Index

Why Own Innovative Companies?

Multiple Secular Trends Provide Significant Long-Term Growth Potential

Digital Consumers

In today’s connected economy, consumers are increasingly seeking state of the art technologies. This

began with personal computers and eventually shifted to smartphones. Now, almost everything consumers buy is powered by technology, from automobiles to smartwatches. The proliferation of enhanced devices continues to fuel the growth of consumer-centric technologies such as 5G, which at speeds up to 100x faster than 4G, will accelerate the development of connected devices that will significantly enhance the prevalence of artificial intelligence.

Investors can capitalize on these trends by allocating capital to companies that are supporting today’s rapid technological advancement. For example, semiconductors represent key components underpinning the digitalization of consumer products. With a growing number of applications across a wide variety of industries, semis are tech building blocks with almost limitless demand. We are witnessing significant growth across verticals but especially in automotive (e.g. electric vehicles), wireless communications and computing & data storage (e.g. high-performance computing processors). With the cost of semiconductor content rising across applications, we believe the value of the industry could surpass $1 trillion by 2030.

Workplace Efficiency

Modern businesses need to have an online presence because they are connecting with clients through a wide array of channels (e.g. websites, chatbots, social media, email and video calls) and devices (e.g. computers, mobile phones, tablets and other smart devices). As a result, companies must continue investing in technology to meet the evolving needs of their clients. Conversely, failure to do so can lead to a significant competitive disadvantage.

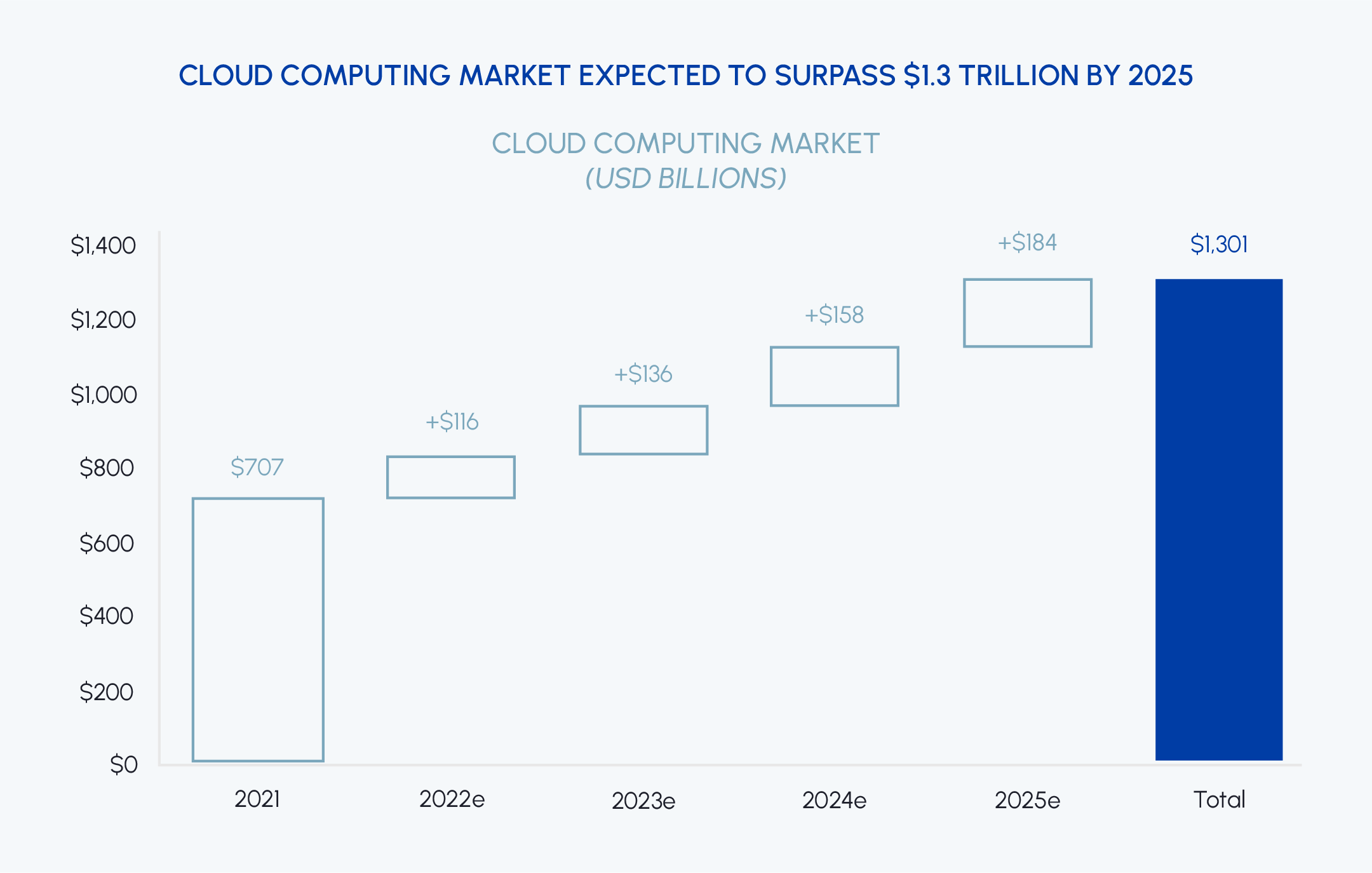

With high inflation and a shortage of skilled labor, global companies are retooling to increase operational efficiencies. Cloud computing is benefiting as the world transitions to a digital-first economy, driving expectations for the cloud market to grow to $1.3 trillion by 2025, representing a 16.9% CAGR since 2021. Cloud services (e.g. AWS) have become essential for modern businesses as they provide a more efficient and less expensive alternative to traditional on premise infrastructure. In addition, they facilitate 24/7 operations and possess the latest cybersecurity capabilities. Lastly, the cloud has become the foundation for the delivery of modern applications (e.g. Microsoft 365) and content (e.g. YouTube).

|

|

Technology Ecosystems

The largest companies in the world have one key asset in common: ecosystems. Apple started with devices but now provides a wide array of services including Apple Music, iCloud and Apple TV+. Microsoft, which began with the Windows operating system, is now fully entrenched in modern businesses through its Microsoft 365 productivity suite and also provides various services across cloud computing and gaming. Amazon started as a pure play E-commerce company but has since expanded into cloud computing, video, music, etc. Google started as a search engine but now offers a variety of services with over 1 billion users including Android, YouTube and Maps, just to name a few. These modern ecosystems have become staples in our lives since we use them on a nearly uninterrupted basis. Moreover, as we use more products / services from each provider, we become more ingrained and less likely to abandon the ecosystem. This is why we believe investors can rely on these leading companies to deliver durable growth while continuing to defy the law of large numbers, supporting the entire tech sector in the process.

Innovation Market Leadership

An important differentiator that underpins our stock selection is technological leadership. This is one of the key components we look for when evaluating a company’s sustainable competitive advantage. This is especially important for innovative companies because technology moves quickly. Leaders that continue to invest through research and development have the ability to extend their technological leadership over time, often at the expense of their competitors. We apply this way of thinking across sectors, industries and investment themes such as software, semiconductors, online advertising, E-commerce, electric vehicles, cybersecurity and payments.

Stellar Performance Supported by Strong Fundamentals

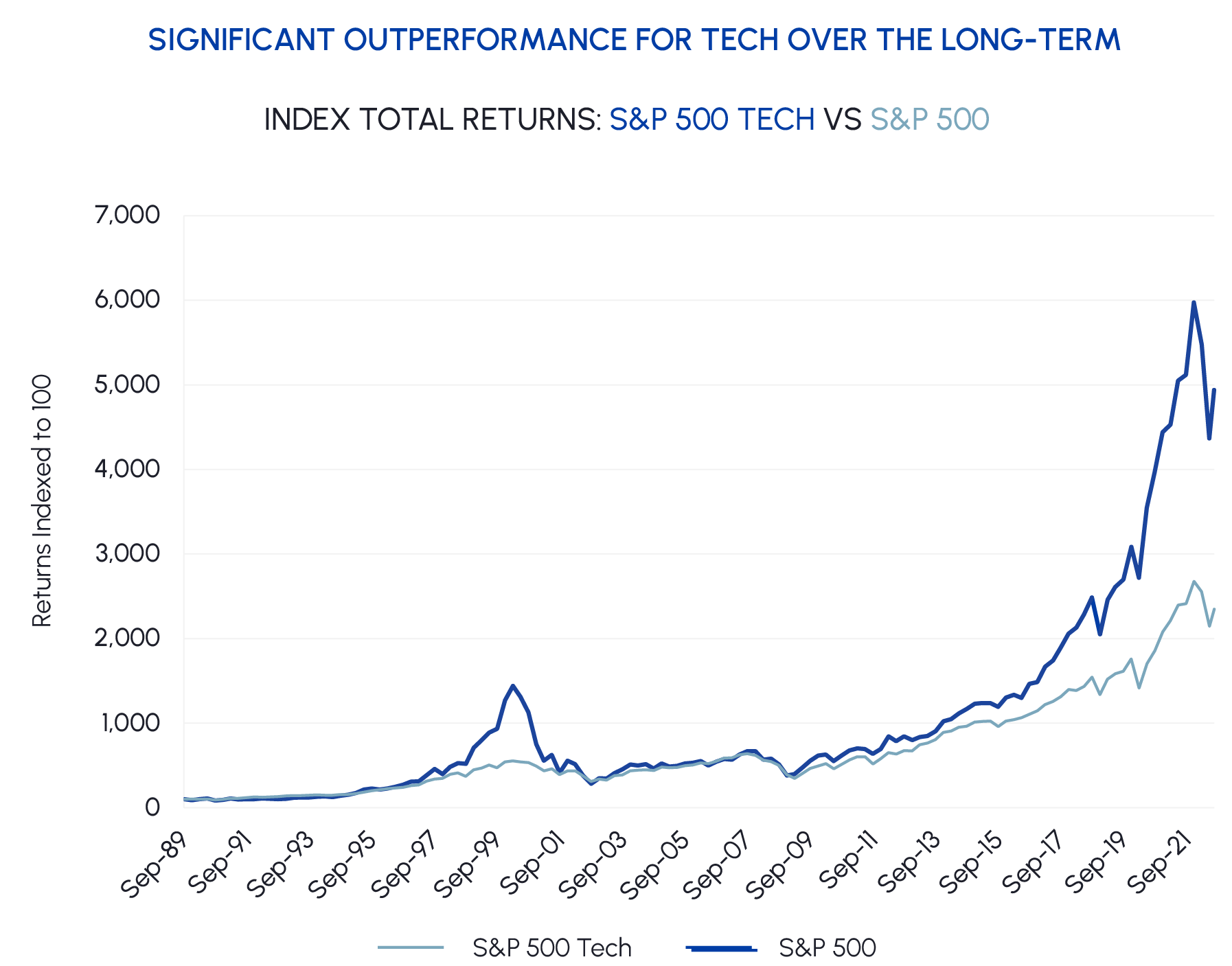

When looking back to 1989, which is as far as the S&P 500 Tech data goes, we can see that the technology sector has significantly outperformed the broader market.

|

|

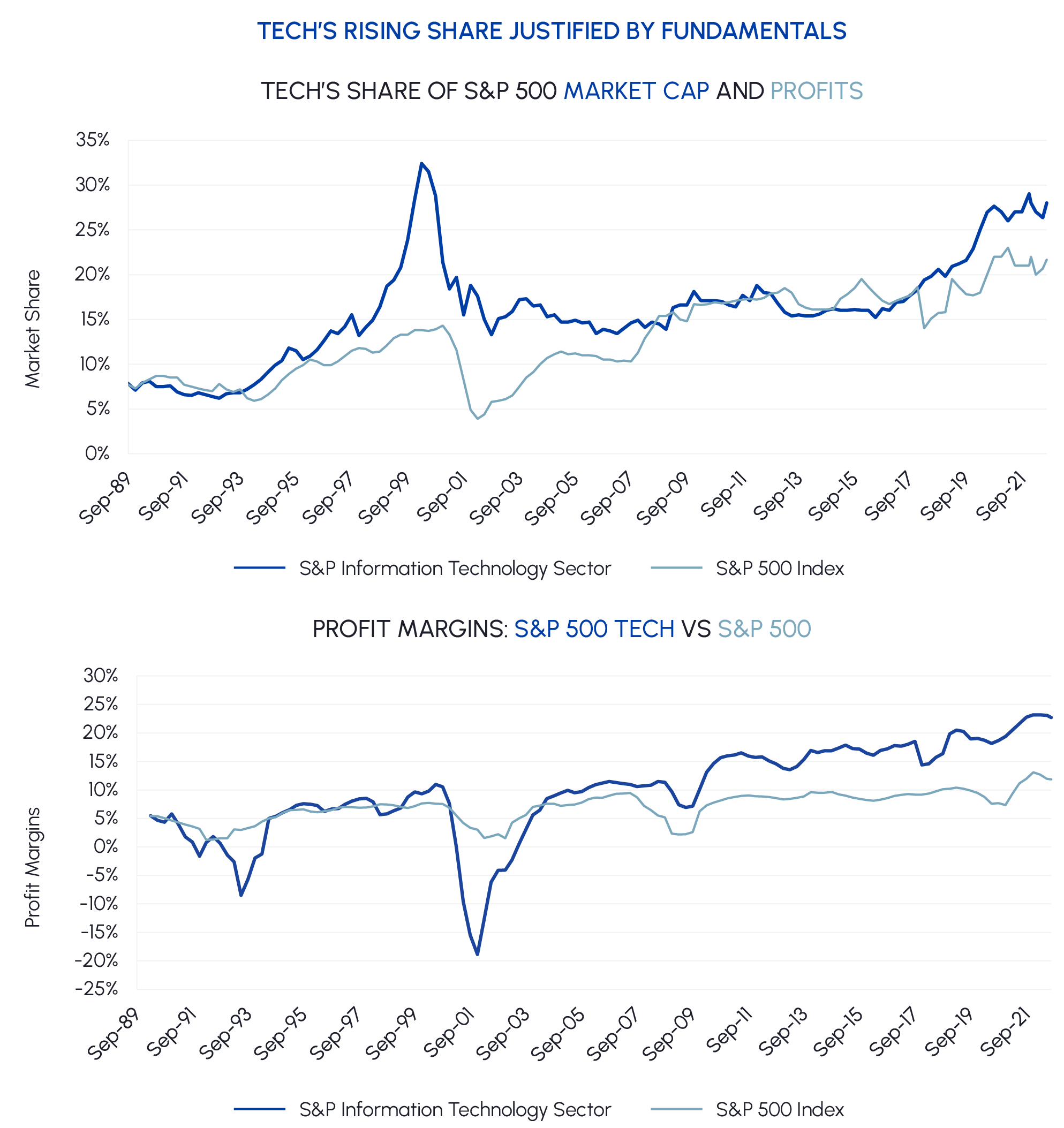

Unlike the critics who claim that tech has become too big in the S&P 500, we argue that its dominance is grounded in fundamentals. While tech’s share of S&P 500 market cap has increased since the financial crisis, so has its share of S&P 500 profits. During the tech bubble, there was a massive divergence between tech’s share of market capitalization and its share of profits. That is not the case in the current bull market, with tech representing 28% of market cap and 22% of profits. Lastly, tech has been highly successful in increasing profit margins, which, at ~23% are nearly 2x the S&P average of ~12%.

|

|

Middlefield’s Innovation Strategies

Solutions Overview

| Strategy | Fund Structure | Ticker/Fund Code | Investment Focus | Risk Rating | Fund Inception Date |

|---|---|---|---|---|---|

| Middlefield Innovation Dividend ETF | ETF | MINN | Diversified Global Innovation |

Medium | March 23, 2018 |

| Middlefield Innovation Dividend Class | Mutual Fund | MID925 | Diversified Global Innovation |

Medium | May 31, 2022 |

Growth + Income

All Middlefield innovation funds provide investors with attractive capital appreciation potential and significant levels of monthly income.

Holdings

Middlefield’s innovation strategies are actively managed portfolios holding approximately 25-35 names with an emphasis on large-cap companies with leading market positions that have the ability to pay and grow their dividends over time.

|

Exclusive Industry Technology Advisor

SSR Tech, Media and Telecom (TMT) Provides Our Funds With Expert-Driven Insights

SSR TMT is an independent research firm that provides expert analysis on the technology industry as well as unique comprehension and actionable investment ideas. SSR is highly regarded across the TMT industry and its client base includes multiple types of institutional investors. SSR is an independent research firm and does not engage in investment banking or sales and trading activities.

SSR Technology Lead

Paul Sagawa has 20+ years of TMT industry experience. Prior to co-founding SSR, he worked at Sanford C. Bernstein as a senior research analyst. While there, Paul was named to the Institutional Investor All-Star Team in three different categories. Prior to Bernstein, he spent six and a half years at McKinsey and Company. Paul earned his BA in Economics and MBA from Harvard University.

Innovative Areas We Like

Powerful Secular Trends Are Driving Opportunities In The Following Industries

Software

Companies are adding new applications to enhance productivity & streamline functions across areas such as design, customer relationship management and IT services.

Semiconductors

Already widely used in smartphones and computers, semiconductors are becoming critical for industries such as automotive and data center.

Online Advertising

As a result of modern consumers always being online, particularly on their phones, digital channels continue to take market share in the overall advertising market.

E-commerce

We expect that E-commerce adoption will continue to trend higher as consumers become increasingly comfortable transacting online, especially in underpenetrated categories such as personal care.

Disclaimer

This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and ETF investments. Please read the prospectus and publicly filed documents before investing. Mutual funds and ETFs are not guaranteed, their values

change frequently, and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell shares of an investment fund on the Toronto Stock Exchange or alternative Canadian trading platform (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedar.com. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements in this press release may be viewed as forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, intentions, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “plans”, “estimates” or “intends” (or negative or grammatical variations thereof), or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements including as a result of changes in the general economic and political environment, changes in applicable legislation, and the performance of each fund. There are no assurances the funds can fulfill such forward-looking statements and the funds do not undertake any obligation to update such statements. Such forward-looking statements are only predictions; actual events or results may differ materially as a result of risks facing one or more of the funds, many of which are beyond the control of the funds.