Index

Why Should Investors Have Exposure to REITs?

Over decades, REITs have delivered high, tax efficient dividends plus capital appreciation. Moreover, due to their focus on paying regular dividends which are derived from contractual tenant rental payments, they are ideal for investors seeking regular forms of income such as retirees who rely on their investment portfolio to cover every day living expenses.

REITs also have low correlations to other equities and fixed-income investments and, as a result, are a good portfolio diversifier. Moreover, individual investors should consider following the example of large institutional investors such as pension funds who have 5% to 15% of their total portfolio allocated to real estate and real assets.

In summary, REITs have a long track record of providing investors with:

Why Now?

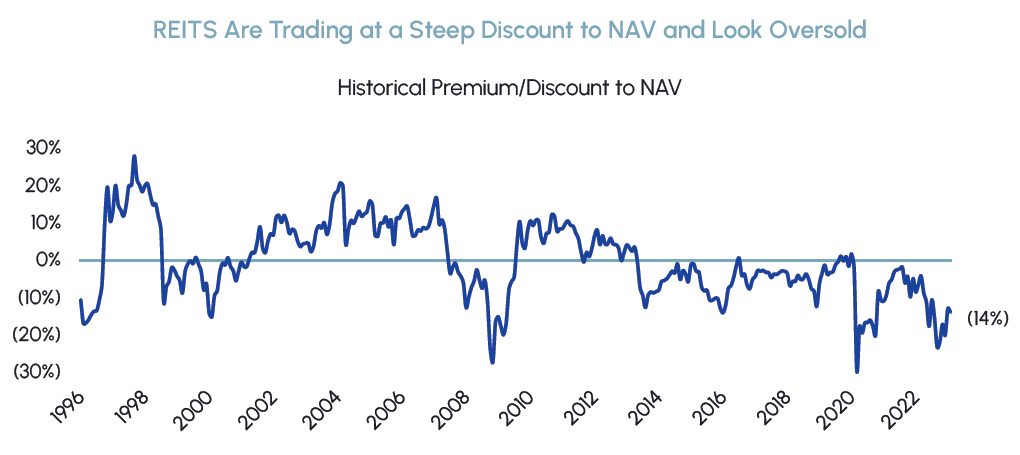

In light of the rapid and significant increase in interest rates beginning in 2022, REITs are attractively valued and trading at a wide discount to NAV. Notwithstanding the lower valuations, fundamentals across most REIT subsectors remain very solid with increases in cash flows more than offsetting the impact of higher capitalization rates. Moreover, the best REITs have reduced their debt levels and locked in lower borrowing costs prior to the recent increase in interest rates. Furthermore, as the chart below shows, REITs have historically been a good hedge against inflation.

|

|

Is Home Ownership a Good Substitute For Investing In REITs?

A house should not be considered an investment but instead is more similar to a consumption good, especially when financed by a mortgage. To this point, one’s home does not generate income but instead requires the owner to cover the cost of mortgage interest, property taxes, insurance and maintenance.

REITs, on the other hand, provide exposure to commercial real estate which generates recurring and often growing levels of income for investors. Last but not least, REITs are liquid investments often diversified by sector and geography versus a house which is much less liquid with more concentrated risk.

Middlefield’s Real Estate Solutions

Middlefield’s real estate strategies are designed for investors seeking income and growth from a portfolio of large-cap companies diversified across the global real estate sector. Middlefield’s history in real estate began when the firm was founded over 40 years ago and we have been managing dedicated REIT strategies for over 10 years. Our solutions provide Canadian investors with global exposure to a sector that has attractive defensive and inflation-protection attributes. Middlefield’s real estate funds have won multiple awards in the real estate sector.

| Strategy | Fund Structure | Ticker/Fund Code | Investment Focus | Risk Rating |

|---|---|---|---|---|

| Middlefield Real Estate Dividend ETF | ETF | TSX: MREL | Diversified Global Real Estate |

Medium |

| Middlefield Real Estate Dividend Class | Mutual Fund |

F Series: MID 601 |

Diversified Global Real Estate |

Medium |

| Middlefield Real Estate Split Corp. | Split Share |

Preferred Shares: RS.PR.A |

15-20 high conviction REITs |

Medium |