Contents

Why Should Investors Own Healthcare Stocks?

Powerful Long-Term Trends Are Driving Growth In The Sector

When people think about investing in healthcare, key household names likely come to mind. However, the healthcare sector is much more diversified than the well-known pharma companies. Additional sectors include biotech, medical devices, healthcare facilities, life science tools and services, and insurance.

The healthcare industry is booming. McKinsey & Company expects healthcare profit pools to grow at a 7% compound annual growth rate, from $583 billion in 2022 to $819 billion in 2027 (McKinsey & Company, 2024).

One of the key reasons to own healthcare stocks long term is that the companies in this sector sell needs-based products and services. So, despite what’s going on in the economic environment or macro backdrop, consumers will always need healthcare products and services. Demand is therefore inelastic, stable and predictable. These characteristics underpin the defensive reputation that healthcare has. In addition, there are demographic tailwinds that will drive sustainable demand growth for decades to come.

Aging Population

Aging Population

By 2050, the world’s population of people aged 60 and older will double. The population of people over the age of 80 is expected to grow by about 50% over the next 10 years in the U.S. and those over the age of 85 are expected to triple over the next 25 years in Canada. In the U.S., this older cohort spends nearly $20,000 per year on healthcare products and services — double that of those aged 45 to 64 and quadruple those aged 19 to 44. This will lead to more than 5% annual healthcare spending growth in the U.S., benefiting investors.

Technological Innovation

Technological Innovation

The pace of innovation in healthcare has never been faster. Groundbreaking technologies are evolving rapidly in fields such as genomics, mRNA vaccines, robotic surgeries as well as molecular diagnostics and neuroscience. The scientific community’s unprecedented understanding of human biology, combined with larger data sets and faster information processing capabilities, is expected to yield therapies and procedures that will change medicine. Companies in this area are going to be growing significantly faster than the sector average.

Healthcare Is Essential

Healthcare Is Essential

Healthcare spending represents 12% of GDP in Canada and ~18% in the U.S. Immense financial and human resources are required to ensure equitable access to drugs, doctors and medical equipment. The COVID-19 pandemic highlighted the importance of a well-functioning healthcare system and strengthened research and development (R&D) commitments from governments, corporations and academic institutions.

Healthier Lifestyle Trends

Healthier Lifestyle Trends

People are living more active lifestyles and view health and wellness through an increasingly broad and sophisticated lens. Overall health encompasses physical and mental health, fitness, nutrition and appearance. Preventative strategies are growing in practice and substantially reduce the risk of chronic diseases such as diabetes, hypertension and heart disease.

Strong Performance In Good Times And Bad

Strong Performance In Good Times And Bad

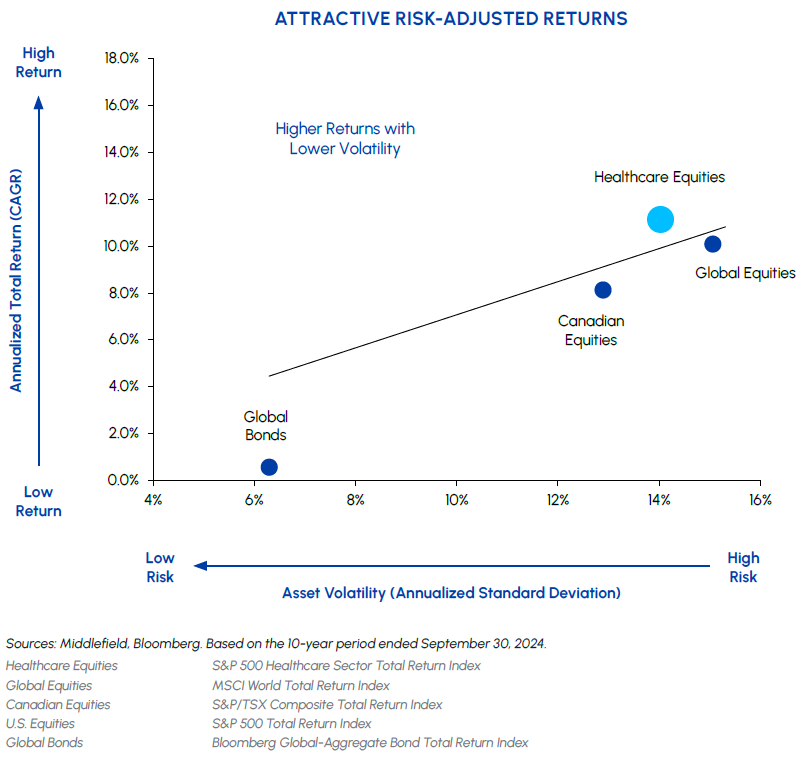

Healthcare equities offer investors an attractive mix of defensive qualities and growth. Historically, the sector has generated higher total returns while exhibiting lower volatility. Large and established companies in this sector often demonstrate remarkable resilience during market downtrends. For example, during the great financial crisis in 2008–09, sales volumes of pharmaceutical products declined by only 1% to 3% on average. This inelastic demand is due to the needs-based nature of healthcare products and supports recession-resistant businesses. Healthcare companies also do well during periods of inflation as many of the best firms have low commodity price exposure, high margins and pay growing levels of dividends.

Middlefield’s Healthcare Strategies

Both Middlefield’s healthcare ETF and mutual fund have similar underlying portfolios and total return profiles. Each invests in established companies with a strong track record of sustainable earnings growth. The majority of their portfolios are invested in dividend-payers, with a particular emphasis on companies that grow their dividends over time.

Solutions Overview

| Strategy | Fund Structure | Ticker / Fund Code | Investment Focus | Risk Rating |

|---|---|---|---|---|

| Middlefield Healthcare Dividend ETF | ETF | TSX: MHCD | Diversified Global Healthcare | Medium |

| Middlefield Healthcare Dividend Fund | Mutual Fund | A Series: MID 325 F Series: MID 326 |

Diversified Global Healthcare | Medium |

Distributions

All Middlefield healthcare funds provide investors with attractive levels of monthly distributions. MHCD (ETF) currently pays a dividend yield over 5%, while MID326 (mutual fund) pays approximately 3%.

Holdings

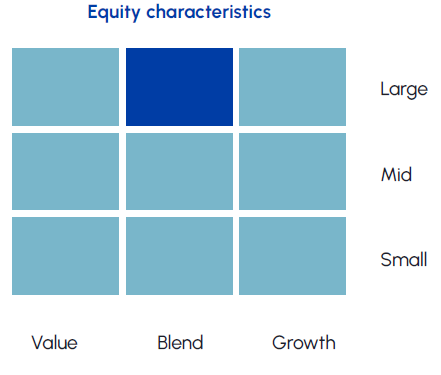

Middlefield’s healthcare strategies are actively managed portfolios holding approximately 30–45 names with emphasis on stable, mature, large-cap companies that pay and grow their dividends over time.

The funds’ benchmark is the MSCI World Health Care Index. Its sector mix is comprised of about 40% pharmaceuticals, 15% medical equipment, 15% biotechnology, 10% life science tools and services, and the remainder split amongst various healthcare services. The geographic mix of the benchmark is approximately 70% in the U.S., with the remainder split between Europe and other international markets.

By using an active management strategy, Middlefield is able to differ from the benchmark, providing investors with unique exposure relative to the benchmark.

Why Active Management?

Why Active Management?

It’s particularly important to have an active management overlay when investing in healthcare because there’s so much diversity within the sector. Further, the dynamics within healthcare are always evolving. Middlefield believes that having an active approach is useful because investors can assess prevailing market conditions and overweight sectors that have the most attractive fundamentals while avoiding or being underweight companies and sectors that are facing headwinds.

For instance, with passive management, a portfolio might have a 5% weight in a healthcare company that has limited growth prospects. With active management, Middlefield can underweight this stock relative to the benchmark and allocate to more attractive opportunities. Middlefield typically does not overweight or underweight any particular subsector by more than 10% from the benchmark.

Exclusive Industry Healthcare Advisor

SSR Health Provides Our Funds With Expert-Driven Healthcare Insights

SSR Health is an independent research firm that provides expert analysis of the industry and political landscape impacting the healthcare sector, as well as unique comprehension and actionable investment ideas. SSR is highly regarded across the healthcare industry and its client base includes asset managers and government agencies. SSR does not engage in investment banking or sales and trading activities.

SSR Healthcare Lead

SSR Healthcare Lead

Dr. Richard Evans has 20+ years of healthcare industry experience. A former senior pharmaceuticals executive with Roche and top-ranked pharmaceuticals analyst with Sanford C. Bernstein, he was ranked #1 by both Bloomberg and Institutional Investor for his thought-leading industry coverage. Middlefield’s portfolio management team engages in regular discussions with Dr. Evans for his valuable insights on the healthcare sector. www.ssrhealth.com

Healthcare Areas We Like

Powerful Secular Trends Are Driving Opportunities In The Following Subsectors

Biotech

The biotechnology industry is on the cusp of a multi-decade innovation cycle, which is expected to yield groundbreaking therapeutics and treatments. It typically takes 10 years for a drug to go from the preclinical stage to the commercial phase, which means many of the recent advancements that have taken place in research labs are yet to reach a commercial setting. This includes advancements in artificial intelligence (AI), gene editing and novel cancer treatments. Further, big pharma companies face patent cliffs in the coming years and are incentivized to replenish their drug pipelines. These companies will likely supplement internal R&D efforts with mergers and acquisitions, focusing on innovative biotech companies to fill pipeline gaps.

Pharmaceuticals

Pharmaceutical companies generate stable and predictable earnings, carry low financial leverage and consistently grow their dividends. These companies have strong balance sheets and are focused on investing in R&D, as well as innovation. Key areas to watch are product developments in oncology, immunology and neurology. With established sales and distribution networks for the better part of a century, pharmaceutical companies are leaders in product development and commercialization.

Equipment & Supplies

Robust innovation, expanding end markets and growing volumes of elective surgeries result in higher average growth rates. Over the long term, these companies are playing an increasingly important role in diagnosing and monitoring diseases. For instance, certain drugs have now been replaced by devices and equipment that can treat that specific condition. As a result, Middlefield is overweight this subsector relative to the benchmark.

Life Science Tools & Service

Consistent R&D spending from biopharma companies, governments and academic institutions support robust innovation in emerging fields such as genomics, DNA sequencing and molecular diagnostics. Life science tools and services companies sell products and services to research labs, with biopharma companies representing their core end market. These products can range from low-cost consumables and reagents to multimillion-dollar instruments and equipment, like gene sequencers. AI is another key trend in this space, with companies leveraging AI to analyze genetic information and improve the drug discovery process.

Managed Care & Insurance

Subsiding COVID-19 hospitalizations and low unemployment improves the margin outlook for managed care organizations. These companies’ long-term growth prospects are supported by the general growth in healthcare spending. An aging population will increase the demand for health insurance which will lead to higher revenues from plan sponsors and beneficiaries.

Healthcare Distributors

With three big healthcare distributors that touch over 90% of the drugs in the U.S. market, there are high barriers to entry for incumbents. Distributors manage logistics from manufacturing facilities to the pharmacy or physician’s office, earning a low but consistent margin. These companies are set to benefit from the unique tailwinds that are coming from the growth of new classes of therapeutics, including weight-loss drugs and biosimilars (those that copy original products).

Healthcare Facilities & REITs

The 80+ population is growing quickly, so there is growing demand for senior housing. Further, pandemic related headwinds have started to fade with labour prices decreasing and margin pressures easing. Investing in senior housing, which includes retirement homes and assisted living facilities, is a core competency across Middlefield’s healthcare and real estate portfolios.

Long-Term Macro Outlook

The COVID-19 pandemic caused the healthcare industry to boom. Billions of dollars were spent on vaccine initiatives, R&D spending and improving patient access to healthcare. These investments strengthened the sector’s long-term earnings power and highlighted the importance of having a resilient healthcare system.

With inflation continuing to ease and further rate hikes appearing less likely, the economy appears increasingly stable. KPMG noted that this will create an improved environment for dealmaking. In 2023, healthcare transactions by strategic investors went up, with deal volumes rising to 566 from 475 in 2022, according to KPMG.

Many large, established biopharma companies face expiring patents in the coming years. Given the abrupt impacts these can have on revenues, M&A will be essential for replenishing drug pipelines and driving growth in the sector in the latter half of the decade. In fact, 54% of health industry CEOs say they plan to make at least one acquisition in the next three years, according to PwC’s 27th Annual Global CEO Survey.

The medical equipment subsector is another area that could experience an uptick in M&A. This includes innovations in cardiology, robotic surgery, and internet-connected wearable devices, KPMG said in its annual report. These areas are driving advancement in this field, and many of the deals in 2024 will be focused on these areas.

As M&A picks up and R&D and innovation continues, the healthcare sector is entering a period of elevated growth. For the next three years, the expected earnings growth rate for the healthcare sector is in the double digits. Also, there is potential for upside from new product developments, like GLPs, which are growing at a much higher rate. (Glucagon-like peptide-1, for example, treats hyperglycemia in those with Type 2 diabetes, as well as obesity.) There are also new drugs within oncology that could be blockbusters and accelerate growth. Within that baseline and the sector returning to normal, there’s upside from innovation and new products coming out in the next few years.

A Look At Subsectors

In pharmaceuticals, drugs for weight-loss and diabetes (e.g., GLP-1s) will create important downstream health benefits. These drugs will help address obesity and diabetes earlier in the patient’s life, which can offset other types of health risks. For instance, Novo Nordisk released a study in 2023 that showed taking their weight loss drug, Wegovy, reduced the chances of getting adverse cardiovascular events, like heart attacks and strokes, by about 20%.

And the number of patients meeting clinical eligibility criteria for these types of drugs for obesity and diabetes is among the largest of any new drug class in the past 20 to 30 years, McKinsey & Company said in a 2024 report.

Further, in the area of oncology, there’s a new class of drugs called antibody drug conjugates (ADCs), which combine the targeting properties of antibodies with a chemical that creates an effect similar to chemotherapy. This drug essentially kills tumour cells in a targeted and controlled method, and causes less collateral damage than conventional chemotherapy. As a result, big pharma is investing billions of dollars within this vertical, driving growth in this subsector.

Additionally, many people put off surgeries, like hip or knee replacements, during the pandemic. That backlog is now being realized as hospitals are seeing elevated activity. This creates a solid environment for medical technology (MedTech) companies, especially those in orthopedics. However, insurance companies are faced with reimbursing those procedures. As a result, Middlefield is tactically overweight MedTech companies and underweight insurance companies as their margins have come under pressure.

Meanwhile, MedTech will continue to play a big role in treating diseases, providing growth in the healthcare sector. For instance, continuous glucose monitoring devices are an important new technology for patients with diabetes, allowing patients to monitor their blood glucose levels in real time with high accuracy. This gives them a good sense of how much insulin they need. As a result of these types of product innovations, Middlefield expects mid-teens earnings-per-share growth for the MedTech industry over the long term. Further, MedTech companies are trading at reasonable valuations, roughly in line with their five-year averages.

Risks To Watch

Political risk is always top of mind in the healthcare sector — especially during an election year. Typically, the subsectors in healthcare that are most exposed to these types of risk include pharmaceuticals and insurance companies. For instance, elevated cost for drugs and insurance is the type of issue that tends to get attention on the campaign trail. Meanwhile, medical technology companies don’t tend to get caught up in political crosshairs and typically keep their prices flat.

Active management can help navigate some of that political risk. For instance, Middlefield is able to underweight politically sensitive subsectors, including insurance and managed care during periods of elevated risk.

Another risk to watch is labour shortages in U.S. hospitals and physician practices. The shortage has resulted in higher expenses for hospitals that have had to hire travel nurses to fill the gap. However, Moody’s expects this issue to be resolved by year-end, as hospitals make more effort to recruit and retain staff by providing enhanced benefits packages. These factors signal a financial recovery in 2024, marked by an uptick in cash-flow margins, noted Moody’s.

Also, investors should be cautious about the ebb and flow dynamic of the healthcare sector, which can change on a weekly basis. For instance, in 2023, the market was led by technology and consumer discretionary, which caused capital to flow into those areas. This type of sentiment risk can impact the sector because capital may not flow into healthcare the way it should.

Overall, investors can expect continued growth in healthcare as product innovation and R&D offer opportunities. The key is to actively manage portfolios to under- or overweight certain subsectors depending on prevailing industry conditions.

How To Invest

The defensive characteristics of the healthcare sector make it a stable, long-term investment opportunity. Here are some tips on how to invest and what to consider beforehand.

Understand The Sector

Do research so you understand the various subsectors within the healthcare industry — biotech, pharmaceuticals, medical devices and equipment, life science tools, managed care and insurance, healthcare distributors, healthcare facilities, and technology.

Review Past Performance

Evaluate the financial health of the companies included within a healthcare fund, looking at factors such as revenue growth, profit margins, cash flow and debt levels. Focus on companies with strong balance sheets and sustainable business models. Also look for companies with a competitive advantage, such as proprietary technology, or a strong brand, as these companies are more likely to maintain market share and generate long-term returns.

Evaluate M&A

M&A is common in the healthcare sector and can impact the competitive landscape and stock prices of companies. Stay informed about M&A activity and evaluate how it may affect companies in healthcare strategies.

Monitor Healthcare Costs

Rising costs in the healthcare industry can impact the profitability of companies and influence consumer behaviour. Ensure you regularly review how costs are impacting the companies in the portfolio.

Stay Abreast Of Regulatory Changes

Stay informed of changes to regulations, particularly when it comes to drug approvals and healthcare policies. Also, changes to government healthcare programs or healthcare reform initiatives should be top of mind.

Pay Attention To Clinical Trial Results

For biotech and pharmaceutical companies, clinical trial results can impact stock prices. Stay updated on trial progress and results, whether positive or negative.

Determine Resiliency

The pandemic impacted a variety of healthcare subsectors and highlighted the importance of resiliency. Determine how healthcare companies responded to the pandemic and assess their ability to withstand future health crises or economic downturns.

Remember To Diversify

As with all investment strategies, diversification is important to ensure you capture upside while protecting against volatility. Ensure the healthcare fund invests in a variety of subsectors, including pharmaceuticals, biotech and medical devices.

Ask Questions

Ask fund managers questions, whether about dividend payouts, sector breakdowns, upside growth, downside protection, or how the fund performs in various market cycles.

Look Beyond The Short Term

Consider long-term trends and how they can impact the healthcare industry, as well as funds. This includes medical advances, new product innovation and AI. Invest in companies that are well positioned to capitalize on these long-term trends.

Remember that as with any investment, there are risks. Conduct thorough research before making investment decisions and stay up to date on market conditions and adjust the strategy as needed to help investors achieve their goals.

Sources: PwC, McKinsey & Company, KPMG

For specific investment inquiries or general questions about Middlefield, our team is here to assist you.

Contact Us

Disclaimer: This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument.Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and ETF investments.Please read the prospectus and publicly filed documents before investing. Mutual funds and ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell shares of an investment fund on the Toronto Stock Exchange or alternative Canadian trading platform (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedar.com. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this document may be viewed as forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, intentions, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “plans”, “estimates” or “intends” (or negative or grammatical variations thereof), or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements including as a result of changes in the general economic and political environment, changes in applicable legislation, and the performance of each fund. There are no assurances the funds can fulfill such forward-looking statements and the funds do not undertake any obligation to update such statements. Such forward-looking statements are only predictions; actual events or results may differ materially as a result of risks facing one or more of the funds, many of which are beyond the control of the funds.