningful upside potential and believe we are still in the early stages of a sustained re-rating for the sector. As expected, the policy proposals from the White House are proving to have more bark than bite, leaving the fundamental backdrop unchanged. Healthcare companies are expected to generate solid earnings growth over the next several years, underpinned by steady demand and new product launches. We are encouraged by the positive earnings revisions we have seen in recent weeks expect widespread earnings beats during the upcoming Q3 earnings season. Our healthcare funds are positioned to capture this upside as they are fully invested and unencumbered by covered call overwriting.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

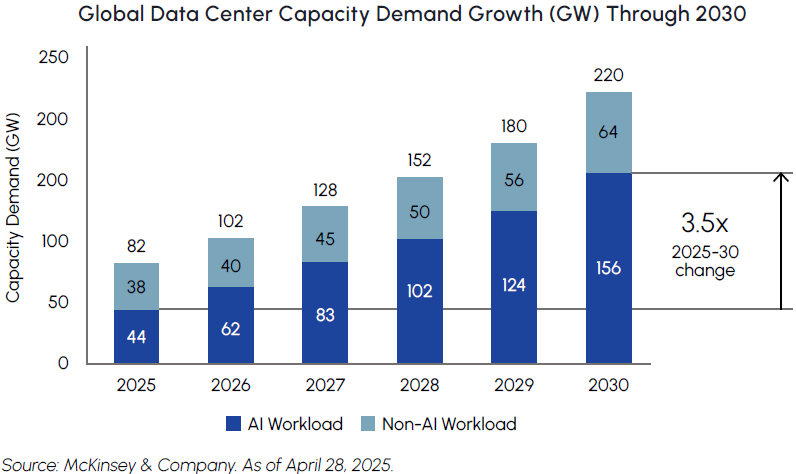

Alberta’s power market remains one of the most dynamic investment opportunities in Canada, with AESO’s ongoing power allocation process marking the beginning of a new growth phase for independent power producers (IPPs) including TransAlta (TA) and Capital Power (CPX). Phase 1 of the allocation, tied to data center capacity totaling 1.2GW, is expected to favor TA, while CPX is positioned to benefit through re-contracting power purchase agreements (PPAs) at premiums to forward prices. The combination of structurally higher power prices, re-contracting opportunities, and hyperscaler-backed projects in Alberta has driven CPX up +14% and TA up +13% in September. Greater clarity on Phase 2 allocations could further de-risk development timelines and enhance visibility into long-term load growth. With accelerating electrification and AI-driven demand, Alberta’s IPPs are entering a more profitable power market, increasingly supported by data center growth, tightening supply-demand dynamics, and policy momentum aimed at ensuring grid reliability and energy security.

Brookfield Renewable (BEP) and Brookfield Infrastructure Partners (BIP) reinforced this powerful narrative at their recent Investor Day, highlighting the strongest global power demand outlook in decades. Management pointed to 3 structural drivers: digitalization and AI data centers, electrification and industrial onshoring as catalysts for multi-decade growth. BEP forecasts data center power demand to rise 8-10% annually through 2050, representing nearly half of U.S. demand growth over the next decade. With a diversified asset base spanning hydro, nuclear, and battery storage, BEP is uniquely positioned to deliver reliable, dispatchable clean power sought by major hyperscalers such as Google and Microsoft. BEP’s increased 5-year capital deployment target of $9-10B (up from $8-9B), along with 10%+ annual FFO/unit growth target, underscore its conviction in the accelerating energy transition. More broadly, this signals a new era of nation building where Canadian utilities, midstreamers, and power producers benefit from unprecedented investment visibility and long-duration, inflation-linked growth. Our infrastructure funds remain well-positioned to capitalize on these themes through our exposure to high-quality names.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

The pace of the AI revolution is accelerating, with tangible proof points emerging from the industry’s most important players. Look no further than OpenAI’s global infrastructure ramp, which serves as a real-time roadmap to the key beneficiaries. The company’s massive, multi-year deal with Oracle for cloud capacity, alongside its foundational partnership with Microsoft Azure, confirms a multi-cloud strategy is essential to meet its immense computational needs. This spending directly benefits not only the cloud providers but also the entire hardware ecosystem, from Nvidia’s GPUs to the memory and storage leaders who supply the critical components for these scaled-out systems. On the adoption side, the excitement is palpable. As we predicted in January, the progression from text to image and now to video is driving an exponential increase in demand for compute. The recent buzz around new generative video models like OpenAI’s Sora 2 and Google’s Nano Banana validates this trend; generating high-fidelity video is orders of magnitude more compute-intensive than text, fueling the next leg of infrastructure demand.

We expect to see further proof of this AI flywheel during the upcoming earnings season. Cloud service providers are positioned to report strong results, demonstrating accelerating consumption of AI services, which in turn is funding their next wave of investment in AI capabilities. This virtuous cycle is also quickening growth in other categories. In online advertising, for instance, both Meta and Google are seeing strong adoption of new AI-powered tools that automate campaign creation and dramatically improve ad targeting and performance. This is a clear, early sign of how AI is moving beyond a cost center for infrastructure and becoming a tangible revenue accelerant for application-layer businesses.

Given this landscape, our portfolio positioning remains focused and consistent. We continue to favor the established “AI leaders” within semiconductors, as well as the key infrastructure and cybersecurity players within software. We also see a compelling opportunity in the memory and storage hardware providers who are essential to the AI data center build-out. Finally, we are maintaining our differentiated, bullish view on the video game industry, which we believe is in the early stages of a new secular upswing, representing a unique tech-adjacent growth opportunity.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

Gold prices surged in September after nearly five months of consolidation, setting new all-time highs near US$4,000/oz and positioning the metal for its strongest annual gain since 1979. The rally was fueled by the resumption of Fed easing, rising U.S. debt levels, renewed ETF inflows, sustained central bank buying, and ongoing geopolitical tensions. Bloomberg data showed that September’s ETF inflows were the largest in three years, while global central banks now hold more gold than U.S. Treasuries for the first time in nearly three decades. Gold’s share of global foreign exchange reserves has reached a record 24%, with central banks net buyers in 27 of the past 28 months.

The S&P/TSX Gold Index has climbed 120% year to date — its best performance since 1993 — yet valuations remain reasonable given solid earnings momentum, strong balance sheets, lower multiples, and higher free cash flow yields versus historical averages. Producers remain disciplined, emphasizing organic growth, debt reduction, and capital returns, while investors have begun to reward new project development. Junior producers deploying free cash flow into mine expansion have been among the top performers while capitalizing on this strength by raising record quarterly proceeds from share sales. Positive earnings revisions and further multiple expansion appear likely. Gold equities outpaced both bullion and broader markets in September, with gold up 11.9% versus a 20.4% gain for the S&P/TSX Gold Index.

September brought the launch of the new Major Projects Office, led by former TransAlta CEO Dawn Farrell, with LNG Canada’s Phase 2 expansion named among the top five projects for fast-tracking. We remain constructive on natural gas prices given strong U.S. demand growth, which should eventually draw down storage and lift prices—benefiting Canadian producers that sell roughly half their volumes to U.S. markets. LNG Canada expects Train 2 to commence in mid-October which will also spur demand for AECO gas. European gas prices have remained steady with inventories above 80% capacity. The EU continues to explore ways to accelerate its phaseout of Russian gas, which now accounts for just 13% of Europe’s supply, down from 45% before the invasion of Ukraine. The S&P/TSX Capped Energy Index rose 3.4% in September with a 10.2% rebound in natural gas prices offsetting a 2.6% decline in the price of oil.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Closed-End Funds

| Fund | Ticker | Strategy |

|---|---|---|

| MINT Income Fund | MID.UN | Equity Income |

| Sustainable Innovation & Health Dividend Fund | SIH.UN | Innovation & Healthcare |

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.