Index

Macro Update

by Dean Orrico, President & CEO and Robert Lauzon, Managing Director & CIO

Equity markets have fully recovered from April’s tariff turmoil. The S&P 500, TSX Composite and MSCI World Index all finished the first half of 2025 at all-time highs. Growth stocks had a particularly strong month in June with the NASDAQ Composite returning 6.6% and the S&P 500 Information Technology sector returning 9.8%. Year-to-date, the TSX Composite still leads the pack with a total return of 10.2% which compares to the S&P 500 and MSCI World returns of 6.2% and 9.8%, respectively.

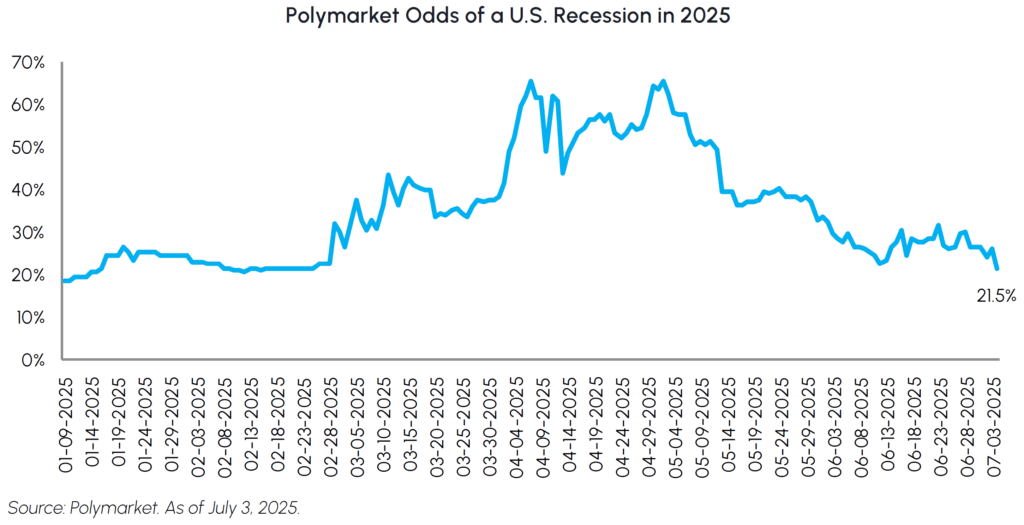

The outlook for the U.S. economy has improved dramatically in recent weeks. According to Polymarket, the odds of a U.S. recession this year have fallen from 65% in May to just 22% in July. Solid labour data, stable growth forecasts and rebounding consumer sentiment form a constructive backdrop. The June Nonfarm Payrolls report underscores this dynamic, with 147,000 jobs added – well above consensus expectations of 106,000 – and the unemployment rate declining to 4.1%, ahead of forecasts calling for 4.3%.

The one drawback of such strong data is that it likely extends the timeline for rate cuts from the Federal Reserve and puts upward pressure on the long-end of the curve. Despite President Trump’s recent criticism of Fed policy, the U.S. economy likely does not require monetary stimulus with full employment and inflation risks, at least on a transitory basis during the summer, remaining elevated. The recent passage of One Big Beautiful Bill, which delivers fiscal stimulus in the form of tax cuts and increased spending, further strengthens the Fed’s argument to remain on pause. We do not expect rate cuts until September and remain vigilant of rising bond yields in response to fiscal imbalances of the U.S. Treasury.

Surging capital markets activity offers another sign that market conditions are healthy. Global M&A saw a strong rebound in the first half of 2025, with aggregate deal value climbing nearly 20% year-over-year to $1.8 trillion. Three notable IPO’s have also taken place this year with Circle, CoreWeave and Chime entering the public markets and now accounting for $130 billion in market capitalization. In Canada, net issuances of equity securities in aggregate by both private and public Canadian corporations totalled $85 billion in the first quarter, snapping a streak of twelve consecutive quarters in which retirements exceeded new issuances. We expect the rebound in capital markets activity to continue through the remainder of the year. Financials are one of our preferred sectors as their capital markets and trading divisions are direct beneficiaries of this trend.

Although equities have been on a remarkable run since their April 8 lows, we continue to see a clear path higher for stocks, supported by the ongoing expansion in market leadership. While the Magnificent Seven drove returns for much of the last two years, their earnings growth is expected to moderate. On the other hand, profits are expected to accelerate in other areas through 2025 and into 2026. This broadening of earnings growth across multiple sectors and companies provides a much healthier and more durable foundation for the market to build upon, suggesting the current bull market has further to run. We believe active management is crucial in this environment and remain focused on companies with clear catalysts, reasonable valuations, and strong underlying business fundamentals to drive earnings growth.

Real Estate

Middlefield Fund Tickers & Codes: MREL / MID 600 / RS / RS.PR.A

by Dean Orrico, President & CEO

Canadian REITs have had a strong first half of the year with the TSX Capped REIT Index generating a total return of 7.6%. U.S. REITs have lagged their Canadian counterparts with a total return of 3.5% over the same period. Our global real estate strategies have been overweight Canadian REITs throughout the year given their more attractive valuations and earnings growth. Despite starting to close the valuation gap in recent months, we believe Canadian REITs offer more upside potential and expect to maintain our geographic mix in the second half of the year.

Seniors housing continues to outperform with the group returning nearly 4% in June. We recently met with the CEOs of Chartwell Retirement Residences and Extendicare, Canada’s two leading players in the retirement and long-term care sectors, respectively. Both were extremely constructive on their business outlooks, claiming that fundamentals “have never been better”. As a result, we have a healthy weighting to seniors housing of approximately 18% in our dedicated real estate strategies.

The acquisition market in this sector remains active, highlighted by Sienna Senior Living’s (SIA) recent $60 million acquisition of the Credit River Retirement Residence in the GTA. We view the transaction as attractive, with a purchase price of approximately $450,000 per suite and an implied cap rate of 5.75%—well below replacement cost. Over the past year, SIA has announced more than $400 million of acquisitions and is concurrently executing on $300 million of development projects. With supply/demand fundamentals in seniors housing expected to remain favourable for at least the next five years, we view these growth investments as well-timed and accretive. The Credit River acquisition is being funded through existing credit facilities and we believe SIA retains meaningful balance sheet capacity to pursue further external growth without the need for equity issuance.

SIA was not the only Canadian REIT making opportunistic acquisitions this month. Primaris REIT (PMZ), another core holding, announced a $416 million acquisition of Lime Ridge Mall in Hamilton from Cadillac Fairview. The 793 thousand square foot property is the leading regional mall in Hamilton with annual sales topping $250 million. The purchase brings PMZ’s total 2025 acquisitions above $1 billion, surpassing its three-year target. We are optimistic the deal will drive NOI upside given PMZ’s track record of conservative underwriting, proven leasing capabilities and effective cost management. Despite consistently executing on its defined strategy of improving the quality of its portfolio, PMZ continues to trade at a ~25% discount to NAV, largely due to macro uncertainty. We believe the upside in PMZ’s share price is among the highest in Canada with an attractive mix of growth and value while boasting a peer-leading balance sheet and premiere management team.

Healthcare

Middlefield Fund Tickers & Codes: MHCD / MID 625 / SIH.UN

by Robert Moffat, Portfolio Manager

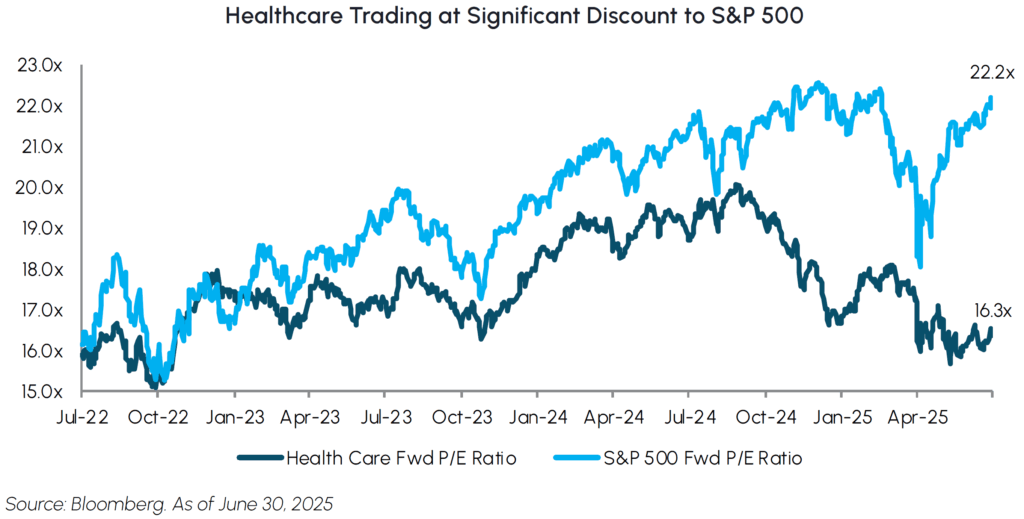

It was a tale of two quarters for the healthcare sector in the first half of 2025. Healthcare outperformed the S&P 500 by more than 10% in Q1, only to underperform by 18% in Q2 amidst policy uncertainty and a sharp reversal in risk behaviour. Year-to-date, the sector has returned -1.1% and is trading at a 5.9x forward P/E multiple discount relative to the S&P 500. The current discount is among the widest in the past 30 years, making healthcare one of the few pockets of the market offering attractive relative valuations.

Eli Lilly (LLY) has established itself as the clear market leader in diabetes and obesity medications. The annual American Diabetes Association conference held in June underscored the depth and breadth of LLY’s cardio-metabolic pipeline which we expect to strengthen the moats around this franchise. LLY provided incremental details on its oral GLP-1 pill, orforglipron, which demonstrated high tolerability and efficacy among patients with diabetes. The company is expected to release phase 3 data in patients with obesity over the next several months which we believe represents a multi-billion dollar market expansion opportunity. Orforglipron is expected to hit the market early next year and can address patient populations with needle aversion, those seeking maintenance dosing and will support geographic expansion into areas where injectables face logistical challenges. LLY also provided data from several other pipeline programs targeting alternative pathways to weight-loss (e.g., elorinitide and bimagrumab) which have the potential to expand treatment options and improve patient outcomes in the vast diabetes / obesity market.

In a noteworthy milestone for robotic surgery, surgeons at Baylor St. Luke’s Medical Center recently completed the first fully robotic heart transplant in U.S. history. The procedure used Intuitive Surgical’s (ISRG) Da Vinci system, allowing for the transplant to be conducted entirely through minimally invasive incisions. The patient, a 45-year-old male with advanced heart failure, was discharged without complications after a month-long observation period. While ISRG’s historical focus has skewed toward urology and general surgery, we view this development, alongside the recent appointment of a new head of cardiac and ISRG Ventures’ investment in a competitor, as a signal that the company is re-engaging with the cardiac space. This is an area we believe investors have largely overlooked in recent years, and we see the confluence of these developments as an encouraging step toward renewed growth in one of the most complex and underpenetrated robotic surgery verticals.

Infrastructure

Middlefield Fund Tickers & Codes: MINF / MID 265 / MID 510 / ENS / IS / IS.PR.A

by Robert Lauzon, Managing Director & CIO

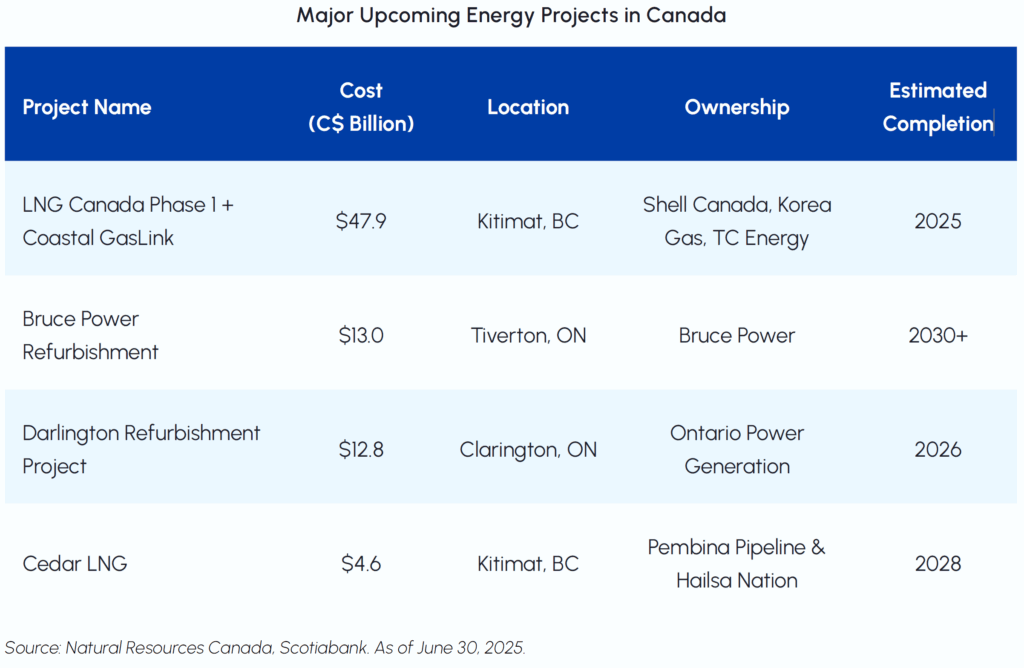

Canada’s push toward fast-tracking nation-building infrastructure continues to gain momentum. The federal government’s Bill C-5 (“One Canadian Economy Act”), which passed the Senate in late June, aims to streamline approval processes for major energy and trade-enabling projects by removing interprovincial barriers and expediting permitting. For Canadian energy and midstream players, this marks a pivotal shift, especially for shovel-ready projects or those awaiting regulatory clearance. The table below outlines key energy infrastructure developments expected to come online before the end of the decade, many of which stand to benefit from this accelerated framework.

During a recent meeting with Gibson Energy (GEI) management, the company reaffirmed its disciplined approach to organic growth. GEI emphasized the company’s stable base of contracted infrastructure revenues that are ~75% take-or-pay and outlined a $1B capital deployment plan across key growth initiatives, targeting 5-7% annual EBITDA/share growth over the next 5 years. Projects include new storage tanks to support increased TMX volumes in Alberta and expanded tankage and dockage infrastructure at its Gateway export facility in the U.S., where utilization is expected to rise. With a 7% dividend yield and 6 consecutive years of dividend growth, GEI offers a compelling total return profile. Additional clarity on strategy and long-term targets is expected at its upcoming Investor Day in December.

Enbridge (ENB) and TC Energy (TRP) stand out as key beneficiaries of the deregulatory push. With expansive North American networks, long-term take-or-pay contracts, and robust earnings growth visibility, both are well-positioned to capitalize on an accelerated permitting environment. With Coastal GasLink now completed, TRP is pivoting toward lower-risk brownfield expansions and LNG-aligned infrastructure, areas that could advance more swiftly under the new legislation. Keyera (KEY) also strengthened its competitive position with the $1.4B acquisition of Plains’ Alberta-based midstream assets. The deal enhances KEY’s scale, operating leverage, and exposure to natural gas and NGLs, positioning it as a higher-quality player in the Canadian midstream landscape. This coincides with LNG Canada’s first export shipment to South Korea in late June, a milestone that signals Canada’s growing role as a global LNG supplier and underscores the critical need for expanded gas infrastructure.

Technology & Communications

Middlefield Fund Tickers & Codes: MINN / SIH.UN / MID 925 / MDIV

by Shane Obata, Portfolio Manager

After a sharp rally that saw technology stocks recover and surge past their pre-Liberation-day highs, the sector’s focus now squarely shifts from valuation recovery to fundamental execution. With the Nasdaq 100 having posted strong gains and forward P/E ratios now above their 5 and 10-year averages, the path to future returns will be paved by earnings growth. Here, technology remains well positioned. For Q2 2025, the Information Technology sector is projected to lead the S&P 500 with the highest year-over-year revenue growth, and it is expected to demonstrate the highest earnings growth among all sectors for the full year. This superior growth profile keeps the sector attractive even as valuations are no longer considered cheap.

The biggest driver of this earnings power is the immense capital flowing into AI infrastructure, epitomized by initiatives like OpenAI’s “Stargate” project. This ambitious, multi-hundred-billion-dollar venture to build out AI data centers is a massive undertaking that sends demand signals throughout the entire supply chain. The direct beneficiaries are clear, including semiconductor leaders like Nvidia, but the impact extends to custom chip designers, memory providers, data center REITs, and even industrial companies supplying power and construction equipment for these massive builds. This tangible, long-term spending cycle provides a durable tailwind for a wide array of companies enabling the AI revolution.

This dynamic explains why semiconductor stocks are again outpacing software, as the hardware layer is where most of AI profits are currently being captured. However, we believe the next phase of value creation lies in software monetization. This will be a disruptive period, creating a clear divergence between winners and losers. Companies with vast distribution channels and proprietary data are best positioned to integrate and charge for new AI capabilities. In contrast, many smaller software players may struggle to compete. AI has also become much bigger than just the technology sector; we are seeing its transformative power ripple across the entire economy. What once seemed a far-fetched pitch has become reality: banks and other financial institutions are now viewed as key AI beneficiaries. By leveraging AI for fraud detection, risk management, and automating back-office tasks, the financial services industry is set to unlock significant cost savings and efficiency gains, proving that the AI theme is a broad-based, productivity-led transformation.

Resources

Middlefield Fund Tickers & Codes: MID 800 / MID 161 / MID 265 / MRF FT LP / Discovery FT LP

by Dennis da Silva, Senior Portfolio Manager

On June 30th, the first LNG cargo onboard the GasLog Glasgow tanker left the LNG Canada facility delivering fuel to Asian buyers signaling a paradigm shift in energy exports at a time when Canada pursues alternative markets away from the United States. Canada is poised to see the largest increase in natural gas export volumes in its history as LNG Canada marks the first of several projects expected to drive significant demand growth for Canadian natural gas over the coming decade. The start of exports should help strengthen AECO pricing, providing a meaningful boost to cash flows for leading low-cost producers like Canadian Natural Resources and Tourmaline. Additionally, the recent change in leadership improves the likelihood of approval for the Pathways Alliance carbon capture network, one of the most ambitious initiatives tied to oilsands decarbonization, which could unlock further production upside for Canadian producers. Canada looks to be increasingly well-positioned to supply global markets with safe, clean and reliable energy amidst an uncertain geopolitical backdrop.

Oil prices were volatile in June as markets contended with geopolitical crises. Prices surged early in the month following Israeli strikes on Iranian nuclear infrastructure and key military personnel, raising fears of broader regional escalation. The market closely monitored the risk of Iranian retaliation, including potential threats to the Strait of Hormuz or Gulf oil facilities, as well as the implications of U.S. involvement following B-2 airstrikes on Iranian sites. At the same time, markets were focused on future OPEC+ output increases as producers signaled plans to gradually taper voluntary cuts. As tensions began to ease with both sides agreeing to a ceasefire, oil prices retraced much of their earlier gains. With Middle East risks now subsiding, oil markets appear to have stabilized in the mid-$60 range.

Gold stocks outperformed the commodity in June with the S&P/TSX Gold Index returning 3.3% versus gold up only 0.4%. Gold traded within a narrow US$160/oz range, a sharp contrast to recent volatility. Although a resilient U.S. economy may delay rate cuts, haven demand driven by tensions in the Middle East and renewed concerns around Trump’s trade policy, will likely continue to support prices. Major strategists at Goldman Sachs, Morgan Stanley, and Bank of America increasingly view a move to US$4,000/oz as a matter of “when,” not “if,” citing de-dollarization and central bank accumulation. China, for instance, has increased gold holdings for seven consecutive months but still holds just ~7% of reserves in gold versus the ~20% global average, leaving room for further buying. Both U.S. adversaries and allies are participating in this trend, with BRICS+ countries controlling 42% of global reserves and driving the shift away from the U.S. dollar.

Exchange Traded Funds (ETFs)

Mutual Funds (FE | F)

TSX-Listed Split Share Corps. (Class A | Preferred)

| Fund | Ticker | Strategy |

|---|---|---|

| E-Split Corp. | ENS | ENS.PR.A | Energy Infrastructure |

| Real Estate Split Corp. | RS | RS.PR.A | Real Estate |

| Infrastructure Dividend Split Corp. | IS | IS.PR.A | Infrastructure |

LSE-Listed Investment Fund

| Fund | Ticker | Strategy |

|---|---|---|

| Middlefield Canadian Income Trust | MCT | Canadian Equity Income |

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. You will usually pay brokerage fees to your dealer if you purchase or sell units/shares of investment funds on the Toronto Stock Exchange or other alternative Canadian trading system (an “Exchange”). If the units/shares are purchased or sold on an Exchange, investors may pay more than the current net asset value when buying and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units or shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Mutual funds and investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this disclosure are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may”, “will”, “should”, “could”, “expect”, “anticipate”, “intend”, “plan”, “believe”, or “estimate”, or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Middlefield Funds and the portfolio manager believe to be reasonable assumptions, neither Middlefield Funds nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.