Contents

Overview

Once the domain of institutional and wealthy investors, global real estate has evolved into a mainstream asset class and is now an integral component of investors’ portfolios. Investors engage in the sector to diversify their portfolios, take advantage of international market opportunities, and potentially benefit from varying economic conditions and property cycles. The sector also offers the potential for enhanced returns and can help mitigate risk and hedge against inflation.

The global real estate sector comprises many property types, each with unique characteristics and challenges. Factors such as economic conditions in different regions, local demand/supply dynamics and evolving market trends typically shape the landscape for real estate investors.

Investors can participate in the global real estate sector in three main ways:

- Direct ownership: Directly owning and managing properties in different countries requires a deep understanding of local real estate markets, regulations and legal considerations and is generally suited for institutional and wealthy investors.

- Real estate funds: These include private equity funds, ETFs and real estate mutual funds.

- Real estate investment trusts (REITs): REITs, which allow for indirect ownership of real estate, pool funds from multiple investors and invest in a diversified portfolio of properties across multiple countries.

Investing in REITs

Public REITs own, operate or finance income-generating portfolios of real estate assets. In fact, they were initially established in the U.S. to provide “all investors” with the opportunity to invest in real estate assets, something that was previously available only to wealthy investors. As a result, they are issued by prospectus, trade on a stock exchange and are suitable for a wide range of investors and investment sizes.

More specifically, public REIT investors are not subject to restrictive eligibility requirements, minimum investment sizes or upfront costs. In addition, because they are issued by a prospectus approved by securities regulators, they have greater regulatory oversight and receive more third-party scrutiny from stock analysts and institutional investors. Since public REITs trade on exchanges, they are extremely liquid and easy to access.

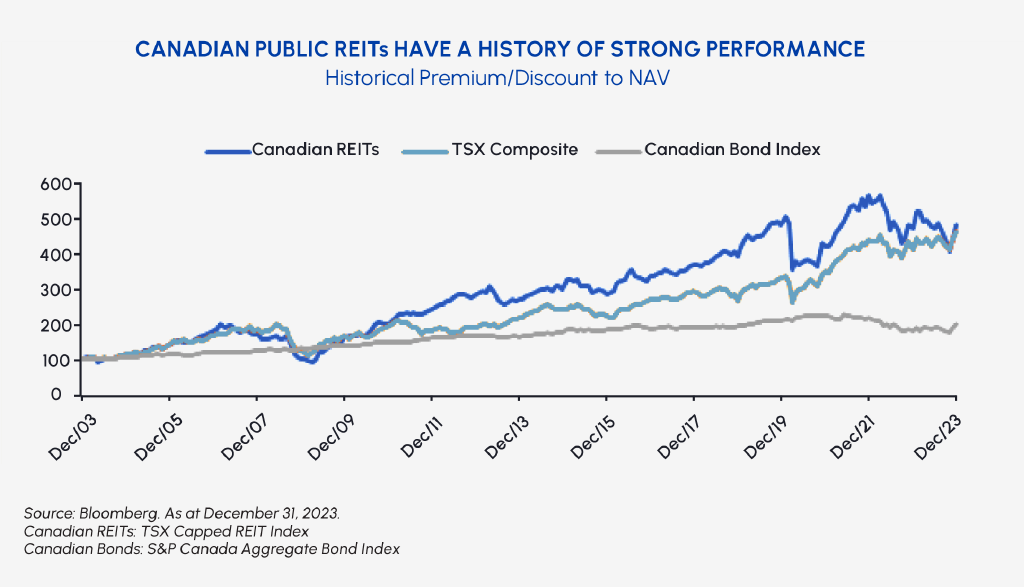

Traditionally, sophisticated institutional investors have invested in real estate due to its attractive income streams and lower correlations with conventional asset classes. More recently, institutional investors have been supplementing their exposure to private real estate with publicly traded REITs due to their increasing quality, attractive valuations and better liquidity.

Public REITs have also become frequent takeover targets of pension plans and other large asset managers. In Canada we’ve seen a number of takeover transactions, including Blackstone’s acquisition of Pure Industrial Real Estate Trust in 2018 and WPT REIT in 2021, and its acquisition of Tricon Residential at a 30% premium, announced in January 2024. And in 2022, Dream Industrial REIT and GIC (sovereign wealth fund in Singapore) acquired Summit Industrial Income REIT.

Advantages of Investing in REITs

REITs offer several benefits:

Tax-advantaged income. REITs have the potential to provide sustainable income and competitive total returns. They are among the most tax-efficient sources of income for investors. Due to their unique structure, REITs are required to distribute at least 90% of their taxable income to investors in the form of distributions because they typically do not pay corporate income taxes. Avoiding taxation at the corporate level leaves more distributable income for investors and results in attractive dividend yields. If an investor holds a REIT in a tax-exempt vehicle such as an RRSP, tax on the distributions can be deferred until the investment is withdrawn.

The distributions from REITs regularly exceed the trust’s income, with deductions such as capital cost allowance effectively flowing through to investors in the form of tax-efficient distributions. Any portion of distributions exceeding income and capital gains represents a return of capital (ROC), which is not taxable in the hands of the investor. Any amount characterized as ROC serves to reduce the cost base of the trust units, effectively converting this amount into a capital gain when the units are sold. Capital gains receive preferential tax treatment in Canada relative to interest income.

Moreover, since REITs are distributing a significant level of their free cash flow to investors, they do not engage in as much development activity, which often carries higher levels of risk because development activities can be expensive, lengthy and complicated. Income generated from real estate tends to be higher than the dividends received from other equities.

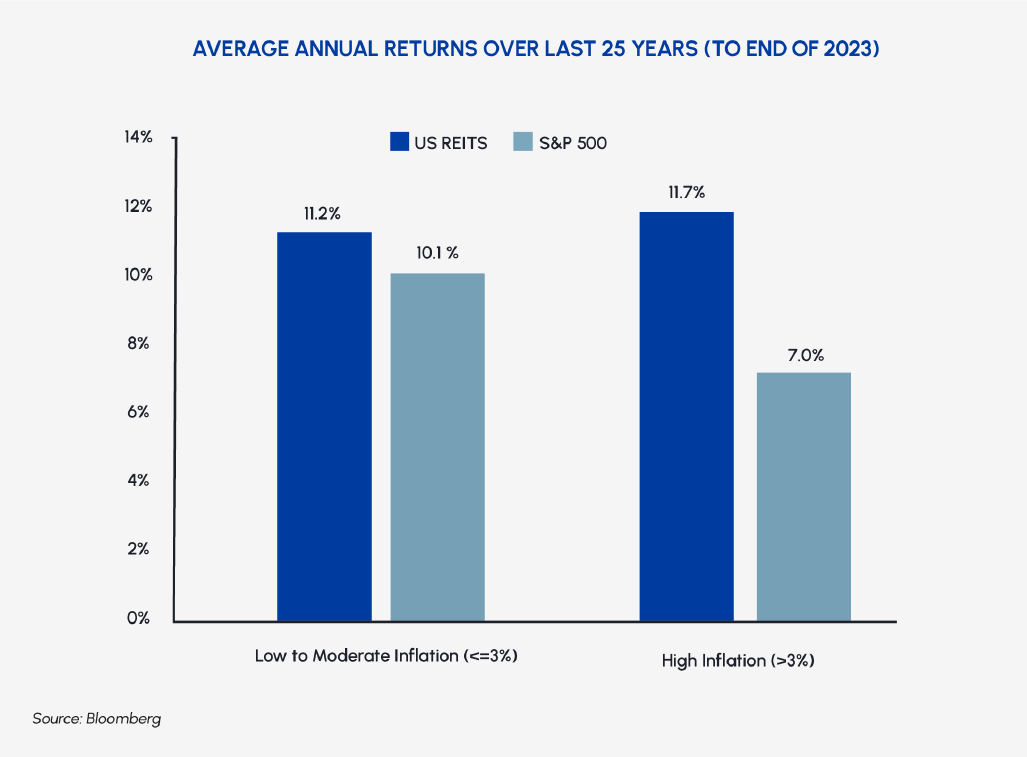

Inflation hedge. REIT returns have outpaced inflation (as measured by the Consumer Price Index) over the last 20+ years. Investing in real estate can serve as a useful hedge against inflation. Many leases include inflation-linked rent escalators, and landlords can pass on higher costs by raising rents. Rents are growing at a record pace within certain asset classes, including multi-family apartments and industrial warehouses.

Inflation often reflects a stronger economy, which supports an increase in rental rates for commercial and residential property leases. When rents increase above the costs of owning real estate, property prices also tend to rise over the long term.

Stable and defensive earnings. REITs possess defensive characteristics. Their revenues are secured by long-term leases which provide predictable revenue streams, even under challenging economic conditions. Many of the operating expenses for the properties they own, such as utility bills, are borne by tenants, which provides margin protection. This has resulted in consistent earnings growth over time and has also supported dividend growth. The FTSE NAREIT All REITs Index had an average annual dividend growth rate of 6.6% for the period of 1994 to 2020. (Source: FTSE NAREIT)

Canada’s national downtown office vacancy rate reached a record high of 19.4% in Q4 2023. “While this might suggest ongoing gloom for the office market, demand for quality spaces and slowing construction of new office projects helped vacancy improve in the fourth quarter in five of the 10 major Canadian markets: Vancouver, Calgary, Edmonton, Ottawa and Halifax,” said the CBRE website in January 2024. (Source: CBRE)

Access to a high-barrier asset class. Direct ownership of real estate is expensive and complicated. Commercial properties often cost hundreds of millions of dollars to develop and require specialized capabilities to navigate zoning, title transfers, building maintenance, property management, etc. As a result, these assets are often concentrated in the hands of large institutional investors with real estate expertise. REITs offer an excellent solution to these high barriers to entry as they are liquid, professionally managed, publicly traded securities with no minimum investment requirements. They also offer the smaller investor the ability to diversify among various real estate classes and locations.

Diversification. REITs are only moderately correlated with fixed-income investments and can be a valuable source of diversification. This can help lower overall risk and increase potential returns across a portfolio.

| 10-year Monthly Correlations between Global REITs and Fixed Income | |

|---|---|

| Asset Class | Correlation to Global REITs |

| S&P Global REIT Index | 1 |

| S&P US Aggregate Bond Index | 0.54 |

| S&P CAD Aggregate Bond Index | 0.59 |

| Source: Bloomberg. As at Dec 31, 2023 | |

Other points. In addition to REITs being an excellent portfolio diversifier and complementing traditional asset classes, adding an allocation to REITs from stocks and bonds can improve expected returns and reduce risk, based on Morningstar research (Morningstar study: REITFactSheetDiversification1.pdf).

Bond prices are primarily based on term to maturity, credit quality and discount rates. REIT prices are primarily driven by the performance of the properties in their investment portfolios. REITs could help insulate a portfolio from a check back in bond prices.

Risks of Investing in REITs

Investing in REITs also comes with risks, such as market fluctuations, economic downturns and property-specific challenges. Investors should assess their financial goals, risk tolerance and the market conditions before making real estate equity investments.

Market sensitivity – REITs can be sensitive to changes in interest rates and market conditions. Rising interest rates can lead to increased borrowing costs for REITs and impact their profitability. Economic recessions, reduced demand for real estate and other macroeconomic factors can lead to lower occupancy rates and property values.

Interest rate risk – Changes in interest rates can impact borrowing costs and, consequently, the financial performance of the REIT.

Management risk – The success of a REIT depends on the competence of its management team. Poor decision-making, inadequate risk management or other management issues can negatively impact performance. Unlike direct real estate ownership, REIT investors do not have direct control over the management and decision-making of the underlying properties.

Industry concentration risk – Some REITs may focus on specific property types, such as residential, commercial or industrial. Concentration in a particular sector exposes investors to risks associated with that sector’s performance.

Dividend volatility – While REITs are known for their dividends, economic downturns or financial challenges may lead to reduced or suspended dividend payments.

|

Why should investors add real estate now? Lower interest rates, excellent fundamentals & higher returns |

|

|---|---|

| Near-term Performance Drivers | Medium & Long-term Tailwinds |

| ✓ Inflation is subsiding and rate cuts expected in 2024

✓ Prices trading at excessive discounts to NAV ✓ Volatility has historically subsided after peak rates ✓ Inflows coming from cash and near cash alternatives ✓ Portfolio companies are fundamentally solid ✓ Rising rents and increasing cash flows across focus areas ✓ Economic soft landing scenario is coming into view |

Active Management25+ year history with intimate knowledge of the REIT sector evidenced by long-term outperformance vs. peers and benchmark Strong REIT Balance SheetsREITs have solid balance sheets, access to debt and ample liquidity Built-in Growth for High-Quality AssetsMarket rents are above in-place rents for many of our portfolio companies Limited Supply Coming to MarketNew supply, especially in Canada, is down significantly due to high development costs and interest rates |

Real Estate Sub-Sectors

Traditional Property Types

1. Industrial

What is it? Warehousing, logistics and manufacturing space

What impacts demand: Onshoring trends, inventory management systems, proliferation of e-commerce

Industrial REITs:

E-commerce, reshoring and just-in-case inventory management are driving demand for industrial warehouse space.

- Canadian availability rate of 2% vs. 15-year average rate of 4.8% (Source: PwC)

- Elevated land and construction costs limit the risk of new supply

Outlook: Robust rent growth driven by significant supply/demand imbalances

2. Multi-Family

What is it? Purpose-built rental apartments

What impacts demand: Homebuyers being priced out of the market, immigration levels, demographic changes

Multi-family REITs:

Supply of apartment rentals is unable to keep pace with increasing demand for housing

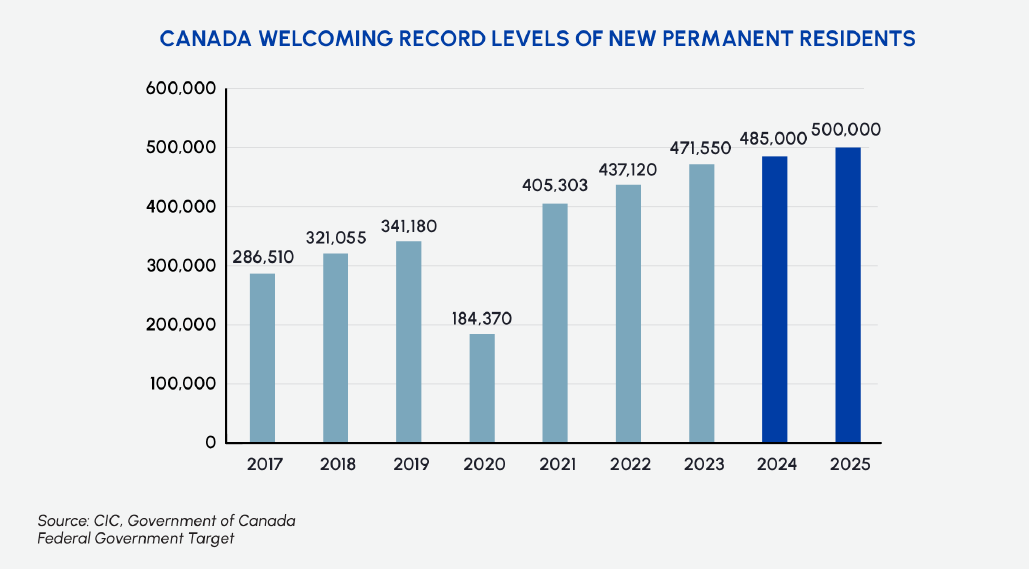

- Record-setting immigration and demand from non-permanent residents driving apartment rents higher

- Increase in mortgage rates forcing would-be homebuyers to rent

Outlook: Sustained growth in apartment rents and occupancy until supply can meet the growing demand for housing.

3. Retail

What is it? Properties used to sell consumer goods and services.

What impacts demand: Amenity-rich ecosystems with high foot traffic and mixed-use development upside

Outlook: Investors concentrating on grocery-anchored centres or urban properties with mixed-use or redevelopment potential

4. Office

What is it? Office space located primarily in central business districts.

What impacts demand: General economic activity and employees returning to the office

Outlook: Uncertain outlook due to high number of employees working from home

5. Healthcare

What is it? Hospitals, clinics and seniors housing facilities

What impacts demand: Demographic trends such as an aging population and the emergence of outpatient and in-home health-care access

Outlook: Defensive asset class with a stable cash flow profile; evolving landscape of health-care delivery, technological advancements and regulatory changes will continue to shape demand and supply

Emerging Property Types

1. Towers

What is it? Communications towers that host cellular network broadcast equipment

What impacts demand: Growth in mobile data traffic and expansion of wireless networks, such as the ongoing build-out of 5G; influencing factors include topography, zoning and regulations, and infrastructure availability

Outlook: Positive, as more people use smartphones and other mobile devices that require investments in connectivity; advancements in communications technology may influence the need for new towers or the upgrading of existing ones

2. Data Towers

What is it? Specialized facilities used to store, process and manage data

What impacts demand: Increased reliance on digital technologies and increasing demand for data storage and processing capacity

The following are some of the factors that influence real estate decisions for data centres.

- Power infrastructure – Considerations include proximity to power substations and the availability of affordable and sustainable energy sources.

- Connectivity and network infrastructure – Data centres need high-speed and reliable network connections. Proximity to fibre optics networks, internet exchange points (IXPs) and major network hubs is important for efficient data transmission.

- Cooling and climate – Efficient cooling systems are essential to prevent data centre equipment from overheating. Locations with a favourable climate — cooler temperatures or access to natural cooling sources like water — can reduce the energy required for cooling.

- Physical security – Access control, surveillance systems and proximity to law enforcement can influence the choice of location.

Outlook: Industry trends are attractive, but growing competition requires careful security selection

3. Self-Storage

What is it? Facilities that provide rental storage space for individuals and businesses. What impacts demand: The rise of e-commerce and more people renting or downsizing their homes creates the need for extra storage space

Here are key considerations for the establishment of self-storage facilities:

Population density – Urban and suburban areas, where living spaces may be smaller or transient populations are common, often see increased demand for storage units.

Housing trends – Housing market trends, such as downsizing, moving or renting, can impact the demand for self storage.

Business and commercial needs – Small and medium-sized enterprises may require storage space for inventory, equipment or documents. Proximity to commercial and industrial areas can influence this demand.

Seasonal demand – The need for storage during moving seasons or for seasonal items like holiday decorations and sports equipment can contribute to fluctuations in demand.

Accessibility and convenience – Locations that are easily accessible and offer convenient operating hours are likely to attract more customers.

Outlook: Stable outlook in a defensive asset class that is less sensitive to interest rate fluctuations and economic cycles

4. Manufactured Housing Communities

What is it: Communities of modular homes that share common amenities

What impacts demand: Growing popularity of low-maintenance housing options among retirees and affordable housing solutions for middle-class families

Other influential factors include the following:

Zoning and regulatory environment – Regulations and local ordinances play a crucial role in the development, expansion, operation and management of manufactured housing communities.

Community amenities and services – Availability of amenities and services, such as recreational areas, community centres and maintenance services, can impact demand.

Infrastructure and utilities – Access to water, sewage, electricity and internet connectivity is crucial for the functionality and livability of manufactured housing communities.

Outlook: Defensive asset class with a positive outlook as the population ages and more families seek affordable housing options

5. Life Science Office

What is it? Offices, research laboratories and drug manufacturing facilities

What impacts demand: Specific needs of life science research and development, such as sterilized rooms, collaboration space and unique temperature control requirements

Some factors that influence the real estate for life sciences offices include the following:

- Proximity to research institutions and universities – This proximity facilitates collaboration, access to talent and opportunities for technology transfer.

- Biotech and pharmaceutical cluster – Life sciences firms tend to cluster in specific regions known for their biotech and pharmaceutical industries. This provides networking opportunities, access to a skilled workforce and collaboration with other industry players.

Outlook: Positive long-term outlook as biopharma companies, academic centres and government institutions continue to invest in life sciences research

Trends Impacting Real Estate

Real estate is influenced by a variety of trends that reflect changes in demographics, technology, economic conditions and societal preferences.

1. Demographics

- Canada is expected to welcome roughly 1.1 million new permanent residents between 2025 and 2027. (Source: Government of Canada, 2016)

- Many newcomers expected to rent for a number of years before amassing enough savings to consider home ownership

- Baby boomers are retiring and making major lifestyle decisions while seniors are moving into retirement homes

- Growing demand for manufactured housing communities and seniors facilities

- Younger populations are drawn to amenity-rich urban environments

- Lasting demand for needs-based retail such as grocery stores and pharmacies

Fundamentals remain intact

- Canada targeting roughly 1.5 million new permanent residents between 2024 and 2026

- 82% of Canada’s 40 million people live in major urban centres; 46% live in the six “VECTOM” cities: Vancouver, Edmonton, Calgary, Toronto, Ottawa and Montreal

- Canada is one of the most supply constrained markets in the world

- Major institutional investors such as Blackstone and TPG announcing multi-billion acquisitions/investments in late 2023/early 2024

2. Sustainability

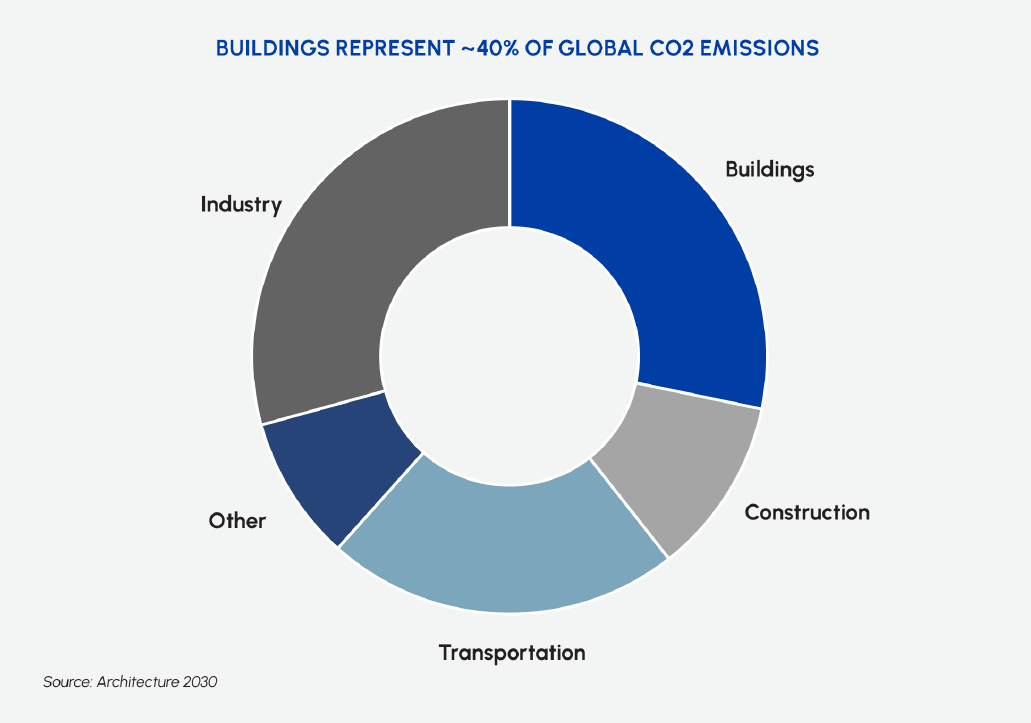

- Buildings represent ~40% of global CO2 emissions

- Owners of sustainable real estate benefit from premium valuations

- 5 million homes need to be built by 2030 in Canada to meet growing demand for affordable housing; affordable housing solutions receive favourable borrowing terms

Source: Canada Mortgage Housing Corporation, September 2023

- Mitigating climate-related risks such as floods, fires, storms and rising sea level is becoming increasingly important for real estate owners

- Both commercial and residential real estate developers are focusing on incorporating green building technologies, renewable energy sources, and eco-friendly designs to meet environmental standards and appeal to environmentally conscious consumers

3. Technology

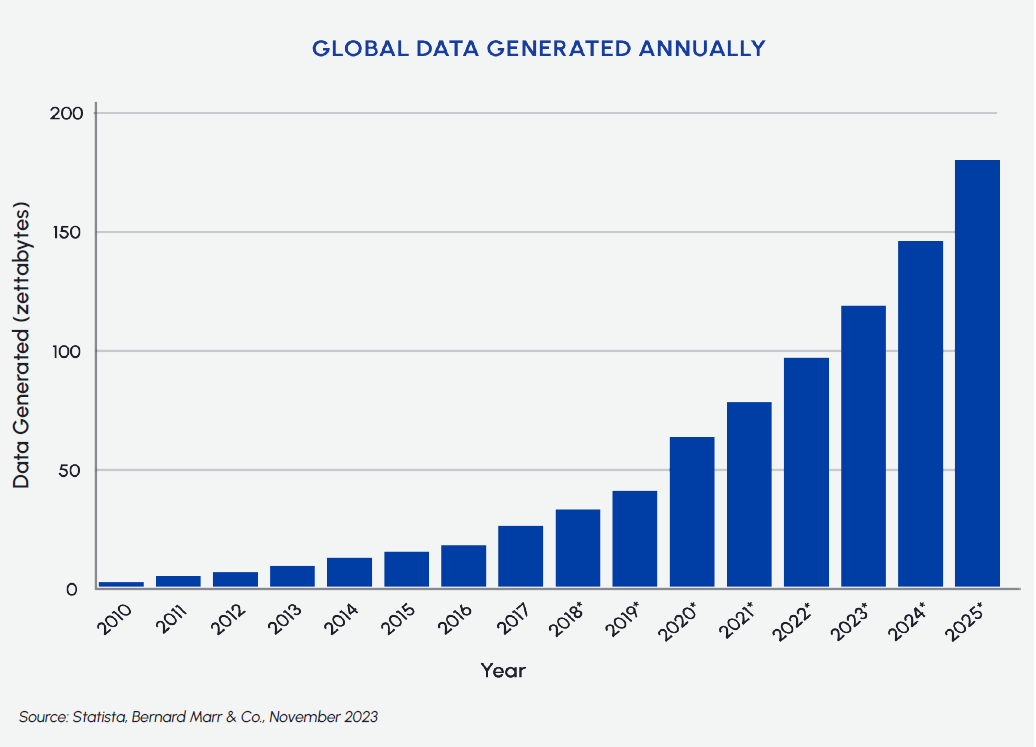

- The amount of data that will be generated, processed and stored is growing exponentially (see graph below)

- Data centres and cell towers are the backbone of cloud infrastructure

- Modern supply chains require advanced warehousing and logistics capabilities

- Growing demand for industrial real estate driving higher occupancy rents

- Hybrid working models have become commonplace

- Higher standards are being set by office tenants

- The integration of technology in real estate, known as PropTech continue to evolve. This includes the use of artificial intelligence, data analytics, virtual reality, and smart home technologies to enhance property management, streamline transactions, and improve tenant experience.

Middlefield’s Approach to Investing in Real Estate

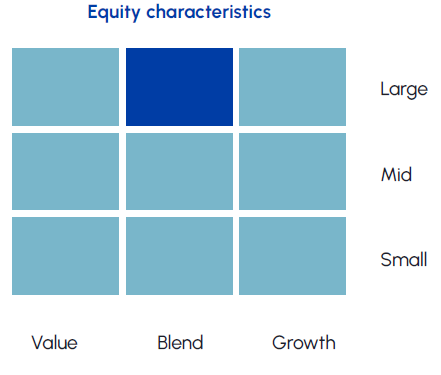

Middlefield’s real estate strategies are designed for investors seeking income and growth from a portfolio of large-cap companies diversified across the global real estate sector. Middlefield’s history in real estate began when the firm was founded over 40 years ago, and we have been managing dedicated REIT strategies for over 10 years. Our solutions provide Canadian investors with global exposure to a sector that has attractive defensive and inflation-protection attributes.

| Strategy | Fund Structure | Ticker / Fund Code | Investment Focus | Risk Rating |

|---|---|---|---|---|

| Middlefield Real Estate Dividend ETF | ETF | TSX: MREL | Diversified Global Real Estate | Medium |

| Middlefield Real Estate Dividend Class | Mutual Fund | A Series: 600 F Series: 601 |

Diversified Global Real Estate | Medium |

| Middlefield Real Estate Split Corp. | Split Share | A Shares: RS Preferred Shares: RS.PR.A |

15-20 high conviction REITs | Medium |

All Middlefield real estate funds provide investors with attractive levels of monthly income. Middlefield’s real estate strategies are actively managed portfolios holding approximately 30 to 45 names. We focus on REITs that generate stable operating income, carry low leverage and pay growing levels of dividends.

Disclaimer: This material has been prepared for informational purposes only without regard to any particular user’s investment objectives or financial situation. This communication constitutes neither a recommendation to enter into a particular transaction nor a representation that any product described herein is suitable or appropriate for you. Investment decisions should be made with guidance from a qualified professional. The opinions contained in this report are solely those of Middlefield Limited (“ML”) and are subject to change without notice. ML makes every effort to ensure that the information has been derived from sources believed to reliable, but we cannot represent that they are complete or accurate. However, ML assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. ML is under no obligation to update the information contained herein. This document is not to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product or instrument. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and ETF investments. Please read the prospectus and publicly filed documents before investing. Mutual funds and ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. You will usually pay brokerage fees to your dealer if you purchase or sell shares of an investment fund on the Toronto Stock Exchange or alternative Canadian trading platform (an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning shares of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in the public filings available at www.sedar.com. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this document may be viewed as forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, intentions, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “plans”, “estimates” or “intends” (or negative or grammatical variations thereof), or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements including as a result of changes in the general economic and political environment, changes in applicable legislation, and the performance of each fund. There are no assurances the funds can fulfill such forward-looking statements and the funds do not undertake any obligation to update such statements. Such forward-looking statements are only predictions; actual events or results may differ materially as a result of risks facing one or more of the funds, many of which are beyond the control of the funds.